Over the next 30 years, Social Security and Medicare face a combined $103 trillion cash deficit, which will push the national debt to nearly 150% of GDP. At that point, interest on that debt would consume 40% of all tax revenues or more, if interest rates rise.

Full Answer

Will Social Security and Medicare run $82 trillion deficits?

Aug 15, 2018 · The cause of this coming debt deluge is no mystery: Social Security and Medicare are projected to run a staggering $82 trillion cash deficit over the next 30 years.

What is the US national debt?

They are funded by taxpayer withholding taxes. In point of fact, the government owes Social Security over $4 Trillion, from social security taxes withheld in excess of benefits paid out, going back decades. That $4+Trillion actually is a part of the national debt in that the government owes it to Social Security.

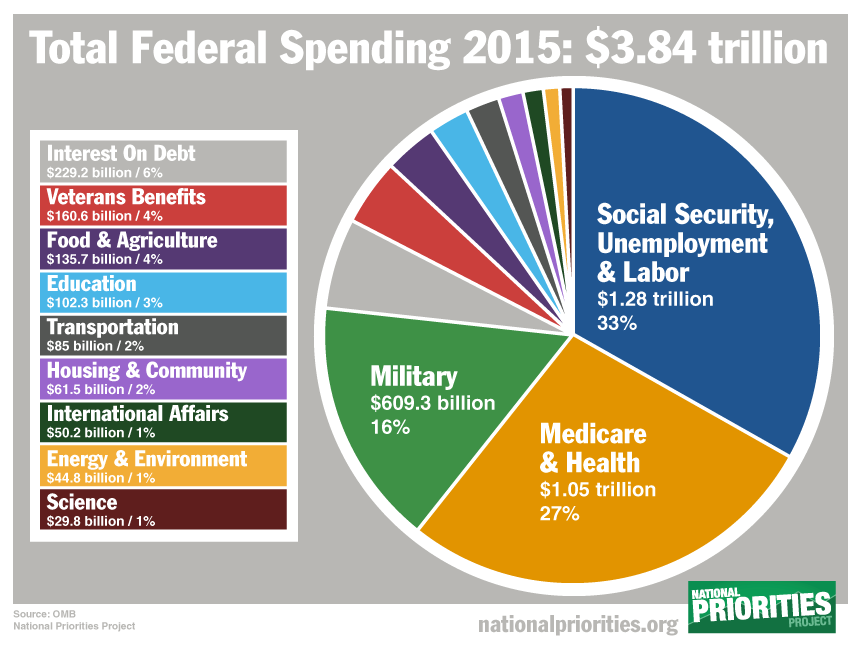

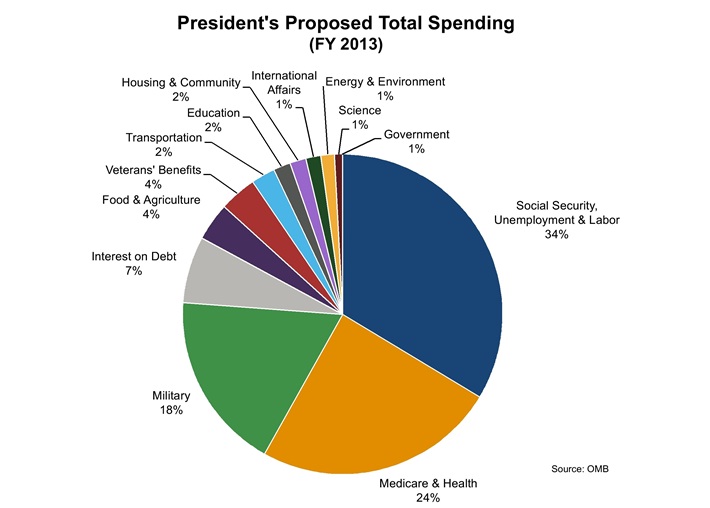

How much of federal spending goes toward social security?

Apr 28, 2022 · DI - $139,145,000,000. So, that's almost $2.6 trillion for the Old-Age and Survivors Insurance trust fund, plus an additional $140 billion or so for the Disability Insurance trust fund. Ouch. Source: SSA.gov - Status of the Social Security and Medicare Programs.

How much will Social Security and Medicare cost in 30 years?

Jan 28, 2020 · • Over the next 30 years, the Social Security and Medicare systems are projected by CBO to run a $103 trillion cash shortfall. The rest of the budget is projected to run a $23 trillion surplus. • Specifically, Social Security will run a $19 trillion cash …

How much of the national debt is held by Social Security?

What contributes most to the national debt?

Who owns over 70% of the US debt?

Who does the US owe the most debt to?

What happens when national debt gets too high?

How much debt is the US in 2021?

How much debt is Canada in?

How Much Does China owe the US?

What happens if China stops buying U.S. debt?

Does China own the US?

Which country owes the most money to China?

Does Russia owe China money?

Why is the national debt growing?

National debt growing due to Social Security and Medicare. Cuts in Social Security and Medicare are inevitable. Delaying reform will make it worse.

What is the significance of August 14th?

One such issue on August 14, which marked the 83rd birthday of Social Security, is whether its record of paying full benefits will make it to the 100th birthday.

Is the long term debt problem a Medicare issue?

The long-term debt problem is overwhelmingly a Social Security and Medicare issue . The rest of the budget is projected by CBO to produce growing surpluses over the long-term – but cannot balance out a $103 trillion projected shortfall within Social Security and Medicare.

Will the baby boomers retire into Medicare?

For decades, economists and policy experts warned that a budgetary and economic tsunami would come when the 74 million baby boomers retire into Social Security and Medicare. Nevertheless, nothing significant has been done to avert the crisis. To the contrary, both parties added a new Medicare drug entitlement in 2003, after which the Affordable Care Act further expanded federal health obligations for Medicaid and new subsidized health-insurance exchanges.

Is a strong economy necessary?

Steep economic growth. A strong economy is necessary but far from sufficient for major deficit reduction. Growth rates will already be limited by the labor-force slowdown caused by baby-boomer retirements and declining birthrates. That leaves productivity to drive growth.

Why is healthcare underperforming?

The primary reasons why our healthcare system underperforms is because the typical factors that fuel improvement and innovation in other industries are lacking in healthcare: 1 Historically, consumers have not been cost sensitive because their employers and health plans often cover a large share of their costs, and because they lack the information required to assess quality and cost. 2 Employers and insurers often assume a passive role, accepting annual cost increases, and eventually passing these costs on to customers and employees. 3 Providers generally operate under a fee-for-service model in which they are compensated based on the volume of their services, rather than the value of the care they provide. 4 Improvements in technology often make healthcare more expensive.

What are the long term fiscal challenges?

Combined with the demographic realities of an aging population, America’s healthcare system leaves us with an unsustainable fiscal future. Not only will more Americans qualify for federal healthcare programs like Medicare in the coming years, but older people, on average, need more healthcare. Consequently, without reform, the federal budget will bear the cost of rapidly growing healthcare bills.

What is the national debt of the United States?

national debt is the sum of these two federal debt categories: Public debt, held by other countries, the Federal Reserve, mutual funds, and other entities and individuals. Intragovernmental holdings, held by Social Security, Military Retirement Fund, Medicare, and other retirement funds.

What is the US debt in 2021?

The Balance / Nusha Ashjaee. The U.S. debt reached a new high of $28.1 trillion as of March 31, 2021. 1. Most headlines focus on how much the United States owes China, one of the largest foreign owners. What many people don’t know is that the Social Security Trust Fund, also known as your retirement money, owns most of the national debt.

What is public debt?

Public debt, held by other countries, the Federal Reserve, mutual funds, and other entities and individuals. Intragovernmental holdings, held by Social Security, Military Retirement Fund, Medicare, and other retirement funds.

Who is Kimberly Amadeo?

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch.

Who is Tom Catalano?

Tom Catalano is the owner and Principal Advisor at Hilton Head Wealth Advisors, LLC. He holds the coveted CFP designation from The Certified Financial Planner Board of Standards in Washington, DC, and is a Registered Investment Adviser with the state of South Carolina. Article Reviewed on May 03, 2021.

How much is the national debt in 2021?

These are part of mandatory spending, which are programs established by prior Acts of Congress. The interest payments on the national debt total $378 billion for FY 2021. They are necessary to maintain faith in the U.S. government. About $1.485 trillion in FY 2021 goes toward discretionary spending, which pays for all federal government agencies.

How much is discretionary spending?

Discretionary spending is $1.485 trillion. 1 It pays for everything else. Congress decides how much to appropriate for these programs each year. It's the only government spending that Congress can cut. 12

What is the budget for FY 2021?

Key Takeaways. Government spending for FY 2021 budget is $4.829 trillion. Despite sequestration to curb government spending, deficit spending has increased with the government’s effort to continually boost economic growth. Two-thirds of federal expenses must go to mandatory programs such as Social Security, Medicare, and Medicaid.

How much will the mandatory budget cost in 2021?

The mandatory budget will cost $2.966 trillion in FY 2021. 1 Mandatory spending is skyrocketing, because more baby boomers are reaching retirement age. By 2030, one in five Americans will be older than 65. 8

Who is Kimberly Amadeo?

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. Read The Balance's editorial policies. Kimberly Amadeo. Reviewed by. Full Bio.