| Plan name | Monthly premium |

|---|---|

| Plan F | $174 |

| High Deductible Plan F | $44 |

| Plan G | $140 |

| Plan N | $103 |

What is the best Cigna plan?

Is there a deductible for Cigna’s Medicare Supplement Plan N? Cigna Medigap Plan N does not cover the Medicare Part B deductible. This deductible is $233 in 2022. Other out-of-pocket expenses include copayments up to $20 per office visit, $50 for E.R. visits and Medicare Part B Excess charges are not covered.

What is the best Medicare supplement insurance plan?

Jul 28, 2020 · In 2021, that deductible is $203. This will go up slightly in 2021. This means the first $198 of your medical bills are paid by you, and after that Medicare and the Plan, G come in and pay 100% of all your approved expenses for the rest …

What are the top Medicare supplement plans?

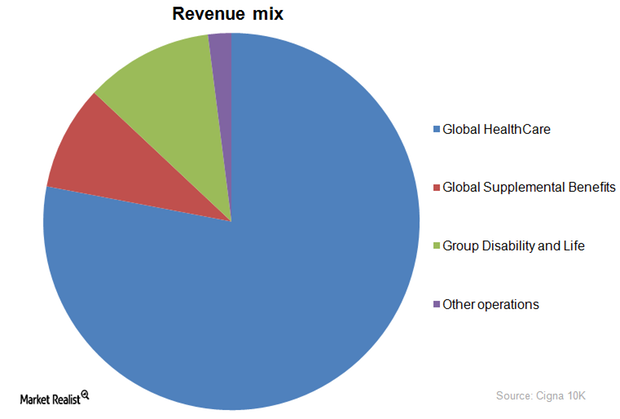

Sep 07, 2021 · Cigna is one of the major players in the health insurance market, with almost 40 years in the business. Now a Fortune 500 company, it ranked as one of the fastest-growing companies of 2020. 1 That status allows for a more robust platform than smaller companies, with perks such as a Healthy Rewards Program offering lifestyle discounts and easy access to …

How much does a Medicare supplemental insurance plan cost?

The average rate for Supplements plans is around $300 a month, but that price varies due to which insurance company you pick, which of the Supplement plans you sign up for and where you live. Cigna can charge different rates across the United States for the exact same plans. If you want to see what the rates are, then just use our site.

How much do Medicare supplements go up every year?

between 3% and 10% per yearMedicare supplement rate increases usually average somewhere between 3% and 10% per year. And sometimes Medicare supplement rate increases even happen twice in the same year!Apr 11, 2022

How much a month is Medicare supplement?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.Mar 21, 2022

What are the top 3 Medicare supplement plans?

Three plans — Plan F, Plan G, and Plan N — are the most popular (accounting for over 80 percent of all plans sold). Here's an in-depth look at this trio of Medicare Supplement plans, and the reasons so many people choose them.Sep 25, 2021

Does Cigna Supplemental cover Medicare deductible?

Cigna Medicare Supplement Plan G Plan G covers all the services of Plan F, except for the Part B deductible. This makes it a good choice if you became eligible for Medicare in 2020 or later and are looking for comprehensive supplemental coverage.

What is the most expensive Medicare Supplement plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

What is the least expensive Medicare Supplement plan?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage.Mar 16, 2022

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

How much is Cigna supplemental insurance?

Cigna offers the following Medigap plans in 46 states. Plan availability may vary by state....Cigna vs. competitor Medicare supplement carriers.Plan nameMonthly premiumPlan A$127Plan F$174High Deductible Plan F$44Plan G$1401 more row•Jan 24, 2022

Is Cigna the same as Medicare?

Medicare Advantage: This is also known as Part C. Medicare Advantage plans are offered through private insurers like Cigna. They bundle all of Part A and B (hospital and medical care), and usually include Part D prescription drug coverage, too. Many of these plans include dental and vision care.Oct 1, 2021

What is Medicare Plan G deductible for 2021?

Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Can my policy be canceled?

Your policy can be renewed for life, as Cigna states: “Your policy cannot be terminated for any reason other than nonpayment of premium or material...

When can I switch plans?

You can choose a Medicare Supplement plan from a different company at any time after your open enrollment period. As the government controls what b...

What are the eligibility requirements?

To buy a Medicare Supplement plan, you must be enrolled in Medicare Part B, living in the state where the policy is offered, and be age 65 or older...

When can I enroll?

The Medicare Supplement open enrollment period starts on the first day of the first month in which you’re age 65 or older and enrolled in Medicare...

Cigna Medicare Supplement Plan F

Medicare supplement plan F is only available to people who were enrolled in Medicare prior to January 1st of 2020.

Cigna Medigap Plan G

So before I get into the details of Medigap plan G let me just offer this one big piece of advice :

Cigna Medicare Supplement Plan G

As I mentioned is going to be the most popular plan regardless of which company that we sign you up with, because there’s only one out-of-pocket expense with Plan G.

Medicare supplement plan N

Now another very popular Cigna Medicare supplement is called Medicare Plan N. This plan is a terrific plan with great coverage and lower premiums than plan G.

Cigna Medicare Supplement Rates

So by now, you’re probably thinking “Great, either plan sounds awesome. How much is a Cigna Medicare supplement Plan G or a Plan N?”

When does Medicare Supplement open enrollment start?

The Medicare Supplement open enrollment period starts on the first day of the first month in which you’re age 65 or older and enrolled in Medicare Part B. In some states, you may buy a plan on the first day you’re enrolled in Medicare Part B, even if you’re not yet 65.

What is a Medigap Plan A?

Plan A, the Medigap plan with the lowest level of coverage, will pay for some of the basic costs not covered by Original Medicare. With Plan A, you'll still pay your Part A (hospital) and Part B (medical) deductibles. Medigap Plan A will then cover the remaining costs for both hospital and medical expenses, including copays and coinsurance associated with hospice care.

Which plan has the highest deductible?

Plan G and Plan F provide the highest levels of coverage. Plan G provides nearly the same level of coverage as Plan F, which offers the most coverage with zero out-of-pocket costs for Medicare-covered services. However, you'll need to pay the Medicare Part B (medical) annual deductible before Plan G kicks in.

What is Plan N?

Plan N offers lower premiums than some of the other Medigap plans. With this plan, you'll be responsible for copayments up to $20 for doctor's office visits or up to $50 for emergency room visits. You'll also be responsible for any excess costs the doctor may charge for services above what Medicare covers.

Does Medigap cover hospice?

Medigap Plan A will then cover the remaining costs for both hospital and medical expenses, including copays and coinsurance associated with hospice care. Quick Tip: Medicare Supplement insurance plans A, F, and G provide benefits at higher premiums with limited out-of-pocket costs.

Does high deductible plan F have the same coverage as plan F?

High Deductible Plan F has the same coverage as Plan F but with a much lower monthly premium. Coverage kicks in only after you pay the (higher) calendar year deductible of Medicare Part B.

Is Cigna a Fortune 500 company?

Cigna is one of the major players in the health insurance market, with almost 40 years in the business. Now a Fortune 500 company, it ranked as one of the fastest-growing companies of 2020.1 That status allows for a more robust platform than smaller companies, with perks such as a Healthy Rewards Program offering ...

What is Supplement Plan G?

Supplement Plan G- With this Supplement policy, you will be protected for the cost of all Medicare Part A charges, most Medicare Part B charges, nursing care, blood usage and foreign travel exchange costs for up to 80%.

Does Medicare cover blood?

The cost of blood you use each year is only partially covered by Medicare, as is hospitalization and nursing care . Supplement plans can cover those things for you and leave you with a whole lot less to pay from your own finances. You can simply pay that manageable, competitively-priced monthly premium for the Medicare Supplement ...

Does Medicare cover medical expenses?

Covering What Medicare Will Not . While Medicare does a decent job of taking care of some medical expenses for its members, it also leaves a lot of medical expenses for them to pay out of pocket. These are deductibles that are due once a year and copayments that are due with each visit to the hospital or doctor’s office.

Does Cigna cover Medicare?

Cigna Medicare Supplement. There are medical costs that Medicare will not cover for seniors, and those costs can be covered with a Cigna Medicare Supplement. This is a medical insurance plan that comes in a lot of different varieties, so you can find the one that is tailored to fit your needs. Seniors should know how to compare Medicare Supplement ...

How long do you have to be in a hospital to be eligible for Medicare?

Must have been in a hospital for at least 3 days and have entered a Medicare-approved facility within 30 days after discharge from the hospital. Services. Medicare Pays. Plan G Pays. You Pay. First 20 days. All approved amounts. $0. $0.

What is included in hospital expenses?

Includes expenses in or out of the hospital and outpatient hospital treatment, such as physician’s services, inpatient and outpatient medical and surgical services and supplies, physical and speech therapy, diagnostic tests, and durable medical equipment.

What is an excess charge for a doctor?

A doctor may charge an amount for services that exceeds what Medicare covers. This is called an “excess charge.” Medicare puts a 15 percent limit on the extra amount a doctor can charge.

Is Medicare Supplement Plan G the same as Medicare Supplement Plan G?

Rates for Medicare Supplement Plan G. While the benefits of Medica re Supplement Plan G remain the same regardless of your insurance company (as mandated by the government), in some states the premium you pay may vary according to a number of factors, including age, location, gender, and overall health.

Shop and Compare Cigna Medicare Insurance Plans

Ideal for bundling all your Medicare benefits into 1 convenient Cigna plan, plus no-cost extras you don’t get with Original Medicare.

Why choose Cigna for your Medicare coverage?

Shop Medicare Advantage, Part D, and Medicare Supplement Insurance options—there’s a wide range to meet all lifestyle needs.

How long does it take to get Medicare?

Open enrollment is a 6-month period during which you can buy any Medicare supplement policy sold in your state, even if you have pre-existing health conditions. This starts on the first day of the month after: 1 You're 65 (or older) and 2 You’re enrolled in Medicare Part B (Medical Insurance)

What is Medicare Supplement Plan F?

Medicare Supplement Plan F. The most coverage and the lowest out-of-pocket costs. Medicare Supplement High Deductible Plan F. Same coverage as Plan F, with a lower monthly premium. Coverage kicks in after you pay the calendar year deductible. Medicare Supplement Plans Available to Minnesota Residents.

How long is open enrollment for Medicare?

Open enrollment is a 6-month period during which you can buy any Medicare supplement policy ...

When does Medicare Part B start?

You’ve applied for Medicare Part B, and your coverage is scheduled to start on September 1. Your open enrollment period for Medicare Supplement insurance would start on September 1, as soon as your Medicare Part B kicks in.

What age do you retire from Medicare?

Say you’ve already turned 65, but you’re still working and receiving health care insurance through your employer. At age 68, you decide to retire and enroll in Medicare Part B because you no longer have insurance through your employer. Your open enrollment period for Medicare Supplement insurance would begin the first day ...

Lump Sum Heart Attack and Stroke Insurance

If you suffer a heart attack or stroke, this insurance provides a cash benefit that you can use in any way you choose. 1

Lump Sum Cancer Insurance

Provides a lump sum cash benefit if you are diagnosed with cancer, to help pay for medical costs and everyday expenses. 1

Cancer Treatment Insurance

Receive cash benefits for cancer treatments and other covered events throughout your illness. 1

Hospital Indemnity Insurance

A hospital indemnity policy can help you cover out-of-pocket expenses with a fixed benefit dollar amount.

Whole Life Insurance

A whole life policy can help your family cover your final expenses, including funeral costs, with a lump sum cash payment.

Does Medicare increase over time?

ALL standardized Medigap plans will increase in price over time. There are several driving factors that affect the rates. Your Medicare supplement rate can increase with your age, inflation, the insurance companies internal reasons (claims, cost of doing business, etc), or a combination of all three. See our full explanation on how policies are ...

Who is Alex Wender?

Alex Wender. Alex Wender is the founder and CEO of Bluewave Insurance. He has been blogging about Medicare-related topics since 2010. Since then, he and his agency have helped thousands of people across the country choose the right Medicare to fit their needs.