not present

| Original Medicare | Medicare Advantage |

| For Part B-covered services, you usually ... | Out-of-pocket costs vary —plans may have ... |

| You pay a premium (monthly payment) for ... | You may pay the plan’s premium in additi ... |

| There’s no yearly limit on what you pay ... | Plans have a yearly limit on what you pa ... |

| You can get Medigap to help pay your rem ... | You can’t buy and don’t need Medigap. |

Full Answer

What is the average cost of a Medicare Advantage plan?

With a Medicare Advantage plan, covered benefits and costs can change from year to year. You might suddenly discover that, thanks to a shift in coverage, a drug you rely on has doubled or ...

How much cheaper is Medicare Advantage compared to Medicare?

Medicare Advantage (also known as “MA”) plans monthly premiums are typically much lower than a traditional Medicare Supplement plan. The reasoning behind this is “cost sharing.” Some Medicare Supplements cover 100% of the cost sharing left by Medicare on Medicare approved expenses.

What are the requirements for Medicare Advantage plans?

The Centers for Medicare & Medicaid Services yesterday released proposed regulations for the 2023 Medicare Advantage ... of health plans, including provisions to better monitor provider networks and compliance with the medical loss ratio requirements ...

How many people have Medicare Advantage plans?

Over the last decade, the role of Medicare Advantage, the private plan alternative to traditional Medicare, has grown. In 2021, more than 26 million people are enrolled in a Medicare Advantage plan, accounting for 42 percent of the total Medicare population, and $343 billion (or 46%) of total federal Medicare spending (net of premiums).

Where does the money come from for Medicare Advantage plans?

Three sources of revenue for Advantage plans include general revenues, Medicare premiums, and payroll taxes. The government sets a pre-determined amount every year to private insurers for each Advantage member. These funds come from both the HI and the SMI trust funds.

Does Medicare Advantage pay 80%?

Under Medicare Part B, patients usually pay 20% of their medical bills and Medicare pays the remaining 80%. Medicare Advantage, however, can charge patients coinsurance rates above 20%.

How profitable is Medicare Advantage?

Medicare Advantage is the common thread. Big-name health insurers raked in $8.2 billion in profit for the fourth quarter of 2019 and $35.7 billion over the course of the year.

Do Medicare Advantage plans pay the 20 %?

In Part B, you generally pay 20% of the cost for each Medicare-covered service. Out-of-pocket costs vary – plans may have different out-of-pocket costs for certain services.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Do Medicare Advantage plans pay 100 %?

Medicare Advantage plans must limit how much their members pay out-of-pocket for covered Medicare expenses. Medicare set the maximum but some plans voluntarily establish lower limits. After reaching the limit, Medicare Advantage plans pay 100% of eligible expenses.

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

What are the advantages and disadvantages of Medicare Advantage plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Which health insurance company makes the most money?

UnitedHealthcareBased on our analysis, UnitedHealthcare is the largest health insurance company by revenue, with total revenue topping $286 billion for 2021. This makes the insurer the largest company by membership, market share and revenue. Anthem is the second-largest health care company in all three categories.

What percent of seniors choose Medicare Advantage?

[+] More than 28.5 million patients are now enrolled in Medicare Advantage plans, according to new federal data. That's up nearly 9% compared with the same time last year. More than 40% of the more than 63 million people enrolled in Medicare are now in an MA plan.

Is Medicare Advantage cheaper than original Medicare?

The costs of providing benefits to enrollees in private Medicare Advantage (MA) plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county. However, MA plans that are able to keep their costs comparatively low are concentrated in a fairly small number of U.S. counties.

How can Medicare Advantage plans have no premiums?

$0 Medicare Advantage plans aren't totally free Medicare Advantage plans are provided by private insurance companies. These companies are in business to make a profit. To offer $0 premium plans, they must make up their costs in other ways. They do this through the deductibles, copays and coinsurance.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the Medicare 80/20 rule?

The 80/20 Rule generally requires insurance companies to spend at least 80% of the money they take in from premiums on health care costs and quality improvement activities. The other 20% can go to administrative, overhead, and marketing costs. The 80/20 rule is sometimes known as Medical Loss Ratio, or MLR.

Do all seniors pay the same for Medicare?

Everyone pays for Part B of Original Medicare. In 2020, the standard premium is $144.60/month for those making no more than $87,000 per year ($174,000 per year for married couples filing jointly). For 2020, the threshold for having to pay higher premiums based on income increased.

Does Medicare pay for cataract surgery?

Medicare covers cataract surgery that involves intraocular lens implants, which are small clear disks that help your eyes focus. Although Medicare covers basic lens implants, it does not cover more advanced implants.

What is Medicare Advantage?

The amount you are required to pay for each health care visit or service. Medicare Advantage plans typically include cost-sharing measures such as copayments and coinsurance, and the amounts of these costs can correlate with that of the premium. The type of plan.

What is a Medicare Savings Account?

A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible.

What to look for when shopping for Medicare Advantage?

When you are shopping for a Medicare Advantage plan, you may consider features such as a plan’s range of benefits and possible network rules. But above all else, perhaps the biggest thing you might consider is the cost of a plan. When it comes to Original Medicare (Medicare Part A and Part B), the cost of premiums is standardized across the board.

How to save money on medicaid?

Saving money with Medicare Advantage 1 If you qualify for Medicaid, your Medicaid benefits can be used to help pay your Medicare Advantage premiums. 2 A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible. 3 If your Medicare Advantage plan includes a doctor and/or pharmacy network, you can save a considerable amount of money by staying within that network when receiving services. 4 Some Medicare Advantage plans may include extra health perks such as gym memberships. There is even the possibility of Medicare Advantage plans soon covering expenses like the cost of air conditioners, home-delivered meals and transportation.

How much does vision insurance cost?

Vision insurance can typically cost around $20 per month or less. 3. Hearing plans. Unlike dental and vision insurance, hearing insurance plans are not a common insurance product. Some hearing aid companies may offer extended warranties, but the warranties apply only to the hearing aid product itself.

Which state has the lowest Medicare premium?

A closer look at 2021 data also reveals: Nevada has the lowest average monthly premium for Medicare Advantage Prescription Drug (MAPD) plans at $11.58 per month. The highest average MAPD monthly premium is in North Dakota, at $76.33 per month.

Does Medicare Advantage cover dental?

While a Medicare Advantage plan by law must cover the same benefits as Medicare Part A and Medicare Part B , benefits like prescription drugs, dental, vision and hearing can be covered at varying degrees (or not at all).

What is Medicare Advantage?

Most Medicare Advantage Plans offer coverage for things that aren't covered by Original Medicare, like vision, hearing, dental, and wellness programs (like gym memberships). Plans can also cover more extra benefits than they have in the past, including services like transportation to doctor visits, over-the-counter drugs, adult day-care services, ...

What happens if you have a Medicare Advantage Plan?

If you have a Medicare Advantage Plan, you have the right to an organization determination to see if a service, drug, or supply is covered. Contact your plan to get one and follow the instructions to file a timely appeal. You also may get plan directed care.

How much is Medicare Advantage 2021?

In addition to your Part B premium, you usually pay a monthly premium for the Medicare Advantage Plan. In 2021, the standard Part B premium amount is $148.50 (or higher depending on your income). If you need a service that the plan says isn't medically necessary, you may have to pay all the costs of the service.

What is Medicare health care?

Health care services or supplies needed to diagnose or treat an illness, injury, condition, disease, or its symptoms and that meet accepted standards of medicine. under Medicare. If you're not sure whether a service is covered, check with your provider before you get the service.

Is Medicare Advantage covered for emergency care?

In all types of Medicare Advantage Plans, you're always covered for emergency and. Care that you get outside of your Medicare health plan's service area for a sudden illness or injury that needs medical care right away but isn’t life threatening.

Does Medicare cover hospice?

Medicare Advantage Plans must cover all of the services that Original Medicare covers. However, if you’re in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies. In all types of Medicare Advantage Plans, you're always covered for emergency and Urgently needed care.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is Medicare Advantage?

Medicare Advantage ( Medicare Part C) is an alternative you can choose instead of Original Medicare (also known as Medicare Parts A and B). A Medicare Advantage plan covers more than Original Medicare and is sold by private insurance companies that contract with Medicare.

What Can You Expect to Pay for Medicare Advantage?

Along with your Medicare Advantage monthly premium, the costs you’ll incur can include deductibles and cost-sharing (copayments or coinsurance).

10 Things That Can Affect the Cost of Your Medicare Advantage Plan

There is no one set formula for what all Medicare Advantage plans cost. Instead, the exact amount that you will pay depends on many factors. These factors include:

The Plan You Choose and When You Sign Up For It Determines Your Medicare Advantage Cost

It’s important to select your Medicare Advantage plan during what is known as the Open Enrollment Period each year. This is because private insurance companies are typically allowed to perform medical underwriting to decide whether to accept your application, and how much to charge you.

Where Can You Go to Get Help Determining Your Medicare Advantage Cost?

The federal government has a handy online tool you can use to determine your specific Medicare Advantage costs. Go to www.medicare.gov/oopc/ and find the answer to all of your important questions.

Why do people choose Medicare Advantage?

Many individuals beyond retirement age opt for Medicare Advantage Plans because they reduce annual out-of-pocket health care costs. They feel familiar, too, because they’re essentially the same as other health insurance plans.

How much does Medicare pay for seniors?

In 2019, seniors paid an average of $29 a month for their Medicare Advantage plans. Available plans vary by state, and monthly premiums vary too: Some plans pay for a person’s Medicare Part B premiums, while other plans include extra benefits, like dental and vision coverage.

Why do seniors not have to pay Medicare Part D?

Many plans eliminate the need for Medicare Part D because they include prescription drug coverage. Seniors pay a premium for their Medicare Advantage Plans every month. They also pay a deductible on covered services, and coinsurance after they’ve met the deductible.

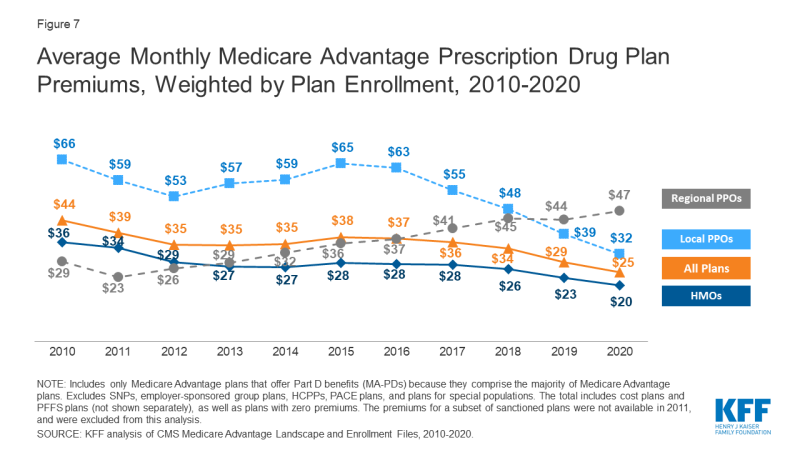

What is the cheapest Medicare plan for seniors?

With an average $23 monthly premium, HMO plans were the cheapest option for seniors in 2019.

Can I get Medicare Part A for free?

Most retirees qualify for premium-free Medicare Part A. Seniors who paid Medicare taxes for less than 40 quarters aren’t automatically eligible to receive free Medicare Part A, but they can buy into the plan by paying a monthly fee.

Do seniors need to sign up for Medicare Part B?

Seniors don’t need to buy Medicare Part B if they decide to opt for Original Medicare; however if they want a Medicare Advantage Plan, they usually do need to sign up for Medicare Part B. Again, some Medicare Advantage Plans pay Medicare Part B costs to the government on a policyholder’s behalf.

How much does Medicare save?

Medicare saves people over 65 thousands of dollars every year on health insurance costs. While the new Medicare beneficiary realizes a savings, the cost of the insurance doesn’t go away. Medicare funds a large portion of the insurance cost when they select a Medicare Advantage Plan or a stand alone PDP.

How does Medicare pay per capita?

Medicare makes per capita monthly payments to plans for each Part D enrollee. The payment is equal to the plan’s approved standardized bid amount, adjusted by the plan beneficiaries’ health status and risk, and reduced by the base beneficiary premium for the plan.

How much is Medicare subsidized in Sacramento?

In the Sacramento region, Medicare beneficiaries are having their MA-PD subsidized by $738 – $750 on average. (Average capitation rate – Part B cost of $99.90). The stand alone PDP are subsidized on average of $53 across the nation.

How much money was spent on Medicare in 2011?

We all know that the Federal expenditures for Medicare are growing fast and it’s putting a real strain on our budget. $835 billion dollars was spent on Medicare and Medicaid in 2011. That big number doesn’t translate well into an expense per Medicare beneficiary for me.

Is capitation only for Medicare Advantage?

The capitation amount is only for the medical portion of the Medicare Advantage health plan. There is a separate amount if the plan includes prescription drug coverage.