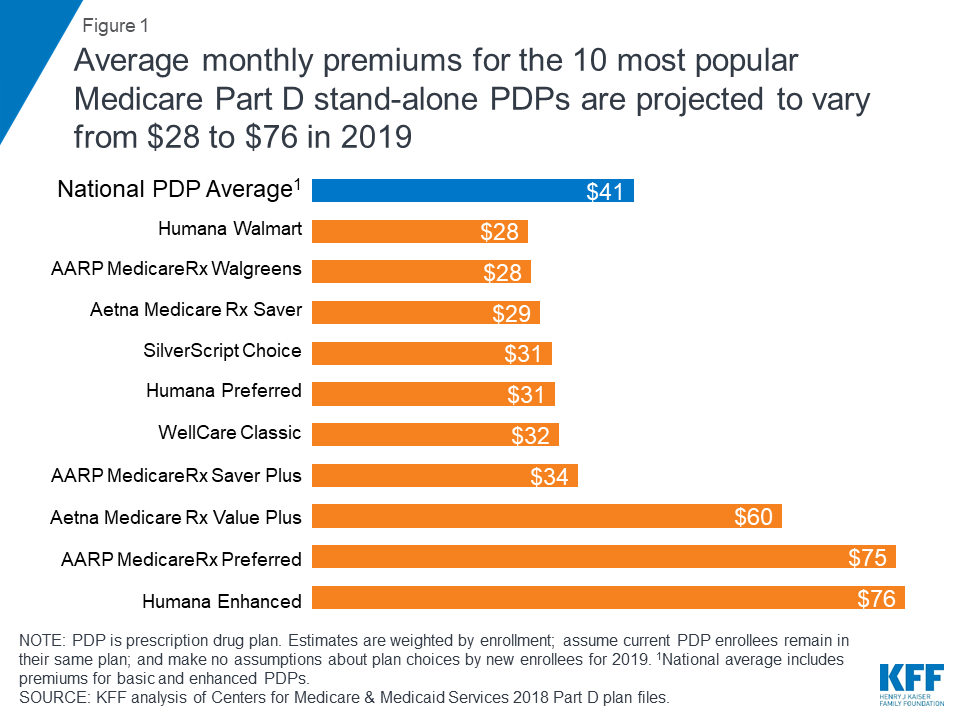

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount (IRMAA), meaning if you make more, you’ll pay more.

Full Answer

Are Medicare costs based on your income?

Nov 08, 2019 · Each year the Medicare premiums, deductibles, and copayment rates are adjusted according to the Social Security Act. For 2020, the Medicare Part B monthly premiums and the annual deductible are higher than the 2019 amounts. The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019.

What is the average cost of Medicare coverage?

Dec 21, 2019 · Medicare Part B, which covers outpatient services like doctor visits, works differently from hospital coverage. Part B participants pay premiums, with the monthly premium for most people in 2020...

Does Medicare coverage cost money?

You’ll pay $233, before Original Medicare starts to pay. You pay this deductible once each year. Costs for services (coinsurance) You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How does income affect monthly Medicare premiums?

This base premiums is used even if the plan you wish to enroll in does not charge you a monthly premium. For 2020, the national base premium is $32.74; the penalty percentage is 1%. If you are without coverage for a full 10 months, you would multiply 10 by $0.3274, which would make your penalty payment $3.27.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Do you have to pay late enrollment penalty for Medicare?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is the monthly premium for Medicare Part B?

Part B participants pay premiums, with the monthly premium for most people in 2020 set to go up to $144.60. That's up by $9.10 per month from 2019 levels, which is a fairly high boost compared ...

How much is Medicare Part B?

Part B participants pay premiums, with the monthly premium for most people in 2020 set to go up to $144.60. That's up by $9.10 per month from 2019 levels, which is a fairly high boost compared with recent years.

Do you have to have Medicare if you are 65?

Americans 65 and older rely on Medicare for the healthcare coverage they need. But even though most people are entitled to Medicare benefits, they don't come without cost. In fact, if you don't plan for healthcare expenses under Medicare, you'll get a nasty shock when you approach retirement.

Does Medicare cover co-pays?

In particular, the various parts of Medicare coverage impose a wide variety of different costs for participants to pay. Whether you face deductibles, co-payments, premiums, or other expenses, being on Medicare requires some financial planning in order to make sure you can cover your costs. The following sections take a look at Medicare ...

How much is Part B insurance?

Part B participants pay premiums, with the monthly premium for most people in 2020 set to go up to $144.60. That's up by $9.10 per month from 2019 levels, which is a fairly high boost compared with recent years.

Who is Dan Caplinger?

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is the maximum deductible for Medicare?

The annual deductible is the amount you must pay before your insurer begins to cover the costs of your prescriptions. While individual plans can set different deductible amounts, Medicare imposes a maximum limit. In 2020, plans cannot set their deductible higher than $435.

What is a Part D plan?

Part D plans are offered by private insurers as stand-alone plans or as part of a Medicare Advantage plan. These carriers determine the monthly premium recipients pay and carriers may offer a selection of plans at different monthly price points. Factors that determine how much the monthly premium will be include the copay ...

What is the deductible for Medicare Part B 2020?

Changes to the 2020 Annual Deductible. Medicare recipients must meet an annual deductible with Medicare Part B, which is $198 for 2020. If a Medicare enrollee was eligible for a Medigap plan that pays for the Part B deductible prior to 2020, they can still receive that benefit. Medigap plans that pay the Part B deductible are no longer offered as ...

How much do you pay in 2020?

between $136,000 and $163,000, you pay $376.20 a month in 2020. between $163,000 and $500,000, you pay $462.70 a month in 2020. more than $500,000, you pay $491.60 a month in 2020. If you filed a joint tax return in 2018 and your income was: less than $174,000, you pay $144.60 a month in 2020.

How much is the deductible for Medicare Part B?

Medicare recipients must meet an annual deductible with Medicare Part B, which is $198 for 2020. If a Medicare enrollee was eligible for a Medigap plan that pays for the Part B deductible prior to 2020, they can still receive that benefit. Medigap plans that pay the Part B deductible are no longer offered as of January 1st, 2020.

How much is Part B insurance?

Changes to the 2020 Monthly Premium. The minimum premium for Part B coverage in 2020 is $144.60 each month, which is a $9 increase from 2019’s minimum premium of $135.50 each month.

How much do you make a month in 2020?

between $109,000 and $136,000, you pay $289.20 a month in 2020. between $136,000 and $163,000, you pay $376.20 a month in 2020. between $163,000 and $500,000, you pay $462.70 a month in 2020. more than $500,000, you pay $491.60 a month in 2020.

How much is Part B premium for 2020?

more than $413,000, you pay $491.60 a month in 2020. The Part B premium can be scaled to the Social Security cost-of-living adjustment (COLA) if the rise in a premium is more than the change in a retiree’s Social Security benefit.

What is the COLA for 2020?

For 2020, the COLA is 1.6%; if this change in a beneficiary’s Social Security payment does not cover the rise in their premium cost, their premium will only increase by 1.6% of the prior year’s premium. If you qualify as a dual eligible enrollee with Medicare and Medicaid, your Medicare premium will be $144.60 a month and is paid by Medicaid.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

Does Medicare Part A require coinsurance?

Part A also requires coinsurance for hospice care and skilled nursing facility care. Part A hospice care coinsurance or copayment. Medicare Part A requires a copayment for prescription drugs used during hospice care. You might also be charged a 5 percent coinsurance for inpatient respite care costs.

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

What is Medicare Part B excess charge?

Part B excess charges. If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

What is a Medicare donut hole?

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a “donut hole” or “coverage gap,” which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

What does Medicare Part B cover?

This is a very broad category that covers medical office visits, non-emergency ambulance transportation, durable and disposable medical supplies and certain outpatient treatments.

Does Medicare cover coinsurance?

Many Medicare beneficiaries find that the gaps in their coverage – such as Medicare deductibles, coinsurance, copays and more – can leave them having to pay significant out of pocket costs. Medicare supplemental policies can pick up some of the coinsurance and co-payment requirements for each part of Medicare.

Is Medicare Part D a private insurance?

Since 2006, Medicare-eligible seniors have had the option to enroll in Part D, Medicare’s prescription drug benefit. Unlike Part A and Part B, Medicare Part D prescription drug benefits are provided through a private insurance company that has been approved for the program.

What is the average Medicare premium for 2020?

Average Medicare Advantage premiums are projected to drop to $23.00 in 2020. 1 Although each Medicare Advantage plan is different, the government believes that monthly Medicare Advantage premiums have decreased since 2017 when they were $31.91. 2

How much is Medicare deductible for 2020?

In 2020, you’ll pay: $1,408 deductible per benefit period (this was $1,364 in 2019) $352 per day for days 61–90 of each benefit period (this was $341 in 2019) $704 per “lifetime reserve day” after day 90 of each benefit period, up to a maximum of 60 days over your lifetime (this was $682 in 2019) Some Medicare Supplement plans pay ...

What is Medicare Part A?

Medicare Part A covers inpatient stays in hospitals and skilled nursing facilities, as well as home health care and hospice. You need to keep Part A and B to get additional coverage such as a Medicare supplement plan or Medicare Advantage plan.

What is the maximum out of pocket cost for Medicare Advantage 2020?

In 2020, the maximum out-of-pocket cost for those with Medicare Advantage is $6,700. You won’t have to pay a penny more than this amount for services that would have been covered under Original Medicare (Parts A & B). However, this only applies to services that would have been covered under Original Medicare.

How much do you pay for unemployment?

In 2020, you pay: 1 $0 for the first 20 days of each benefit period 2 $176 per day for days 21–100 of each benefit period 3 All costs for each day after day 100 of the benefit period