Full Answer

What does Medicare Part a cover for hospital costs?

If you’re eligible for Medicare, Medicare Part A can provide some coverage for inpatient care and significantly reduce costs for extended hospital stays. But in order to receive the full scope of benefits, you may need to pay a portion of the bill. Keep reading to learn more about Medicare Part A, hospital costs, and more.

How much does Medicare pay for you to stay in a hospital?

How Much Medicare Pays for You to Stay in a Hospital. Medicare Part A pays only certain amounts of a hospital bill for any one spell of illness. (And for each spell of illness, you must pay a deductible before Medicare will pay anything. In 2018, the hospital insurance deductible is $1,340.)

When does Medicare cover inpatient hospital care?

Inpatient hospital care. covers inpatient hospital care when all of these are true: You’re admitted to the hospital as an inpatient after an official doctor’s order, which says you need inpatient hospital care to treat your illness or injury. The hospital accepts Medicare.

What are my Medicare options for hospital coverage?

Another option for hospital coverage is a Medicare Advantage (Part C) plan. These plans are offered through private providers and include all benefits covered through original Medicare (Part A and Part B). These plans often include extra benefits, too, such as Medicare Part D (prescription drug coverage). They may also offer coverage for:

Does Medicare cover 100 percent of hospital?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

Does Medicare a cover hospitalization?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

What percentage does Medicare cover?

Medicare Part B pays 80% of the cost for most outpatient care and services, and you pay 20%. For 2022, the standard monthly Part B premium is $170.10.

What is the maximum out of pocket expense with Medicare?

Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

What happens when your Medicare runs out?

For days 21–100, Medicare pays all but a daily coinsurance for covered services. You pay a daily coinsurance. For days beyond 100, Medicare pays nothing. You pay the full cost for covered services.

Can a Medicare patient pay out-of-pocket?

Keep in mind, though, that regardless of your relationship with Medicare, Medicare patients can always pay out-of-pocket for services that Medicare never covers, including wellness services.

Is there a Medicare plan that covers everything?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

Does Medicare cover all health care expenses?

En español | Medicare covers some but not all of your health care costs. Depending on which plan you choose, you may have to share in the cost of your care by paying premiums, deductibles, copayments and coinsurance. The amount of some of these payments can change from year to year.

What is the 3 day rule for Medicare?

The 3-day rule requires the patient have a medically necessary 3-consecutive-day inpatient hospital stay. The 3-consecutive-day count doesn't include the discharge day or pre-admission time spent in the Emergency Room (ER) or outpatient observation.

What is the Medicare deductible for 2021?

$203 inThe standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What will Medicare cost in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the Medicare deductible for 2020?

$198 inThe annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.

How many days can you use Medicare in one hospital visit?

Medicare provides an additional 60 days of coverage beyond the 90 days of covered inpatient care within a benefit period. These 60 days are known as lifetime reserve days. Lifetime reserve days can be used only once, but they don’t have to be used all in one hospital visit.

How much does Medicare Part A cost in 2020?

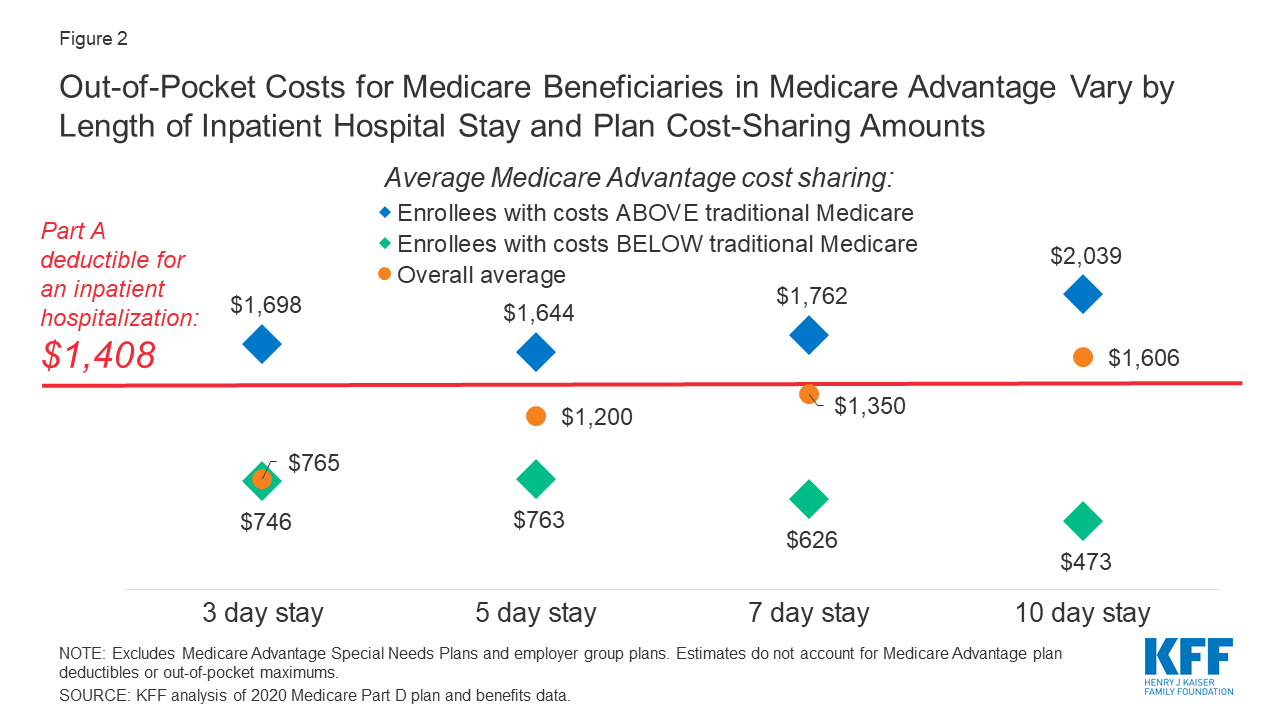

In 2020, the Medicare Part A deductible is $1,408 per benefit period.

How long does Medicare Part A deductible last?

Unlike some deductibles, the Medicare Part A deductible applies to each benefit period. This means it applies to the length of time you’ve been admitted into the hospital through 60 consecutive days after you’ve been out of the hospital.

What is the Medicare deductible for 2020?

Even with insurance, you’ll still have to pay a portion of the hospital bill, along with premiums, deductibles, and other costs that are adjusted every year. In 2020, the Medicare Part A deductible is $1,408 per benefit period.

What is Medicare Part A?

Medicare Part A, the first part of original Medicare, is hospital insurance. It typically covers inpatient surgeries, bloodwork and diagnostics, and hospital stays. If admitted into a hospital, Medicare Part A will help pay for:

How long do you have to work to qualify for Medicare Part A?

To be eligible, you’ll need to have worked for 40 quarters, or 10 years, and paid Medicare taxes during that time.

Does Medicare cover hospital stays?

Medicare Part A can help provide coverage for hospital stays. You’ll still be responsible for deductibles and coinsurance. A stay at the hospital can make for one hefty bill. Without insurance, a single night there could cost thousands of dollars. Having insurance can help reduce that cost.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

How long does Medicare cover hospital stays?

Medicare covers a hospital stay of up to 90 days, though a person may still need to pay coinsurance during this time. While Medicare does help fund longer stays, it may take the extra time from an individual’s reserve days. Medicare provides 60 lifetime reserve days. The reserve days provide coverage after 90 days, but coinsurance costs still apply.

What is covered by Medicare before a hospital stay?

This coverage includes: general nursing care. a semi-private room. hospital equipment and services. meals. medication that is part of inpatient hospital treatment.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How much does Medicare pay for skilled nursing in 2020?

Others, who may have long-term cognitive or physical conditions, require ongoing supervision and care. Medicare Part A coverage for care at a skilled nursing facility in 2020 involves: Day 1–20: The patient spends $0 per benefit period after meeting the deductible. Days 21–100: The patient pays $176 per day.

What is Medicare Part A?

Medicare Part A. Out-of-pocket expenses. Length of stay. Eligible facilities. Reducing costs. Summary. Medicare is the federal health insurance program for adults aged 65 and older, as well as for some younger people. Medicare pays for inpatient hospital stays of a certain length. Medicare covers the first 60 days of a hospital stay after ...

How much is the deductible for Medicare 2020?

This amount changes each year. For 2020, the Medicare Part A deductible is $1,408 for each benefit period.

What is long term acute care?

Long-term acute care hospitals specialize in treating medically complex conditions that may require extended hospital stays, of several weeks , for example. After doctors at a general acute care hospital have stabilized a patient, the patient may be transferred to a long-term care hospital.

How much does Medicare pay for hospital bills?

Medicare Part A pays only certain amounts of a hospital bill for any one spell of illness. (And for each spell of illness, you must pay a deductible before Medicare will pay anything. In 2020, the hospital insurance deductible is $1,408.)

How long does Medicare cover psychiatric hospitals?

Psychiatric Hospitals. Medicare Part A hospital insurance covers a total of 190 days in a lifetime for inpatient care in a specialty psychiatric hospital (meaning one that accepts patients only for mental health care, not just a general hospital). If you are already an inpatient in a specialty psychiatric hospital when your Medicare coverage goes ...

What is Medicare Part A?

Medicare Part A is also called "hospital insurance," and it covers most of the cost of care when you are at a hospital or skilled nursing facility as an inpatient. Medicare Part A also covers hospice services. For most people over 65, Medicare Part A is free. The following list gives you an idea of what Medicare Part A pays for, ...

How many days can you use Medicare lifetime reserve?

If you are in the hospital more than 90 days during one spell of illness, you can use up to 60 additional "lifetime reserve" days of coverage. During those days, you are responsible for a daily coinsurance payment of $704 per day in 2020. Medicare pays the rest of covered costs.

How long does a skilled nursing home stay in the hospital?

Your skilled nursing stay or home health care must begin within 30 days of being discharged.

How many reserve days do you have to use for Medicare?

You do not have to use your reserve days in one spell of illness; you can split them up and use them over several benefit periods. But you have a total of only 60 reserve days in your lifetime. (Note: If you have a Medicare Advantage Plan, called Medicare Part C, you may not have to pay ...

Does Medicare cover skilled nursing?

Skilled Nursing Facilities and Home Health Care. Under some circumstances, Medicare will cover some of the cost of inpatient treatment in a skilled nursing facility or visits from a home health care agency. Your stay in a skilled nursing home facility or home health care is covered by Medicare Part A only if you have spent three consecutive days, ...

What does Medicare cover inpatient?

What Inpatient Hospital Costs Does Medicare Cover? As an inpatient at a hospital, your Medicare Part A coverage includes the following: Semi-private rooms. Meals. General nursing. Inpatient treatment drugs. Care as part of a qualifying clinical research study. Other hospital services and supplies.

What is Medicare Part A?

Medicare Part A covers inpatient hospital stays, as well as skilled nursing care, hospice care and limited home health services. Medicare beneficiaries can expect to meet a deductible before Part A starts paying its share of benefits. A Medicare Supplement (Medigap) plan can help pay for your hospital stays, including costs such as Medicare ...

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plan (Medigap) helps pay for out-of-pocket costs associated with a hospital stay. All Medigap plans offer coverage for the following hospital benefits: Medicare Part A coinsurance and hospital costs. First three pints of blood if needed for a transfusion. Part A hospice care coinsurance or copayment.

When will Medicare plan F and C be available?

Important: Plan F and Plan C are not available to beneficiaries who became eligible for Medicare on or after January 1, 2020. Call today to speak with a licensed insurance agent who can help you compare Medigap plans that are available where you live.

Does Medicare Part A cover hospice?

Some Medigap plans may also include coverage for: Coinsurance for skilled nursing facility stay. Medicare Part A deductible. With 10 standardized Medigap plans to choose from in most states, you can find one that meets your needs.

How does hospital status affect Medicare?

Inpatient or outpatient hospital status affects your costs. Your hospital status—whether you're an inpatient or an outpatient—affects how much you pay for hospital services (like X-rays, drugs, and lab tests ). Your hospital status may also affect whether Medicare will cover care you get in a skilled nursing facility ...

How long does an inpatient stay in the hospital?

Inpatient after your admission. Your inpatient hospital stay and all related outpatient services provided during the 3 days before your admission date. Your doctor services. You come to the ED with chest pain, and the hospital keeps you for 2 nights.

What is an ED in hospital?

You're in the Emergency Department (ED) (also known as the Emergency Room or "ER") and then you're formally admitted to the hospital with a doctor's order. Outpatient until you’re formally admitted as an inpatient based on your doctor’s order. Inpatient after your admission.

When is an inpatient admission appropriate?

An inpatient admission is generally appropriate when you’re expected to need 2 or more midnights of medically necessary hospital care. But, your doctor must order such admission and the hospital must formally admit you in order for you to become an inpatient.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , coinsurance. An amount you may be required to pay as your share of the cost for services after you pay any deductibles.

Is an outpatient an inpatient?

You're an outpatient if you're getting emergency department services, observation services, outpatient surgery, lab tests, or X-rays, or any other hospital services, and the doctor hasn't written an order to admit you to a hospital as an inpatient. In these cases, you're an outpatient even if you spend the night in the hospital.

Does Medicare cover skilled nursing?

Your hospital status may also affect whether Medicare will cover care you get in a skilled nursing facility (SNF) following your hospital stay. You're an inpatient starting when you're formally admitted to the hospital with a doctor's order. The day before you're discharged is your last inpatient day. You're an outpatient if you're getting ...