How much is Medicare Part B monthly?

| If your yearly income in 2020 (for what you pay in 2022) was | You pay each month (in 2022) | |

|---|---|---|

| File individual tax return | File joint tax return | |

| $91,000 or less | $182,000 or less | $170.10 |

| above $91,000 up to $114,000 | above $182,000 up to $228,000 | $238.10 |

| above $114,000 up to $142,000 | above $228,000 up to $284,000 | $340.20 |

What is the Medicare Part B premium for 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Is Medicare Part B free for anyone?

How much is Medicare Part B out of your Social Security check?

Is Medicare Part B going up 2022?

What is Medicare Part A deductible for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What is the Medicare Part B premium for 2022?

Which of the following services are covered by Medicare Part B?

Is Medicare premium based on income?

Is there really a $16728 Social Security bonus?

Is Medicare Part B premium automatically deducted from Social Security?

What is deducted from your monthly Social Security check?

What Is the Cost of Medicare Part B for 2022?

Have you ever asked a friend or family member: “How much does Medicare Part B cost?” If so, they probably responded with their monthly premium amou...

What is the Maximum Cost of Medicare Part B?

Typically, the cost of your Medicare Part B coverage comes down to several costs, starting with your monthly premium and annual Medicare Part B ded...

Is Medicare Part B Free for Seniors?

If you have Original Medicare (Parts A and B), you’ll likely pay for your Part B plan. Medicare beneficiaries that worked 10 or more years often re...

How is Medicare Part B premium calculated?

The Medicare Part B premium changes each year and is calculated based on data collected by the Centers for Medicare and Medicaid Services (CMS). Th...

How do I pay my Part B premium?

Your Medicare Part B premium is a monthly payment. It may be deducted automatically for you if you receive the following benefits:

What does Medicare Part B cover exactly?

Medicare Part B generally covers the medical treatments you receive. But Part B won’t cover everything — your treatments or services must either be:

How to enroll in Medicare Part B?

Are you or a loved one turning 65 and looking to enroll in Medicare? You’ll want to know when to enroll, and how. As a starting point, find your In...

How does Medicare calculate my Part B premium and Income Related Monthly Adjustment Amount (IRMAA)?

When you enroll, your IRMAA, if you pay one, will be based on your tax returns from two years prior. That year’s income will be used to determine h...

Do Part B costs remain the same after I enroll? Or do they increase each year?

Your Part B costs will change each year based on data collected by the Centers for Medicare and Medicaid Services (CMS). This generally means incre...

If I enroll in Medicare Advantage, will I still pay a Part B premium?

This depends on your plan. Some insurance companies will include the Part B premium in what you pay each month for your Medicare Advantage policy....

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is Medicare Advantage Plan?

Medicare Advantage plans are offered by private insurance companies and will cover everything that Original Medicare offers and more.

Will Medicare premiums increase in 2021?

With a $3.90 increase in monthly premiums for 2021, it is unlikely that many people will have their premiums reduced this year. For those who are dual eligible, Medicaid will pay their Medicare premiums. They will be charged the higher Part B premium rates.

Who is Shereen Lehman?

Shereen Lehman, MS, is a healthcare journalist and fact checker. She has co-authored two books for the popular Dummies Series (as Shereen Jegtvig). Part B is what covers the bulk of your healthcare expenses. Understand how much you will pay out of pocket and budget for the year ahead.

Is Medicare Part B based on income?

Unlike the Part B premium, this amount isn’t based on income. Everyone enrolled in Original Medicare pays the same Part B deductible. That means no matter how high your income is, you’ll pay the standard Medicare Part B deductible amount.

How does Medicare Part B work?

How it Works Premiums & Deductibles Coverage & Enrollment FAQs. Medicare Part B provides the medical portion of your Medicare coverage . Part B has costs, including a premium, deductible and coinsurance. Together, they make up the overall cost of Medicare Part B. But the costs aren’t the same for everyone.

What is Medicare premium?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. A deductible is the amount you pay out of pocket before your insurance company covers its ...

Does Medicare Supplement Insurance cover Part B?

Medicare Supplement Insurance (Medigap) has several policies that will help cover your Part B costs, including premiums, deductibles and out-of-pocket costs.

Does Medicare cover wheelchairs?

Medically necessary: Your doctor must deem your treatment is required to improve or maintain your health. Preventive services: Medicare-approved screenings and other preventive services are covered and generally at no-cost. Part B can also cover wheelchairs and other medically necessary equipment.

Does Medicare Advantage include Part B?

Some insurance companies will include the Part B premium in what you pay each month for your Medicare Advantage policy . Others will pay the cost of the Part B premium and charge you a reduced rate. If you’re on Medicare Advantage and want to find out what you have, give your insurance company a call.

What is premium insurance?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. and annual deductible. A deductible is the amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs ...

What is Medicare Part B excess charge?

Part B excess charges. If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

Does Medicare Part A require coinsurance?

Part A also requires coinsurance for hospice care and skilled nursing facility care. Part A hospice care coinsurance or copayment. Medicare Part A requires a copayment for prescription drugs used during hospice care. You might also be charged a 5 percent coinsurance for inpatient respite care costs.

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

What is the average Medicare premium for 2021?

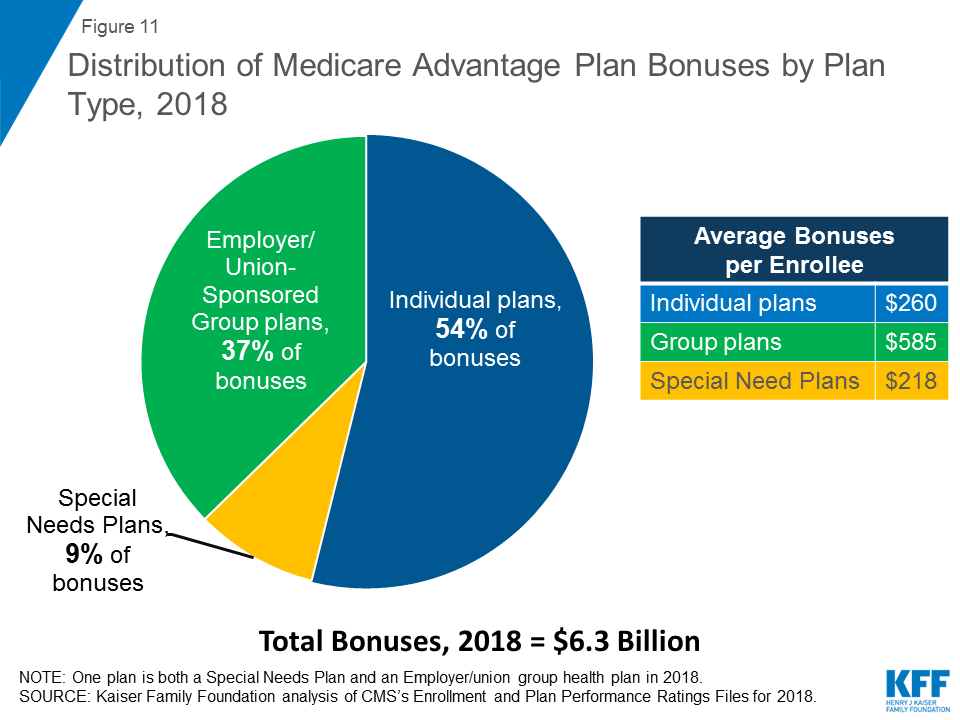

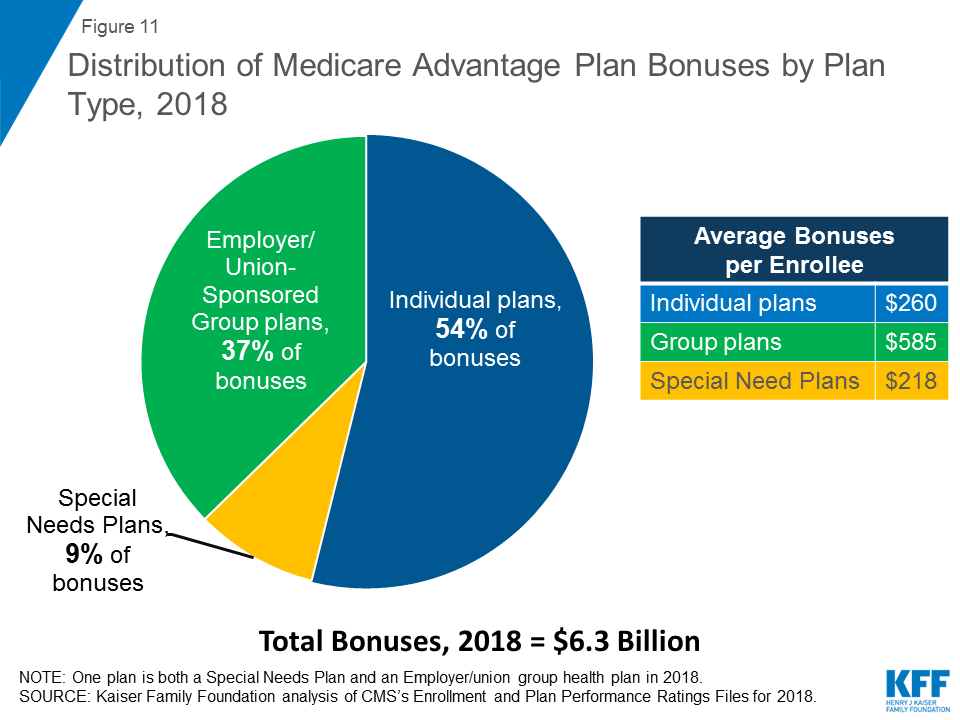

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

What is a Medicare donut hole?

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a “donut hole” or “coverage gap,” which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.