Who pays more for health insurance – employers or Medicare?

Employers provide health insurance coverage for more than 153 million Americans. The companies and insurers in the study paid nearly $20 billion more than Medicare would have for the same care from 2016 through 2018, according to the RAND researchers.

Do employers pay Medicare tax on wages more than $200k?

No, employers only pay 1.45%, even if an employee earns more than $200,000. Additional Medicare tax only applies to employees. For example, an employee earns $250,000 per year, so the employee pays 1.45% on the $250,000 in wages, plus 0.9% on the $50,000 over $200,000. Calculate the Medicare tax for the entire gross wages:

How many employees does Medicare pay for small group health insurance?

If your company has 20 employees or less and you’re over 65, Medicare will pay primary. Since your employer has less than 20 employees, Medicare calls this employer health insurance coverage a small group health plan.

Should employers pay hospitals at Medicare rates?

If employers and health plans that participated in the study had paid for services at Medicare rates, it would have reduced total payments to hospitals by $19.7 billion from 2016 to 2018. Every year, Medicare issues a fee schedule that determines how much the federal insurance program will reimburse hospitals for specific services.

What percentage does Medicare pay?

You'll usually pay 20% of the cost for each Medicare-covered service or item after you've paid your deductible. If you have limited income and resources, you may be able to get help from your state to pay your premiums and other costs, like deductibles, coinsurance, and copays.

How much more than Medicare do private insurers pay a review of the literature?

Private insurers paid nearly double Medicare rates for all hospital services (199% of Medicare rates, on average), ranging from 141% to 259% of Medicare rates across the reviewed studies.

Do hospitals lose money on Medicare patients?

Privately insured patients and others often make up the difference. Payments relative to costs vary greatly among hospitals depending on the mix of payers. In 2015, two-thirds of hospitals lost money providing care to Medicare and Medicaid patients and nearly one-fourth lost money overall (see chart above).

How are hospitals reimbursed by Medicare?

A Prospective Payment System (PPS) is a method of reimbursement in which Medicare payment is made based on a predetermined, fixed amount. The payment amount for a particular service is derived based on the classification system of that service (for example, diagnosis-related groups for inpatient hospital services).

How are Medicare reimbursement rates determined?

Payment rates for these services are determined based on the relative, average costs of providing each to a Medicare patient, and then adjusted to account for other provider expenses, including malpractice insurance and office-based practice costs.

How does insurance reimbursement work?

Reimbursement: Private health insurers or public payers (CMS, VA, etc.) may reimburse the insured for expenses incurred from illness or injury, or pay the provider directly for services rendered. It is often misunderstood that coverage of a condition equates to full reimbursement for these services.

What is the out-of-pocket maximum for Medicare?

Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

How long can you stay in the hospital under Medicare?

90 daysMedicare covers a hospital stay of up to 90 days, though a person may still need to pay coinsurance during this time. While Medicare does help fund longer stays, it may take the extra time from an individual's reserve days. Medicare provides 60 lifetime reserve days.

What is the most profitable department in a hospital?

These 10 physician specialties generate the most revenue for hospitalsCardiovascular surgery. Average revenue: $3.7 million. ... Cardiology (invasive) Average revenue: $3.48 million. ... Neurosurgery. Average revenue: $3.44 million. ... Orthopedic surgery. ... Gastroenterology. ... Hematology/Oncology. ... General surgery. ... Internal medicine.More items...•

How Medicare payments are calculated?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Why do hospitals charge so much?

Why Is My Hospital Bill So Expensive? The cost of US healthcare is soaring. Elements that contribute to the high cost of medical bills include surprise medical bills, administrative costs, rising doctors' fees, the high cost of surgical procedures and diagnostic tests, and soaring drugs costs.

How much money does the average hospital make?

What is the average hospital net patient revenue and operating expense? According to data from the Definitive Healthcare HospitalView product, average net patient revenue (NPR) at U.S. hospitals increased from $160.9 million in 2015 to $192.8 million in 2020.

What happens if you leave Medicare without a creditable coverage letter?

Without creditable coverage during the time you’ve been Medicare-eligible, you’ll incur late enrollment penalties. When you leave your group health coverage, the insurance carrier will mail you a creditable coverage letter. You’ll need to show this letter to Medicare to protect yourself from late penalties.

What happens if you don't have Part B insurance?

If you don’t, your employer’s group plan can refuse to pay your claims. Your insurance might cover claims even if you don’t have Part B, but we always recommend enrolling in Part B. Your carrier can change that at any time, with no warning, leaving you responsible for outpatient costs.

What is a Health Reimbursement Account?

Beneficiaries who participate can get tax-free reimbursements, including their Part B premium. A Health Reimbursement Account is a well-known Section 105 plan. An HRA reimburses eligible employees for their premiums, as well as other medical costs.

Is Medicare billed first or second?

If your employer has fewer than 20 employees, then Medicare becomes primary. This means Medicare is billed first, and your employer plan will be billed second. If you have small group insurance, it’s HIGHLY recommended that you enroll in both Parts A and B as soon as you’re eligible. If you don’t, your employer’s group plan can refuse ...

Is a $4,000 hospital deductible a creditable plan?

For your outpatient and medication insurance, a plan from an employer with over 20 employees is creditable coverage. This safeguards you from having to pay late enrollment penalties for Part B and Part D, ...

Can employers contribute to Medicare premiums?

Medicare Premiums and Employer Contributions. Per CMS, it’s illegal for employers to contribute to Medica re premiums. The exception is employers who set up a 105 Reimbursement Plan for all employees. The reimbursement plan deducts money from the employees’ salaries to buy individual insurance policies.

Social Security

Social Security taxes have a wage base. In 2021, this wage base is $142,800. The wage base means that you stop withholding and contributing Social Security taxes when an employee earns more than $142,800.

Medicare

Unlike Social Security, Medicare taxes do not have a wage base. Instead, Medicare has an additional withholding tax for employees who earn more than a set amount. In 2021, this base amount is $200,000 (single). Therefore, employees who earn more than $200,000 in 2021 pay 1.45% and an additional 0.9% to Medicare.

Self-employed tax

If you are self-employed, pay the entire cost of payroll taxes (aka self-employment taxes ). And, pay the additional 0.9% Medicare tax, too, if you earn more than the threshold per year.

How long does Medicare coverage last?

This special period lasts for eight months after the first month you go without your employer’s health insurance. Many people avoid having a coverage gap by signing up for Medicare the month before your employer’s health insurance coverage ends.

Does Cobra pay for primary?

The only exception to this rule is if you have End-Stage Renal Disease and COBRA will pay primary. Your COBRA coverage typically ends once you enroll in Medicare. However, you could potentially get an extension of the COBRA if Medicare doesn’t cover everything the COBRA plan does like dental or vision insurance.

Does Medicare pay second to employer?

Your health insurance through your employer will pay second and cover either some or all of the costs left over. If Medicare pays secondary to your insurance through your employer, your employer’s insurance pays first. Medicare covers any remaining costs. Depending on your employer’s size, Medicare will work with your employer’s health insurance ...

Does Medicare cover health insurance?

Medicare covers any remaining costs. Depending on your employer’s size, Medicare will work with your employer’s health insurance coverage in different ways. If your company has 20 employees or less and you’re over 65, Medicare will pay primary. Since your employer has less than 20 employees, Medicare calls this employer health insurance coverage ...

Can an employer refuse to pay Medicare?

The first problem is that your employer can legally refuse to make any health-related medical payments until Medicare pays first. If you delay coverage and your employer’s health insurance pays primary when it was supposed to be secondary and pick up any leftover costs, it could recoup payments.

What is the difference between Medicare and private insurance?

The difference between private and Medicare rates was greater for outpatient than inpatient hospital services, which averaged 264% and 189% of Medicare rates overall, respectively. For physician services, private insurance paid 143% of Medicare rates, on average, ranging from 118% to 179% of Medicare rates across studies.

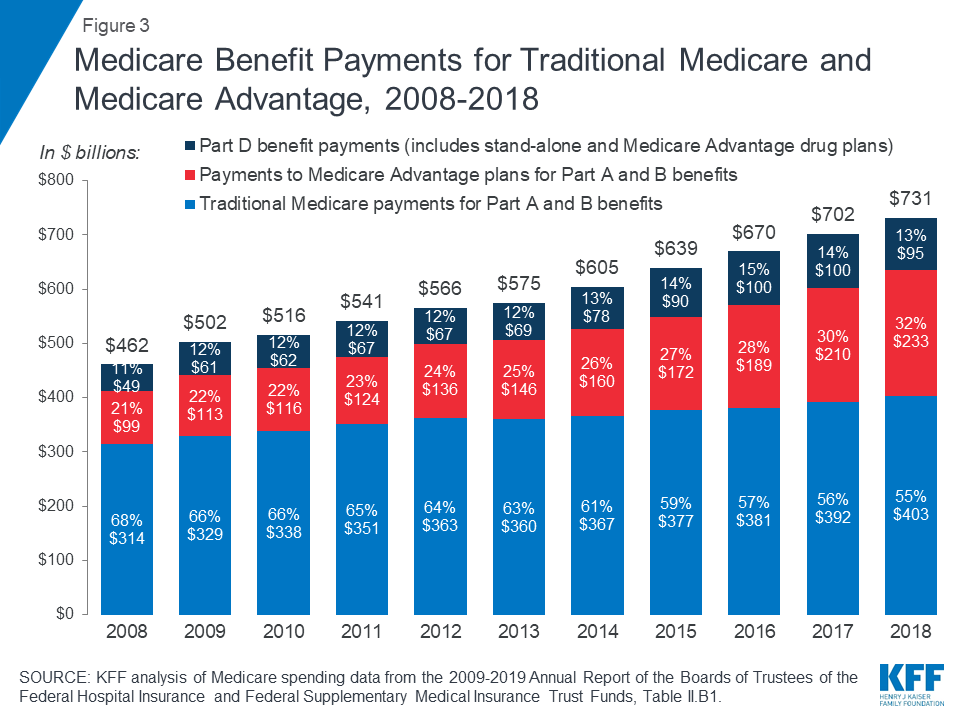

How much is healthcare spending?

Health care spending in the United States is high and growing faster than the economy. In 2018, health expenditures accounted for 17.7% of the national gross domestic product (GDP), and are projected to grow to a fifth of the national GDP by 2027. 1 Several recent health reform proposals aim to reduce future spending on health care while also expanding coverage to the nearly 28 million Americans who remain uninsured, and providing a more affordable source of coverage for people who struggle to pay their premiums. 2 Some have argued that these goals can be achieved by aligning provider payments more closely with Medicare rates, whether in a public program, like Medicare-for-All, a national or state-based public option, or through state rate-setting initiatives. 3,4,5,6,7,8 9,10,11

How are private insurance rates determined?

By contrast, private insurers’ payment rates are typically determined through negotiations with providers, and so vary depending on market conditions, such as the bargaining power of individual providers relative to insurers in a community.

What percentage of healthcare expenditures are private insurance?

Private insurers currently play a dominant role in the U.S. In 2018, private insurance accounted for more than 40% of expenditures on both hospital care and physician services.

Does Medicare have a payment system?

Over the years, Medicare has adopted a number of payment systems to manage Medicare spending and encourage providers to operate more efficiently, which in turn has helped slow the growth in premiums and other costs for beneficiaries.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

How much would Medicare have reduced?

If employers and health plans that participated in the study had paid for services at Medicare rates, it would have reduced total payments to hospitals by $19.7 billion from 2016 to 2018.

Is vertical integration in healthcare a trend?

There is also a growing trend of vertical integration in the healthcare market. Hospital systems have been buying up physician practices, which might also enable them to charge high prices. “Suppose there are two hospitals. One is cheaper and high quality, and the other is more expensive.

Do private hospitals pay more than Medicare?

A new study published by RAND Corporation finds that private insurers pay much higher prices for hospital services than Medicare does. As hospital prices have increased in recent years, so has per capita healthcare spending among privately insured populations.

Which hospital is the most expensive in Massachusetts?

Mass General Brigham, formerly Partners Healthcare, was the most expensive system in Massachusetts, but Massachusetts General, one of its premier hospitals, charged private insurers nearly three times what Medicare paid in 2016 through 2018, compared to roughly two times for the system’s Newton-Wellesley Hospital, according to the study.

Do employers oppose government action?

Many employers, including some represented by the U.S. Chamber of Commerce, oppose government action, but others are growing more open to the idea of some sort of government intervention, ranging from rate regulation to a public option.

Do employers pay more than Medicare?

A study shows that employers in many states are paying much more than Medicare prices for hospital services. The study, which exposes the aggressive pricing by mega-hospital systems that have gained enormous market power through widespread consolidation, is sure to kick-start the debate over the U.S. health care system and the need to overhaul it.

How much Social Security would I get if I turned 65 in 2010?

According to the institute’s data, a two-earner couple receiving an average wage — $44,600 per spouse in 2012 dollars — and turning 65 in 2010 would have paid $722,000 into Social Security and Medicare and can be expected to take out $966,000 in benefits. So, this couple will be paid about one-third more in benefits than they paid in taxes.

Who says it's possible to quantify exactly how much has been spent on beneficiaries beyond what they paid in?

Jagadeesh Gokhale of the libertarian Cato Institute says it’s possible to quantify exactly how much has been spent on beneficiaries beyond what they paid in, using an obscure line in the massive 2012 report of the Social Security trustees.

Why are taxes paid by active workers important?

The taxes paid by active workers help support today’s generation of retirees — which is a big reason why some policymakers are concerned about the program’s long-term solvency. In 1950, the average American lived for 68 years and retirees were supported by 16 active workers.

How much would a 65 year old get back in 2010?

A couple with only one spouse working (and receiving the same average wage) would have paid in $361,000 if they turned 65 in 2010, but can expect to get back $854,000 — more than double what they paid in. In 1980, this same 65-year-old couple would have received five times more than what they paid in, while in 1960, ...

Is Social Security a transfer system?

Thus, Social Security is — and always has been — a transfer system from younger generations to older generations. "We’re not really entitled to get our money back since we didn’t save it but rather spent it on our parents," said C. Eugene Steuerle, who helped assemble the Urban Institute’s calculations.

Does Social Security pay out to beneficiaries?

While there is technically a modest Social Security trust fund, the federal government has long paid out most Social Security revenues to beneficiaries, leaving the government and future workers with what amounts to an IOU to cover the next generation of beneficiaries.

Do people get more Social Security and Medicare?

In most cases, people get more from Social Security and Medicare combined than they put in, though the specific amount can vary depending on income and family circumstances. Here are some examples for people who turned 65 in 2010. See the footnotes for some important caveats.

When did Medicare start paying Social Security taxes?

Social Security taxes began in 1937, at a modest rate of 2%. Medicare hospital insurance taxes didn’t kick in until 1966, at a rate of 0.7%. Rates have climbed since then, of course, with the rate increase for Social Security taxes outpacing the rise in Medicare hospital insurance taxes. In 2020, payroll taxes only apply to the first $137,700 ...

Why is my take home pay different from my salary?

Payroll taxes are part of the reason your take-home pay is different from your salary. If your health insurance premiums and retirement savings are deducted from your paycheck automatically, then those deductions (combined with payroll taxes) can result in paychecks well below what you would get otherwise.

What is the current payroll tax rate for Social Security?

Payroll Tax Rates. The current tax rate for Social Security is 6.2% for the employer and 6.2% for the employee, for a total of 12.4%. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, for a total of 2.9%.

Why did Congress cut payroll taxes?

In tough economic times like the Great Recession, Congress cuts payroll taxes to give Americans a little extra take-home pay. Recently, President Trump allowed employers to temporarily suspend withholding and paying payroll taxes in an effort to offer COVID-19 relief.

How much is payroll tax in 2020?

According to the US Department of the Treasury, payroll taxes made up 38.3% of federal tax revenue in fiscal year 2020. That’s $1.31 trillion out of $3.42 trillion. These taxes come from the wages, salaries, and tips that are paid to employees, and the government uses them to finance Social Security and Medicare.

Do you pay payroll tax if you are self employed?

Employer Payroll Tax. Employers pay a share of some payroll taxes for their employees. That’s why if you go from being an employee of someone else to being self-employed your payroll tax liability will double. It’s something to budget for if you’re thinking of making the jump to self-employment.

Is raising the maximum taxable income a complement or an alternative to raising payroll tax rates?

As discussed, raising the maximum taxable income might be a complement or an alternative to raising payroll tax rates. Since 2013, high-income folks have had to pay a little extra in Medicare payroll taxes under a provision of the Affordable Care Act.

Key Findings

- Private insurers paid nearly double Medicare rates for all hospital services (199% of Medicare rates, on average), ranging from 141% to 259% of Medicare rates across the reviewed studies.

- The difference between private and Medicare rates was greater for outpatient than inpatient hospital services, which averaged 264% and 189% of Medicare rates overall, respectively.

- For physician services, private insurance paid 143% of Medicare rates, on average, ranging fr…

- Private insurers paid nearly double Medicare rates for all hospital services (199% of Medicare rates, on average), ranging from 141% to 259% of Medicare rates across the reviewed studies.

- The difference between private and Medicare rates was greater for outpatient than inpatient hospital services, which averaged 264% and 189% of Medicare rates overall, respectively.

- For physician services, private insurance paid 143% of Medicare rates, on average, ranging from 118% to 179% of Medicare rates across studies.

Background

- Health care spending in the United States is high and growing faster than the economy. In 2018, health expenditures accounted for 17.7% of the national gross domestic product (GDP), and are projected to grow to a fifth of the national GDP by 2027.1 Several recent health reform proposals aim to reduce future spending on health care while also expanding coverage to the nearly 28 mil…

Medicare vs. Private Insurance Rates: Literature Review

- This brief reviews findings from studies that compare Medicare and private insurance rates for hospital and physician services. We include studies with data from 2010 onward to reflect changes to Medicare provider payment rates established by the Affordable Care Act, and subsequent policy adjustments over the past decade. We identified 19 relevant studies through …

Medicare Payments and Provider Costs

- To assess the adequacy of Medicare’s hospital payment rates, MedPAC regularly compares the program’s payments to hospitals’ care delivery costs. Their findings show that, across all hospitals over the period from 2010 to 2018, costs for the treatment of Medicare beneficiaries have exceeded Medicare payments, resulting in negative and declining aggregate Medicare mar…

Discussion

- Based on the reviewed studies comparing Medicare and private insurance rates for hospital and physician services, this brief finds that private insurance payments are consistently greater, averaging 199% of Medicare rates for hospital services overall, 189% of Medicare rates for inpatient hospital services, 264% of Medicare rates for outpatient hospital services, and 143% o…