The Medicare Part A deductible, as well as the coinsurance for care, fluctuates slightly every year, but here are the current Part A costs for 2022: $1,556 deductible Days 1 – 60: $0 coinsurance Days 61 – 90: $389 coinsurance Days 91+: $778 coinsurance per “lifetime reserve day,” which caps at 60 days

Full Answer

Does Medicare have monthly premiums?

· All of the estimates displayed below are from leading financial professionals and economic organizations that are calculated based on a ten-year forecast assuming immediate implementation. • No estimates available for Representative Jayapal’s proposal. • Senator Sander’s cost is $14 Trillion. • Economist Kenneth Thorpe’s cost is $27 ...

Is there a monthly premium for Medicare?

You’ll pay $233, before Original Medicare starts to pay. You pay this deductible once each year. Costs for services (coinsurance) You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

What is the monthly payment for Medicare?

· The question is how much. "Medicare for All" is estimated to cost tens of trillions of dollars over a decade. Several independent studies …

What is the average cost of Medicare per person?

· Here’s a look at the health-care costs that Original Medicare (Part A and Part B) may cover. Part A (hospital insurance) typically covers health-care costs such as your care and medical services. You’ll usually need to pay a deductible ($1,484 per benefit period* in 2021). You pay coinsurance or copayment amounts in some cases, especially ...

How many cosponsors did the Medicare for All Act have?

The study looked at the impact of the Medicare for All Act introduced by Sanders on Sept. 13, 2017. The bill, which has 16 Democratic cosponsors, would expand Medicare into a universal health insurance program, phased in over four years. (The bill hasn’t gone anywhere in a Republican-controlled Senate.)

Why do M4A payments exceed current Medicare payment rates?

Anticipating these difficulties, some other studies have assumed that M4A payment rates must exceed current-law Medicare payment rates to avoid sending facilities into deficit on average or to avoid triggering unacceptable reductions in the provision and quality of healthcare services. These alternative payment rate assumptions substantially increase the total projected costs of M4A.

Who tweeted "Thank you Koch brothers for accidentally making the case for Medicare for All"?

Our fact-checking colleagues at the Washington Post first wrote about this when, on July 30, Sanders tweeted, “Thank you, Koch brothers, for accidentally making the case for Medicare for All!”

Will Medicare have negative margins in 2040?

The Centers for Medicare and Medicaid Services (CMS) Office of the Actuary has projected that even upholding current-law reimbursement rates for treat ing Medicare beneficiaries alone would cause nearly half of all hospitals to have negative total facility margins by 2040. The same study found that by 2019, over 80 percent ...

Is 40 percent reduction in reimbursement rate an unlikely outcome?

Or, as Blahous told us via email, achieving a 40 percent reduction in reimbursement rates is an “unlikely outcome” and “actual costs are likely to be substantially greater.”

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Is there a late fee for Part B?

It’s not a one-time late fee — you’ll pay the penalty for as long as you have Part B.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

What is Medicare for All?

Here's the basic idea: "Medicare for All" is a single-payer health insurance plan that would require all U.S. residents be covered with no copays and deductibles for medical services. The insurance industry would be regulated to play a minor role in the system.

How much will the government spend on healthcare?

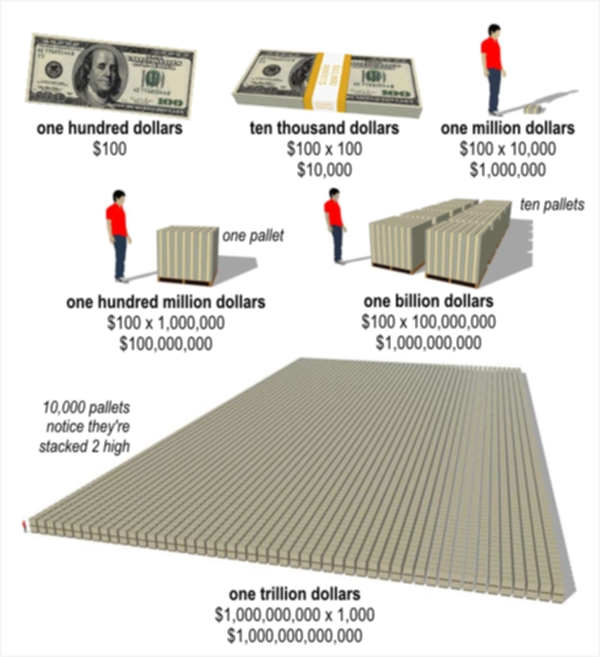

Several independent studies have estimated that government spending on health care would increase dramatically, in the range of about $25 trillion to $35 trillion or more over a 10-year period.

How much money would the government need to raise in the first year of the new stimulus?

With significant cost savings, the government would need to raise about $1.1 trillion from new revenue sources in the first year of the new program.

How long will the "for all" plan last?

It would be slowly extended to citizens — from older to younger — over a period of four years, NPR reports.

Is Medicare for All coming back?

Vermont Sen. Bernie Sanders ' "Medicare for All" proposal is coming back in a major way as Democratic presidential hopefuls begin stumping for 2020. The government-funded health care system — strongly opposed by President Trump and fellow Republicans — would expand benefits beyond what is already offered under former President Barack Obama's ...

How much is coinsurance for Medicare?

For example, if the Medicare-approved amount for a doctor visit is $85, your coinsurance would be around $17, if you’ve already paid your Part B deductible.

How long does Medicare pay for hospital visits?

Remember those Part A costs you have to pay when you’ve been a hospital inpatient longer than 90 days? Medicare Supplement insurance plans typically pay up to 365 days of hospital costs when your Part A benefits are used up. (Under Medicare Supplement Plan N, you might have to pay a copayment up to $20 for some office visits, and up to $50 for emergency room visits if they don’t result in hospital admission.) Learn more about Medicare Supplement insurance plans.

What type of insurance is used for Medicare Part A and B?

This type of insurance works alongside your Original Medicare coverage. Medicare Supplement insurance plans typically help pay for your Medicare Part A and Part B out-of-pocket costs, such as deductibles, coinsurance, and copayments.

What does Medicare cover?

Medicare coverage: what costs does Original Medicare cover? Here’s a look at the health-care costs that Original Medicare (Part A and Part B) may cover. If you’re an inpatient in the hospital: Part A (hospital insurance) typically covers health-care costs such as your care and medical services. You’ll usually need to pay a deductible ($1,484 per ...

How much is a deductible for 2021?

You’ll usually need to pay a deductible ($1,484 per benefit period* in 2021). You pay coinsurance or copayment amounts in some cases, especially if you’re an inpatient for more than 60 days in one benefit period. Your copayment for days 61-90 is $371 for each benefit period in 2021.

What are the benefits of Medicare Advantage?

Most Medicare Advantage plans include prescription drug coverage, and many plans offer extra benefits. Routine vision and dental services and acupuncture are examples of some of the benefits a Medicare Advantage plan might offer.

Does Medicare cover prescription drugs?

Medicare Part A and Part B don’ t cover health-care costs associated with prescription drugs except in specific situations. Part A may cover prescription drugs used to treat you when you’re an inpatient in a hospital. Part B may cover medications administered to you in an outpatient setting, such as a clinic.

How much would the single payer plan cost?

While the campaign itself estimated that plan would cost the federal government about $14 trillion over a decade, most other estimates that we are aware of are at least twice that high.

What is the Medicare for All Act?

Representative Jayapal’s Medicare for All Act would replace nearly all current insurance with a government-run single-payer plan and extend that plan to those who currently lack health coverage. The plan itself would be far more generous than either Medicare or most private coverage, as it would include no deductibles or copayments, would not restrict beneficiaries to networks of care, and would offer a broad suite of benefits including dental care, vision care, transportation for disabled and low-income patients, certain dietary and nutritional care, long-term care, and other long-term services and support. The proposal also establishes a global health budget, moves away from fee-for-service and toward lump-sum payments for many providers, includes a number of measures to hold down drug prices, and makes a variety of other changes to the health care system.

How much will the Sanders Plan cost in 2026?

At the time, for example, the Committee for a Responsible Federal Budget estimated roughly that the plan would cost $28 trillion through 2026 (we estimated the Sanders plan in particular would also raise $11 trillion of revenue, leading to $17 trillion of net costs). All other estimates come to similar conclusions.

How much will single payer healthcare cost in 2026?

For example, economist Kenneth Thorpe estimated that single-payer health care would cost the federal government $24.7 trillion through 2026, excluding the costs associated with long-term care benefits (likely about $3 trillion).

How much will the government cost in 2029?

The Center for Health and Economy (H&E) produced an estimate that the American Action Forum calculates would cost the federal government $36 trillion through 2029.

Is Medicare a single payer system?

Representative Pramila Jayapal (D-WA), a co-chair of the Medicare for All Caucus, released a bill today that would adopt a single-payer system, where the federal government replaces private health insurance companies as the sole provider of most health care financing.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

Which states have the lowest Medicare premiums?

Florida, South Carolina, Nevada, Georgia and Arizona had the lowest weighted average monthly premiums, with all five states having weighted average plan premiums of $17 or less per month. The highest average monthly premiums were for Medicare Advantage plans in Massachusetts, North Dakota and South Dakota. *Medicare Advantage plans are not sold in ...

What is the second most popular Medicare plan?

Medigap Plan G is, in fact, the second-most popular Medigap plan. 17 percent of all Medigap beneficiaries are enrolled in Plan G. 2. The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018. 3.

How to contact Medicare Advantage 2021?

New to Medicare? Compare Medicare plan costs in your area. Compare Plans. Or call. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 to speak with a licensed insurance agent.

How much would Medicare cost?

Sanders has said publicly that economists estimate Medicare for All would cost somewhere between $30 trillion and $40 trillion over 10 years. Research by the nonpartisan Urban Institute, a Washington, D.C., think tank, puts the figure in the $32 trillion to $34 trillion range.

Why is Biden's comparison of Medicare for All's price to total federal spending misses the mark?

But it turns out, based on the numbers and interviews with independent experts, Biden’s comparison of Medicare for All’s price to total federal spending misses the mark because the calculation is flawed.

What did Biden argue about Medicare for All?

Biden argued that Medicare for All “would cost more than the entire federal budget that we spend now.”

How much did Biden's budget cost?

Biden’s campaign directed us to the 2018 federal budget, which totaled $4.1 trillion. It compared that amount with the estimated cost of Sanders’ single-payer proposal: between $30 trillion and $40 trillion over a decade. The math, they said, shows Medicare for All would cost more than the national budget.

Who questioned the price tag of Medicare for All?

During the Feb. 7 Democratic presidential debate, former Vice President Joe Biden once again questioned the price tag of “Medicare for All,” the single-payer health care proposal championed by one of his key rivals, Sen. Bernie Sanders of Vermont. Biden argued that the plan was fiscally irresponsible and would require raising middle-class taxes.

How much money will the federal budget consume in 2030?

Goldwein looked at the numbers another way: Including interest, he found, the federal budget would consume about $55 trillion between now and 2030. Again, that’s more than what Medicare for All would cost during the same period.