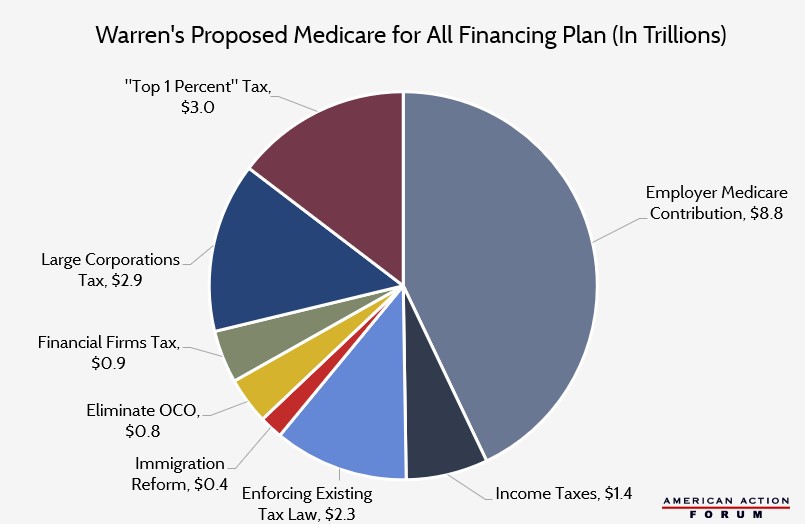

Senator Elizabeth Warren released her plan for funding Medicare for All on November 1st (her lack of an explanation on how she could deliver it without a tax increase on the middle class, as has been her promise, was a prominent moment in the last Democratic debate). And here is her Number: $26.6 Trillion.

Full Answer

What are the CBO Medicare for all options?

May 05, 2020 · All of the estimates displayed below are from leading financial professionals and economic organizations that are calculated based on a ten-year forecast assuming immediate implementation. • No estimates available for Representative Jayapal’s proposal. • Senator Sander’s cost is $14 Trillion. • Economist Kenneth Thorpe’s cost is $27 ...

How much will Medicare for all cost?

Aug 29, 2018 · 's (I-Vt.) “Medicare for all” bill would cost $32 trillion has set off a furious debate over the cost of the plan. But there's one estimate that would make an even bigger splash: the score from the...

Do Warren and Sanders’ health plans really save Americans money?

Mar 17, 2020 · A VAT could be introduced at the federal level to finance Medicare for All. Based on estimates from the Congressional Budget Office (CBO), we project a broad-based VAT of 42 percent would raise about $30 trillion over a decade. The first-order effect of this VAT would be to increase the prices of most goods and services by 42 percent; the VAT would thus represent …

What would Elizabeth Warren do with all that money?

What is Elizabeth Warren's response to Sanders' concerns about their health plans?

The central response from Warren and Sanders to concerns about their health plans’ cost has been to tout the overall savings for Americans, and the Urban Institute analysis suggests that for lower- and middle-income families, that’s possible.

How much will the single payer plan cost in 2020?

(The CBO says Washington will spend about $4.6 trillion in 2020.) But over the next decade, the plan on its own would represent a nearly 60 percent increase in total expected ...

Why is the federal government less revenue than its projected cost?

That’s slightly less revenue than its projected cost, because it would generate some offsetting savings by eliminating certain tax benefits the government now provides , such as the exclusion for employer-provided health care.

How much would the federal government increase in 2029?

By 2029, with the added cost of single payer factored in, federal revenue would increase to close to 30 percent of the total economy. That would mean federal revenue would increase as a share of the economy by about three-fourths over a decade, far more rapidly than in any other 10-year period since World War II. It would also mean that federal revenue would considerably exceed the share of the economy it consumed even during World War II, when it reached 20.5 percent in 1944, a level unmatched since.

How much money will households save?

The study projects that households will save nearly $887 billion in annual costs and employers another $955 billion, some of which could revert to workers in the form of higher wages.

Did Elizabeth Warren support single payer?

At the debate, as throughout the campaign, Warren refused to provide any specifics about how she would fund a single-payer plan. Instead, whether questioned by moderators or challenged by other candidates, she recycled variants on the same talking points she has used in venues from campaign town halls to a recent appearance on The Late Show With Stephen Colbert. Rather than explaining what revenue she would raise to fund the plan, Warren insisted that under single payer, middle-income families would save more money with the elimination of health-care premiums, co-pays, and deductibles, regardless of any taxes imposed. “Costs will go up for the wealthy and for big corporations, and for hard-working middle-class families, costs will go down,” she said at the debate.

Which CBO option most closely approximates current Medicare for All proposals?

The CBO option that most closely approximates current Medicare for All proposals is Option 3, which features low payment rates and low cost sharing. That option produces $650 billion of savings in 2030.

What does CBO stand for in Medicare?

CBO: Medicare for All Reduces Health Spending. Yesterday, the Congressional Budget Office (CBO) released an estimate of the cost of implementing a single-payer health insurance program in the United States.

How much money would single payer save?

The CBO answered these questions for four different single-payer designs and found that a single-payer system would save $42 billion to $743 billion in 2030 alone.

What is more interesting than the CBO's headline finding?

More interesting than the CBO’s headline finding is the extremely detailed inquiry they do into each specific variable and the comparison of the results of their inquiry to the results of other similar studies.

Does Medicare Advantage have sick people?

This rebuttal never really made any sense. Private Medicare Advantage plans have a similarly sick and elderly enrollment population, but manage to spend a whopping 13.7 percent of their revenue on administrative expenses. The CBO’s analysis, which starts with the current Medicare administrative costs and then determines how each element of those costs would go up or down in a single-payer system, seems to put this claim to bed once and for all.

What is the CBO?

The CBO is a nonpartisan outfit that analyzes the potential cost and impact of legislation. Its estimate that millions would be made uninsured by Republican bills to repeal the Affordable Care Act was key to the survival of Obama's health care law.

What is Medicare for All?

Here's the basic idea: "Medicare for All" is a single-payer health insurance plan that would require all U.S. residents be covered with no copays and deductibles for medical services. The insurance industry would be regulated to play a minor role in the system.

How much will the government spend on healthcare?

Several independent studies have estimated that government spending on health care would increase dramatically, in the range of about $25 trillion to $35 trillion or more over a 10-year period.

How long will the "for all" plan last?

It would be slowly extended to citizens — from older to younger — over a period of four years, NPR reports.

Do Americans know about the Grand Plan?

Many Americans still don't know specifics about the grand plan. A recent survey from social research nonprofit NORC at the University of Chicago found almost half of adults say they haven't heard anything about "Medicare for All.".

Is Medicare for All coming back?

Vermont Sen. Bernie Sanders ' "Medicare for All" proposal is coming back in a major way as Democratic presidential hopefuls begin stumping for 2020. The government-funded health care system — strongly opposed by President Trump and fellow Republicans — would expand benefits beyond what is already offered under former President Barack Obama's ...

How would Medicare for All be financed?

Though most of the federal cost of Medicare for All would come from replacing private spending with public spending, these costs would nonetheless need to be financed through higher taxes, lower spending, more borrowing, or some combination of the three.

How much will Medicare cost in 10 years?

Medicare for All is likely to increase federal costs by between $25 trillion and $35 trillion over ten years, depending both on estimating assumptions and on important design choices and policy details. To finance $30 trillion – a rough midpoint – policymakers would likely adopt a combination of approaches that are equivalent to a 32 percent ...

How much money does Medicare for All require?

resident for nearly all medical services and eliminates premiums and cost sharing would require the federal government to identify between $25 trillion and $35 trillion of financing.

How much would Medicare need to be financed?

Assuming no changes in projected interest rates or economic growth, deficit-financing Medicare for All over the next decade would require nearly $34 trillion of new borrowing including interest, which is the equivalent of 105 percent of GDP by 2030.

What is the impact of Medicare for All?

PWBM found that universal health care itself would grow the economy through a healthier and more productive workforce, longer lifespans, and higher wages. However, the analysis found that options to finance Medicare for All would reduce the incentive to work, save, and invest and reduce economic output.

How much payroll tax is needed to finance a $13 trillion program?

Financing a $13 trillion program would require a 13 percent payroll tax, for example, compared to the 32 percent payroll tax required to fund $30 trillion and 39 percent required to fund $35 trillion.

What is Medicare for All?

The term Medicare for All has come to represent proposals that offer universal, single-payer health insurance coverage for virtually all health care services (including dental, vision, and long-term care) with no meaningful premiums, deductibles, copayments, or restrictive networks.