_0.png)

This is particularly helpful if you are trying to settle a case without the assistance of an attorney. In these cases, regardless of the amount of the total Medicare lien, Medicare typically will accept 25 percent of the total amount received by you in full and final resolution of its claim for reimbursement.

How much of the settlement was deducted from Medicare payments?

Oct 27, 2021 · That is possible due to the volume of patients covered. It is essentially a mass volume discount that helps them create revenue. If an individual might get charged $10,000 for the medical procedure, the Medicare reimbursement rate might only be $500. That means the other $9,500 gets written off by the scheme.

What happens after you settle a Medicare claim?

Dec 22, 2021 · And, the total of all healthcare liens cannot exceed 40% of the total recovery. Furthermore, no single group can receive more than 1/3 of the total recovery. If the total amount of liens exceed 40%, the liens will reduce. The total of all healthcare professionals’ liens in this case, cannot exceed 20% of the recovery.

How much will Medicare receive from my lawsuit?

Dec 13, 2018 · How to Reimburse Medicare With Your Settlement Money. When the COB Contractor mails you an invoice of all medical costs you supposedly owe Medicare upon receiving your settlement, you and your lawyer will have the chance to review the charges and verify that they are accurate. If they are correct, your lawyer will allot a portion of your ...

What happens if a Medicare lien is less than the settlement?

Mar 12, 2019 · Normally Medicare’s liens are surprisingly reasonable and the rule of thumb is that they are approximately 20% of the full retail charge, also known as the “chargemaster” which are the huge amounts you see on Explanation of Benefits forms when a carrier reports to you the amounts paid for your care and your portion, if any.

Do you have to repay Medicare?

The payment is "conditional" because it must be repaid to Medicare if you get a settlement, judgment, award, or other payment later. You're responsible for making sure Medicare gets repaid from the settlement, judgment, award, or other payment.

How is Medicare lien amount calculated?

Formula 1: Step number one: add attorney fees and costs to determine the total procurement cost. Step number two: take the total procurement cost and divide that by the gross settlement amount to determine the ratio. Step number three: multiply the lien amount by the ratio to determine the reduction amount.Jun 5, 2020

How do I repay Medicare?

How do I pay my Medicare premium using my Medicare account?Log into your secure Medicare account (or create a Medicare account if you don't have one yet).Select "My Premiums" and then "Pay Now."Choose your payment method, like credit/debit card or checking or savings account, and enter the amount you want to pay.

Can you negotiate a Medicare lien?

Medicaid and Medicare liens are administered through the Benefits Coordination and Recovery Center (BCRC). If you can prove any hardship, you'll likely be able to negotiate your lien substantially downward with a BCRC representative.Mar 28, 2022

How long does it take to be reimbursed from Medicare?

60 daysFAQs. How long does reimbursement take? It takes Medicare at least 60 days to process a reimbursement claim. If you haven't yet paid your doctors, be sure to communicate with them to avoid bad marks on your credit.Sep 27, 2021

Why am I getting a letter from CMS?

When the most recent search is completed and related claims are identified, the recovery contractor will issue a demand letter advising the debtor of the amount of money owed to the Medicare program and how to resolve the debt by repayment. The demand letter also includes information on administrative appeal rights.Dec 1, 2021

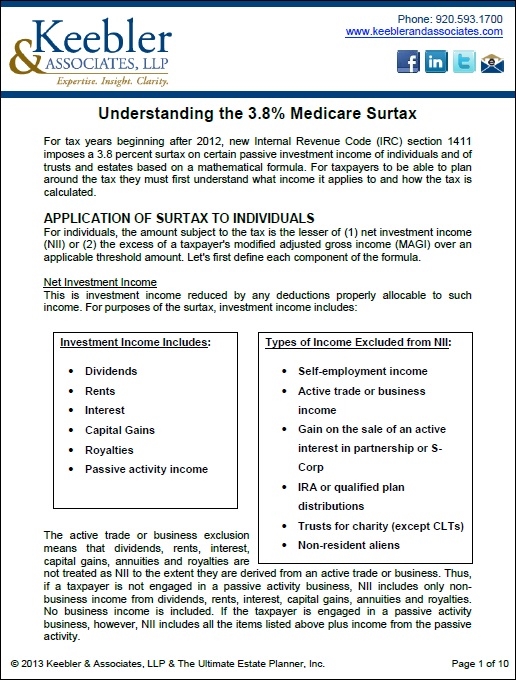

How much does Medicare take out of Social Security?

You will pay no monthly premium for Medicare Part A if you are older than age 65 and any of these apply: You receive retirement benefits from Social Security....Is Medicare Part A free?Amount of time worked (and paid into Medicare)Monthly premium in 2021< 30 quarters (360 weeks)$47130–39 quarters (360–468 weeks)$259Dec 1, 2021

Why is my first Medicare premium bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.Dec 3, 2021

What month is Medicare deducted from Social Security?

Hi RCK. The Medicare premium that will be withheld from your Social Security check that's paid in August (for July) covers your Part B premium for August. So, if you already have Part B coverage you'll need to pay your Medicare premiums out of pocket through July.Mar 5, 2021

What is a Medicare consent to release form?

The medicare consent to release form is a form that allows a beneficiary to provide all of the information needed for the Centers for Medicaid and Medicare Service (also known as CMS), to release information regarding an injury/illness and/or a settlement for the date (specified) of illness or injury.

What is an Erisa lien?

An ERISA lien comes into effect if an employee is harmed as a result of another person's negligence and his medical expenses are paid using a health benefits plan administered by ERISA, the employer might be entitled to recoup the money spent on the healthcare dollar-for-dollar.Feb 28, 2022

Does Medicare Subrogate?

Subrogation rules are written into the statutes that govern Medicare and Medicaid. Virtually always, if Medicare or Medicaid paid medical expenses incurred because of a personal injury, there will be at least some subrogation payment from a personal injury judgment or settlement.Nov 15, 2016

So You Have Resolved Your Personal Injury Claim, What's Next?

Medicare requires you to report, within 60 days, any settlement or judgment resulting from any personal injury claims for which it has paid medical...

Claims Resolved For $5,000.00 Or Less

Fortunately, in cases that settle or result in a judgment for $5,000.00 or less, Medicare has a fixed percentage option. This is particularly helpf...

The Potential Requirement of A Medicare Set Aside

In some cases, as the injured party, you may be required to take into account the cost of any future treatment stemming from accident-related injur...

Does An Admission of Liability Matter?

In most instances, when a personal injury claim is resolved by a negotiated settlement, the insurance company that will pay the settlement tenders...

How long does it take for Medicare to report a claim?

Medicare requires you to report, within 60 days, any settlement or judgment resulting from any personal injury claims for which it has paid medical claims. Failure to timely report can result in substantial fines—as high as $1,000.00 per day.

What is the best course of action for Medicare?

If the requirement of future medical care is a realistic possibility, the best course of action is to speak with an experienced attorney who can help with the process and determine what's necessary to appropriately take into account Medicare's future interest.

What is a lien on Medicare?

The lien gives Medicare a claim to the judgment or settlement funds and the Medicare lien is superior to any other person or entity, including you as the insured party. Unlike cases involving private health insurance, Medicare offers little to no flexibility to negotiate away, or negotiate down, its lien amount.

Does Medicare reduce a lien?

If that is the case, Medicare typically will reduce its lien by one-third. This is Medicare's recognition that the total recovery you receive from a judgment or settlement is already being reduced by the attorneys' fees, which often are paid as a contingency fee at or near one-third of the judgment or settlement amount.

Do you have to take into account the cost of future treatment?

In some cases, as the injured party, you may be required to take into account the cost of any future treatment stemming from accident-related injuries. This can occur when you receive a settlement or judgment as a Medicare insured (or someone who soon will become a Medicare insured) and it is determined that your injury will require future care for which Medicare will be billed.

Does Medicare cover disability?

Medicare is the federal health insurance program that covers people who are 65 or older and certain younger individuals with disabilities. If you are a Medicare recipient and you are injured, Medicare may cover the cost of your medical care. However, if the costs Medicare pays are the result of an injury, and you have a successful personal injury ...

What is the common fund doctrine?

That is known as the Common Fund Doctrine which for California cases is codified in Insurance Code Section 3040. That statute provides that a medical insurance lien cannot exceed one-third of the moneys due to the insured under from a final judgment, compromise, or settlement agreement.

What does it mean to be a plaintiff?

Having suffered an injury subjects you as a plaintiff [a person making a personal injury claim once a lawsuit is file] to laws that are basically unfair and a corruption of justice. As plaintiffs’ lawyers we have fought against these arcane legal concepts for years.

Can you sue Kaiser for malpractice?

Kaiser in the past has asked patients to sign an acknowledgement of its contractual lien rights which also give up the right to sue Kaiser for malpractice in California courts. Never sign any such document no matter what the threat. If the lien is valid, there is no need to ask you to re-acknowledge it.

Can you control what happens to you?

You cannot control what happens to you. You can only control what you do in response. Here is how we recommend fighting back on medical insurance liens. Health insurance policies are entitled to claw back payments for medical care from the person who caused injury.

Is failure to retain counsel a mistake?

Your failure to retain counsel was a serious mistake. You no have a problem with Medicare. When a third party pays in a personal injury matter, Medicare is entitled to get its money back. The amount Medicare was entitled to should have been included in your claim and paid on top of your settlement. It makes perfect sense. The wrongdoer was liable to pay for the medical expenses you incurred as a result...

Can Medicare be a lien on a judgment?

Medicare, if you received benefits from them associated with medical treatment for the injuries suffered in your accident, is entitled to a lien on the proceeds of the settlement or judgment. Your attorney will have to determine if Medicare will compromise the lien.

Can Medicare help with a lien?

Medicare is entitled to the amount paid for care provided related to your accident. You may want to try to find an attorney to assist in negotiating the lien. If you plan to continue negotiating yourself, request a copy of all payments made by medicare relating to the accident and review them to make sure that they are accurate. Once you have obtained the accurate number, you can attempt to negotiate the lien...

Does Medicare have a lien?

A personal injury attorney knows that there is a Medicare lien that needs to be satisfied in a case like yours. However, the federal Medicare lien statute provides for certain setoffs against the lien claim, such as your costs of receiving a settlement... 0 found this answer helpful. found this helpful.