Full Answer

Why are hospitals losing money on medicare care?

If hospitals do not aggressively manage the cost of caring for Medicare patients against these fixed payments, losses result.

How can the government decrease the cost of Medicare?

The government could decrease Medicare costs if they adjusted the criteria for bonuses, and increased overall competition between plans. 15 Decrease Medicare fraud, waste, and abuse: Private insurance companies run Medicare Advantage (Part C) and prescription drug plans (Part D).

How much will Medicare spending double in the next 10 years?

Looking ahead, CBO projects Medicare spending will double over the next 10 years, measured both in total and net of income from premiums and other offsetting receipts. CBO projects net Medicare spending to increase from $630 billion in 2019 to $1.3 trillion in 2029 (Figure 6).

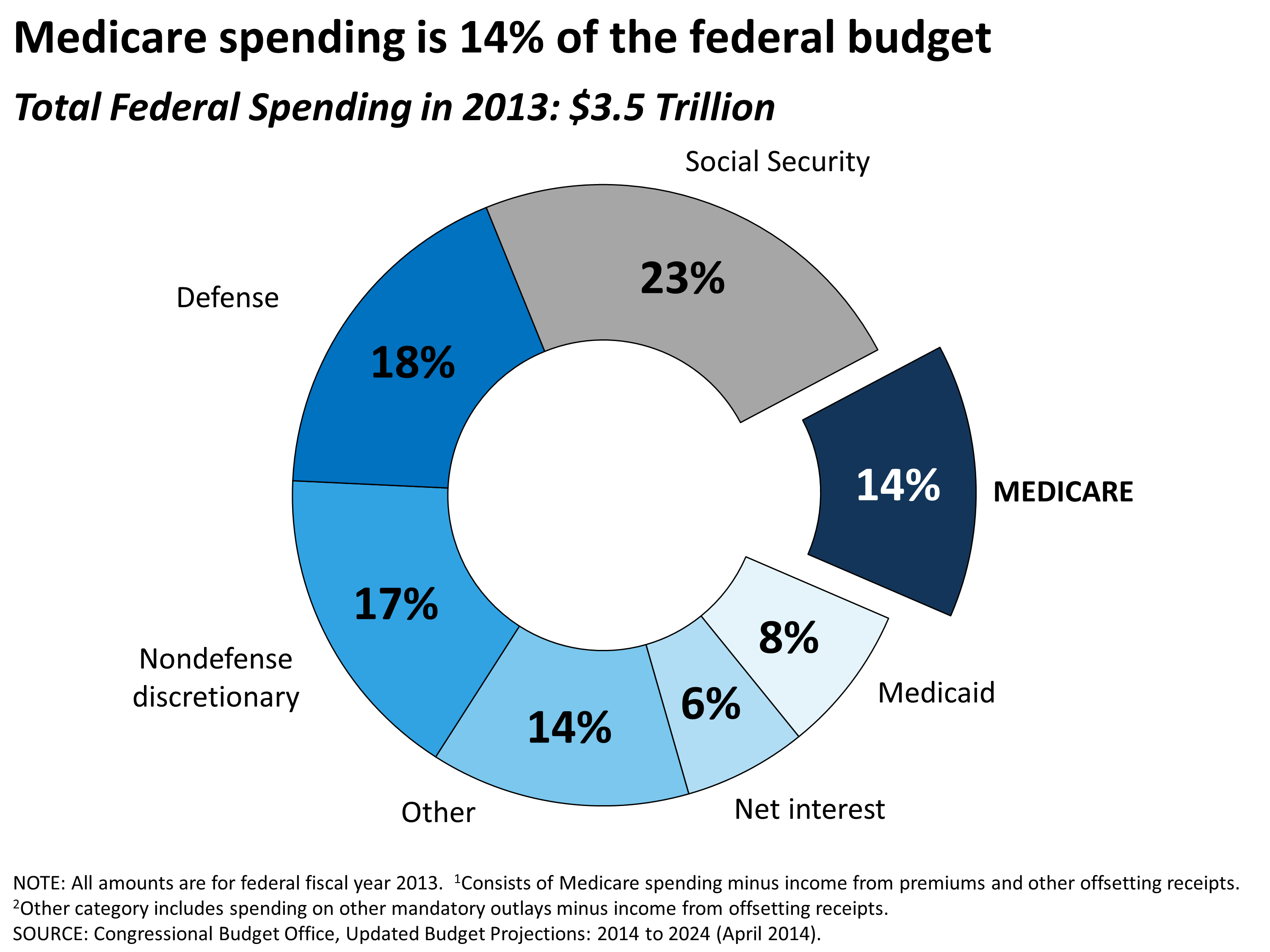

How much of the federal budget is spent on Medicare?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1). In 2018, Medicare benefit payments totaled $731 billion, up from $462 billion in 2008 (Figure 2) (these amounts do not net out premiums and other offsetting receipts).

How much does Medicare lose each year?

Medicare loses approximately $60 billion annually due to fraud, errors, and abuse, though the exact figure is impossible to measure.

Is the cost of Medicare going down?

In a report to Becerra, the agency said the premium recommendation for 2022 would have been $160.40 a month had the price cut and the coverage determination both been in place when officials calculated the figure. The premium for 2023 for Medicare's more than 56 million recipients will be announced in the fall.

How much is Medicare in debt?

Medicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

How much of the US budget goes to Medicare and Medicaid?

Historical NHE, 2020: NHE grew 9.7% to $4.1 trillion in 2020, or $12,530 per person, and accounted for 19.7% of Gross Domestic Product (GDP). Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE. Medicaid spending grew 9.2% to $671.2 billion in 2020, or 16 percent of total NHE.

Will Medicare Part B premium go down in 2022?

Medicare Part B Premiums Will Not Be Lowered in 2022.

Is Medicare cost going down 2022?

In 2021, the Part B premium increased by only $3 a month, but Congress directed CMS to begin paying that reduced premium back, starting in 2022.

Is Medicare underfunded?

Politicians promised you benefits, but never funded them.

Is Medicare running a deficit?

This $247.4 billion deficit represents the cumulative difference between Part A spending and revenues over these years, after taking into account the assets in the trust fund between 2021 and 2028 that can be used to pay for Part A spending until the assets are depleted.

How much money did the government spend on Medicare in 2021?

$696 billionWhat is the spending on Medicare? In FY 2021 the federal government spent $696 billion on Medicare.

What is the biggest part of the US budget?

Social Security takes up the largest portion of the mandatory spending dollars. In fact, Social Security demands $1.046 trillion of the total $2.739-trillion mandatory spending budget. It also includes programs like unemployment benefits and welfare.

What are the 5 largest federal expenses?

Major categories of FY 2017 spending included: Healthcare such as Medicare and Medicaid ($1,077B or 27% of spending), Social Security ($939B or 24%), non-defense discretionary spending used to run federal Departments and Agencies ($610B or 15%), Defense Department ($590B or 15%), and interest ($263B or 7%).

How much of the US budget goes to social programs?

In 2019, major entitlement programs—Social Security, Medicare, Medicaid, Obamacare, and other health care programs—consumed 51 percent of all federal spending, larger than the portion of spending for other national priorities (such as national defense) combined.

What is Medicare budget?

Budget Basics: Medicare. Medicare is an essential health insurance program serving millions of Americans and is a major part of the federal budget. The program was signed into law by President Lyndon B. Johnson in 1965 to provide health insurance to people age 65 and older. Since then, the program has been expanded to serve the blind and disabled.

How Much Does Medicare Cost and What Does It Cover?

Medicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

What Are the Components of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts":

How much of Medicare was financed by payroll taxes in 1970?

In 1970, payroll taxes financed 65 percent of Medicare spending.

How is Medicare self-financed?

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, ...

What percentage of GDP will Medicare be in 2049?

In fact, Medicare spending is projected to rise from 3.0 percent of GDP in 2019 to 6.1 percent of GDP by 2049. That increase in spending is largely due to the retirement of the baby boomers (those born between 1944 and 1964), longer life expectancies, and healthcare costs that are growing faster than the economy.

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

What percentage of Medicare is spending?

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

How is Medicare Financed?

Medicare is funded primarily from general revenues (43 percent), payroll taxes (36 percent), and beneficiary premiums (15 percent) (Figure 7) .

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

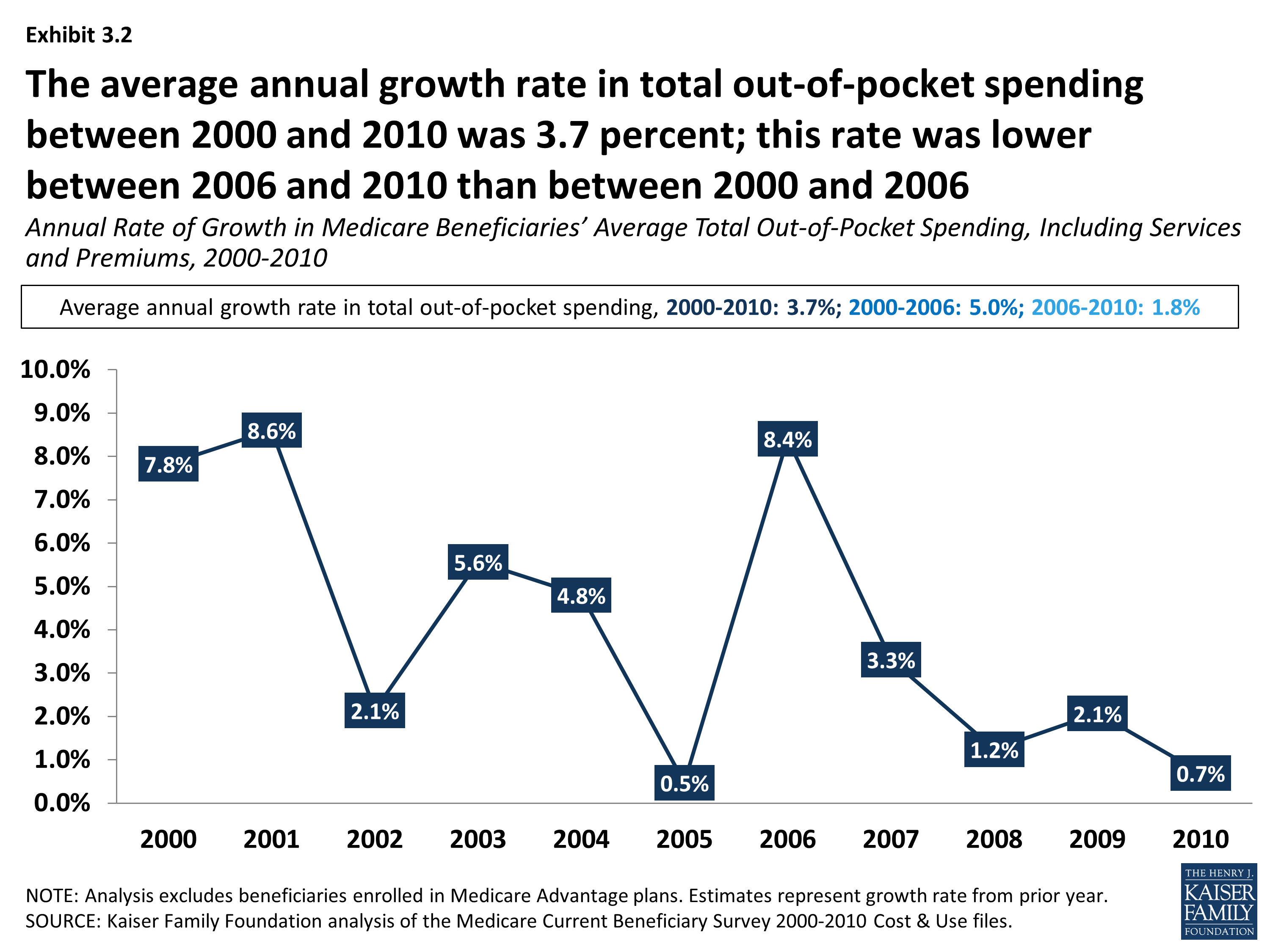

Why is Medicare spending so slow?

Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care and reduce costs, including accountable care organizations (ACOs), medical homes, bundled payments, and value-based purchasing initiatives. The BCA lowered Medicare spending through sequestration that reduced payments to providers and plans by 2 percent beginning in 2013.

What is the average annual growth rate for Medicare?

Average annual growth in total Medicare spending is projected to be higher between 2018 and 2028 than between 2010 and 2018 (7.9 percent versus 4.4 percent) (Figure 4).

What is excess health care cost?

Over the next 30 years, CBO projects that “excess” health care cost growth—defined as the extent to which the growth of health care costs per beneficiary, adjusted for demographic changes, exceeds the per person growth of potential GDP (the maximum sustainable output of the economy)—will account for half of the increase in spending on the nation’s major health care programs (Medicare, Medicaid, and subsidies for ACA Marketplace coverage), and the aging of the population will account for the other half.

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

How Does Medicaid Expansion Affect State Budgets?

That’s because the federal government pays the vast majority of the cost of expansion coverage , while expansion generates offsetting savings and , in many states, raises more revenue from the taxes that some states impose on health plans and providers. 19

What is CMS and Medicaid?

CMS works alongside the Department of Labor (DOL) and the U.S. Treasury to enact insurance reform. The Social Security Administration (SSA) determines eligibility and coverage levels. Medicaid, on the other hand, is administered at the state level.

What is Medicare contribution tax?

It is known as the unearned income Medicare contribution tax. Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans .

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...

How much will healthcare cost in 2028?

The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028. This means healthcare will cost an estimated $6.2 trillion by 2028. Projections indicate that health spending will grow 1.1% faster than GDP each year from 2019 to 2028.

How much did the Affordable Care Act increase in 2019?

1 2 . According to the most recent data available from the CMS, national healthcare expenditure (NHE) grew 4.6% to $3.8 trillion in 2019.

How is Medicare funded?

Rather, they are funded through a combination of enrollee premiums (which support only about one-quarter of their costs) and general revenues —another way of saying the government borrows most of the money it needs to pay for Medicare.

Why did Medicare build up a trust fund?

Because it anticipated the aging Boomers, Medicare built up a trust fund while its costs were relatively low. But that reserve is rapidly being drained, and, in 2026, will be out the money. That is the source of all those “going broke” headlines.

When did Medicare change to Medicare Access and CHIP?

But that forecast is built on several key assumptions that are unlikely to occur. In the 2010 Affordable Care Act, Congress adopted a package of cost-cutting measures. In 2015, in a law called the Medicare Access and CHIP Reauthorization Act (MACRA), it began to change the way Medicare pays physicians, shifting from a system that pays by volume to one that is intended to pay for quality. As part of the transition, MACRA increased payments to doctors until 2025.

What is Medicare report?

The report is an annual exercise designed to review the health of the nation’s biggest health insurance program. It looks in detail at each of Medicare’s pieces, including Part A inpatient hospital insurance; Part B coverage for outpatient hospital care, physician services, and the like; Part C Medicare Advantage plans; and Part D drug insurance.

Will Medicare costs increase in the next 75 years?

So we face what the economists like to call an asymmetric risk: It is possible that future Medicare costs will grow more slowly than predicted, but it is more likely that they’ll be significantly higher than the trustees forecast .

Will Medicare go out of business in 2026?

No, Medicare Won't Go Broke In 2026. Yes, It Will Cost A Lot More Money. Opinions expressed by Forbes Contributors are their own. It was hard to miss the headlines coming from yesterday’s Medicare Trustees report: Let’s get right to the point: Medicare is not going “broke” and recipients are in no danger of losing their benefits in 2026.

Will Medicare stop paying hospital insurance?

It doesn’t mean Medicare will stop paying hospital insurance benefits in eight years. We don’t know what Congress will do—though the answer is probably nothing until the last minute. Lawmakers could raise the payroll tax.

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What percentage of Medicare is paid to MA?

Based on a federal annual report, KFF performed an analysis to reveal the proportion of expenditure for Original Medicare, Medicare Advantage (MA) and Part D (drug coverage) from 2008 to 2018. A graphic depiction on the KFF website illustrates the change in spending of Medicare options. Part D benefit payments, which include stand-alone and MA drug plans, grew from 11% to 13% of total expenditure. Payments to MA plans for parts A and B went from 21% to 32%. During the same time period, the percentage of traditional Medicare payments decreased from 68% to 55%.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

Is Medicare a concern?

With the aging population, there is concern about Medicare costs. Then again, the cost of healthcare for the uninsured is a prime topic for discussion as well.

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

What happens if hospitals don't manage Medicare?

If hospitals do not aggressively manage the cost of caring for Medicare patients against these fixed payments, losses result. Medicare’s legacy payment system places a premium on controlling labor and supply expenses and eliminating wasted or low-value imaging procedures and laboratory tests as well as minimizing operating-room time, intensive-care stays, and a host of other expensive services.

How many hospitals lost money in 2016?

About three-fourths of short-term acute-care hospitals lost money treating Medicare patients in 2016, according to the Medicare Payment Advisory Commission (MedPAC), an independent agency established to advise the U.S. Congress on issues affecting the Medicare program.

Why are hospitals penalized by Medicare?

Hospitals are also penalized by Medicare if quality problems such as adverse drug reactions lengthen the patient’s stay or otherwise require additional treatment. Recent changes in the program also place hospitals at financial risk if they experience excessive readmissions, hospital-acquired infections, and other quality problems. Medicare has been exploring how to expand the scope of the DRG system to include the physician fees incurred in treating patients as well as some post-acute (i.e., after hospitalization) costs, making control of episode costs even more important.

Why is it important to maintain control over the cost of clinical episodes?

All these steps are necessary to achieve and maintain control over the cost of clinical episodes, the key to reducing losses from treating Medicare patients. The very same processes can result in better clinical results for commercially insured and Medicaid patients, assuring that hospitals can improve their margins in the face of far-more-demanding payment constraints. These steps will become essential in the event that federal deficits and corporate benefits costs rise, forcing further changes in how care is paid for.

How many people will be on Medicare in 2030?

By 2030, there will be 81.5 million Medicare beneficiaries vs. 55 million today.

Is Medicare the largest federal program?

The fact that Medicare is the largest single federal domestic program means that further cuts in Medicare payment are a virtual certainty when, not if, the federal budget deficit is driven higher by recessions. What this means for hospitals is crystal clear: Unless their losses from treating Medicare patients can be contained, ...

Does Medicare cover DRG?

Medicare has been exploring how to expand the scope of the DRG system to include the physician fees incurred in treating patients as well as some post-acute (i.e., after hospitalization) costs, making control of episode costs even more important.

How much does Medicare cover?

But mid-way through the year, it’s hard to say.”. Generally speaking, Medicare only covers about two-thirds of the cost of health-care services for the program’s 62.4 million or so beneficiaries, the bulk of whom are age 65 or older. That’s the age when you become eligible for Medicare.

How much is Medicare Part A deductible?

However, Part A has a deductible of $1,408 per benefit period, along with some caps on benefits.

How much is Part D insurance in 2020?

Meanwhile, the average cost for Part D coverage in 2020 is about $42 per month, although high earners pay extra for their premiums (see chart below). The maximum deductible for Part D this year is $435.

How long do you have to sign up for Medicare if you lose your job?

Additionally, be aware Medicare’s enrollment rules if you lose your job: You get eight months to sign up. Otherwise, you could face life-lasting late-enrollment penalties.

Does Medicare cover dental work?

Also, be sure to think about how you’ll pay for the things Medicare excludes. For instance, it generally doesn’t cover dental work and routine vision or hearing care. Same goes for long-term care, cosmetic procedures and medical care overseas.

Is Medicare free for older people?

Sometimes, it comes as a surprise to older folks that Medicare is not free. Depending on the specifics of your coverage and how often you use the health-care system, your out-of-pocket costs could reach well into six-figure territory over the course of your retirement, according to a recent report from the Employee Benefit Research Institute. ...

Can you pair a medicaid plan with an Advantage plan?

You cannot, however, pair a Medigap policy with an Advantage Plan. Of people without any type of extra coverage beyond basic Medicare — such as employer coverage or Medicaid — 28% have either struggled to pay their medical bills or to get care due to the cost, according to the Kaiser Family Foundation.

What about Medicare Advantage plans?

The price for Medicare Advantage (Part C) plans greatly varies. Depending on your location, you may have dozens of options, all with different premium amounts. Because Part C plans don’t have a standard plan amount, there are no set income brackets for higher prices.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What about Medicaid?

If you qualify for Medicaid, your costs will be covered. You won’t be responsible for premiums or other plan costs.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

Is Medicare plan change every year?

Medicare plan options and costs are subject to change each year. Healthline.com will update this article with 2022 plan information once it is announced by the Centers for Medicare & Medicaid Services (CMS).

Who was the secretary of health and human services who testified before Congress that $716 billion could “both” save Medicare?

Kathleen Sebelius, then the Secretary of Health and Human Services, infamously testified before Congress that this $716 billion could “both” save Medicare while funding Obamacare. Only Washington politicians could claim with a straight face to spend the same money twice. President Biden, who has spent the last half-century in Washington, ...

How much did Biden's family plan cost?

But Biden’s “families” plan proposed using some of that same money to pay for his new entitlement expansions, including an expansion of Obamacare subsidies estimated to cost $163 billion over ten years. That would siphon more than two-thirds of the revenue that’s supposed to be going toward Medicare.

Why is Biden's tax provision called unfair?

The very provision Biden’s Treasury Department called “unfair” because they might allow people to “avoid paying their fair share” is one the Bidens used to avoid more than $500,000 worth of taxes in the last four years.

What is the Biden budget?

Among its myriad tax increases, the Biden budget includes a line item to “rationalize net investment income and Self-Employment Contributions Act taxes, ” applying the 3.8 percent payroll tax to all income received by “high-income” taxpayers. The Treasury’s budget explanation justifies this proposed change by claiming the “different treatment” of income by the self-employed and owners of business partnerships “is unfair, inefficient … and provides tax planning opportunities for business owners, particularly those with high incomes, to avoid paying their fair share of taxes.”

Does Joe Biden value Medicare?

In both his family’s budget and his administration’s fiscal policies, Joe Biden shows he neither value Medicare nor the seniors who rely on it. Chris Jacobs is founder and CEO of Juniper Research Group, and author of the book, " The Case Against Single Payer .". He is on Twitter: @chrisjacobsHC. Photo Global News / YouTube.

Does Biden want to raise Medicare taxes?

President Biden, who has spent the last half-century in Washington, wants to do just that. His budget takes a page out of the Obama playbook, raising Medicare taxes while raiding those additional funds from Medicare to pay for his Obamacare expansion.

Did Biden pay Medicare taxes?

Well, he and his wife dodged hundreds of thousands of dollars in Medicare taxes, the better to fund their luxury lifestyle. Now, as president, Biden wants others to pay the Medicare taxes he avoided — not because he views Medicare as a sacred promise to seniors, but to create a slush fund he can raid to pay for other programs.

Summary

Health

- In 2017, Medicare spending accounted for 15 percent of the federal budget (Figure 1). Medicare plays a major role in the health care system, accounting for 20 percent of total national health spending in 2016, 29 percent of spending on retail sales of prescription drugs, 25 percent of spending on hospital care, and 23 percent of spending on physici...

Cost

- In 2017, Medicare benefit payments totaled $702 billion, up from $425 billion in 2007 (Figure 2). While benefit payments for each part of Medicare (A, B, and D) increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased from 47 percent to 42 percent, sp…

Causes

- Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care …

Effects

- In addition, although Medicare enrollment has been growing around 3 percent annually with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending. In general, Part A trust fund solvency is also affected by the level of growth in the economy, which affects …

Impact

- Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Future

- While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicares actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care pri…

Funding

- Medicare is funded primarily from general revenues (41 percent), payroll taxes (37 percent), and beneficiary premiums (14 percent) (Figure 7). Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. Expected future increases in spending under Part B and …

Assessment

- Medicares financial condition can be assessed in different ways, including comparing various measures of Medicare spendingoverall or per capitato other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

Purpose

- The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is one way of measuring Medicares financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years whe…

Benefits

- A number of changes to Medicare have been proposed that could help to address the health care spending challenges posed by the aging of the population, including: restructuring Medicare benefits and cost sharing; further increasing Medicare premiums for beneficiaries with relatively high incomes; raising the Medicare eligibility age; and shifting Medicare from a defined benefit s…