| If your yearly income in 2020 (for what you pay in 2022) was | You pay each month (in 2022) | |

|---|---|---|

| File individual tax return | File joint tax return | |

| $91,000 or less | $182,000 or less | $170.10 |

| above $91,000 up to $114,000 | above $182,000 up to $228,000 | $238.10 |

| above $114,000 up to $142,000 | above $228,000 up to $284,000 | $340.20 |

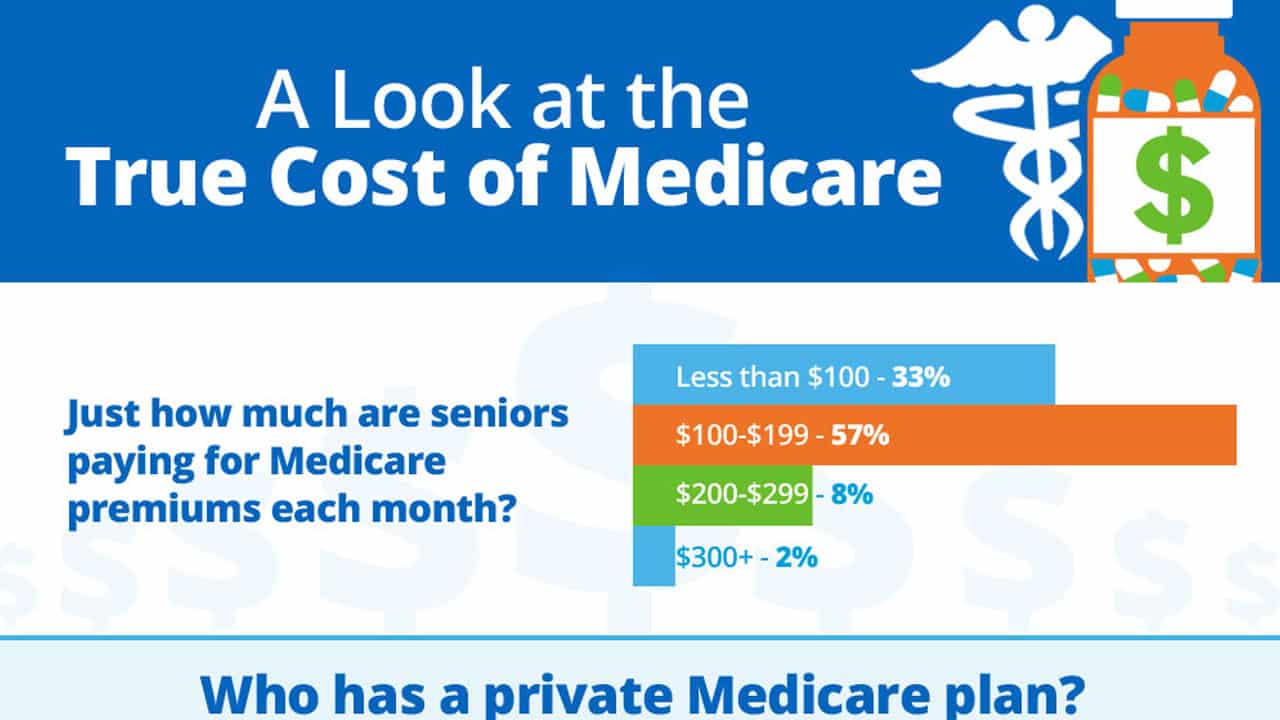

What is the average cost of Medicare per person?

The type of Medicare will determine your monthly costs. In 2022, A Medicare Advantage plan can cost an average of $33 per month. Medicare Part B usually costs $170.10 per month, and a Medicare Part D plan for prescription drugs costs an average of $42 per month.

Does Medicare have monthly premiums?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021 ($499 in 2022). If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471 ($499 in 2022).

Is there a monthly premium for Medicare?

What does Medicare cost? Generally, you pay a monthly premium for Medicare coverage and part of the costs each time you get a covered service. There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance (

What is the monthly payment for Medicare?

- automatic deduction from your Social Security monthly benefit payment (if you receive one)

- mailing a monthly check to the plan

- arranging an electronic transfer from a bank account

- charging the payment to your credit or debit card (though not all plans offer this option)

What is the average cost of Medicare per person?

Medicare's total per-enrollee spending rose from $11,902 in 2010 to $14,151 in 2019. This included spending on Part D, which began covering people in 2006 (and average Part D spending rose from $1,808 in 2010 to $2,168 in 2019). These amounts come from p. 188 of the Medicare Trustees Report for 2020.

What is the average monthly cost for Medicare?

How much does Medicare cost?Medicare planTypical monthly costPart B (medical)$170.10Part C (bundle)$33Part D (prescriptions)$42Medicare Supplement$1631 more row•Mar 18, 2022

What will Medicare cost in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

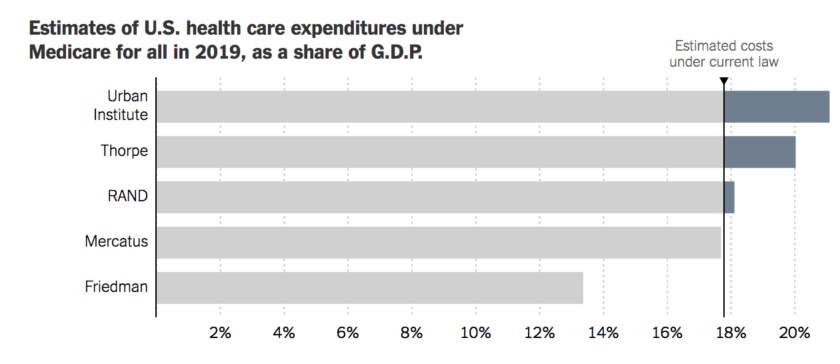

What is the total cost of Medicare?

$776 billionIn fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending.

What is the cheapest Medicare plan?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Are Medicare premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Why is Medicare Part B so expensive?

Why? According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

Why is my first Medicare bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

Do I have to pay for Medicare?

Most people don't have to pay a monthly premium for their Medicare Part A coverage. If you've worked for a total of 40 quarters or more during your lifetime, you've already paid for your Medicare Part A coverage through those income taxes.

Why does Medicare cost so much?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

How much does Medigap cost?

The average Medigap premiums can be anywhere from $20 to over $500. Essentially, you are paying an extra monthly cost to have more coverage later on if Original Medicare falls short. Deductibles range from $203 (the deductible you pay for Medicare Part B) to $6,220, if you opt for a high-deductible Medigap plan.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much is the late enrollment penalty for Medicare?

The penalties are added to your monthly premium. Part A late enrollment penalty : 10% higher premium for twice the number of years you didn’t sign up. Part B late enrollment penalty : 10% higher premium for every 12 months you don’t sign up after becoming eligible, for as long as you have the plan.

Medicare costs vary widely depending on the type of coverage you have and how healthy you are

Medicare cost per person per month can depend on a number of factors, including how you receive your benefits (Part A and Part B) and how much you use them each month.

Medicare Costs

The out-of-pocket expenses you may have with Medicare (or any health insurance plan) include:

How Much Does Medicare Part A Cost?

Part A (hospital insurance) covers most inpatient hospital needs, skilled nursing facility (SNF) care, nursing home care, hospice care, and home health care (if you qualify). When you apply for Medicare, you’re automatically enrolled in Part A.

How Much Does Medicare Part B Cost?

Part B (medical insurance) covers most medically necessary services or supplies you need to diagnose or treat a medical condition, as well as preventive services to help you stay healthy longer.

How Much Does Medicare Part C Cost?

Part C, or Medicare Advantage, is an alternative way to receive your Medicare benefits. These plans, offered by private insurance companies who contract with Medicare, offer the same coverage you’d get with Original Medicare Part A and Part B, as well as additional benefits.

How Much Does Medicare Part D Cost?

Part D, or prescription drug coverage, can be purchased as a stand-alone plan, or included with a Part C plan. Part D plans can also vary in cost based on a number of different factors, including deductibles, premiums, coinsurance and copays that can vary by plan.

What Is Medigap?

When you’re enrolled in Medicare Part A and Part B, you can purchase a Medigap plan to help fill the gaps in your coverage, such as payment for copays, deductibles, and healthcare when you travel.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How much does Medicare cover?

Since Medicare only covers about 80% of your medical bills, many people add on a Medicare Supplement to pick up the remaining costs. The monthly premium for a Medicare Supplement will depend on which plan you choose, your age, your gender, your zip code, and your tobacco usage.

How much does Medicare Part B cost in MA?

Often times, MA plans also include a drug benefit, so you also replace Part D. However, you still must pay the $148.50 monthly premium for Medicare Part B. MA premiums vary, depending on which type of plan you choose, which area you’re in, and other similar factors.

What is Medicare MSA?

A Medicare MSA, a type of Medicare Advantage plan, is another option for seniors. The most widely available plan is from Lasso Healthcare, and it is $0 premium. An MSA combines high-deductible health coverage with an annually funded medical savings account.

How much is Medicare Part A deductible for 2021?

The Medicare Part A deductible, as well as the coinsurance for care, fluctuates slightly every year, but here are the current costs for 2021: $1,484 deductible. Days 1-60: $0 coinsurance. Days 61-90: $371 coinsurance. Days 91+: $742 coinsurance per “lifetime reserve day,” which caps at 60 days. Beyond lifetime reserve days: You pay all costs.

What will Medicare pay for in 2021?

2021 Medicare Part A Costs. Medicare Part A helps cover bills from the hospital. So, if you are admitted and receive inpatient care, Medicare Part A is going to help with those costs. If you’ve worked at least 10 years or can draw off a spouse who has, Medicare Part A is free to have.

How much is coinsurance for days 21 through 100?

For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $185.50 in 2021.

Is MA insurance low?

In general, MA premiums are quite low, and sometimes, they’re even $0. . While the monthly premium is very low or even $0, there are some things to consider before opting an MA plan. You can read about the pros and cons of Medicare Advantage here.

How much does Medicare Part B cost?

Generally, when you file your taxes, if you make less than $88,000 a year, then you would pay $148.50 per month. Below you can find an exact breakdown of the different income thresholds for Medicare Part B premiums.

How much does Medigap cost at 65?

In this case, premiums will be lower for people who buy at a younger age. For example, if you bought a Medigap policy at age 65, your premium could be $200, but if you bought the same plan at 80, that policy might cost $300.

How much is Medicare Part B deductible for 2021?

For 2021, the Part B deductible is $203, which means you would need to pay $203 before coinsurance benefits would kick in.

What is the deductible for Medicare Part A 2021?

In addition, a large cost for Medicare Part A is the deductible. Enrollees will find that in 2021, the deductible is $1,484, which represents an increase of $76 from the previous year. However, this cost is usually covered if you enroll in a Medigap policy or Medicare Advantage.

How does a Medigap policy work?

The cost of a Medigap policy, also called a Medicare Supplement policy, will depend on two factors: the policy you choose and the pricing structure of the company. Firstly, different plan letters have different prices since each policy provides a different level of coverage.

What is Medicare Part C?

Part C is a pure private health insurance product, meaning that it is not standardized across companies, and every policy has different levels of coverage, premiums and deductibles.

How long do you have to work to get Medicare Part A?

If you have worked for more than 10 years or 40 quarters, then you are eligible to pay $0 for Medicare Part A. This is because, during your working years, you contributed to Social Security and Medicare payroll taxes.

What percentage of Medicare deductible is paid?

After your deductible is paid, you pay a coinsurance of 20 percent of the Medicare-approved amount for most services either as an outpatient, inpatient, for outpatient therapy, and durable medical equipment.

How many people are covered by Medicare?

Today, Medicare provides this coverage for over 64 million beneficiaries, most of whom are 65 years and older.

How many parts of Medicare are there?

The four parts of Medicare have their own premiums, deductibles, copays, and/or coinsurance costs. Here is a look at each part separately to see what your costs may be at age 65.

How much does Medicare Part B cost?

Medicare Part B has a monthly premium. The amount you pay depends on your yearly income. Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year.

How much is Part A deductible for 2020?

If you purchase Part A, you may have to also purchase Part B and pay the premiums for both parts. As of 2020, your Part A deductible for hospital stays is $1408.00 for each benefit period. After you meet your Part A deductible, your coinsurance costs are as follows: • Days 1 – 60: $0 coinsurance per benefit period.

How much does Medicare cover?

But mid-way through the year, it’s hard to say.”. Generally speaking, Medicare only covers about two-thirds of the cost of health-care services for the program’s 62.4 million or so beneficiaries, the bulk of whom are age 65 or older. That’s the age when you become eligible for Medicare.

How much is Medicare Part A deductible?

However, Part A has a deductible of $1,408 per benefit period, along with some caps on benefits.

Is Medicare free for older people?

Sometimes, it comes as a surprise to older folks that Medicare is not free. Depending on the specifics of your coverage and how often you use the health-care system, your out-of-pocket costs could reach well into six-figure territory over the course of your retirement, according to a recent report from the Employee Benefit Research Institute. ...

Does Advantage Plan cover dental?

If you end up choosing an Advantage Plan, there’ s a good chance limited coverage for dental and vision will be included. For long-term care coverage — which involves help with daily living activities like dressing and bathing — some people consider purchasing insurance specifically designed to cover those expenses.

Can you pair a medicaid plan with an Advantage plan?

You cannot, however, pair a Medigap policy with an Advantage Plan. Of people without any type of extra coverage beyond basic Medicare — such as employer coverage or Medicaid — 28% have either struggled to pay their medical bills or to get care due to the cost, according to the Kaiser Family Foundation.