Does Medicaid pay for deductible?

Not only does ... no deductibles or co-pays. "The benefits are, generally speaking, much broader than you see in the typical employer-based insurance and certainly broader than you see in Medicare ...

Can I deduct Medicare costs on my income tax?

You may be eligible to deduct Medicare costs such as copayments or premiums if you itemize your income taxes. Unreimbursed medical or dental expenses may be deductible if they exceed 7.5% your adjusted gross income. Part A premiums can be deducted under certain circumstances.

Is Medicare Part B premiums tax-deductible?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it's not mandatory to enroll in Part B, you can be "rewarded" with a tax break for choosing to pay this medical expense.

What is the monthly premium for Medicare Part B?

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

How much is the annual Medicare deductible for 2021?

$203The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What will 2022 Medicare deductible be?

What is the Medicare deductible for 2022? The Part A deductible for 2022 is $1,556 for each benefit period. The Part B deductible is $233. You will usually then pay 20 percent of the cost for anything covered by Part B after you have met your deductible.

What is the deductible amount for 2021?

Here is a list of our partners and here's how we make money. The standard deduction is a specific dollar amount that reduces your taxable income. For the 2021 tax year, the standard deduction is $12,550 for single filers and married filing separately, $25,100 for joint filers and $18,800 for heads of household.

What changes are coming to Medicare in 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

Is there an extra deduction for over 65 in 2021?

Increased Standard Deduction: You qualify for a larger standard deduction if you or your spouse is age 65 or older. The standard deduction for single seniors in 2021 is $1,700 higher than the deduction for taxpayer younger than 65 who file as single or head of household.

What is the standard deduction for seniors over 65 in 2021?

Example 2: Ellen is single, over the age of 65, and not blind. For 2021, she gets the normal standard deduction of $12,550, plus one additional standard deduction of $1,700 for being over the age of 65.

What is the standard deduction for seniors over 65?

If you are age 65 or older, your standard deduction increases by $1,700 if you file as Single or Head of Household. If you are legally blind, your standard deduction increases by $1,700 as well. If you are Married Filing Jointly and you OR your spouse is 65 or older, your standard deduction increases by $1,350.

PinPoints

Medicare made some modifications to the 2021 deductible. The rising cost of healthcare necessitates an increase in Medicare premiums and deductibles.

What changes are made to Medicare Part A in 2021?

Medicare Part A covers hospitalization, nursing home care, and a portion of home healthcare.

The adjustments to Medicare Part B for 2021 are as follows

Part B of Medicare covers physician costs, outpatient treatments, some home health care services, medical equipment, and medications.

Medicare Part D will have the following changes in 2021

Medicare prescription medication coverage is another name for Medicare Part D.

What changes are coming to Medigap in 2021?

Supplemental Medicare or Medigap insurance covers a portion of your Medicare premiums. Supplements to Medicare can help pay the cost of premiums and deductibles.

To fight the coronavirus (COVID-19)

On March 20, 2020, Medicare was modified to fulfil the needs of enrollees.

Conclusion

Apart from increased Medicare premiums and deductibles, there are more ways to save money on healthcare.

How much will Medicare cost in 2021?

Standard monthly premiums for Part B will cost $3.90 more, rising to $148.50 in 2021, up from $144.60 in 2020.

Why did Medicare pay for Part B?

In addition to the health care costs to treat the coronavirus, the federal government also paid doctors and other Part B providers to offset the money they lost because many Medicare enrollees are postponing some routine and preventive care during the crisis.

Why are Medicare premiums higher?

Premiums for some Medicare enrollees will be higher than the standard because these monthly payments are based on income . Part B beneficiaries with annual incomes greater than $88,000 will pay more ($207.90 for individuals with incomes between $88,000 and $111,000, for example).

When does Medicare open enrollment start?

Almost all Medicare beneficiaries (99 percent) pay no Part A premium. Open enrollment for Medicare began Oct. 15 and continues through Dec. 7. This is the one period during the year when beneficiaries can review their coverage and decide whether to make changes.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much will Medicare cost in 2021?

In 2021, it costs $259 or $471 each month, depending on how long you paid Medicare taxes. 2 . That doesn’t mean you aren’t charged a deductible. For each benefit period, you pay the first $1,484 in 2021. A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days.

What is Medicare Part A 2021?

Medicare Part A Costs in 2021. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. 1 For most people, this is the closest thing to free they’ll get from Medicare, as Medicare Part A (generally) doesn't charge a premium. 2 . Tip: If you don't qualify for Part A, you can buy Part A coverage.

What does Medicare cover?

What you pay for Medicare depends on the type of enrollment you have: Parts A, B, C, and/or D. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. It doesn't generally charge a premium. Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium ...

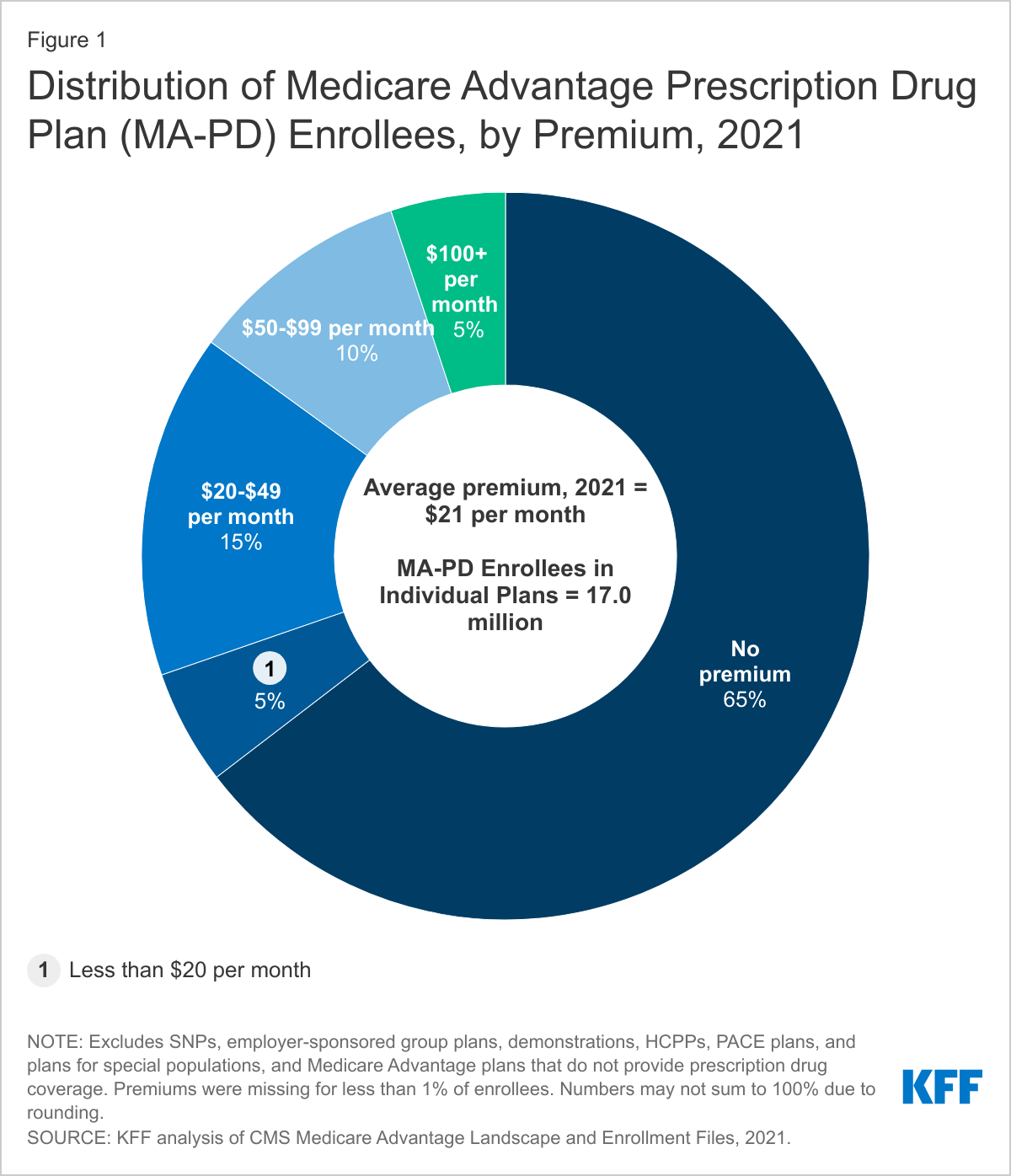

What is the Medicare Advantage premium for 2021?

The average plan premium is about $21.00 a month in 2021. 7 . But coinsurance, copayments, premiums, and deductibles may still vary depending on your plan of choice. 3 .

How much does Medicare pay for a hospital stay in 2021?

Part A also charges coinsurance if your hospital stay lasts more than 60 days. In 2021, for days 61 to 90 of your hospital stay, you pay $371 per day; days 91 through the balance of your lifetime reserve days, you pay $742 per day. 3 Lifetime reserve days are 60 days that Medicare gives you to use if you stay in the hospital for more than 90 days.

What is the premium for Part B?

Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium of $148.50 in 2021. A small percentage of people will pay more than that amount if reporting income greater than $88,000 as single filers or more than $176,000 as joint filers. 3

How long does a hospital benefit last?

A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days . If you re-enter the hospital the day after your benefit period ends, you’re responsible for the first $1,484 of charges again. 3 .

Key Takeaways

Parts A and B of Original Medicare have deductibles you must meet before Medicare will pay for healthcare.

What is the Medicare Deductible for 2022?

A deductible refers to the amount of money you must pay out of pocket for covered healthcare services before your health insurance plan starts to pay. A deductible can be based upon a calendar year, upon a plan year or — as is unique to Medicare Part A — upon a benefit period.

Does Original Medicare Have Deductibles?

Original Medicare is composed of Medicare Part A and Medicare Part B. Both parts of Original Medicare have deductibles you will have to pay out of pocket before your plan starts to pay for your healthcare.

Medicare Advantage (Part C) Deductibles

Medicare Advantage (Part C) is an alternative type of Medicare plan that is purchased through a private insurer. Not every Part C plan is available throughout the country. Your state, county and zip code will determine which plans are available for you to choose from in your area.

Medicare Part D Deductibles

Medicare Part D is prescription drug coverage. People are often surprised to learn that Part D is not included in Original Medicare. This is understandable since prescription medications are very often integral to health.

Medicare Supplement Plan Deductible Coverage

Medicare Supplement Insurance is also known as Medigap. Medigap is supplemental insurance sold by private insurers. It is designed to fill in the cost “gaps” for people who have Original Medicare.

Do You Have to Pay a Deductible with Medicare?

You’ve probably heard the one about death and taxes. If you have Original Medicare, you can add deductibles to that list.