How does income affect monthly Medicare premiums?

plan premium. 2022 Part D national base beneficiary premium— $33.37. This amount is used to estimate the Part D late enrollment penalty and the income-related monthly adjustment amounts listed in the table above. The national base beneficiary premium amount can change each year. If you pay a late enrollment penalty, these amounts may be higher.

Are Medicare premiums deducted from Social Security payments?

Nov 12, 2021 · Each year the Medicare Part B premium, deductible, and coinsurance rates are determined according to the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021.

How does Medicare calculate my premium?

Mar 02, 2022 · Medicare Premiums. Medicare premiums are monthly fees beneficiaries pay for their Medicare coverage. In 2022, the Medicare Part B standard premium is $170.10 a month. Most people pay no premiums for Medicare Part A, while premiums for Medicare Part D drug coverage and Medicare Advantage plans vary.

Who is eligible for Medicare Part B premium reimbursement?

Feb 15, 2022 · The standard monthly Medicare Part B premium is $170.10 in 2022, though some beneficiaries who have higher reported incomes will be charged a higher premium. This higher Part B premium is called the Income-Related Monthly Adjusted Amount (IRMAA) .

What is the estimated Medicare premium for 2022?

$170.10(Your state will pay the standard premium amount of $170.10 in 2022.) If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard Part B premium and an income-related monthly adjustment amount.

Is the Medicare premium for 2022 going up?

Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021). And those with fewer than 30 quarters worth of Medicare taxes will likely see a jump from the current rate of $471 in 2021 to $499 in 2022.Jan 4, 2022

Are Medicare premiums going down in 2022?

In 2021, the Part B premium increased by only $3 a month, but Congress directed CMS to begin paying that reduced premium back, starting in 2022.Jan 25, 2022

What will the Medicare Part B monthly premium be in 2022?

$170.10The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $170.10 in 2022, an increase of $21.60 from $148.50 in 2021.

Will Social Security get a $200 raise in 2022?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 22, 2022

What changes are coming to Medicare in 2022?

Also in 2022, Medicare will pay for mental health visits outside of the rules governing the pandemic. This means that mental health telehealth visits provided by rural health clinics and federally qualified health centers will be covered. Dena Bunis covers Medicare, health care, health policy and Congress.Jan 3, 2022

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

What will the COLA be for 2022?

5.9 percentIn October the Social Security Administration announced a historic cost-of-living adjustment (COLA) of 5.9 percent that will be applied to benefits for 2022.Dec 3, 2021

How Much Will SSI checks be in 2022?

$841 per monthFor individuals receiving SSI, the maximum federal benefit for 2022 will rise to $841 per month. The figure is $1,261 for couples. Actual payments could be higher since some states contribute more.Jan 10, 2022

How much is deducted from Social Security for Medicare?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

How can I lower my Medicare Part B premium?

Those premiums are a burden for many seniors, but here's how you can pay less for them.Sign up for Part B on time. ... Defer income to avoid a premium surcharge. ... Pay your premiums directly from your Social Security benefits. ... Get help from a Medicare Savings Program.Jan 3, 2022

What is the Medicare Advantage premium for 2021?

The CMS estimates that the average Medicare Advantage premium of $21 for 2021 is the lowest in 14 years. The agency figured monthly premiums dropped an average of nearly 8.7 percent from $23 in 2020.

How much is Medicare Part B in 2021?

Medicare premiums are monthly fees beneficiaries pay for their Medicare coverage. In 2021, the Medicare Part B standard premium is $148.50 a month. Most people pay no premiums for Medicare Part A, while premiums for Medicare Part D drug coverage and Medicare Advantage plans vary.

What happens if you don't pay Medicare Part D?

If you don’t pay the extra fee, you can lose your Medicare Part D coverage.

What is the original Medicare?

Original Medicare includes Medicare Part A hospital insurance and Part B medical insurance. The U.S. Centers for Medicare & Medicaid Services adjust the premiums for the following year in the fall.

How many Medicare Advantage plans will be available in 2021?

There were 3,550 Medicare Advantage plans available in 2021 and because these vary based on location, the average Medicare beneficiary had access to 33 Medicare Advantage plans, the most ever according to the Kaiser Family Foundation.

Does Medicare pay out of Social Security?

The extra amount you pay is not part of your plan premium and you do not pay it to your Medicare Part D insurer. In most cases, the extra amount will be held out of your Social Security check .

Does Medicare Part B have to be based on income?

Medicare Part B uses a complex formula to determine the amount of your monthly premium. The cost is based on your modified adjusted gross income. That’s adjusted gross income plus any tax-exempt interest reported on your most recent tax return.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is IRMAA in insurance?

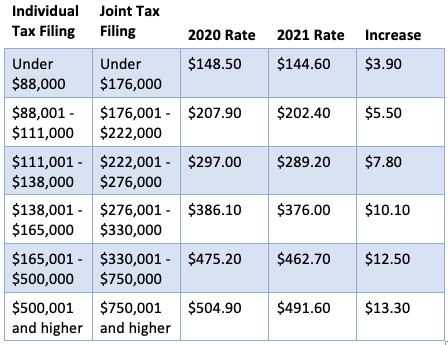

IRMAA is an extra charge added to your premium. If your yearly income in 2019 (for what you pay in 2021) was. You pay each month (in 2021) File individual tax return. File joint tax return. File married & separate tax return. $88,000 or less. $176,000 or less. $88,000 or less.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

Why Could the Premium Change?

According to the Washington Post, this is the first time that Medicare has considered a change to its premiums after announcing its annual figures. But this year’s Part B premium rise – the largest dollar amount increase in program history – has been an unusual situation.

How Much Will the New Part B Premium Be?

It is currently unclear how much beneficiaries could see their Part B premium decrease if Medicare does opt to make a change to this year’s amounts. But the updated premium could be significantly lower.