Full Answer

How much could Medicare for all save you?

Most found Medicare for All would reduce our total health care spending. Even a study by the Koch-funded Mercatus Center found that Medicare for All would save around $2 trillion over a 10-year period. With Medicare for All, most families would spend less on health care than they do now on premiums, copays and deductibles.

How much does Medicare cost the government per year?

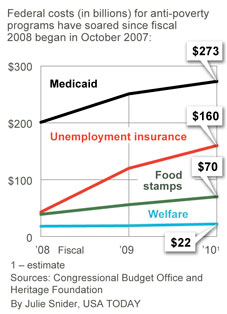

Medicare spending grew 6.7% to $799.4 billion in 2019, or 21 percent of total NHE. Medicaid spending grew 2.9% to $613.5 billion in 2019, or 16 percent of total NHE.

Does Medicare have monthly premiums?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021 ($499 in 2022). If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471 ($499 in 2022).

Is there a monthly premium for Medicare?

What does Medicare cost? Generally, you pay a monthly premium for Medicare coverage and part of the costs each time you get a covered service. There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance (

How much does the US spend on Medicare annually?

Historical NHE, 2020: Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE. Medicaid spending grew 9.2% to $671.2 billion in 2020, or 16 percent of total NHE. Private health insurance spending declined 1.2% to $1,151.4 billion in 2020, or 28 percent of total NHE.

How Medicare for All would hurt the economy?

The real trouble comes when Medicare for all is financed by deficits. With government borrowing, universal health care could shrink the economy by as much as 24% by 2060, as investments in private capital are reduced.

What will Medicare cost in 2030?

$1.72 trillionMedicare cost $775 billion in 2019, and is projected to grow to $1.2 trillion by 2025, and $1.72 trillion by 2030.

How much would Medicare for All cost CBO?

Thus, where CBO projects NHE of $6.6 trillion in 2030, a projection consistent with CMS's most recently published estimates would likely be about $300 billion higher, or $6.9 trillion.

What are the disadvantages of free healthcare?

Disadvantages of universal healthcare include significant upfront costs and logistical challenges. On the other hand, universal healthcare may lead to a healthier populace, and thus, in the long-term, help to mitigate the economic costs of an unhealthy nation.

What are the arguments against universal healthcare?

Counterargument: P1: Universal healthcare would cause our taxes to go up. P2: Universal healthcare will cause doctor's wages to decrease. P3: People may abuse universal healthcare and cause the overuse of health care resources. C: Therefore, universal healthcare needs not to be available for every individual.

How much did the federal government spend on Medicare in 2021?

In 2021, Medicare benefit payments totaled $689 billion, up from just under $200 billion in 2000 (these amounts net out premiums and other offsetting receipts). In percentage terms, this translates to an average annual growth rate of 6.2% over these years.

How will baby boomers retiring affect healthcare?

The Impact of Baby Boomers on Health Care By 2020, retiring baby boomers are expected to more than double Medicare and Medicaid costs. As a result, some pundits anticipate that the Trust Fund will be bankrupt by 2033. Meanwhile, taxes will cover only 48 percent of the associated health care costs.

How much did Medicare cost in 2021?

$696 billionWhat is the spending on Medicare? In FY 2021 the federal government spent $696 billion on Medicare.

How much do Canadians pay for healthcare?

incomes will pay an average of about $496 for public health care insurance in 2018. The 10% of Canadian families who earn an average income of $66,196 will pay an average of $6,311 for public health care insurance, and the fami- lies among the top 10% of income earners in Canada will pay $38,903.

How much does Canada spend on healthcare?

Total health spending in Canada is expected to reach a new level in 2021, at more than $308 billion, or $8,019 per Canadian. It is anticipated that health expenditure will represent 12.7% of Canada's gross domestic product (GDP) in 2021, following a high of 13.7% in 2020.

How much does the NHS cost per year?

Consequently, the wage bill for the NHS makes up a substantial proportion of its budget. In 2019/20, the total cost of NHS staff was £56.1 billion which amounted to 46.6 per cent of the NHS budget.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How many cosponsors did the Medicare bill have?

The bill, which has 16 Democratic cosponsors, would expand Medicare into a universal health insurance program, phased in over four years. (The bill hasn’t gone anywhere in a Republican-controlled Senate.)

Will Medicare have negative margins in 2040?

The Centers for Medicare and Medicaid Services (CMS) Office of the Actuary has projected that even upholding current-law reimbursement rates for treat ing Medicare beneficiaries alone would cause nearly half of all hospitals to have negative total facility margins by 2040. The same study found that by 2019, over 80 percent ...

How much would the single payer plan cost?

While the campaign itself estimated that plan would cost the federal government about $14 trillion over a decade, most other estimates that we are aware of are at least twice that high.

How much will single payer healthcare cost in 2026?

For example, economist Kenneth Thorpe estimated that single-payer health care would cost the federal government $24.7 trillion through 2026, excluding the costs associated with long-term care benefits (likely about $3 trillion).

How much will the government cost in 2029?

The Center for Health and Economy (H&E) produced an estimate that the American Action Forum calculates would cost the federal government $36 trillion through 2029.

What is Jayapal's Medicare for All Act?

Representative Jayapal’s Medicare for All Act would replace nearly all current insurance with a government-run single-payer plan and extend that plan to those who currently lack health coverage.

Is Medicare a single payer system?

Representative Pramila Jayapal (D-WA), a co-chair of the Medicare for All Caucus, released a bill today that would adopt a single-payer system, where the federal government replaces private health insurance companies as the sole provider of most health care financing.

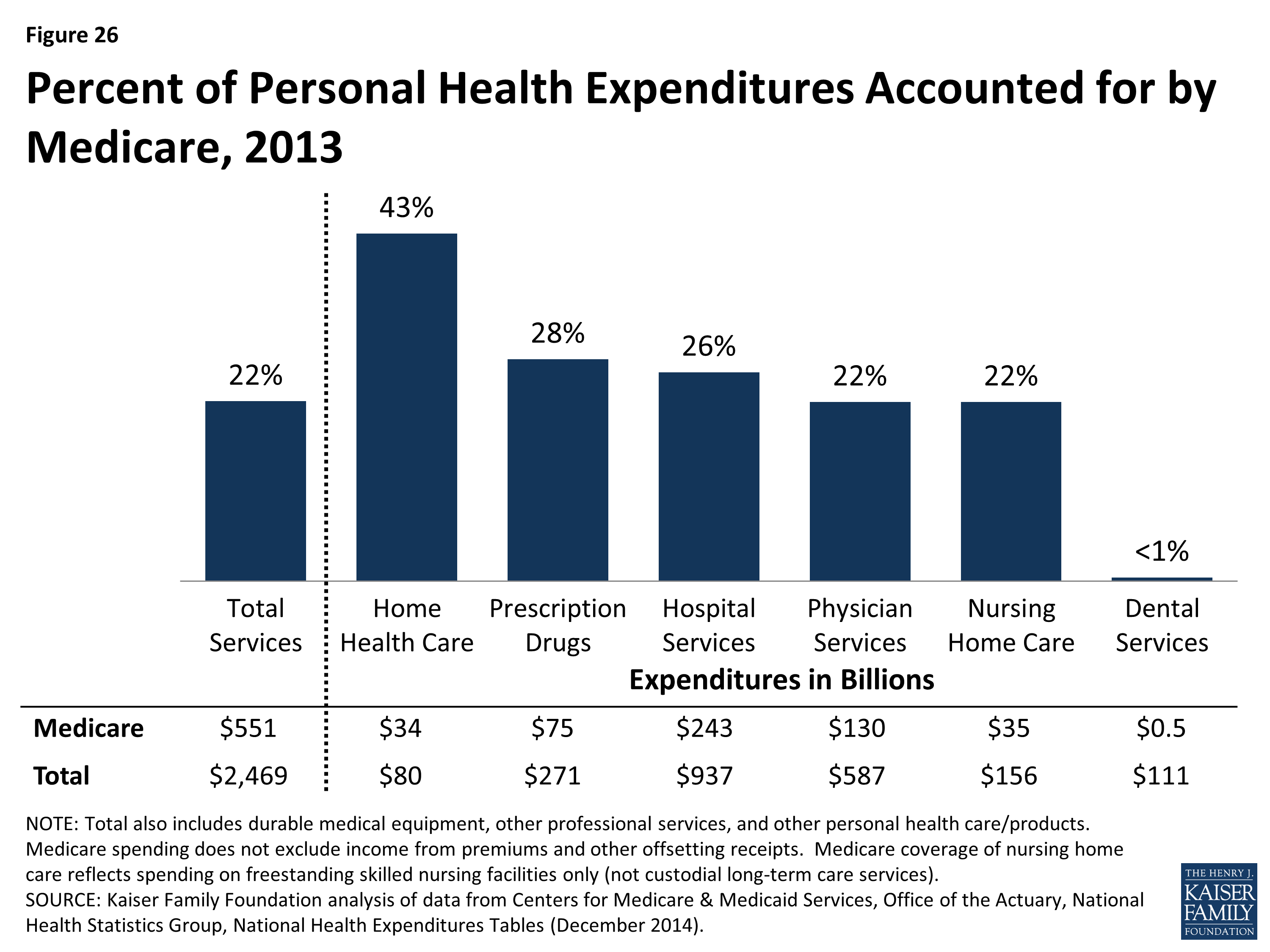

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

How much would Medicare cut for 90% of hospitals?

Although a slice of hospitals might financially benefit from a single-payer model based on Medicare rates, 90% would face cuts totaling $200 billion each year, according to a new industry analysis.

How much would Medicare cut hospital revenue?

Use of Medicare rates for any single-payer system would cut hospital net revenue by $200 billion annually. Shifting to Medicare rates would cause much steeper losses in outpatient — rather than inpatient — care. Savings from administrative simplification would not offset the net revenue loss.

What did Bernie Sanders say about Medicare?

Democratic responses to concerns about expanding Medicare payments. Sen. Bernie Sanders (I-Vt.) has responded to hospital payment concerns by proposing a “$20 billion emergency trust fund to help states and local communities purchase hospitals that are in financial distress,” according to media reports.

Projections of additional federal spending over 10 years for Medicare for all

Center for Health and Economy analysis of Sen. Bernie Sanders’s legislation (2016): $34.7 trillion to $47.6 trillion, depending on level of benefit

Estimates from the right

Researchers from groups on the conservative side of the spectrum have also run the numbers. Charles Blahous, a researcher at the conservative Mercatus Center, has estimated that federal spending would increase by $32.6 trillion from 2022 to 2031 if Sanders’s Medicare for all bill became law.