What is the maximum Social Security and Medicare tax for 2020?

7.65%The Federal Insurance Contributions Act (FICA) tax rate, which is the combined Social Security tax rate of 6.2% and the Medicare tax rate of 1.45%, will be 7.65% for 2020 up to the Social Security wage base. The maximum Social Security tax employees and employers will each pay in 2020 is $8,537.40.Dec 10, 2019

How do you calculate Social Security and Medicare tax 2021?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.Jan 12, 2022

How much of my Social Security is taxable in 2021?

50%For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.Apr 6, 2022

How much is the Medicare tax for 2021?

1.45%2021 updates. For 2021, an employee will pay: 6.2% Social Security tax on the first $142,800 of wages (maximum tax is $8,853.60 [6.2% of $142,800]), plus. 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return), plus.Oct 15, 2020

What percentage of Social Security is taxed?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

How much federal tax is taken out?

For the 2021 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your filing status and taxable income (such as your wages) will determine what bracket you're in....2021 Married Filing Jointly Tax Brackets.If taxable income is:The tax due is:Not over $19,90010% of the taxable income6 more rows•Mar 15, 2022

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

How is Medicare tax calculated?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay.Nov 7, 2019

What age do you stop paying taxes on Social Security?

Key Takeaways. Social Security benefits may or may not be taxed after 62, depending in large part on other income earned. Those only receiving Social Security benefits do not have to pay federal income taxes.

What is the 2022 Medicare tax rate?

1.45%For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021). For 2022, an employee will pay: 6.2% Social Security tax on the first $147,000 of wages (6.2% of $147,000 makes the maximum tax $9,114), plus.Jan 12, 2022

How is Social Security tax calculated?

The Social Security tax rate for both employees and employers is 6.2% of employee compensation (for a total of 12.4%). The Social Security tax rate for those who are self-employed is the full 12.4%.

How much does Medicare take out of Social Security?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

Social Security Tax Rates

The Social Security tax functions very much like a flat tax. A single rate of 12.4 percent is applied to wages and self-employment income earned by...

The Math Behind The Social Security Tax

All wages and self-employment income up to the Social Security wage base in effect for a given year are subject to the Social Security tax. Here's...

What Is The Social Security Tax for?

Unlike income taxes, which are paid into the general fund of the United States and can be used for any purpose, Social Security taxes are paid into...

There was A Special Rate Reduction in 2011 and 2012

The Social Security tax rate paid by employees was only 4.2 percent in 2011 and 2012. Employers still paid the full 6.2 percent rate, but employees...

What is the Social Security tax rate percentage?

The employee tax rate for Social Security is 6.2% 鈥?and the employer tax rate for Social Security is also 6.2%. So, the total Social Security tax rate percentage is 12.4%.

What are the Social Security and Medicare withholding rates?

Social Security and Medicare Withholding Rates. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer’s Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer鈥檚 Tax Guide for agricultural employers.

Is Social Security tax the same as Medicare tax?

Social Security Tax Social Security tax, like Medicare tax, is designed to help support the millions of retired Americans. This tax pays for federal disability and retirement benefits. Both employers and employees must pay Social Security Tax.

How much is Medicare tax for 2021?

The amount increased to $142,800 for 2021. (For SE tax rates for a prior year, refer to the Schedule SE for that year). All your combined wages, tips, and net earnings in the current year are subject to any combination of the 2.9% Medicare part of Self-Employment tax, Social Security tax, or railroad retirement (tier 1) tax.

What is the tax rate for self employment?

The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance). For 2020, the first $137,700 of your combined wages, tips, and net earnings is subject to any combination of the Social Security part of self-employment tax, ...

What is self employment tax?

Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. You figure self-employment tax (SE tax) yourself using Schedule SE (Form 1040 or 1040-SR).

When do you have to use the maximum earnings limit?

If you use a tax year other than the calendar year, you must use the tax rate and maximum earnings limit in effect at the beginning of your tax year. Even if the tax rate or maximum earnings limit changes during your tax year, continue to use the same rate and limit throughout your tax year.

Does the 1040 affect self employment?

This deduction only affects your income tax. It does not affect either your net earnings from self-employment or your self-employment tax. If you file a Form 1040 or 1040-SR Schedule C, you may be eligible to claim the Earned Income Tax Credit (EITC).

Is self employment tax included in Medicare?

Self-Employment Tax (Social Security and Medicare Taxes) It should be noted that anytime self-employment tax is mentioned, it only refers to Social Security and Medicare taxes and does not include any other taxes that self-employed individuals may be required to file. The list of items below should not be construed as all-inclusive.

Do you have to figure out your net earnings before you file taxes?

Before you figure your net earnings, you generally need to figure your total earnings subject to self-employment tax. Note: The self-employment tax rules apply no matter how old you are and even if you are already receiving Social Security or Medicare.

What is the percentage of Social Security tax?

So, the total Social Security tax rate percentage is 12.4%. Only the employee portion of Social Security tax is withheld from your paycheck.

How much Medicare tax is withheld from paycheck?

There’s no wage-based limit for Medicare tax. All covered wages are subject to Medicare tax. If you receive wages over $200,000 a year, your employer must withhold a .9% additional Medicare tax. This will apply to the wages over $200,000.

Do you have to file Medicare taxes if you are married?

If you’re married, you might not have enough Medicare taxes withheld. If you’re married filing jointly with earned income over $250,000, you’re subject to an additional tax. This also applies to married filing separately if your income is over $125,000.

What is the Social Security tax rate for 2021?

Everyone pays the same rate, regardless of how much they earn, until they hit the ceiling. As of 2021, a single rate of 12.4% is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of $142,800. 1.

How much is self employed taxed?

If you were self-employed, multiply your earnings up to this limit by 12.4% to calculate the Social Security portion of your self-employment tax. If your wages were more than $137,700 in 2020, multiply $137,700 by 6.2% to arrive at the amount you and your employer must each pay. Anything you earned over this threshold is exempt from Social Security ...

How much do you get if you work for more than one employer?

If You Work More Than One Job. Keep the wage base in mind if you work for more than one employer. If you've earned $69,000 from one job and $69,000 from the other, you've crossed over the wage base threshold.

When does Social Security start back up?

These are annual figures, so the Social Security tax starts right back up again on Jan. 1 until you hit the next year's Social Security wage base.

Does it matter if you have reached the wage base threshold?

It doesn't matter that individually, neither job has reached the wage base threshold. The wage base threshold applies to all your earned income. But separate employers might not be aware you've collectively reached this limit, so you'll have to notify both employers they should stop withholding for the time being.

Do self employed people pay Social Security taxes?

If You're Self-Employed. Self-employed persons must pay both halves of the Social Security tax because they're both employee and employer. They pay the combined rate of 12.4% of their net earnings up to the maximum wage base. This is calculated as the self-employment tax on Schedule SE.

Not everyone pays for Medicare with their Social Security check

Lorraine Roberte is an insurance writer for The Balance. As a personal finance writer, her expertise includes money management and insurance-related topics. She has written hundreds of reviews of insurance products.

Who Is Eligible for Medicare?

Medicare is a social insurance program available to U.S. citizens and permanent residents 65 years of age or older. It’s also available to some younger Americans who are disabled or diagnosed with End-Stage Renal Disease (ESRD).

When Do You Have To Pay for Medicare?

If you don’t qualify for premium-free Part A coverage, you’ll need to pay a monthly premium. You’ll also have to pay a premium if you sign up for Part B, which is optional.

Medicare Costs You Can Deduct From Social Security

Most people who receive Social Security benefits will have their Medicare premiums automatically deducted. Here’s a closer look at what costs you can expect to see taken out of your checks.

Can You Change How You Pay for Medicare?

If you have Social Security benefits, your Part B premiums will be automatically deducted from them. If you don’t qualify for Social Security benefits, you’ll get a bill from Medicare that you’ll need to pay via:

What does Medicare pay for?

Medicare pays for many different types of medical expenses. Part A covers inpatient hospital care, surgery, and home health care, among other items. Part B covers things such as preventive care, doctors’ visits, and durable medical equipment. Part D covers prescription drugs.

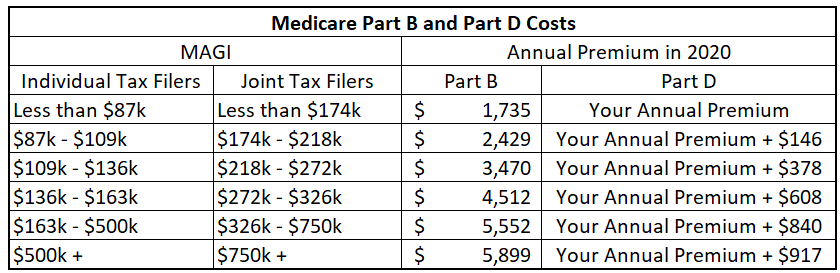

How much will I pay for Medicare?

The amount you’ll pay for Medicare depends on several factors, including your sign-up date, income, work history, prescription drug coverage, and whether you sign up for extra coverage with an Advantage or Medigap plan. The Medicare Plan Finder can help you compare costs between different plans.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is the Medicare tax rate if you make more than the threshold?

The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional Medicare tax of 0.9%.

What is the Medicare tax rate for 2019?

In 2019, the tax rate for employees was 1.45% for Medicare and 6.2% for Social Security. High-income employees are charged an additional 0.9% Medicare surtax. Employers have the responsibility of withholding FICA taxes from their employees’ wages.

What is FICA tax?

FICA Tax. FICA is an acronym for Federal Insurance Contributions Act. This act was introduced in 1930 to cover Social Security. Both you and your employer will pay into this tax. Now, the tax is divided into Medicare and Social Security tax which is why you will probably see these two items on your paystub rather than just FICA.

What is the most important tax to stay on top of and get correct?

FICA taxes are the most important tax to stay on top of and get correct. Not withhold or paying the correct amount of FICA taxes will result in serious consequences for the employer. All businesses must report FICA taxes quarterly to the IRS using Form 941.

What happens if you don't pay Social Security taxes?

If an employee makes more than the set $132,900, Social Security tax should not be withheld from their pay for any earning made above this amount. If you do not follow Social Security, Medicare, or FICA instruction carefully, you may end up either not deducting enough or too much.

Do self employed people pay Medicare taxes?

If you are self-employed, you will pay self-employment tax, which is the equivalent of both employee and employer portions of the Medicare Tax. In 2019, the rate of Medicare tax was 1.45% of an employee’s gross earnings. The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional ...

Do self employed pay Social Security taxes?

Both employers and employees must pay Social Security Tax. As with Medicare tax, self-employed individuals will have to pay both the employee and employer portion of Social Security Tax. The rate for Social Security tax in 2019 was 6.2% of an employee’s gross wages below $132,900. The employer must match the amount paid by the employee.

What is the Medicare tax rate for 2013?

Starting in 2013, people with high salaries will pay a new additional Medicare tax of 0.9%. Unlike the rest of Medicare, this new tax depends on your filing status:

How much did the employee contribute to Social Security in 2011?

For 2011 and 2012 only, the employee's "half" didn't equal the employer's "half" for Social Security: they contributed 4.2% and 6.2% respectively. For 2013, both contribute 6.2%. For 2017, there is a very large increase in the Social Security income limit, from $118,500 to $127,200.

What is FICA tax?

The FICA (for Federal Insurance Contributions Act) tax (also known as Payroll Tax or Self-Employment Tax, depending on your employment status) is your contribution to Social Security and Medicare as a percentage of your salary: If you're an employee, then you pay one half of this total (probably as a withholding on your paycheck);

Do self employed people pay FICA?

And so, if you're self-employed, you don't have to pay FICA on all your salary, just on 92.35% of it (92.35 being 100 minus 7.65 - which is the contribution that your employer would have paid, if you had an employer, which you don't).