How much does Medicare Part B costs?

Oct 12, 2018 · The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, an increase of $1.50 from $134 in 2018. An estimated 2 million Medicare beneficiaries (about 3.5%) will pay less than the full Part B standard monthly premium amount in 2019 due to the statutory hold harmless provision, which limits certain beneficiaries’ increase in their Part B …

What is the monthly premium for Medicare Part B?

Oct 12, 2018 · The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, a slight increase from $134 in 2018.

How much does Part B insurance cost?

Apr 29, 2017 · That has increased to $135.50 for 2019. The standard monthly premium for Part B is $135.50 for individuals who: enroll in Part B for the first time in 2019; don’t get Social Security benefits; or; are directly billed for Part B premiums (e.g. do not have it taken out of their Social Security check).

Does Medicaid pay for Part B premium?

2019 Medicare Part B premium. Medicare Part B provides coverage for doctor’s office visits and other types of outpatient care, along with durable medical equipment (DME). The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium.

What was the Medicare Part B premium in 2019?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

How much did Medicare cost in 2019?

$135.50The standard monthly premium will be $144.60 for 2020, which is $9.10 more than the $135.50 in 2019. The annual deductible for Part B will rise to $198, up $13 from $185 this year. About 7% of beneficiaries will pay extra from income-related adjustment amounts.Nov 11, 2019

What is the monthly cost for Medicare Part B in 2022?

$170.10 forThe standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

How much does Medicare Part B increase each year?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

What is the cost for Medicare Part B for 2018?

$134 per monthAnswer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

What did Medicare cost in 2018?

The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. However, a statutory “hold harmless” provision applies each year to about 70 percent of enrollees.Nov 17, 2017

How much will Part B go up in 2022?

$170.10Part B costs The standard monthly premium for Part B will be $170.10 in 2022, up from $148.50 this year and marking the program's largest annual jump dollar-wise ($21.60).Dec 31, 2021

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

How much did Medicare go up in 2021?

2021 = $148.50 per month. 2020 = $144.60 per month.Feb 15, 2022

How much will Medicare B go up in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Why did Medicare Part B go up so much in 2022?

Medicare officials cited the high price of the drug as a key reason for a 14.5 percent increase in the Part B premium, from $148.50 in 2021 to $170.10 in 2022.Jan 14, 2022

How much will Medicare pay in 2019?

An estimated 2 million Medicare beneficiaries (about 3.5 percent) will pay less than the full Part B standard monthly premium amount in 2019 due to the statutory hold harmless provision, which limits certain beneficiaries’ increase in their Part B premium to be no greater than the increase in their Social Security benefits.

What is the Medicare Part B premium?

The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, a slight increase from $134 in 2018.

When does Medicare open enrollment end?

Ahead of Medicare Open Enrollment – which begins on October 15, 2018 and ends December 7, 2018 – CMS is making improvements the Medicare.gov website to help beneficiaries compare options and decide if Original Medicare or Medicare Advantage is right for them.

How much is Medicare Part A deductible?

The Medicare Part A inpatient deductible that beneficiaries will pay when admitted to the hospital is $1,364 in 2019, an increase of $24 from $1,340 in 2018.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

How much will Medicare premiums decrease in 2019?

On average, Medicare Advantage premiums will decline while plan choices and new benefits increase. On average, Medicare Advantage premiums in 2019 are estimated to decrease by six percent to $28, from an average of $29.81 in 2018.

What is CMS eMedicare?

As announced earlier this month, CMS launched the eMedicare Initiative that aims to modernize the way beneficiaries get information about Medicare and create new ways to help them make the best decisions for themselves and their families.

What is the Medicare Part B premium?

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium.

How much is Medicare Part C?

Plan premiums will vary by provider, plan and location. The Centers for Medicare and Medicaid Services (CMS) reports that the average Medicare Advantage plan premium in 2019 will be $28.00 per month.

What is Medicare Part A?

2019 Medicare Part A premium. Medicare Part A (hospital insurance) helps provide coverage for inpatient care costs at hospitals and other types of inpatient facilities.

How much is Medicare premium per month?

If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. How it changed from 2018. The 2019 Part A premiums increased a little over 3 percent from 2018.

Is Medicare Part B optional?

Medicare Part B is optional. You will likely be automatically enrolled in Part B (with the option to drop it) if you are automatically enrolled in Medicare Part A.

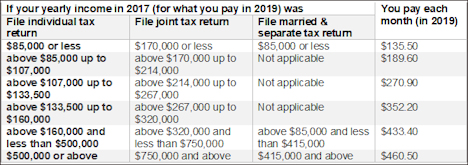

What is the COLA for 2019?

The COLA in 2019 is 2.8 percent. An additional income bracket was added in 2019. In 2020, the IRMAA will be indexed to inflation for the first time since 2010. It’s expected that the income thresholds that determine when someone pays a Medicare IRMAA will rise slightly in 2020.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) provides coverage for some of the out-of-pocket costs that Medicare Part A and Part B don't cover. This can include costs such as Medicare deductibles, copayments, coinsurance and more. Medigap plans are sold by private insurance companies so there is no standard premium.

How much is Medicare Part B deductible?

The annual deductible for all Medicare Part B beneficiaries is $185 in 2019, an increase of $2 from the annual deductible $183 in 2018. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement. Since 2007, a beneficiary’s Part B monthly premium is based on his ...

What is the Medicare Part B premium?

The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, an increase of $1.50 from $134 in 2018.

Is FEHB a supplemental insurance?

FEHB is a secondary insurance to Part B and not a supplemental to Part B...there is a difference. Secondary will cover some items that medicare doesn't cover while supplemental won't cover anything that Part B doesn't cover. No one really knows what will happen in the future.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

Is Medicare A free?

Medicare A is "free" (You have already paid for it). You will have to pay for Medicare B. The cost, beyond the normal premium depends on your income. if your income is too much, you will pay more. Also, learn about the maximum pay out per year you will make before FEHB pays 100% of your expenses.

How much is Medicare Part B 2019?

I won't keep you in suspense. The standard Medicare Part B monthly premium for 2019 will be $135.50, a modest increase of just $1.50 per month over 2018's standard premium. In addition, the annual Medicare Part B deductible will increase, but by just $2, to $185.

What is Medicare Part B?

Medicare Part B is the medical insurance component of the Medicare program. It pays for costs like doctor's office visits, medical equipment, and outpatient procedures.

Is Medicare Part A premium free?

Meanwhile, Medicare Part A, which mainly covers hospital stays, remains premium-free for most American seniors, although the Part A deductible is rising from $1,340 in 2018 to $1,364 in 2019.

Where is Matt from Motley Fool?

Matt is a Certified Financial Planner based in South Carolina who has been writing for The Motley Fool since 2012. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price.

Is Medicare Part B rising?

The Centers for Medicare and Medicaid Services just announced the 2019 Medicare Part B premiums. You might not be surprised to learn that premiums are rising, but you might be pleasantly surprised to learn that they aren't rising by very much.

How much does Medicare pay in 2019?

Answer: The Centers for Medicare & Medicaid Services announced that most people will pay $135.50 per month for Medicare Part B in 2019, up slightly from $134 per month in 2018.

What is the Medicare deductible for 2019?

Deductibles will also go up in 2019. The deductible for Medicare Part A, which covers hospital services, will increase from $1,340 in 2018 to $1,364 in 2019. The deductible for Medicare Part B, which covers physician services and other outpatient services, will see a mild bump from $183 to $185.

How much is Social Security going up in 2019?

Social Security benefits are increasing by 2.8% in 2019, which will cover the increase in premiums for most people. Premium increases are also minor for most higher-income beneficiaries—those with adjusted gross income plus tax-exempt interest income of more than $85,000 if single or $170,000 if married filing jointly.

Why do Medicare beneficiaries pay less?

A small group of Medicare beneficiaries (about 3.5%) will pay less because the cost-of-living increase in their Social Security benefits is not large enough to cover the full premium increase. The “hold-harmless provision” prevents enrollees’ annual increase in Medicare premiums from exceeding their cost-of-living increase in Social Security ...

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B insurance in 2021?

In 2021, most enrollees will be paying $148.50/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month).

How much is the 2020 Medicare premium?

Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month). But that’s in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium.

What is the Medicare deductible for 2021?

Part B deductible also increased for 2021. Medicare B also has a deductible, which has increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20 percent of the Medicare-approved cost for Part B services.

What is the income threshold for Part B?

For people with income above $87,000 ($174,000 for a couple) in 2020, Part B premiums for 2020 ranged from $202.40/month to $491.60/month. As explained by the math above, the high-income threshold has increased to $88,000 for a single individual and $176,000 for a couple in 2021.

When do you pay income related premium surcharge?

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. [2019 tax returns were filed in 2020, so those are the most current returns available when income-related premium adjustments are determined for 2021.]

How much is the 2020 Social Security Cola?

But the 1.6 percent Social Security COLA for 2020 increased the average beneficiary’s Social Security benefit by $24/month. Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees have been paying the standard premium in 2020. And for 2021, the 1.3 percent COLA is adequate to cover the increase to ...

Does Medicare cover coinsurance?

But supplemental coverage (from an employer-sponsored plan, Medigap, or Medicaid) often covers these coinsurance charges. For people who became eligible for Medicare before the start of 2020, there are Medigap plans available (Plans C and F) that cover the Part B deductible, in addition to coinsurance charges.

2019 Medicare Part B Reimbursement

We have been informed that the City of New York Health Benefits Program will distribute the 2019 Medicare Part B reimbursements by the end of April 2020.

2019 Medicare Part B Reimbursement Differential

As you may know, you and/or your dependent may be eligible for an additional reimbursement of up to $300, known as the “Reimbursement Differential”, if you and/or your dependent meet any of the following criteria: