What percentage of the federal budget goes to Medicaid?

· If we look at each program individually, Medicare spending grew 3.5% to $829.5 billion in 2020, which is 20% of total NHE, while Medicaid spending grew 9.2% to $671.2 billion in 2020, which is 16%...

How much does Medicare cost the federal government?

Welfare Programs, including the Medicaid Program represents 15% of the federal budget. Federal Spending By Welfare Program For Fiscal Years 2019, 2020 and 2021 In Billions Increased costs in the SNAP, Refundable Income Taxes and Housing Assistance Programs, over the last two years, were from expansion of benefits for Coronavirus relief.

What percentage of the federal budget is spent on welfare?

· In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

How much of Medicare spending is funded by payroll taxes?

But in the recovery since 2010 Other Welfare spending has steadily decreased to an estimated 2.3 percent GDP in 2017. Since 2015 Medicaid spending has remained steady at 3 percent GDP. In 2021 Medicaid spending was 3.3 percent GDP and Other Welfare was 7.2 percent GDP. See also Welfare Spending History .

What percentage of the US budget is Medicaid?

Historical NHE, 2020: NHE grew 9.7% to $4.1 trillion in 2020, or $12,530 per person, and accounted for 19.7% of Gross Domestic Product (GDP). Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE. Medicaid spending grew 9.2% to $671.2 billion in 2020, or 16 percent of total NHE.

What percent of the budget goes to welfare?

In 2020 federal welfare spending was 4.67 percent GDP, state welfare spending was 0.57 percent GDP and local welfare spending was 0.50 percent GDP.

What are the 5 largest federal expenses?

Major categories of FY 2017 spending included: Healthcare such as Medicare and Medicaid ($1,077B or 27% of spending), Social Security ($939B or 24%), non-defense discretionary spending used to run federal Departments and Agencies ($610B or 15%), Defense Department ($590B or 15%), and interest ($263B or 7%).

What is the biggest part of the US budget?

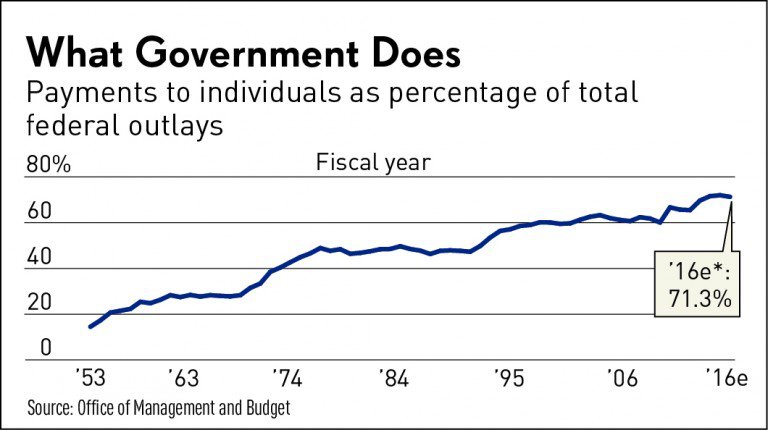

Social Security takes up the largest portion of the mandatory spending dollars. In fact, Social Security demands $1.046 trillion of the total $2.739-trillion mandatory spending budget. It also includes programs like unemployment benefits and welfare.

What percentage of federal tax goes to welfare?

Safety net programs: About 8 percent of the federal budget in 2019, or $361 billion, supported programs that provide aid (other than health insurance or Social Security benefits) to individuals and families facing hardship.

How much does the US spend on welfare 2020?

Federal Spending in Fiscal Years 2019, 2020, and 2021 in Billions: The federal budget increased from $4.4 trillion in 2019 to $6.8 trillion in 2021. Welfare spending increased from $773 billion to $1,056 trillion. These are dramatic increases and relate to various Coronavirus relief legislation.

What percent of US budget is Social Security and Medicare?

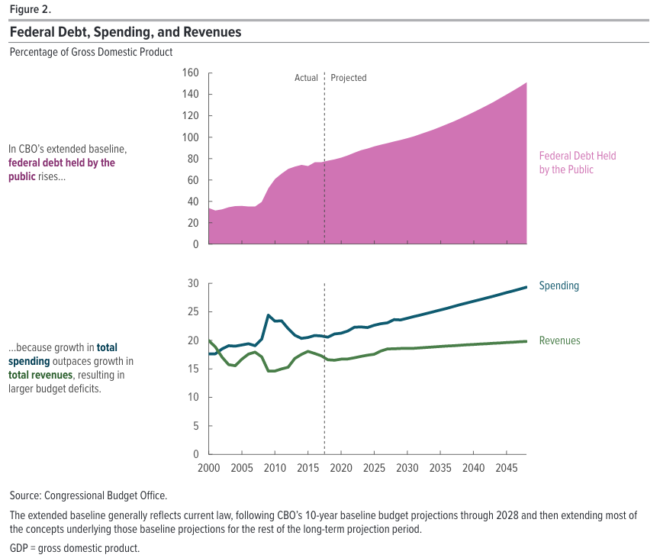

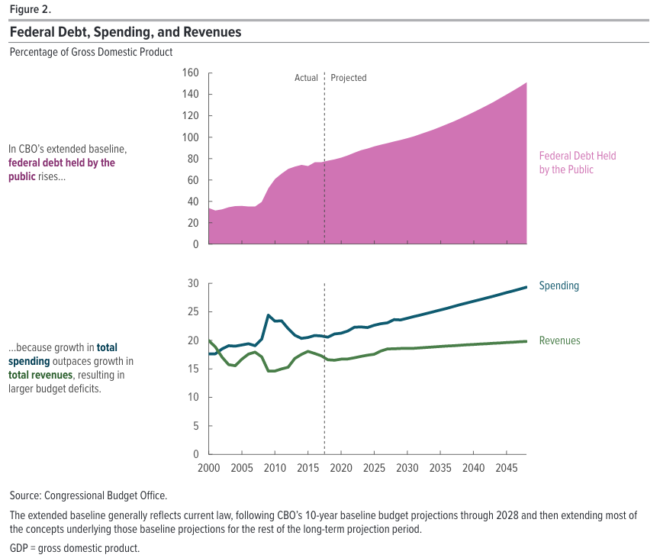

Total program spending, including Social Security and Medicare, will be 19.0 percent of GDP in 2019 — below the peak of 23.1 percent in 2009 (during the depths of the Great Recession) but above the 40-year historical average.

What are the 3 largest categories of federal government spending?

The U.S. Treasury divides all federal spending into three groups: mandatory spending, discretionary spending and interest on debt. Together, mandatory and discretionary spending account for more than ninety percent of all federal spending, and pay for all of the government services and programs on which we rely.

How much does the US spend on social welfare?

In 2020, the cost of the Social Security and Medicare programs was $2.03 trillion. The majority of Social Security and Medicare funding comes from tax revenue and interest on trust fund reserves. For 2020, income for these programs was $2.02 trillion.

What are the top 5 expenditures for the federal government in 2020?

See More About Mandatory Spending See More About Discretionary Spending $345 Billion Defense $714 Billion Nondefense $914 Billion Other $988 Billion Recovery Rebates $275 Billion Unemployment Compensation $473 Billion PPP $526 Billion Medicaid $458 Billion Medicare $769 Billion Social Security $1.1 Trillion $6.6 ...

Where does most of the US budget go?

More than half of FY 2019 discretionary spending went for national defense, and most of the rest went for domestic programs, including transportation, education and training, veterans' benefits, income security, and health care (figure 4).

What is the biggest source of revenue for the federal government?

The individual income taxThe individual income tax has been the largest single source of federal revenue since 1950, amounting to about 50 percent of the total and 8.1 percent of GDP in 2019 (figure 3).

How much is welfare in the US?

According to USDA data as of January 7, 2022, SNAP paid on average $243.42 per person and $460.64 per household.

What percent of US budget is Social Security and Medicare?

Total program spending, including Social Security and Medicare, will be 19.0 percent of GDP in 2019 — below the peak of 23.1 percent in 2009 (during the depths of the Great Recession) but above the 40-year historical average.

How many are on welfare in the US?

59 millionThe number of people on welfare in the US is 59 million. There are 6 major welfare programs in the US. Four out of ten people in the US have been part of a welfare program for over 3 years. Nearly 50% of Americans believe government spending on social security needs to be increased.

What is Medicare budget?

Budget Basics: Medicare. Medicare is an essential health insurance program serving millions of Americans and is a major part of the federal budget. The program was signed into law by President Lyndon B. Johnson in 1965 to provide health insurance to people age 65 and older. Since then, the program has been expanded to serve the blind and disabled.

How much of Medicare is funded by the government?

They financed 15 percent of Medicare’s overall costs in 2019, about the same share as in 1970. The federal government’s general fund has been playing a larger role in Medicare financing. In 2019, 43 percent of Medicare’s income came from the general fund, up from 25 percent in 1970.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

When was Medicare first introduced?

The program was signed into law by President Lyndon B. Johnson in 1965 to provide health insurance to people age 65 and older. Since then, the program has been expanded to serve the blind and disabled.

How many people are on Medicare in 2019?

The number of people enrolled in Medicare has tripled since 1970, climbing from 20 million in 1970 to 61 million in 2019, and it is projected to reach about 88 million in 30 years.

How much did Medicare cost in 2019?

In 2019, it cost $644 billion — representing 14 percent of total federal spending. 1. Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and about 40 percent of all home health spending. In 2019, Medicare provided benefits to 19 percent of the population. 2.

What is Medicare Advantage?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": Part A pays for hospital care; Part B provides medical insurance for doctor’s fees and other medical services; Part C is Medicare Advantage, which allows beneficiaries to enroll in private health ...

How much of Medicaid is financed by the state?

Spending. Funding for the state (often referred to as the nonfederal) share of Medicaid comes from a variety of sources. By law, at least 40 percent must be financed by the state and up to 60 percent may come from local governments.

What is the total state budget?

Total state budgets include all state (solid segments) and federal funds (dotted segments). State-funded state budgets include all non-federal funds, and consist of state general funds (expenditures from revenues raised through income, sales, and other broad-based state taxes); other state funds ...

Is Medicaid a shared responsibility?

Funding for education is generally a state and local responsibility, but the local portion is generally not reflected in state budgets. In contrast, Medicaid is a shared responsibility ...

Is Medicaid a federal or state program?

In contrast, Medicaid is a shared responsibility between the federal government and states, and most of the program’s funding flows through state budgets. As a result, when combined state and local budgets are examined (rather than state budgets alone), education’s share of spending remains similar and Medicaid’s becomes smaller.

What is the state fund category?

The all federal and state funds category reflects amounts from any source. The state general funds category reflects amounts from revenues raised through income, sales, and other broadbased state taxes. The all state funds category reflects amounts from any non-federal source; these include state general funds, ...

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

How much is Medicare Part A?

Part A ($202.8 billion gross fee-for-service spending in 2018)#N#Medicare Part A pays for inpatient hospital, skilled nursing facility, home health related to a hospital stay, and hospice care. Part A financing comes primarily from a 2.9 percent payroll tax paid by both employees and employers.

How many people are on Medicare Advantage in 2018?

In 2018, Medicare Advantage enrollment will total approximately 20.8 million, or approximately 38 percent of all Medicare beneficiaries. Centers for Medicare and Medicaid Services (CMS) data confirm that 99 percent of Medicare beneficiaries will have access to at least one Medicare Advantage plan in 2018.

What is Medicare Part A?

Medicare Part A pays for inpatient hospital, skilled nursing facility, home health related to a hospital stay, and hospice care. Part A financing comes primarily from a 2.9 percent payroll tax paid by both employees and employers.

What is the FY 2018 budget?

The FY 2018 Budget reflects the President’s commitment to preserve Medicare and does not include direct Medicare cuts. The Budget repeals the Independent Payment Advisory Board, commits to improving the Medicare appeals process, and supports efforts to limit defensive medicine as a part of a larger medical liability reform effort.

What percentage of Medicare beneficiaries are covered by Part B?

Part B coverage is voluntary, and about 91 percent of all Medicare beneficiaries are enrolled in Part B. Approximately 25 percent of Part B costs are financed by beneficiary premiums, with the remaining 75 percent covered by general revenues.

How much is Medicare Part D deductible?

Medicare Part D offers a standard prescription drug benefit with a 2017 deductible of $400 and an average estimated monthly premium of $35.

What is medical liability reform?

Medical Liability Reform: The Budget includes a set of proposals for medical liability reform. This initiative will reduce Federal spending on healthcare, including by curbing the provision of unnecessary services in Medicare.

What percentage of Medicare is spent on healthcare?

Medicare plays a major role in the health care system, accounting for 20 percent of total national health spending in 2017, 30 percent of spending on retail sales of prescription drugs, 25 percent of spending on hospital care, and 23 percent of spending on physician services. In 2018, Medicare spending (net of income ...

How much did Medicare pay in 2018?

In 2018, Medicare benefit payments totaled $731 billion, up from $462 billion in 2008 (Figure 2) (these amounts do not net out premiums and other offsetting receipts). While benefit payments for each part of Medicare (A, B, and D) increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased from 50 percent to 41 percent, spending on Part B benefits (mainly physician services and hospital outpatient services) increased from 39 percent to 46 percent, and spending on Part D prescription drug benefits increased from 11 percent to 13 percent.

How many people are covered by Medicare?

Published: Aug 20, 2019. Medicare, the federal health insurance program for more than 60 million people ages 65 and over and younger people with long-term disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the most recent historical ...

How much will Medicare per capita increase in 2028?

Medicare per capita spending is projected to grow at an average annual rate of 5.1 percent over the next 10 years (2018 to 2028), due to growing Medicare enrollment, increased use of services and intensity of care, and rising health care prices.

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

Is Medicare spending comparable to private health insurance?

Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

How fast will Medicare spending grow?

On a per capita basis, Medicare spending is also projected to grow at a faster rate between 2018 and 2028 (5.1 percent) than between 2010 and 2018 (1.7 percent), and slightly faster than the average annual growth in per capita private health insurance spending over the next 10 years (4.6 percent).