What percent of US budget is Social Security and Medicare?

Social Security ($845B or 24% of spending), Healthcare such as Medicare and Medicaid ($831B or 24%), other mandatory programs such as food stamps and unemployment compensation ($420B or 12%) and interest ($229B or 6.5%). As a share of federal budget, mandatory spending has increased over time.

What percentage of the budget is Medicare?

Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the...

Is Medicare funded by state or government?

That means Medicare is primarily funded by taxpayers through general federal tax revenue, payroll tax revenue from the Medicare tax, and premiums paid by its beneficiaries. How Medicare is funded Funding for Medicare comes from the Medicare Trust Funds, which are two separate trust fund accounts held by the U.S. Treasury:

What is Medicare annual budget?

Medicare consists of four "parts":

- Part A pays for hospital care;

- Part B provides medical insurance for doctor’s fees and other medical services;

- Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits;

- Part D covers prescription drugs.

How much did us spend on Medicare in 2020?

$829.5 billionMedicare spending totaled $829.5 billion in 2020, representing 20% of total health care spending. Medicare spending increased in 2020 by 3.5%, compared to 6.9% growth in 2019. Fee-for-service expenditures declined 5.3% in 2020 down from growth of 2.1% in 2019.

What percentage of the US budget is spent on healthcare?

19.7%Total national health expenditures as a percent of Gross Domestic Product, 1970-2020. The share of the gross domestic product (GDP) devoted to health care reached 19.7% in 2020, an uptick from prior years. While the pandemic drove increases in total health spending in 2020, GDP declined 2.2% that year.

What percentage of the US budget is spent on social programs?

In 2019, major entitlement programs—Social Security, Medicare, Medicaid, Obamacare, and other health care programs—consumed 51 percent of all federal spending, larger than the portion of spending for other national priorities (such as national defense) combined.

How much of the federal budget is allocated to Medicare by 2029?

18 percentMedicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029.

What percent of our taxes go to healthcare?

In other words, the federal government dedicates resources of nearly 8 percent of the economy toward health care. By 2028, we estimate these costs will rise to $2.9 trillion, or 9.7 percent of the economy. Over time, these costs will continue to grow and consume an increasing share of federal resources.

How much does the government spend on Medicare?

Medicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

What is the biggest expense of the US government?

Social Security takes up the largest portion of the mandatory spending dollars. In fact, Social Security demands $1.046 trillion of the total $2.739-trillion mandatory spending budget. It also includes programs like unemployment benefits and welfare.

What are the 3 largest categories of federal government spending?

The U.S. Treasury divides all federal spending into three groups: mandatory spending, discretionary spending and interest on debt. Together, mandatory and discretionary spending account for more than ninety percent of all federal spending, and pay for all of the government services and programs on which we rely.

Where does most of the US budget go?

More than half of FY 2019 discretionary spending went for national defense, and most of the rest went for domestic programs, including transportation, education and training, veterans' benefits, income security, and health care (figure 4).

What percentage of US GDP is healthcare?

19.7%In 2020, U.S. national health expenditure as a share of its gross domestic product (GDP) reached an all time high of 19.7%. The United States has the highest health spending based on GDP share among developed countries. Both public and private health spending in the U.S. is much higher than other developed countries.

What percentage of healthcare is paid by the government?

Government Now Pays For Nearly 50 Percent Of Health Care Spending, An Increase Driven By Baby Boomers Shifting Into Medicare. A new CMS report projects that U.S. health care spending will surpass $5.9 trillion in 2027, growing to represent more than 19 percent of the economy.

Is Medicare subsidized by the federal government?

As a federal program, Medicare relies on the federal government for nearly all of its funding. Medicaid is a joint state and federal program that provides health care coverage to beneficiaries with very low incomes.

How much does the US spend on healthcare 2019?

The federal government spent nearly $1.2 trillion on health care in fiscal year 2019 (table 1). Of that, Medicare claimed roughly $644 billion, Medicaid and the Children's Health Insurance Pro-gram (CHIP) about $427 billion, and veterans' medical care about $80 billion.

How much does the US spend on health care?

$4.1 trillionHealth spending in the U.S. increased by 9.7% in 2020 to $4.1 trillion or $12,530 per capita. This growth rate is substantially higher than 2019 (4.3 percent).

What does the US government spend the most money on?

Nearly 60 percent of mandatory spending in 2019 was for Social Security and other income support programs (figure 3). Most of the remainder paid for the two major government health programs, Medicare and Medicaid.

What percent of the U.S. health care system is government funded?

Federal spending represented 28 percent of total health care spending. Federal taxes fund public insurance programs, such as Medicare, Medicaid, CHIP, and military health insurance programs (Veteran's Health Administration, TRICARE).

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

How is Medicare funded?

How Medicare Is Funded. Medicare is funded by two trust funds that can only be used for Medicare. The hospital insurance trust fund is funded by payroll taxes paid by employees, employers, and the self-employed. These funds are used to pay for Medicare Part A benefits. 11 .

What is CMS and Medicaid?

CMS works alongside the Department of Labor (DOL) and the U.S. Treasury to enact insurance reform. The Social Security Administration (SSA) determines eligibility and coverage levels. Medicaid, on the other hand, is administered at the state level.

How is Medicare supplemental insurance fund funded?

Medicare's supplementary medical insurance trust fund is funded by Congress, premiums from people enrolled in Medicare, and other avenues, such as investment income from the trust fund. These funds pay for Medicare Part B benefits, Part D benefits, and program administration expenses.

What is Medicare contribution tax?

It is known as the unearned income Medicare contribution tax. Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans .

What is the Medicare tax rate for 2013?

On Jan. 1, 2013, the ACA also imposed an additional Medicare tax of 0.9% on all income above a certain level for high-income taxpayers. Single filers have to pay this additional amount on all earned income they receive above $200,000 and married taxpayers filing jointly owe it on earned income in excess of $250,000.

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...

What percentage of Medicare is spending?

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

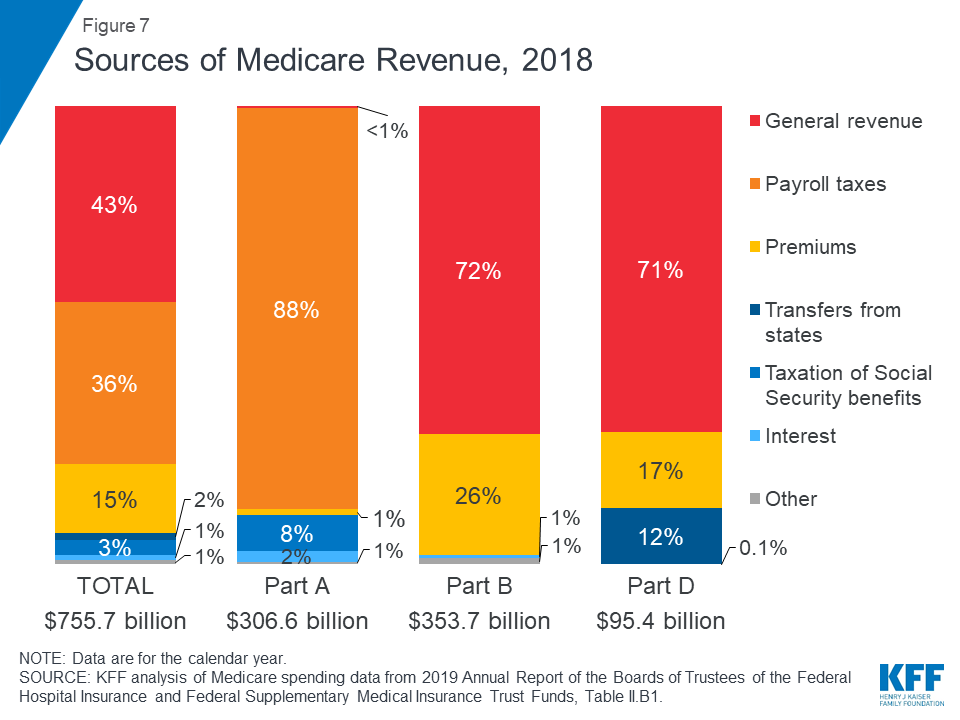

How is Medicare Part D funded?

Part D is financed by general revenues (71 percent), beneficiary premiums (17 percent), and state payments for beneficiaries dually eligible for Medicare and Medicaid (12 percent). Higher-income enrollees pay a larger share of the cost of Part D coverage, as they do for Part B.

How fast will Medicare spending grow?

On a per capita basis, Medicare spending is also projected to grow at a faster rate between 2018 and 2028 (5.1 percent) than between 2010 and 2018 (1.7 percent), and slightly faster than the average annual growth in per capita private health insurance spending over the next 10 years (4.6 percent).

Why is Medicare spending so high?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis.

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

How is Medicare's solvency measured?

The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years when annual income to the trust fund exceeds benefits spending, the asset level increases, and when annual spending exceeds income, the asset level decreases.

What is Medicare recurring?

Recurring Publications. Medicare is the second-largest federal program and provides subsidized medical insurance for the elderly and certain disabled people. CBO’s work on Medicare includes projections of federal spending under current law, cost estimates for legislative proposals, and analyses of specific aspects of the program ...

What percentage of prescriptions were brand name drugs in 2015?

In 2015, brand-name specialty drugs accounted for about 30 percent of net spending on prescription drugs under Medicare Part D and Medicaid, but they accounted for only about 1 percent of all prescriptions dispensed in each program.

Why is Medicare underfunded?

Medicare is already underfunded because taxes withheld for the program don't pay for all benefits. Congress must use tax dollars to pay for a portion of it. Medicaid is 100% funded by the general fund, also known as "America's Checkbook.".

How much is discretionary spending?

Discretionary spending, which pays for everything else, will be $1.688 trillion. The U.S. Congress appropriates this amount each year, using the president's budget as a starting point. Interest on the U.S. debt is estimated to be $305 billion.

What is the budget for 2022?

The discretionary budget for 2022 is $1.688 trillion. 1 Much of it goes toward military spending, including Homeland Security, the Department of Veterans Affairs, and other defense-related departments. The rest must pay for all other domestic programs.

How much is Biden's budget for 2022?

President Biden’s budget for FY 2022 totals $6.011 trillion, eclipsing all other previous budgets. Mandatory expenditures, such as Social Security, Medicare, and the Supplemental Nutrition Assistance Program account for about 65% of the budget. For FY 2022, budget expenditures exceed federal revenues by $1.873 trillion.

How long does it take for the President to respond to the budget?

The president submits it to Congress on or before the first Monday in February. Congress responds with spending appropriation bills that go to the president by June 30. The president has 10 days to reply.

Is Social Security covered by payroll taxes?

Social Security costs are currently 100% covered by payroll taxes and interest on investments. Until 2010, there was more coming into the Social Security Trust Fund than being paid out. Thanks to its investments, the Trust Fund is still running a surplus. Important.

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

How much of Medicare will be paid by 2034?

That means Medicare contributes to the budget deficit. Rising health care costs mean that general revenues would have to pay for 49% of Medicare costs by 2034. 13 As with Social Security, the tax base is insufficient to pay for this.

What is Medicare Part A?

Medicare has two sections: The Medicare Part A Hospital Insurance program, which collects enough payroll taxes to pay current benefits. Medicare Part B, the Supplementary Medical Insurance Program, and Part D, the new drug benefit. Payroll taxes and premiums cover only 57% of benefits.

What does it mean when the government has a high level of mandatory spending?

In the long run, the high level of mandatory spending means rigid and unresponsive fiscal policy. This is a long-term drag on economic growth.

How is Social Security funded?

Social Security is funded through payroll taxes.

How much is mandatory spending in 2021?

Mandatory spending is estimated to be $2.966 trillion for FY 2021. 1 The two largest mandatory programs are Social Security and Medicare. That's 38.5% of all federal spending. It's more than two times more than the military budget. 2.

Why is mandatory spending growing?

That's one reason mandatory spending continues to grow. Another reason is the aging of America. As more people require Social Security and Medicare, costs for these two programs will almost double in the next 10 years. 18 At the same time, birth rates are falling. As a result, the elder dependency ratio is worsening.

How much is Social Security in 2021?

Social Security is the single largest federal budget item, costing $1.151 trillion in FY 2021. 1 The Social Security Act of 1935 guaranteed that workers would receive benefits after they retired. It was funded by payroll taxes that went into a trust fund used to pay out the benefits. 7

How much did the government spend on healthcare?

The federal government spent nearly $1.2 trillion on health care in fiscal year 2019 (table 1). Of that, Medicare claimed roughly $644 billion, Medicaid and the Children’s Health Insurance Pro-gram (CHIP) about $427 billion, and veterans’ medical care about $80 billion. In addition to these direct outlays, various tax provisions for health care ...

How much did the medical exclusion reduce government revenue?

Including its impact on both income and payroll taxes, the exclusion reduced government revenue by $273 billion in 2019. Updated May 2020.

How much does Medicare cost?

Medicare is the largest federal health care program, serving 58 million elderly and disabled people at a gross cost of $702 billion in 2017 and a cost net of premiums of $591 billion.

What percentage of GDP is Medicare?

Medicare, Medicaid, CHIP, military health care, individual insurance, and health tax preferences for employment-based insurance already totaled 7.9 percent of GDP in 2017 and will grow to 9.7 percent by 2028. This growth has important implications for the budget, as health spending will become a larger share of budget and at least partially drive ...

What is Medicaid and CHIP?

Medicaid is a state-run and jointly-financed health insurance program serving lower-income residents – including those making up to 138 percent of the poverty level in states that expanded Medicaid under the Affordable Care Act.

How much is the medical deduction for 2028?

Other tax subsidies totaled about $25 billion in 2017 and will grow to nearly $55 billion by 2028. The largest of these benefits is the medical expense deduction, available only to taxpayers who itemize their deductions and have medical expenses that exceed 7.5 percent of their income (or 10 percent after 2018).

How much does the federal government pay for medicaid?

The federal government pays for 50 to 75 percent of base Medicaid costs, depending on the state, and 90 percent of costs for the expansion population. On average, the federal government provides about 65 percent of total funding for Medicaid and 88 percent for CHIP, though CHIP’s share will fall to 65 percent by 2021.

How much did the government spend on health insurance in 2017?

Other spending on health insurance or health care totaled $167 billion in 2017. This category includes subsidies for insurance purchased on the exchanges ($48 billion), veterans’ health care provided through the Department of Veterans Affairs ($70 billion), and health care for active-duty military and their dependents ($49 billion).

How much will the Cadillac tax increase in 2028?

Though the total number of people receiving employer-sponsored insurance is expected to fall slightly over the next decade, the cost of the subsidy will increase to nearly $650 billion by 2028 as health care costs rise (or higher if the Cadillac tax is repealed or further delayed).

What percentage of the federal budget is Medicare?

Social Security alone comprises more than a third of mandatory spending and around 23 percent of the total federal budget. Medicare makes up an additional 23 percent of mandatory spending and 15 percent of the total federal budget.

How much money did the federal government spend in 2015?

Facebook Twitter. In fiscal year 2015, the federal budget is $3.8 trillion. These trillions of dollars make up about 21 percent of the U.S. economy (as measured by Gross Domestic Product, or GDP). It's also about $12,000 for every woman, man and child in the United States. So where does all that money go?

How much did tax breaks cost in 2015?

Tax breaks are expected to cost the federal government $1.22 trillion in 2015 - more than all discretionary spending in the same year. Unlike discretionary spending, which must be approved by lawmakers each year during the appropriations process, tax breaks do not require annual approval.

What is spending in the tax code?

Spending in the Tax Code. When the federal government spends money on mandatory and discretionary programs, the U.S. Treasury writes a check to pay the program costs. But there is another type of federal spending that operates a little differently.

What is mandatory spending?

Mandatory spending is spending that Congress legislates outside of the annual appropriations process, usually less than once a year. It is dominated by the well-known earned-benefit programs Social Security and Medicare.

What are the three groups of federal spending?

The U.S. Treasury divides all federal spending into three groups: mandatory spending, discretionary spending and interest on debt. Mandatory and discretionary spending account for more than ninety percent of all federal spending, and pay for all of the government services and programs on which we rely.

What is discretionary spending?

Discretionary spending refers to the portion of the budget that is decided by Congress through the annual appropriations process each year. These spending levels are set each year by Congress.

Summary

Health

- In 2017, Medicare spending accounted for 15 percent of the federal budget (Figure 1). Medicare plays a major role in the health care system, accounting for 20 percent of total national health spending in 2016, 29 percent of spending on retail sales of prescription drugs, 25 percent of spending on hospital care, and 23 percent of spending on physici...

Cost

- In 2017, Medicare benefit payments totaled $702 billion, up from $425 billion in 2007 (Figure 2). While benefit payments for each part of Medicare (A, B, and D) increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased from 47 percent to 42 percent, sp…

Causes

- Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care …

Effects

- In addition, although Medicare enrollment has been growing around 3 percent annually with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending. In general, Part A trust fund solvency is also affected by the level of growth in the economy, which affects …

Impact

- Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Future

- While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicares actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care pri…

Funding

- Medicare is funded primarily from general revenues (41 percent), payroll taxes (37 percent), and beneficiary premiums (14 percent) (Figure 7). Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. Expected future increases in spending under Part B and …

Assessment

- Medicares financial condition can be assessed in different ways, including comparing various measures of Medicare spendingoverall or per capitato other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

Purpose

- The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is one way of measuring Medicares financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years whe…

Benefits

- A number of changes to Medicare have been proposed that could help to address the health care spending challenges posed by the aging of the population, including: restructuring Medicare benefits and cost sharing; further increasing Medicare premiums for beneficiaries with relatively high incomes; raising the Medicare eligibility age; and shifting Medicare from a defined benefit s…