What Medicare cuts are being considered?

How Much Does New Budget Cut from Medicaid and Medicare? President Donald Trump’s proposed fiscal year 2021 budget projects that taxpayers would save $920 billion for Medicaid and $756 billion for Medicare over 10 years. However, there’s a catch: All the policies it proposes need to be implemented to achieve those savings.

Will tax reform force Medicare cuts?

· Medicare expansion and a lower eligibility age are included in Democrats' $3.5 trillion budget plan

What are good things about budget cuts?

1 day ago · Cutting Medicare Age to 60 Could Add $155B to U.S. Debt Over 6 Years Spending. The CBO and JCT analysts focus mainly on the net impact of Medicare eligibility expansion on federal budget... Sources of Uncertainty. The analysts emphasize that it’s hard to know how many people ages 60 through 64 would ...

Should Medicare be cut?

· March 19, 2021 WASHINGTON — The House voted on Friday to avert an estimated $36 billion in cuts to Medicare next year and tens of billions more from farm subsidies and other social safety net...

How much will Medicare be cut in 2022?

The Congressional Budget Office, in a letter to Representative Kevin McCarthy of California, the minority leader, estimated that without the waiver enacted before the end of the calendar year, $36 billion would be cut from Medicare spending — 4 percentage points — in 2022 alone and billions more from dozens of other federal programs.

When will Medicare cuts be enacted in 2021?

March 19, 2021. WASHINGTON — The House voted on Friday to avert an estimated $36 billion in cuts to Medicare next year and tens of billions more from farm subsidies and other social safety net programs, moving to stave off deep spending reductions that would otherwise be made to pay for the $1.9 trillion stimulus bill enacted last week.

How would Biden pay for his agenda?

How Biden would pay for it: The president would largely fund his agenda by raising taxes on corporations and high earners, which would begin to shrink budget deficits in the 2030s.

How much money will Biden spend in 2022?

Ambitious total spending: President Biden would like the federal government to spend $6 trillion in the 2022 fiscal year, and for total spending to rise to $8.2 trillion by 2031.

When is the budget for 2022?

Biden’s 2022 Budget. The 2022 fiscal year for the federal government begins on October 1, and President Biden has revealed what he’d like to spend, starting then. But any spending requires approval from both chambers of Congress. Here’s what the plan includes:

Why did Democrats use a fast track budget process?

In passing the virus aid plan, Democrats used a fast-track budget process to push past Republican opposition, arguing that urgent needs brought on by the pandemic outweighed concerns about running up the national debt. But the maneuver meant that Congress had to act separately to prevent the automatic cuts, which would go into effect in January if lawmakers do not act.

Who passed the $36 bill?

Speaker Nancy Pelosi at a news conference in the Capitol on Friday. The House passed the legislation with votes from all House Democrats and 29 Republicans. Credit... WASHINGTON — The House voted on Friday to avert an estimated $36 ...

How long will Medicare HI be in the budget?

The President’s budget would extend the solvency of the Medicare HI trust fund from 2026 to 2040, closing nearly 80 percent of the 30-year solvency gap.

When will Medicare run out of funds?

Under current law, based on estimates in the budget, the HI trust fund will run out of funds in 2026, facing a shortfall of roughly $430 billion through 2031 ( CBO estimates $515 billion) and $6.2 trillion over 30 years.

How much will Social Security increase in 2026?

4 A similar proposal in President Obama's final budget in 2016 would increase Social Security revenue by nearly $5 billion per year by 2026.

How much is a 30 year number rounded to?

Ten-year numbers are rounded to the nearest $5 billion while 30-year numbers are rounded to the nearest $50 billion.

How does restoring solvency to Medicare help?

Restoring solvency to Medicare will eliminate the threat of across-the-board cuts, improve the fiscal outlook, support faster economic growth, and offer the opportunity to improve the delivery of Medicare benefits. Policymakers should enact solutions sooner rather than later.

Why is Medicare double counted?

New Medicare revenue in the budget is effectively “double counted” in the near term because it is used both to strengthen the trust fund and finance the American Families Plan. However, over 20 years, the net savings to the trust funds are not needed to finance the new spending and roughly match the net deficit reduction in the budget.

How long is the Medicare trust fund insolvent?

The Medicare Hospital Insurance (HI) trust fund is only five years from insolvency according to both the Congressional Budget Office (CBO) and the Medicare Trustees. While the text of the President’s Fiscal Year (FY) 2022 budget calls for some substantial changes to Medicare, those changes are not included in the budget numbers, ...

How much did Medicare cut in 10 years?

The budget cuts investments in graduate medical education by $52 billion over 10 years and cuts $88 billion over 10 years by reducing payments to hospitals that care for low-income ...

How much did Trump cut Medicaid?

Slashes more than $900 billion from Medicaid — As a presidential candidate, Mr. Trump promised he would not cut Medicaid. However, as President, his budget cuts the program by more than $900 billion over ten years. This cut represents one in six dollars spent over that time period, which would result in fewer benefits and lost coverage ...

What is the Trump administration doing about the Affordable Care Act?

The Trump Administration is in federal courts waging an anti-health care campaign to eliminate protections for pre-existing conditions and destroy every other protection and benefit of the Affordable Care Act.

How much is TANF cut?

Under the guise of reform, the Administration weakens the Temporary Assistance for Needy Families (TANF) program by cutting the core program 10 percent, reducing the amount of cash assistance and other benefits states may offer. Even worse, the budget eliminates TANF’s contingency fund, a $6 billion cut over 10 years, which provides additional help to families during an economic downturn.

How much is the HHS budget cut for 2021?

Overall, the budget calls for a $9.5 billion cut to HHS’s discretionary budget in 2021 and a $1.6 trillion cut over 10 years from mandatory health care spending. This includes a more than $900 billion cut to Medicaid, a half a trillion-dollar cut to Medicare, and more than $200 billion in cuts to other health programs.

What is the budget for HHS 2021?

Overall, the budget calls for a $9.5 billion cut to HHS’s discretionary budget in 2021 and a $1.6 trillion cut over 10 years from mandatory health care spending. This includes a more than $900 billion cut to Medicaid, a half a trillion-dollar cut to Medicare, and more than $200 billion in cuts to other health programs.

Does Medicaid have work requirements?

The budget includes several destructive Medicaid “reforms,” including mandatory work requirements for adults in Medicaid. There is no evidence that work requirements would improve beneficiaries’ financial well-being; experience so far indicates they function mostly as a red-tape barrier to access to care.

How much did Medicare spend in 2016?

In 2016, people on Original Medicare (Part A and Part B) spent 12% of their income on health care. People with five or more chronic conditions spent as much as 14%, significantly higher than those with none at 8%, showing their increased need for medical care. 9.

How much is Medicare payroll tax?

Medicare payroll taxes account for the majority of dollars that finance the Medicare Trust Fund. Employees are taxed 2.9% on their earnings, 1.45% paid by themselves, 1.45% paid by their employers. People who are self-employed pay the full 2.9% tax.

When will Medicare become insolvent?

Near the peak of unemployment in 2020, David J. Shulkin, MD, ninth secretary of the Department of Veterans Affairs, projected Medicare could become insolvent by 2022 if pandemic conditions persisted. 10

What is the CMS?

As the number of chronic medical conditions goes up, the Centers for Medicare and Medicaid Services (CMS) reports higher utilization of medical resources, including emergency room visits, home health visits, inpatient hospitalizations, hospital readmissions, and post-acute care services like rehabilitation and physical therapy .

How long do people on Medicare live?

A Social Security Administration calculator notes a man who turned 65 on April 1, 2019 could expect to live, on average , 84.2 years. A women who turned 65 on the same date could expect to live, on average, 86.7 years.

How long will a 65 year old live on Medicare?

A Social Security Administration calculator notes a man who turned 65 on April 1, 2019 could expect to live, on average, until 84.0. A women who turned 65 on the same date could expect to live, on average, until 86.5.

What is the source of Medicare HI?

The money collected in taxes and in premiums makes up the bulk of the Medicare HI trust fund. Other sources of funding include income taxes paid on Social Security benefits and interest earned on trust fund investments.

How much did the 2017 tax overhaul cost the Democrats?

Democrats joined Republicans to avert $150 billion in cuts that would have been prompted by the 2017 tax overhaul, including a $25 billion chunk from Medicare.

What is the budget gambit of Biden?

The budget gambit Democrats are embracing to fast-track President Joe Biden’s $1.9 trillion pandemic aid plan will trigger billions of dollars in cuts to critical programs. Top Democrats are already shrugging off the threat, insistent that Congress will once again act in time to head off the slashing to programs like Medicare ...

How much did Medicare cost in 2019?

In 2019, it cost $644 billion — representing 14 percent of total federal spending. 1. Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and about 40 percent of all home health spending. In 2019, Medicare provided benefits to 19 percent of the population. 2.

How much of Medicare is financed?

As a whole, only 53 percent of Medicare’s costs were financed through payroll taxes, premiums, and other receipts in 2020. Payments from the federal government’s general fund made up the difference.

How does Medicare trust fund work?

Medicare’s two trust funds keep track of receipts and expenses within each fund. Income from payroll taxes and other sources are credited to the trust funds, while disbursements for benefits and administration are debited from the funds’ balance.

What percentage of Medicare is hospital expenditure?

Hospital expenses are the largest single component of Medicare’s spending, accounting for 40 percent of the program’s spending. That is not surprising, as hospitalizations are associated with high-cost health episodes. However, the share of spending devoted to hospital care has declined since the program's inception.

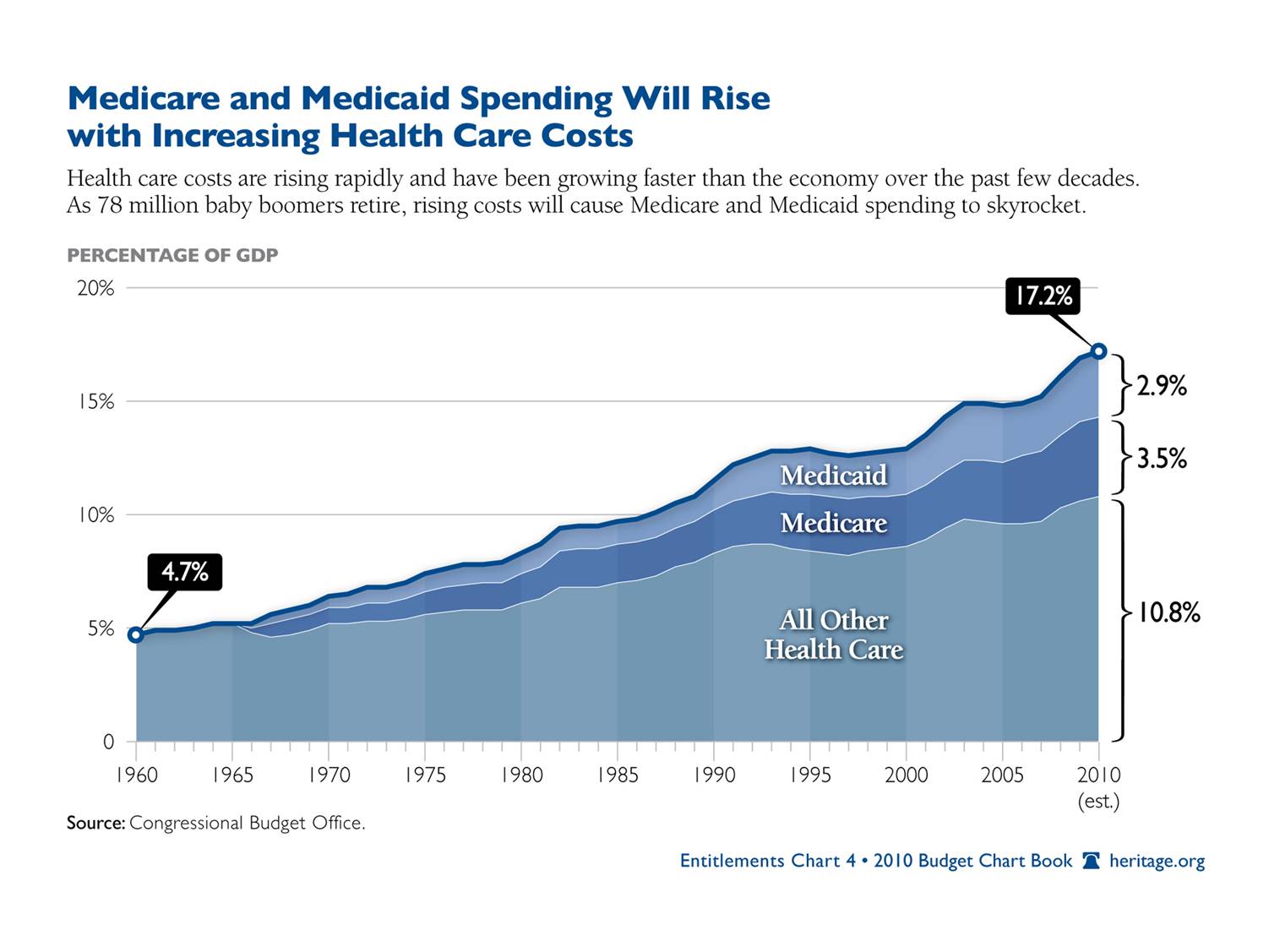

What percentage of GDP will Medicare be in 2049?

In fact, Medicare spending is projected to rise from 3.0 percent of GDP in 2019 to 6.1 percent of GDP by 2049. That increase in spending is largely due to the retirement of the baby boomers (those born between 1944 and 1964), longer life expectancies, and healthcare costs that are growing faster than the economy.

How much of Medicare is funded by the government?

They financed 15 percent of Medicare’s overall costs in 2019, about the same share as in 1970. The federal government’s general fund has been playing a larger role in Medicare financing. In 2019, 43 percent of Medicare’s income came from the general fund, up from 25 percent in 1970.

When did the Affordable Care Act increase payroll tax?

Most recently, the Affordable Care Act increased payroll tax rates for high earners by an additional 0.9 percentage points beginning in 2013. Unfortunately, the sum of those changes will not be sufficient to offset future cost growth. Premiums play only a modest role in funding the Medicare program.