How much does it cost to get Medicare at 65?

The amount you could need to cover premiums and out-of-pocket prescription drug costs from age 65 on could be $130,000 if you’re a man and $146,000 if you’re a woman, according to one study. Sometimes, it comes as a surprise to older folks that Medicare is not free.

How much does health insurance cost for 55 and over?

However, the total costs for health insurance for 55 and over are going to be high. If you were funding the premiums for seven years — age 58-65 — without subsidies, it would total: $150,948 — plus other out of pocket expenses like co pays and out of pocket deductibles.

How much does Medicare cost per month?

Medicare costs at a glance. If you buy Part A, you'll pay up to $437 each month in 2019 ($458 in 2020). If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $437 ($458 in 2020). If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $240 ($252 in 2020).

Who is automatically eligible for Medicare at age 65?

A smaller group of people also automatically get Medicare at age 65: people who receive Railroad Board benefits for at least four months before 65. If you are automatically enrolled, you will receive a “Welcome to Medicare” kit about three months before turning 65.

Can you get on Medicare at 55?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant).

What will Medicare cost seniors in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Does Medicare get more expensive as you get older?

Premiums are low for younger buyers, but go up as you get older. They may be the least expensive at first, but they can eventually become the most expensive. Premiums may also go up because of inflation and other factors.

How much would it cost to lower the Medicare age to 60?

The Congressional Budget Office and Joint Committee on Taxation put a price tag on lowering the eligibility age to 60. Other news is about the rising cost of health care for retirees.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Is Medicare cost based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What is the most expensive Medicare plan?

That's in spite of the fact that Plan F is the most expensive, and many people will go years paying the premiums without getting their money's worth. Does that make choosing it a good or bad decision? “The reason most people pick F is that it covers every row on the Medicare coverage chart.

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

Does Biden lower Medicare to 60?

The Presidents Proposal for Medicare at 60 Besides a proposal to offer a public health insurance option similar to Medicare, President Biden has mentioned the importance of lowering the Medicare eligibility age to 60. This was part of his health care reform platform during the presidential race.

Will Congress change Medicare age to 60?

More than 125 House lawmakers introduced legislation Friday that lowers the Medicare eligibility age to 60 from 65. The Improving Medicare Coverage Act — led by Reps.

Are they changing Medicare to 60?

But this week, the Congressional Budget Office (CBO) released an analysis of lowering the Medicare eligibility to age 60, and there are some interesting takeaways and important caveats. CBO's top line numbers are relatively straightforward.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What are the different levels of ACA coverage?

Type of Coverage: There are four levels of coverage available from the ACA: bronze, silver, gold, platinum. Choosing the right coverage for you and your needs can help you save money. In general, the less you tend to use healthcare the more likely the lower level of coverage will suit you.

How much does a silver plan cost?

However, the average cost for a Silver Plan with the Affordable Care Act for two non-smoking adults age 58 — assuming no subsidies — would be $1,797 per month.

How long should an HSA fund be invested?

Funds invested in the equity market should have a time horizon of a minimum of 5 years and allocations to higher risk assets such small cap stocks, emerging markets, etc. should have time horizons of ten years or more. Note that at the current time, investment choices within most HSA plans are very limited.

How much inflation should be assumed for healthcare?

For healthcare inflation, you should assume two to three times the Consumer Price Index (CPI) rate. ( The CPI is an inflation metric that measures average prices of a group of consumer goods and services, such as transportation, food and medical care.

What are the different types of health insurance plans?

You will also have opportunities to compare the costs of different types of plans: 1 Exclusive Provider Organization (EPO) 2 Health Maintenance Organization (HMO) 3 Point of Service (POS) 4 Preferred Provider Organization (PPO)

Is long term care covered by Medicare?

Long Term Care: Long term care is not usually covered by health insurance — not pre 65 coverage nor Medicare. Choose how you want to plan for this expense if you wind up needing it. Estimate your total retirement healthcare expense now and find out if you can afford these important costs.

Does Healthcare.gov link to exchanges?

Healthcare.gov will link you to your state’s exchange if it has one. If you are looking for information about healthcare, the Kaiser Family Foundation is a great resource for data.

How does age affect Medicare premiums?

How Does Age Affect Medicare Supplement Insurance Premiums? 1 Community-rated Medigap plans#N#With community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.#N#For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market. 2 Issue-age-rated Medigap plans#N#With issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.#N#You will typically pay less for an issue-age-rated plan if you enroll in the plan when you're younger. Your premiums also won't increase based on your age. 3 Attained-age-rate Medigap plans#N#Attained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

What is the lowest Medicare premium for 2020?

Medicare Supplement Insurance Plan F premiums in 2020 are lowest for beneficiaries at age 65 ( $184.93 per month) and highest for beneficiaries at age 85 ( $299.29 per month). Medigap Plan G premiums in 2020 are lowest for beneficiaries at age 65 ( $143.46 per month) and highest for beneficiaries at age 85 ( $235.87 per month).

Why does my Medigap premium increase?

As you age, your Medigap plan premiums will gradually increase each year. Medigap premiums can increase over time due to inflation and other factors , regardless of the pricing model your insurance company uses.

What is the factor that determines the premiums for Medicare Supplement Insurance?

Age is one factor that Medicare Supplement Insurance (Medigap) companies can use when determining the premiums for plans. Your Medigap premium is how much you pay per month to be a member of the plan. Medicare Supplement Insurance premiums tend to increase with age .

What are the factors that affect the cost of Medicare Supplement?

There may be plans available in your area that cost less than the average listed above for your age. Other factors such as gender, smoking status, health and where you live can also affect Medigap plan rates. A licensed insurance agent can help you compare Medicare Supplement Insurance plan costs in your area so that you can find a plan ...

How much is the 203 deductible?

The $203 annual deductible equates to around $17.00 per month. This means that a Plan G with a premium of no more than $17.00 per month more than a Plan F option could actually serve as a better value, provided you meet the entire Part B deductible.

When will Medicare plan F be available?

Important: Plan F is not available to new Medicare beneficiaries who become eligible for Medicare on or after January 1, 2020. If you already have Medicare, you can still enroll in Plan F if the plan is available in your area.

How much does Medicare cover?

But mid-way through the year, it’s hard to say.”. Generally speaking, Medicare only covers about two-thirds of the cost of health-care services for the program’s 62.4 million or so beneficiaries, the bulk of whom are age 65 or older. That’s the age when you become eligible for Medicare.

How much is Medicare Part A deductible?

However, Part A has a deductible of $1,408 per benefit period, along with some caps on benefits.

Is Medicare free for older people?

Sometimes, it comes as a surprise to older folks that Medicare is not free. Depending on the specifics of your coverage and how often you use the health-care system, your out-of-pocket costs could reach well into six-figure territory over the course of your retirement, according to a recent report from the Employee Benefit Research Institute. ...

Does Advantage Plan cover dental?

If you end up choosing an Advantage Plan, there’ s a good chance limited coverage for dental and vision will be included. For long-term care coverage — which involves help with daily living activities like dressing and bathing — some people consider purchasing insurance specifically designed to cover those expenses.

Can you pair a medicaid plan with an Advantage plan?

You cannot, however, pair a Medigap policy with an Advantage Plan. Of people without any type of extra coverage beyond basic Medicare — such as employer coverage or Medicaid — 28% have either struggled to pay their medical bills or to get care due to the cost, according to the Kaiser Family Foundation.

What does it mean to have Medicare at 55?

Having Medicare at 55 in place means that more people will get better care sooner and won’t need to do this catching up. All in all, this means that over a 10-year horizon, the cost will be manageable and low. Along with this, we must fully restore the Affordable Care Act.

How long is Medicare good for at 55?

Medicare at 55 will require a large increase in Medicare taxes. It will also mean that the average length of time that a person is on Medicare will be about 30 years. When Medicare first went into effect the lifespan of men was less than 70 years and for women a few years more than 70.

What happens when you switch Medicare at 55?

Those may even have room to move lower. Medicare at 55 is important, timely, and politically feasible, which means it can deliver significant relief soon.

Why is Medicare 55 important?

Having Medicare at 55 in place means that more people will get better care sooner and won’t need to do this catching up.

Is Medicare affordable?

Lastly it is feasible because it is affordable. The employer will still contribute at the same level. Medicare also has cost advantages compared to other insurers since it accounts for 30 percent of U.S. health-care spending and has by far the greatest buying power.

Is Medicare subsidized by private insurance?

For those who are still working and decide on a Medicare plan rather than the employer plan, have the employer pay the premium (either original Medicare or any additional Medicare advantage premium, and the IRMA add-on for higher incomes). It's not reasonable. Medicare payments are subsidized by private insurance.

Is Medicare Advantage feasible?

It is politically feasible because it helps the average family and because hospitals and insurers will still have their roles: A 55 year-old employee of a company can stay with her current policy or choose Medicare or Medicare Advantage.

How many people are covered by Medicare?

Today, Medicare provides this coverage for over 64 million beneficiaries, most of whom are 65 years and older.

What percentage of Medicare deductible is paid?

After your deductible is paid, you pay a coinsurance of 20 percent of the Medicare-approved amount for most services either as an outpatient, inpatient, for outpatient therapy, and durable medical equipment.

How many parts of Medicare are there?

The four parts of Medicare have their own premiums, deductibles, copays, and/or coinsurance costs. Here is a look at each part separately to see what your costs may be at age 65.

How much does Medicare Part B cost?

Medicare Part B has a monthly premium. The amount you pay depends on your yearly income. Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year.

How much is Part A deductible for 2020?

If you purchase Part A, you may have to also purchase Part B and pay the premiums for both parts. As of 2020, your Part A deductible for hospital stays is $1408.00 for each benefit period. After you meet your Part A deductible, your coinsurance costs are as follows: • Days 1 – 60: $0 coinsurance per benefit period.

Key Takeaways

The standard age for Medicare eligibility has been 65 for the entirety of the health insurance program, which debuted in 1965.

Medicare Eligibility Age Chart

Most older adults are familiar with Medicare and its eligibility age of 65. Medicare Part A and Medicare Part B are available based on age or, in some cases, health conditions, including:

Do I Automatically Get Medicare When I Turn 65?

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Is Medicare Free at Age 65?

While Medicare Part B has a standard monthly premium, 99 out of 100 people don’t have to pay a premium for Medicare Part A. Still, no part of Medicare can genuinely be called “free” because of associated costs you have to pay, like deductibles, coinsurance and copays.

Can You Get on Medicare at Age 62?

No, but while the standard age of eligibility remains 65, some call for lowering it. In a recent GoHealth survey, among respondents age 55 and older who weren’t on Medicare and had heard about proposals to lower the age of eligibility, 64% favored lowering the age.

Full Retirement Age by Year - What to Know

Full retirement age is the age you begin to receive full Social Security benefits. If you start to draw your Social Security benefits before reaching your full retirement age, the payment you receive will be less.

Why are insurance applications rejected for people over 50?

Because most states allow health insurers to charge higher premiums based on age and health, adults in the 50- to-64 age group have difficulty securing health insurance coverage; more than one in five insurance applications from individuals age 50 to 64 is rejected.

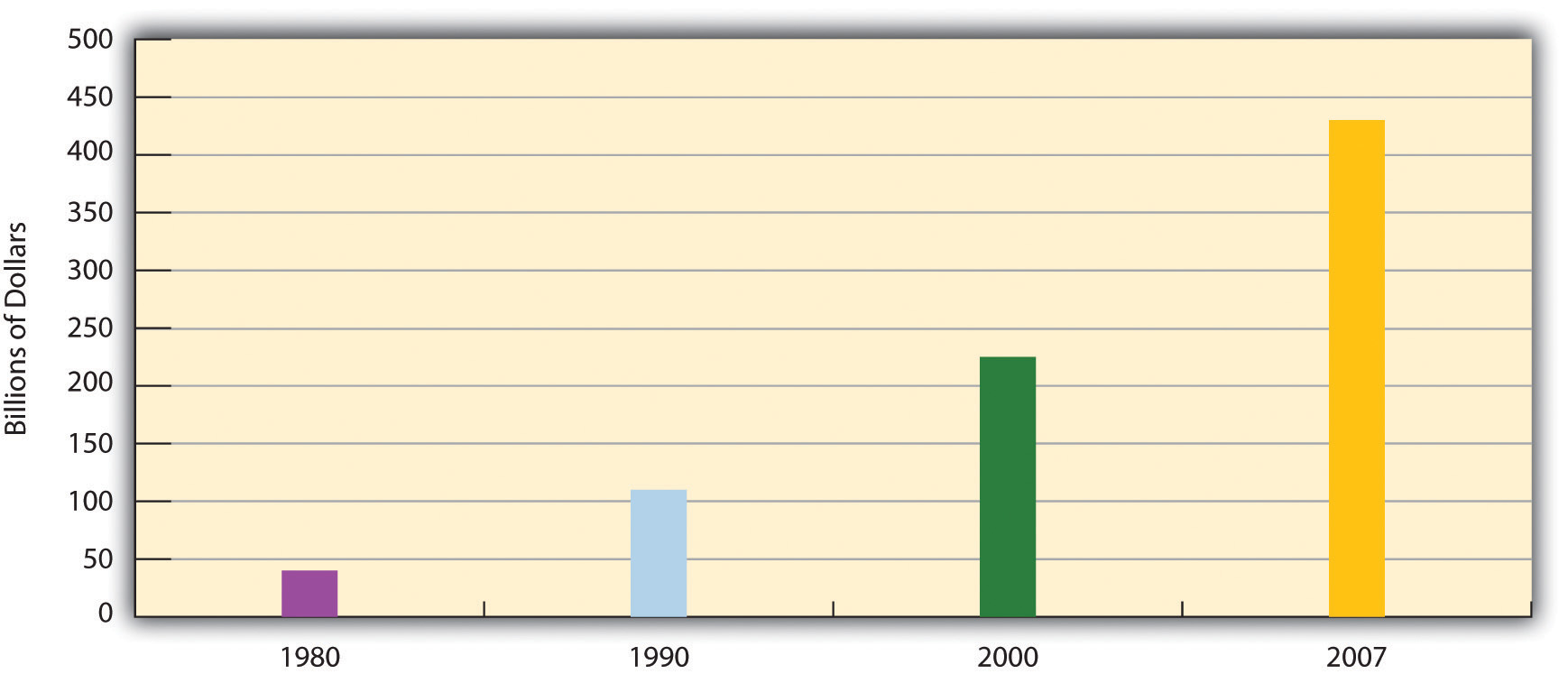

How many people are uninsured in 2010?

The number of uninsured adults age 50 to 64 continues to rise, reaching 8.9 million in 2010 — 3.7 million more than in 2000. Although roughly three in five uninsured Americans age 50 to 64 is employed, many are not eligible for employer health plans or else work for employers that do not offer coverage; the share of the 50-to-64 age group ...