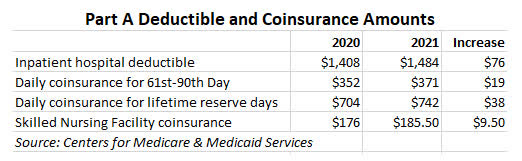

2022 Part A Deductible & Coinsurance Amounts

| Type of Cost Sharing | 2021 | 2022 |

| Inpatient Hospital Deductible | $1,484 | $1,556 |

| Daily Coinsurance for Days 61 to 90 | $371 | $389 |

| Daily Coinsurance for Lifetime Reserve D ... | $742 | $778 |

| Skilled Nursing Facility Coinsurance | $185.50 | $194.50 |

What is the monthly premium for Medicare Part B?

Nov 15, 2021 · Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.

What is a Medicare Part B premium reduction plan?

Nov 12, 2021 · Each year the Medicare Part B premium, deductible, and coinsurance rates are determined according to the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021.

Is Medicare Part B going up?

Nov 12, 2021 · The annual deductible for Medicare Part B beneficiaries grows with the Part B financing and is increasing from $203 in 2021 to $233 in 2022. The Administration is taking action to address the rapidly increasing drug costs that are posing a threat to the future of the Medicare program and that place a burden on people with Medicare.

When do Medicare premiums increase?

Jan 10, 2022 · fstop123 There’s a chance that your Medicare Part B premiums for 2022 could be reduced. Health and Human Services Secretary Xavier Becerra on Monday announced that he is instructing the Centers for...

What will the Medicare premium be for 2022?

The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How much will Part B go up in 2022?

$170.10Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

Is Medicare Part B premium going down 2022?

The 2022 monthly premium was set at $170.10, up from $148.50 in 2021. That $21.60 hike was the largest dollar Part B basic premium increase in the health insurance program's history.Jan 25, 2022

Will Part B premiums increase 2022?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

Is Medicare Part B going up 2022?

If you're on Medicare, chances are you had a bit of a shock when seeing the 2022 Medicare Part B premium amount. It went up by $21.60, from $148.50 in 2021 to $170.10 in 2022. That's a 14.5% increase, and is one of the steepest increases in Medicare's history.Jan 26, 2022

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Why is Medicare Part B going up so much in 2022?

Medicare Part B prices are set to rise in 2022, in part because the Biden administration is looking to establish a reserve for unexpected increases in healthcare spending. Part B premiums are set to increase from $148.50 to $170.10 in 2022. Annual deductibles will also increase in tandem from $203 to $233.

What is the standard Part B premium for 2021?

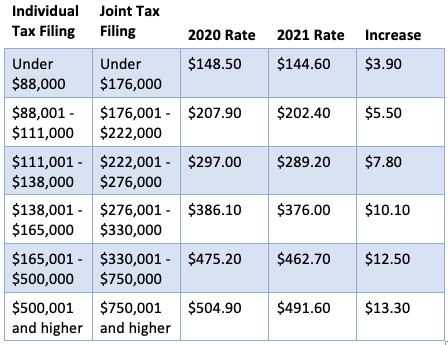

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is IRMAA in insurance?

IRMAA is an extra charge added to your premium. If your yearly income in 2019 (for what you pay in 2021) was. You pay each month (in 2021) File individual tax return. File joint tax return. File married & separate tax return. $88,000 or less. $176,000 or less. $88,000 or less.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What will Medicare Part B cost in 2022?

Next year, the standard Part B premium will be $170.10 a month. That's an increase of $29.60 from 2021. It's also a huge jump compared to recent increases.

So much for that generous Social Security raise

In 2022, seniors on Social Security are in line for a 5.9% cost-of-living adjustment (COLA), their largest in decades. All told, the average benefit will rise from $1,565 a month to $1,657 a month, representing a $92 increase.

The Motley Fool

Founded in 1993 in Alexandria, VA., by brothers David and Tom Gardner, The Motley Fool is a multimedia financial-services company dedicated to building the world's greatest investment community.

What is the Medicare deductible for 2021?

Part B deductible also increased for 2021. Medicare B also has a deductible, which has increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20 percent of the Medicare-approved cost for Part B services.

How much is the Social Security Cola for 2021?

The high-income threshold (where premiums increase based on income) grew to $88,000 for a single person for 2021. The Part B deductible increased to $203 for 2021. Q: How much does Medicare Part B cost the insured? ...

How much is the standard Part B premium in 2020?

The standard Part B premium increased by about $9/month in 2020. But the 1.6 percent Social Security COLA for 2020 increased the average beneficiary’s Social Security benefit by $24/month. Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees have been paying the standard premium in 2020.

How much is the 2020 Medicare premium?

Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month). But that’s in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium.

What is the income threshold for Part B?

For people with income above $87,000 ($174,000 for a couple) in 2020, Part B premiums for 2020 ranged from $202.40/month to $491.60/month. As explained by the math above, the high-income threshold has increased to $88,000 for a single individual and $176,000 for a couple in 2021.

How much is Part B insurance in 2021?

In 2021, most enrollees will be paying $148.50/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month).

How much income is required to pay Part B?

Since 2007, people who earn more than $85,000 ($170,000 for a couple) have paid higher Part B premiums (and higher Part D premiums) based on their income. For the first time, the threshold for what counts as “high income” was adjusted for inflation as of 2020, increasing it to $87,000 for a single individual and $174,000 for a couple.