The terms Medicare Supplement and Medigap are used interchangeably according to Slome. Across the state, the lowest cost for a 65-year-old female purchasing a Medigap Plan F policy was $122.74-per-month in Erie and Allentown. The highest cost for Plan F was $457.75 in Philadelphia.

| Plan Type | Premium Range |

|---|---|

| Plan F | $134-$402 |

| Plan G | $108-$386 |

| Plan N | $82-$330 |

How much do Medicare supplement insurance prices vary across Pennsylvania?

The terms Medicare Supplement and Medigap are used interchangeably according to Slome. Across the state, the lowest cost for a 65-year-old female purchasing a Medigap Plan F policy was $122.74-per-month in Erie and Allentown. The highest cost for …

How is Medicare supplement (Medigap) pricing determined?

Pennsylvania Medicare Insurance Plan G 2020 Price Index Findings. Philadelphia, PA (Zip 19120) FEMALE age 65, Plan G Lowest monthly premium: $133.20 Highest monthly premium: $451.15. MALE age 65, Plan G Lowest monthly premium: $153.19 Highest monthly premium: $509.10. Pittsburgh, PA (Zip 15237) FEMALE age 65, Plan G Lowest monthly premium: $117.35

How much do Medicare supplement prices increase?

Feb 03, 2022 · Medicare Supplement Insurance Plan F premiums in 2022 are lowest for beneficiaries at age 65 ( $184.93 per month) and highest for beneficiaries at age 85 ( $299.29 per month). Medigap Plan G premiums in 2022 are lowest for beneficiaries at age 65 ( $143.46 per month) and highest for beneficiaries at age 85 ( $235.87 per month).

What is the average cost of Medicare Supplement Insurance Plan F?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. ... You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible. ... Medicare Supplement Insurance (Medigap): Monthly premiums vary based on which policy you buy ...

How much are Medicare supplements per month?

How much does Medicare cost in PA?

| People enrolled in Original Medicare | Average plan cost | Annual state spending per beneficiary |

|---|---|---|

| 1,535,135 | Plan A: $0 to $499 per month* Plan B: $170.10 per month** | $10,149 |

Why is my Medicare supplement so expensive?

What is the most basic Medicare supplement plan?

How much does Medicare Part B cost in Pennsylvania?

In 2020, the standard premium will be $144.60/month. Most people will pay this amount.Jan 1, 2020

Does Pa pay for Medicare Part B?

Does Medigap have an out-of-pocket maximum?

What is the deductible for Plan G in 2022?

Why do doctors not like Medicare Advantage plans?

What is the difference between Plan G and high deductible plan G?

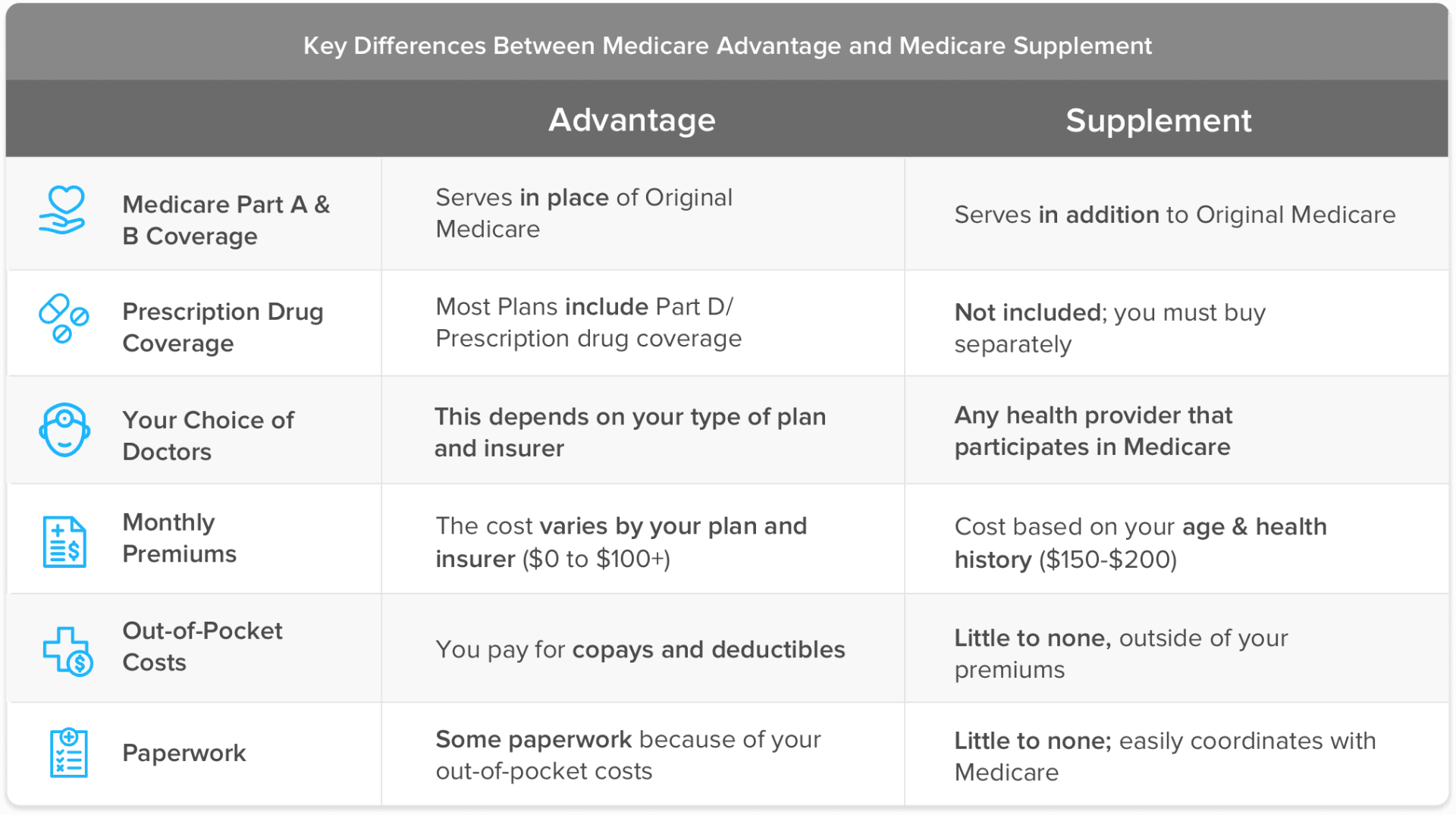

What is the difference between a Medicare Advantage plan and a Medicare supplement plan?

What is the most popular Medicare Part D plan?

| Rank | Medicare Part D provider | Medicare star rating for Part D plans |

|---|---|---|

| 1 | Kaiser Permanente | 4.9 |

| 2 | UnitedHealthcare (AARP) | 3.9 |

| 3 | BlueCross BlueShield (Anthem) | 3.9 |

| 4 | Humana | 3.8 |

When will Medicare plan F be available?

Important: Plan F is not available to new Medicare beneficiaries who become eligible for Medicare on or after January 1, 2020. If you already have Medicare, you can still enroll in Plan F if the plan is available in your area.

What are the Medicare premiums for 2020?

Based on our analysis, we noted several key takeaways: 1 Medicare Supplement Insurance Plan F premiums in 2020 are lowest for beneficiaries at age 65 ( $184.93 per month) and highest for beneficiaries at age 85 ( $299.29 per month). 2 Medigap Plan G premiums in 2020 are lowest for beneficiaries at age 65 ( $143.46 per month) and highest for beneficiaries at age 85 ( $235.87 per month).

How does age affect Medicare premiums?

How Does Age Affect Medicare Supplement Insurance Premiums? 1 Community-rated Medigap plans#N#With community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.#N#For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market. 2 Issue-age-rated Medigap plans#N#With issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.#N#You will typically pay less for an issue-age-rated plan if you enroll in the plan when you're younger. Your premiums also won't increase based on your age. 3 Attained-age-rate Medigap plans#N#Attained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is Medicare Supplement Insurance?

Medicare supplement insurance is private insurance that fills in the gaps left by Medicare. For instance, when you have a hospital or doctor bill, Medicare pays its approved amount first, then the supplemental insurance pays other costs, such as deductibles and copays.

Does Medicare Supplement include dental insurance?

However, the premium you pay for that plan may differ from one company to another. It is important to note that most Medicare supplement plans do not include dental or vision coverage. An alternative to Original Medicare and Medicare supplement insurance is Medicare Part C, or Medicare Advantage.

What is Medicare Advantage?

An alternative to Original Medicare and Medicare supplement insurance is Medicare Part C, or Medicare Advantage. These Medicare-approved health plans are run by private insurance companies and provide benefits for hospital, doctor, and other health care provider services covered under Original Medicare Parts A and B as well as supplemental benefits ...

Which states have standardized Medicare Supplement plans?

With the exception of Massachusetts, Minnesota and Wisconsin, which have their own standardized plans, insurance companies offer standardized Medicare Supplement insurance plans identified by alphabetic letters (such as Medicare Supplement insurance Plan M). However, the premiums (the monthly amount you pay for a Medicare Supplement insurance plan) ...

What is Medicare Supplement?

Medicare insurance Supplement insurance plans (also known as Medigap plans) are offered by private insurance companies and are designed to help pay out-of-pocket costs for services covered under Medicare Part A and Part B, such as deductibles, copayments, and coinsurance. Medicare supplement insurance coverage for these out-of-pocket expenses ...

How does Medicare Supplement insurance work?

How insurance companies set Medicare Supplement insurance plan costs & premiums 1 Community rating: Generally the premium is priced so that everyone who purchases a Medicare Supplement insurance plan of a particular type pays the same premium each month. Over time, premiums may increase because of inflation and other factors, but they won’t change because of your age. 2 Issue-age rating: The premium you pay is based on your age when you buy the Medicare Supplement insurance plan. Premiums are lower if you purchase the Medicare Supplement insurance plan when you are age 65 than if you wait until you are older. Over time, premiums may increase because of inflation and other factors, but they won’t increase because of your age. 3 Attained-age-rating: The premium you pay is based on your current age. Younger buyers may find Medicare Supplement insurance plans that are rated this way very affordable. Over time, however, these plans may become very expensive because your premium increases as you grow older. Premiums may also increase because of inflation and other factors.

Why do Medicare premiums increase?

Premiums may also increase because of inflation and other factors. If you are interested in purchasing a Medicare Supplement insurance plan offered by an insurance company, it is a good idea to ask what rating system they use to set their premiums.

How long does Medicare Part B last?

This period begins the month you are both 65 years old and enrolled in Medicare Part B, and lasts for six months. If you apply during this period, you’re not required to go through medical underwriting, which can lead to a higher premium cost if you have health conditions at the time you apply.

How does community rating work?

Community rating: Generally the premium is priced so that everyone who purchases a Medicare Supplement insurance plan of a particular type pays the same premium each month. Over time, premiums may increase because of inflation and other factors, but they won’t change because of your age.

What is the second most popular Medicare plan?

Medigap Plan G is, in fact, the second-most popular Medigap plan. 17 percent of all Medigap beneficiaries are enrolled in Plan G. 2. The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018. 3.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Medicare Supplement Rate Increases

How much do Medicare Supplement Rates go Up? For most health insurers, once a policy has been issued, any rate changes are generally event-driven.

How Much Do Medicare Supplement Rates Go Up Each Year

Although Medicare controls the minimum coverage that each plan must contain, how much you pay for coverage depends on the company you select. There are ways to limit your exposure and how much your Medicare supplement prices go up.

Why do My Medicare Supplement rates Go Up?

Your Medicare Supplement (Medigap) pricing will typically be based on one of three pricing methods.