How much will you pay in Medicare taxes but get in benefits?

Sep 04, 2014 · Such a couple would have paid $39,000 in Medicare taxes but can expect to benefit from $306,000 -- a ratio of $7.80 in Medicare spending for every dollar the couple paid in taxes. So the ad’s ...

How much does Medicare cost per person?

Feb 01, 2013 · According to the institute’s data, a two-earner couple receiving an average wage — $44,600 per spouse in 2012 dollars — and turning 65 in 2010 would have paid $722,000 into Social Security ...

How much of your paycheck goes to Social Security?

A. The federal government spent nearly $1.2 trillion in fiscal year 2019. In addition, income tax expenditures for health care totaled $234 billion. The federal government spent nearly $1.2 trillion on health care in fiscal year 2019 (table 1). Of that, Medicare claimed roughly $644 billion, Medicaid and the Children’s Health Insurance Pro-gram (CHIP) about $427 billion, and veterans’ …

How is Medicare funded by the government?

Jan 25, 2013 · According to their updated 2012 figures, a single male earning the average wage who retired in 2010 will receive total lifetime Social Security and Medicare benefits worth $457,000, following ...

How much did I pay into Medicare?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

Is Medicare paid for by taxes?

Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state. Both programs received additional funding as part of the fiscal relief package in response to the 2020 economic crisis.

Does everyone have to pay for Medicare?

Everyone pays for Part B of Original Medicare. In 2020, the standard premium is $144.60/month for those making no more than $87,000 per year ($174,000 per year for married couples filing jointly).

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

What is the Medicare tax rate for 2021?

1.45%2021-2022 FICA tax rates and limitsEmployee paysEmployer paysMedicare tax1.45%.1.45%.Total7.65%7.65%Additional Medicare tax0.9% (on earnings over $200,000 for single filers; $250,000 for joint filers)1 more row•Jan 13, 2022

What is the Medicare tax limit for 2020?

The Social Security tax rate remains at 6.2 percent. The resulting maximum Social Security tax for 2020 is $8,537.40. There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax....2020 Social Security and Medicare Tax Withholding Rates and Limits.Tax2019 Limit2020 LimitMedicare liabilityNo limitNo limit3 more rows

Will Medicare run out of funds?

A report from Medicare's trustees in April 2020 estimated that the program's Part A trust fund, which subsidizes hospital and other inpatient care, would begin to run out of money in 2026.Dec 30, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Why is my Medicare Part B premium so high?

According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

Do you have to pay for Medicare out of your Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

How is Medicare funded?

How Medicare Is Funded. Medicare is funded by two trust funds that can only be used for Medicare. The hospital insurance trust fund is funded by payroll taxes paid by employees, employers, and the self-employed. These funds are used to pay for Medicare Part A benefits. 11 .

What are the benefits of the Cares Act?

The CARES Act expands Medicare's ability to cover treatment and services for those affected by COVID-19 including: 1 Providing more flexibility for Medicare to cover telehealth services 2 Authorizing Medicare certification for home health services by physician assistants, nurse practitioners, and certified nurse specialists 5

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...

Is Medicare a government program?

Both Medicare and Medicaid are government-sponsored health insurance plans. Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults.

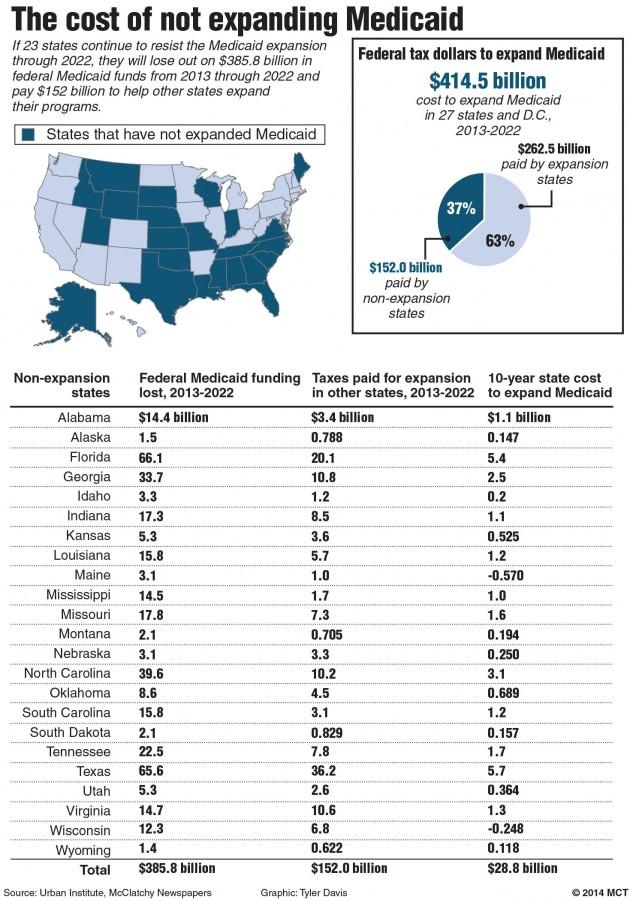

Is Medicaid administered by the state?

Medicaid, on the other hand, is administered at the state level. Although all states participate in the program, they aren't required to do so. The Affordable Care Act (ACA) increased the cost to taxpayers—particularly those in the top tax brackets—by extending medical coverage to more Americans. 1 2 .

Is Medicare a major segment of the health insurance market?

Medicare and Medicaid constitute a major segment of the health insurance market for tens of millions of Americans. Although Medicare and Medicaid funding is projected to fall short at some point, the CARES Act aims to address costs related to the coronavirus outbreak.

When did Social Security taxes start?

The bigger discrepancies common decades ago can be traced in part to the fact that some of these individuals’ working lives came before Social Security taxes were collected beginning in 1937. Some types of families did much better than average.

What is the Urban Institute?

The Urban Institute, a non-partisan research institute in Washington, produces statistics on this topic annually. Institute researchers figured out what people turning 65 in various years have already "paid in" to the system and what can expect to "take out" after they reach age 65. (See our charts below)

Do people get more Social Security and Medicare?

In most cases, people get more from Social Security and Medicare combined than they put in, though the specific amount can vary depending on income and family circumstances. Here are some examples for people who turned 65 in 2010. See the footnotes for some important caveats.

How to set up a Social Security account?

To set up an account, navigate to the SSA.gov homepage, and click on the link for My Social Security. You must have a valid e-mail address, as well as a Social Security number and a mailing address.

What do payroll taxes go to?

Payroll taxes, paid by wage-earners as well as employers, go to fund the Social Security retirement system. If you're self-employed, you pay into the system with self-employment taxes, calculated on your federal return.

What is the benefit statement for Social Security?

The Benefit Statement estimates your future monthly benefit, depending on when you choose to retire. It also reveals your lifetime earnings record: the amount of wages or self-employment income on which you paid in to the system, each year, over your entire working life. The statement also estimates the amount of Social Security and Medicare taxes paid, although it does not break these payments down by year. The estimated total is based on the payroll tax rate as applied to your earnings for each year, and takes into account the fact that the payroll tax rate has varied over the history of the Social Security system.

What does it mean to be vested?

Being vested means you are eligible to receive a retirement allowance. You are vested in the State system if you have at least ten years of full-time service. To be eligible to retire, you need to meet one of the following conditions: 1. 20 years of full-time creditable service at any age, or.

Can I withdraw from my annuity?

No, state law does not allow you to withdraw or borrow from your annuity savings account under any circumstance, including mortgage down payment or college education. The only way to access your money is to leave state service. Each time I receive my paycheck, I notice it shows a deduction for retirement.

How much of your paycheck goes to Social Security?

That 6.2% of your paycheck that goes to Social Security can be broken down even further. Specifically, as noted by the SSA, 5.015% is paid to the Old-Age, Survivors Insurance Trust (OASI), with the remaining 1.185% being directed to the Disability Insurance Trust (DI).

How much is FICA tax?

FICA taxes total 15.3% for most working Americans, though a majority of them pay just half of that directly. Employers and employees typically split the ...

Is Social Security going to burn through?

Yet America's most vital program for seniors isn't on the most solid financial footing. According to the Social Security Board of Trustees' report from last year, Social Security's Old-Age, Survivors, and Disability Insurance (OASDI) Trust is expected to burn through its reserves of more than $2.8 trillion by 2034. This dwindling of Social Security's cash cushion down toward zero is what has led a lot of working Americans to believe that the benefit won't be around for them by the time they retire.

What would happen if all undocumented immigrants were deported today?

If all undocumented immigrants were deported today, next year’s Social Security trust funds would have approximately $13 billion less for benefit payouts. It’s a considerable loss of dollars, especially when it’s projected that the Social Security funds will be depleted by 2034.

Do undocumented immigrants have to pay taxes?

By law, anyone earning an income while in the United States is required to pay taxes, even if they are breaking other laws in doing so.

Do undocumented immigrants get Social Security?

Since undocumented immigrants don’t have Social Security numbers and are not authorized to work legally in the U.S., they are not eligible for any Social Security benefits, whether they’ve paid into the system or not.