Medicare Part B IRMAA

| 2020 Individual tax return | 2020 Joint tax return | 2020 Married and separate tax return | 2022 Part B monthly premium |

| $91,000 or less | $182,000 or less | $91,000 or less | $170.10 |

| More than $91,000 and up to $114,000 | More than $182,000 and up to $228,000 | N/A | $238.10 |

| More than $114,000 up to $142,000 | More than $228,000 up to $284,000 | N/A | $340.20 |

| More than $142,000 up to $170,000 | More than $284,000 up to $340,000 | N/A | $442.30 |

Full Answer

How much are healthcare out of pocket costs?

6 rows · Feb 15, 2022 · The standard Medicare Part B premium is $170.10 per month. However, the Part B premium is based on ...

How much is health insurance out of pocket cost?

May 16, 2020 · For 2020, the largest out-of-pocket maximum that a plan can have is $8,150 for an individual plan and $16,300 for a family. These numbers are up from $7,900 and $15,600 in 2019. In general, if you select a plan with a lower monthly premium, it is associated with a higher out-of-pocket maximum amount.

How much did you pay out of pocket?

Generally, you pay a monthly premium for Medicare coverage and part of the costs each time you get a covered service. There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance ( Medigap ) policy, or you join a Medicare Advantage Plan . What do cost words mean?

How much does Medicare take out of your paycheck?

How much Medicare Part B (medical insurance) costs, including Income Related Monthly Adjustment Amount (IRMAA) and late enrollment penalty. Costs for Medicare health plans. Learn about what factors contribute to how much you pay out-of-pocket when you have a Medicare Advantage Plan (Part C). Compare procedure costs

What is the average out-of-pocket expense with Medicare?

What you spend out of pocket may be totally different than what a family member or friend with Medicare pays. But, on average, people spend more than $5,000 out of pocket annually — or more than $400 per month — on their Medicare costs, according to the Kaiser Family Foundation (KFF).Nov 2, 2021

What is the annual out-of-pocket limit for original Medicare?

The amount varies from plan to plan, from about $3,000 to $6,700. After your spending meets your plan's limit, you pay no more for the rest of the calendar year. Usually the definition of out-of-pocket spending includes deductibles and copays but excludes premiums.

What are Medicare premiums for 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What are the out of pocket expenses for Medicare Part B?

Medicare Deductibles and Coinsurance Medicare Part B has a $198 deductible in 2020. After that, Medicare beneficiaries typically need to pay 20% of the cost of most doctor's services.

What counts towards out-of-pocket maximum?

The out-of-pocket maximum is the most you could pay for covered medical services and/or prescriptions each year. The out-of-pocket maximum does not include your monthly premiums. It typically includes your deductible, coinsurance and copays, but this can vary by plan.

Does Medicare always pay 80 percent?

Medicare Part B pays 80% of the cost for most outpatient care and services, and you pay 20%. For 2022, the standard monthly Part B premium is $170.10.

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

How much does Medicare take out of Social Security?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

Is Medicare Part B going up 2022?

2022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What is the new Medicare Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What counts towards out-of-pocket maximum Medicare Advantage?

Medicare rules allow Medicare Advantage plans to credit the following costs toward your out-of-pocket maximum: Copayments or coinsurance amounts for doctor visits, emergency room visits, hospital stays, and covered outpatient services. Copayments or coinsurance for durable medical equipment and prosthetics.

What happens if you can't leave your home?

If you cannot leave your home, Medicare will allow your doctor to order a test to be brought to you and administered there. The Specified Low-Income Medicare Beneficiary (SLMB) program helps pay only for Part B premiums, not the Part A premium or other cost sharing.

How much will Medicare Advantage cost in 2021?

If you sign up for a Medicare Advantage plan that includes prescription drugs with a mid-priced premium, CMS predicts you’ll pay $4,339 in 2021. These are just estimates, of course, but they can help you choose the policy that’s best for your health care needs and financial situation.

Does Medicare have out of pocket costs?

Medicare’s out-of-pocket costs — premiums, deductibles, copays and coinsurance — can easily result in a large tab each year. If you’re struggling to meet those expenses, you might be eligible for federal and state assistance. If you qualify for Medicaid, the federal-state health insurance program for people with low incomes ...

How many days can you use Medicare?

Medicare also provides 60 “lifetime reserve days” that beneficiaries can use if they need to stay in a hospital for more than 90 days. These can only be used once. Part B: Typically, 20 percent of the Medicare-approved cost of the service for most services.

Does Medicaid pay out of pocket?

If you qualify for Medicaid, the federal-state health insurance program for people with low incomes and individuals with disabilities, it will pay some or all of your out-of-pocket expenses. Individuals on both Medicare and Medicaid are known as “dual eligibles.”.

What is the maximum out of pocket amount for health insurance?

For 2020, the largest out-of-pocket maximum that a plan can have is $8,150 for an individual plan and $16,300 for a family. These numbers are up from $7,900 and $15,600 in 2019.

What is copayment in healthcare?

Copayments are set dollar amounts that are associated with specific visits or treatments, and coinsurance costs are a percentage of care that you are responsible for paying. You will continue to be responsible for paying all coinsurance and copayment amounts until they total an additional $1,500 in payments.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

Get help paying costs

Learn about programs that may help you save money on medical and drug costs.

Part A costs

Learn about Medicare Part A (hospital insurance) monthly premium and Part A late enrollment penalty.

Part B costs

How much Medicare Part B (medical insurance) costs, including Income Related Monthly Adjustment Amount (IRMAA) and late enrollment penalty.

Costs for Medicare health plans

Learn about what factors contribute to how much you pay out-of-pocket when you have a Medicare Advantage Plan (Part C).

Compare procedure costs

Compare national average prices for procedures done in both ambulatory surgical centers and hospital outpatient departments.

Ways to pay Part A & Part B premiums

Learn more about how you can pay for your Medicare Part A and/or Medicare Part B premiums. Find out what to do if your payment is late.

Costs at a glance

Medicare Part A, Part B, Part C, and Part D costs for monthly premiums, deductibles, penalties, copayments, and coinsurance.

What is Medicare out of pocket?

Medicare out-of-pocket costs are the amount you are responsible to pay after Medicare pays its share of your medical benefits. In Medicare Part A, there is no out-of-pocket maximum. Most people do not pay a premium for Part A, but there are deductibles and limits to what is covered.

How much of Medicare is spent on out of pocket?

More than a quarter of all Medicare recipients spend about 20 percent of their annual income on out-of-pocket costs after Medicare reimbursements. People lower income or complex health conditions are likely to pay the most.

Does Medicare have a limit on out of pocket costs?

There is no limit on out-of-pocket costs in original Medicare (Part A and Part B). Medicare supplement insurance, or Medigap plans, can help reduce the burden of out-of-pocket costs for original Medicare. Medicare Advantage plans have out-of-pocket limits that vary based on the company selling the plan.

What is the Medicare Part A deductible for 2021?

Medicare Part A costs include your share of expenses for any inpatient treatments or care. In 2021, the Part A deductible is $1,484. Once you’ve paid this amount, your coverage will kick in and you’ll only pay a portion of your daily costs, based on how long you’ve been in the hospital.

How much does skilled nursing cost in 2021?

Days 1 to 20 are fully covered without out-of-pocket costs to you, but days 21 to 100 will cost you $185.50 per day in 2021.

Does Medicare Part B cover outpatient care?

Medicare Part B covers outpatient medical care. Monthly premiums apply for this coverage and costs are driven by your income level. You will also pay an annual deductible in addition to the monthly premiums, and you must pay a portion of any costs after you meet the deductible.

What is Medicare Part C?

Medicare Part C is a private insurance product that replaces your original Medicare coverage. These plans may also include Medicare Part D, which covers prescription drug costs.

How much did Medicare beneficiaries spend in 2016?

For instance, beneficiaries with at least one inpatient stay in 2016 spent $7,613 out of pocket, on average, compared to $5,044 among those without an inpatient stay. Beneficiaries with no supplemental insurance spent more out of pocket than beneficiaries with some type of supplemental coverage.

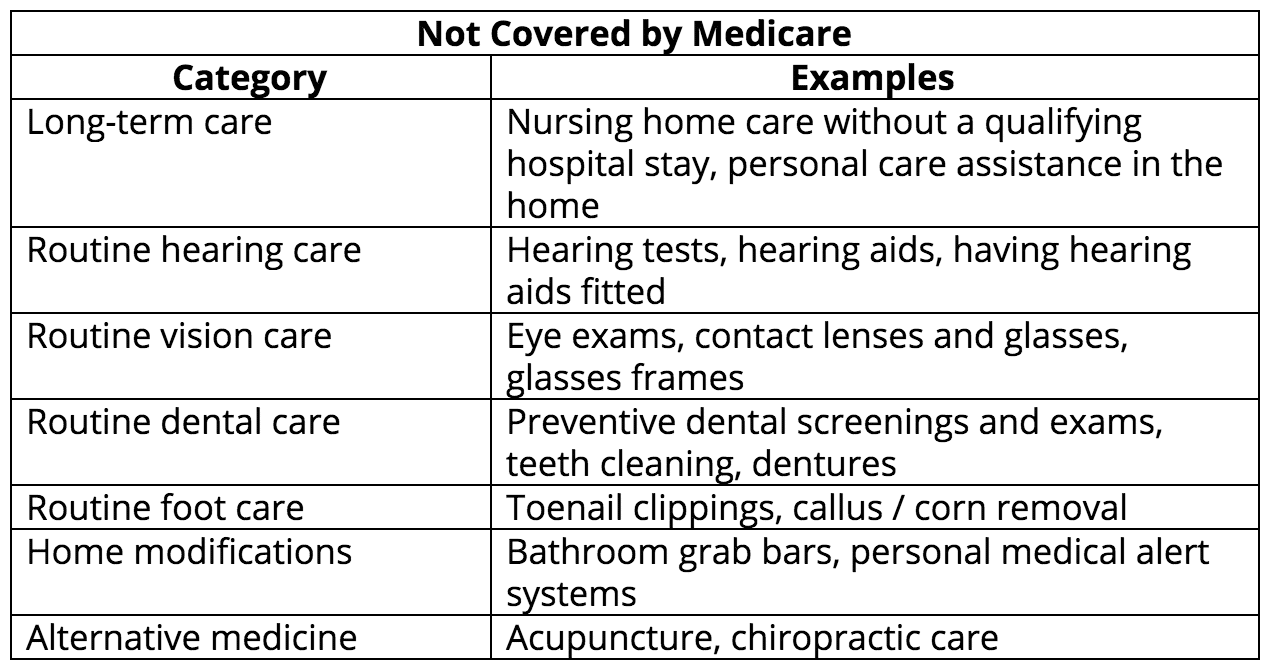

Does Medicare cover long term care?

Although Medicare has helped make health care more affordable for people with Medicare, many beneficiaries face high out-of-pocket costs for care they receive, including costs for services that are not covered by Medicare—in particular, long-term care services.

How much did Medicare spend on prescriptions in 2016?

In 2016, traditional Medicare beneficiaries with five or more chronic conditions spent $1,065 on prescription drugs, on average, compared to $416 among those with one or two chronic conditions; those in poor self-reported health spent $1,018 on drugs compared to $410 among those in excellent self-reported health.