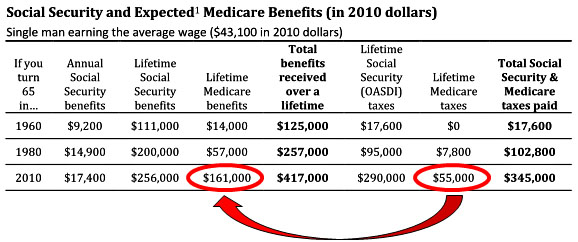

Using the figures from 2010 once again ($180,000 in lifetime benefits for men and $207,000 for women), the average-wage worker pays just $61,000 in lifetime contributions into Medicare. This means average men and women are receiving $119,000 and $146,000 more, respectively, in lifetime benefits than they paid into the program.

Full Answer

How much does Medicare cost per month?

Medicare costs at a glance. If you buy Part A, you'll pay up to $437 each month in 2019 ($458 in 2020). If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $437 ($458 in 2020). If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $240 ($252 in 2020).

Are there lifetime limits on Medicare benefits?

Lifetime Limits on Medicare. Deductibles and coinsurance must be paid for services rendered in each benefit period. There are also lifetime reserve days to consider. Part A covers 90 days in the hospital for any benefit period. After paying the deductible, the first 60 days are free to the beneficiary.

What is the cost of a lifetime reserve day for Medicare?

Medicare offers 60 lifetime reserve days that begin on day 91 that a person is required to remain in hospital. When a person chooses to use their lifetime reserve days, copayments will still apply. In 2021, the copayment for lifetime reserve days is $742 per day.

How long does Medicare Part a cover hospital costs?

Part A covers 90 days in the hospital for any benefit period. After paying the deductible, the first 60 days are free to the beneficiary. In 2018, days 61 to 90 will require a coinsurance of $335 per day. After 90 days, the beneficiary will pay all costs out of pocket or otherwise dip into their lifetime reserve days.

How much can I expect to spend on Medicare?

How much does Medicare cost?PlanPremium (2022)Out-of-pocket maximum (2022)Medicare Part A$0, or $274 or $499 if you claim it earlyNoneMedicare Part B$170.10 and upNoneMedicare Part CVaries$7,550 in-networkMedicare Part D$33.37 and up$7,0501 more row•Dec 1, 2021

Does Medicare have a lifetime dollar limit?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

How much does Medicare cost the average person?

Medicare's total per-enrollee spending rose from $11,902 in 2010 to $14,151 in 2019. This included spending on Part D, which began covering people in 2006 (and average Part D spending rose from $1,808 in 2010 to $2,168 in 2019). These amounts come from p. 188 of the Medicare Trustees Report for 2020.

How much does Medicare cost for the average 65 year old?

Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year. Deductibles for Medicare Part B benefits are $198.00 as of 2020 and you pay this once a year.

What happens when Medicare runs out of money?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

Does Medicare have an out-of-pocket maximum?

The Medicare out of pocket maximum for Medicare Advantage plans in 2021 is $7,550 for in-network expenses and $11,300 for combined in-network and out-of-network expenses, according to Kaiser Family Foundation.

Does Medicare pay for everything?

Original Medicare (Parts A & B) covers many medical and hospital services. But it doesn't cover everything.

What is the average out of pocket cost for healthcare?

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans.

How much does Medicare Part D cost in 2021?

Premiums vary by plan but the base monthly premium for a Part D plan in 2022 is $33.37, up from $33.06 in 2021. If you make more than a certain amount, you will have to pay a higher premium. The extra amount you pay is based on what's known as an income-related monthly adjustment amount (IRMAA).

How much do most seniors pay for Medicare?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Does Medicare get deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

What is the Medicare Advantage spending limit?

Medicare Advantage (Medicare Part C) plans, however, do feature an annual out-of-pocket spending limit for covered Medicare expenses. While each Medicare Advantage plan carrier is free to set their own out-of-pocket spending limit, by law it must be no greater than $7,550 in 2021. Some plans may set lower maximum out-of-pocket (MOOP) limits.

How long does Medicare cover hospital care?

Depending on how long your inpatient stay lasts, there is a limit to how long Medicare Part A will cover your hospital costs. For the first 60 days of ...

What is the Medicare donut hole?

Medicare Part D prescription drug plans feature a temporary coverage gap, or “ donut hole .”. During the Part D donut hole, your drug plan limits how much it will pay for your prescription drug costs. Once you and your plan combine to spend $4,130 on covered drugs in 2021, you will enter the donut hole. Once you enter the donut hole in 2021, you ...

How much is Medicare Part A deductible in 2021?

You are responsible for paying your Part A deductible, however. In 2021, the Medicare Part A deductible is $1,484 per benefit period. During days 61-90, you must pay a $371 per day coinsurance cost (in 2021) after you meet your Part A deductible.

What happens if you spend $6,550 out of pocket in 2021?

After you spend $6,550 out-of-pocket on covered drugs in 2021, you leave the donut hole coverage gap and enter the catastrophic coverage stage. Once you reach this stage, you only pay a small coinsurance or copayment for your covered drugs for the rest of the year.

What is Medicare Part B and Part D?

Medicare Part B (medical insurance) and Part D have income limits that can affect how much you pay for your monthly Part B and/or Part D premium. Higher income earners pay an additional amount, called an IRMAA, or the Income-Related Monthly Adjusted Amount.

What is Medicare Advantage Plan?

When you enroll in a Medicare Advantage plan, it replaces your Original Medicare coverage and offers the same benefits that you get from Medicare Part A and Part B.

What percentage of Medicare expenses are covered by seniors?

If seniors' benefits are increasing, it also means their potential liability might be as well. Keep in mind that about 80% of medical expenses are covered by Medicare, possibly putting seniors on the hook for 20% of a growing number by 2030.

How much does Social Security outweigh Medicare?

So, for those who turned 65 in 2010, average Social Security benefits outweigh average Medicare benefits by $97,000 for men and by $95,000 for women. However, by 2030, per the Urban Institute's calculations, this gap is expected to shrink to $28,000 for men and just $9,000 for women. In other words, Medicare's importance is growing by leaps ...

How much more will male retirees get in 2030?

The Urban Institute estimates that by 2030, male retirees will receive $221,000 more in lifetime benefits than they paid into Medicare, while female retirees will take home $263,000 on top of what they contributed. This fundamental flaw behind Medicare makes fixing the program for the long term a daunting task.

How much does a single woman make in a lifetime?

Single female earning an average wage: $207,000 in lifetime benefits. Two-earner couple earning an average wage: $387,000 in lifetime benefits. You may have noticed the difference in lifetime benefits between men and women. That difference arises because women live an average of five years longer than men, and thus have higher medical costs.

When will Medicare shrink?

First, the current gap (as of 2010) between the estimated lifetime benefits received from Social Security and Medicare is expected to shrink dramatically by 2030.

Is original Medicare only for seniors?

First, understand that original Medicare isn't your only option. For around 70% of today's seniors, original Medicare has been working wonderfully.

Does Medicare Advantage have a prescription?

Obviously, there's some merit to the simplicity offered by Medicare Advantage plans, which often have all of Medicare's perks as well as a prescription drug, vision, hearing, and dental plan, all rolled neatly into one package.

Medicare costs vary widely depending on the type of coverage you have and how healthy you are

Medicare cost per person per month can depend on a number of factors, including how you receive your benefits (Part A and Part B) and how much you use them each month.

Medicare Costs

The out-of-pocket expenses you may have with Medicare (or any health insurance plan) include:

How Much Does Medicare Part A Cost?

Part A (hospital insurance) covers most inpatient hospital needs, skilled nursing facility (SNF) care, nursing home care, hospice care, and home health care (if you qualify). When you apply for Medicare, you’re automatically enrolled in Part A.

How Much Does Medicare Part B Cost?

Part B (medical insurance) covers most medically necessary services or supplies you need to diagnose or treat a medical condition, as well as preventive services to help you stay healthy longer.

How Much Does Medicare Part C Cost?

Part C, or Medicare Advantage, is an alternative way to receive your Medicare benefits. These plans, offered by private insurance companies who contract with Medicare, offer the same coverage you’d get with Original Medicare Part A and Part B, as well as additional benefits.

How Much Does Medicare Part D Cost?

Part D, or prescription drug coverage, can be purchased as a stand-alone plan, or included with a Part C plan. Part D plans can also vary in cost based on a number of different factors, including deductibles, premiums, coinsurance and copays that can vary by plan.

What Is Medigap?

When you’re enrolled in Medicare Part A and Part B, you can purchase a Medigap plan to help fill the gaps in your coverage, such as payment for copays, deductibles, and healthcare when you travel.

How long does Medicare cover hospital stays?

Medicare Part A covers eligible inpatient costs for a hospital admission that lasts between 1 and 90 days. Medicare provides additional coverage for hospital stays that go beyond 90 days. This extra coverage is known as lifetime reserve days. Beneficiaries receive 60 lifetime reserve days that begin on day 91 of hospitalization.

How long can you use Medicare reserve days?

Part A coverage. Rules. Alternatives. Summary. Medicare Part A plans have lifetime reserve days that a person can use for an inpatient hospital stay that stretches beyond 90 days. Out-of-pocket costs may still apply. Medicare is a health program federally funded for adults aged 65 and older, ...

How many days does Medigap cover?

Medigap policies typically cover an additional 365 days of inpatient hospitalization after a person has used all lifetime reserve days. Private insurance companies administer Medigap policies, and a person can compare plans using a helpful tool on Medicare’s website.

What is a lifetime reserve day?

Summary. Lifetime reserve days are additional days that Medicare Part A covers for extended hospital stays. Medicare offers 60 lifetime reserve days that begin on day 91 that a person is required to remain in hospital. When a person chooses to use their lifetime reserve days, copayments will still apply.

How much will Medicare pay in 2021?

In 2021, Medicare Part A has the following copayments: day 1-60: $0 copayment. days 61-90: $371 per day copayment. days 91 and beyond: $742 copayment per day when using lifetime reserve days. after lifetime reserve days have been used the beneficiary pays all costs.

What is Medicare Part A?

Medicare Part A coverage includes most services and care related to an inpatient hospital stay, including: hospital rooms (semi-private) general nursing care. hospital services and equipment. medication. meals. Before Medicare covers an inpatient stay, the beneficiary pays a deductible.

What happens if you use all 60 reserve days?

Once a person uses all 60 of their reserve days, they will be fully responsible for further expenses. There are alternative options that a person can explore, including enrollment in a Medigap or Medicare Advantage plan. For individuals with limited income and resources, additional support is available.

What is a Seniors Flex Card?

Starting in late summer 2021, advertisements started to appear everywhere offering a senior flex card. Depending on the advertisement, some claimed these cards could be worth $2,880 or more!

What is a flex card?

Flex cards are tied to health insurance, and these flex card for seniors are actually a health insurance marketing tactic designed to lure seniors into switching to specific Medicare Advantage plans.

What does a flex card pay for?

According to Healthcare.gov, a flex card can be used to pay for certain out-of-pocket health care costs. These costs may include:

Who qualifies for the flex card?

Flex cards are typically offered alongside health insurance plans. In order to qualify for a flex card, you must qualify for a health insurance plan with a flexible spending account.

Is the flex card real?

I was able to identify many flex cards from legitimate insurers like Humana but I could not find any that offered as much money as the advertisements claimed. The largest legitimate flex plan I found included a $1,000 flex card and a $50 monthly debit card for other out-of-pocket costs, for a total of $1,600 per year.

Why are there so many Medicare scams?

Scammers love Medicare open enrollment season. Historically, the open enrollment period between October and December is a prime time for scammers who want to prey on seniors because this is when seniors can change their health care plans.

How can you protect yourself from Medicare scams?

The whole point of the flex card for seniors is to lure seniors into enrolling in new Medicare Advantage plans while it’s open enrollment season. As you may know from our previous video on Medicare benefits, Medicare has many parts and is very complicated.

How much does a beneficiary pay for a lifetime reserve day?

After 90 days, the beneficiary will pay all costs out of pocket or otherwise dip into their lifetime reserve days. I this case, they will pay $742 per day for each lifetime reserve day. Each person has a maximum of 60 such days they can use over their lifetime. 1 .

How long does a hospital stay in the hospital after paying deductible?

Deductibles and coinsurance must be paid for services rendered in each benefit period. There are also lifetime reserve days to consider. Part A covers 90 days in the hospital for any benefit period. After paying the deductible, the first 60 days are free to the beneficiary.

When did private insurance start adding lifetime limits?

Before the Affordable Care Act (ACA) passed in 2010, private insurance companies had the leeway to add lifetime limits to their plans. Not only did insurers increase the cost of premiums for people who had pre-existing conditions, they stopped paying for care after a certain dollar amount had been spent. Whether there was an annual limit ...

Does Medicare have a lifetime limit?

Medicare limits how many hospital days it will cover. At this time, there are no lifetime limits for Medicaid though it has become increasingly difficult to get coverage in some states.

Does Medicare cover hospice?

Part A, one of four parts of Medicare, provides coverage for inpatient hospital admissions, short-term stays in skilled nursing facilities, and hospice . While many people do not have to pay premiums for Part A, that does not mean it is free.

Is there a lifetime limit on medicaid?

Lifetime Limits for Medicaid. Medicaid is jointly funded by the federal and state governments but is run by the states. While the federal government sets the minimum standards for Medicaid coverage, each state can propose changes to those standards through 1115 Medicaid waivers. While lifetime coverage limits have been denied at this time, ...

Can you take away your medicaid benefits if you pay your share?

Regardless of the health plan used, it could be alarming to learn that, even if someone pays their share, their benefits could be taken away after a certain period of time, regardless of health or need. The Medicaid proposal was not the first time coverage limits were set by insurers.