How much do tax payers pay for Medicare?

May 05, 2020 · • Mercatus Center fellow and former Social Security and Medicare Trustee Chuck Blahous’ cost is $32.1 Trillion • Center for Health and Economy estimate calculated by the American Action Forum cost is $36 Trillion. Funding Sources to Pay for Medicare for All Plans

What is the average cost of Medicare per month?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If …

Do you pay premiums on Medicare?

Aug 31, 2018 · Assuming that can all be captured and redirected, that leaves about $650 per person — or $210 billion total — in more revenue to bring us up to 13.3 percent of GDP. The …

What if I need help paying for Medicare?

Sep 14, 2021 · In 2016, the cost of care in the U.S. came to $9,982 per person. That’s about 25% more than Sweden, the country with the second-costliest care at $7,919 per person, and more …

What are the disadvantages of Medicare for All?

- Providers can choose only private pay options unless mandated differently.

- Doesn't solve the shortage of doctors.

- Health insurance costs may not disappear.

- Requires a tax increase.

- Shifts costs of employer coverage.

Does everyone pay the same price for Medicare?

How much does Medicare actually cost?

| Medicare plan | Typical monthly cost |

|---|---|

| Part B (medical) | $170.10 |

| Part C (bundle) | $33 |

| Part D (prescriptions) | $42 |

| Medicare Supplement | $163 |

How much does Medicare cost the taxpayers?

How much does Medicare cost at age 83?

| Average Monthly Cost of Plan F | Age in Years | Average Monthly Cost of Plan G |

|---|---|---|

| $281.39 | 82 | $221.16 |

| $287.31 | 83 | $225.99 |

| $293.24 | 84 | $230.83 |

| $299.29 | 85 | $235.87 |

Why is my Medicare Part B premium so high?

How much does Medicare take out of Social Security?

Is Medicare Part A free at age 65?

What does Medicare cost per month in 2021?

Why is US healthcare so expensive?

How Much Does Medicare pay out each year?

How much of the US GDP is spent on healthcare?

Why do M4A payments exceed current Medicare payment rates?

Anticipating these difficulties, some other studies have assumed that M4A payment rates must exceed current-law Medicare payment rates to avoid sending facilities into deficit on average or to avoid triggering unacceptable reductions in the provision and quality of healthcare services. These alternative payment rate assumptions substantially increase the total projected costs of M4A.

How many cosponsors did the Medicare for All Act have?

The study looked at the impact of the Medicare for All Act introduced by Sanders on Sept. 13, 2017. The bill, which has 16 Democratic cosponsors, would expand Medicare into a universal health insurance program, phased in over four years. (The bill hasn’t gone anywhere in a Republican-controlled Senate.)

Who tweeted "Thank you Koch brothers for accidentally making the case for Medicare for All"?

Our fact-checking colleagues at the Washington Post first wrote about this when, on July 30, Sanders tweeted, “Thank you, Koch brothers, for accidentally making the case for Medicare for All!”

Will Medicare have negative margins in 2040?

The Centers for Medicare and Medicaid Services (CMS) Office of the Actuary has projected that even upholding current-law reimbursement rates for treat ing Medicare beneficiaries alone would cause nearly half of all hospitals to have negative total facility margins by 2040. The same study found that by 2019, over 80 percent ...

Is 40 percent reduction in reimbursement rate an unlikely outcome?

Or, as Blahous told us via email, achieving a 40 percent reduction in reimbursement rates is an “unlikely outcome” and “actual costs are likely to be substantially greater.”

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Is there a late fee for Part B?

It’s not a one-time late fee — you’ll pay the penalty for as long as you have Part B.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

What percentage of Medicare goes to administration?

Secondly, fully 8 percent of American health-care spending goes to administration — as compared to Germany at 5 percent, Canada at 3 percent, or Sweden at 2 percent. Thus the first priority for a Medicare-for-all bill must be to cut administration spending to the bone.

What is the first priority for Medicare for all?

Thus the first priority for a Medicare-for-all bill must be to cut administration spending to the bone. Given that this is largely down to providers having to navigate the hellishly complex and fragmented status quo system, this should be quite easy. Aiming for Canada's level would be a good goal, since it would be a fairly similar program (and global budgeting can help here). Using 2015 figures for consistency, getting down to 3 percent saves about $160 billion (5 percent of $3.2 trillion) a year.

Why is Obamacare overutilization?

One supposed explanation that received enormous attention during the debate, passage, and implementation of ObamaCare is "overutilization." This idea posits that Americans are getting way too much treatment due to the fee-for-service structure of many medical payment plans and "defensive medicine" from doctors worrying about litigious patients. A big Atul Gawunde article in The New Yorker in 2009 made a strong case for this being the major driver of excess medical spending. A white paper back in 2012 purported to demonstrate $210 billion in unnecessary services.

Should Medicare be broken up?

But the biggest ones should also be broken up. As Philip Longman argues, a Medicare-for-all bill should roll back provider monopolization (itself a major driver of cost bloat), by busting big providers and holding companies to ensure significant competition in all health-care markets. In theory, a national Medicare regulator should be able to force even giant provider pools to just accept cheap national prices, but they pose the political risk of being able to force through price increases through lobbying — and on the other hand, there's basically no downside to cracking them up. If there's even a chance of it helping things along, it should be done.

Do hospitals charge 10fold markups?

Obviously, if many hospitals don't even know what their internal cost structures are, then it's impossible to provide accurate aggregate figures on this kind of waste and fraud. However, one initial study found 50 hospitals charging routine 10-fold markups, and preliminary government chargemaster data on common services found wild price discrepancies between providers. We can certainly say the amounts involved are very large, and that is where the bulk of the remaining excess spending lies.

Will the medical lobby kill Medicare for all?

The medical lobby will kill Medicare-for-all if they can, and the best way through is to bulldoze it.

Is it good to press down on costs?

This finally brings me to the politics. Pressing down hard on costs provides a corresponding benefit — the ability to offer a really, really good plan for cheap. Instead of providing a tax increase about as big as current premium payments and cost-sharing — about $28,000 on average for a family of four, which would be an enormous payroll tax of perhaps 10-25 percent — it would be a meager little tax. Virtually every non-rich person would come out way ahead, creating a gigantic constituency for the new program instantly. People would be slavering for that kind of coverage. Meanwhile, the wildly dysfunctional health-care sector would finally be put in something approaching a rational order, removing a major drain on wages and productivity.

What is Medicare today?

Medicare Today. Medicare is a program that benefits Americans who are age 65 or older or who have disabilities. The current program has two parts: Part A for hospital care and Part B for doctors’ visits, outpatient care, and some forms of medical equipment.

Why would doctors receive less pay under the new Medicare system?

Doctors and Hospitals. They would most likely receive less pay under the new system because Medicare pays lower rates for all forms of care than private insurers do. On the plus side, they would no longer have to worry about unpaid bills from patients who don’t have insurance or insurers who refuse claims. They would also have to spend less time on paperwork, which would keep their administrative costs down. Still, the lower payment rates could force some hospitals to close if they can no longer meet their expenses.

How much of healthcare costs go to administration?

According to the JAMA study, 8% of all health care costs in the U.S. went toward administration — that is, planning, regulating, billing, and managing health care services and systems. By contrast, the 10 other countries in the study spent only 1% to 3% of total costs on administration.

Why do people put off medical care?

These uninsured and underinsured Americans are likely to put off necessary medical treatment because they can’t afford it. Often, they don’t seek medical care until they have a problem serious enough to land them in the emergency room, the most expensive possible place to receive care. Thus, having large numbers of uninsured and underinsured Americans drives up health care costs for the country as a whole.

How much did healthcare cost in 2016?

In 2016, the cost of care in the U.S. came to $9,982 per person. That’s about 25% more than Sweden, the country with the second-costliest care at $7,919 per person, and more than twice as much as Canada at $4,753. The average for all developed nations was only $4,033, about 40% of what Americans spent. The U.S. spent a total of 17.2% of its gross domestic product (GDP) on health care, while the average developed country spent only 8.9% of GDP.

Why are generalist doctors paid higher?

One reason health care prices are higher in the U.S. is that most Americans get their coverage from private insurers, and these companies pay much higher rates for the same health care services than public programs such as Medicare.

How many Americans have no health insurance?

Under the current system, approximately 29.6 million Americans have no health insurance, according to the U.S. Census Bureau. Moreover, a 2020 study by The Commonwealth Fund concluded that another 41 million Americans — about 21% of working-age adults — are underinsured, without enough coverage to protect them from devastatingly high medical expenses.

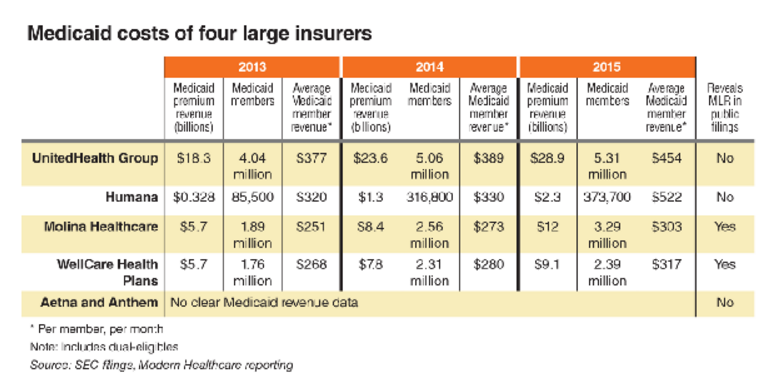

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What percentage of Medicare is paid to MA?

Based on a federal annual report, KFF performed an analysis to reveal the proportion of expenditure for Original Medicare, Medicare Advantage (MA) and Part D (drug coverage) from 2008 to 2018. A graphic depiction on the KFF website illustrates the change in spending of Medicare options. Part D benefit payments, which include stand-alone and MA drug plans, grew from 11% to 13% of total expenditure. Payments to MA plans for parts A and B went from 21% to 32%. During the same time period, the percentage of traditional Medicare payments decreased from 68% to 55%.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

Is Medicare a concern?

With the aging population, there is concern about Medicare costs. Then again, the cost of healthcare for the uninsured is a prime topic for discussion as well.

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

How much does Medicare cover?

Since Medicare only covers about 80% of your medical bills, many people add on a Medicare Supplement to pick up the remaining costs. The monthly premium for a Medicare Supplement will depend on which plan you choose, your age, your gender, your zip code, and your tobacco usage.

How much does Medicare Part B cost?

Medicare Part B does have a deductible, but it’s much cheaper than you’re probably used to seeing – it’s only $203 per year. After you meet that deductible, you typically pay 20% of the Medicare-approved amount for any services, tests, or items you need.

What is Medicare MSA?

A Medicare MSA, a type of Medicare Advantage plan, is another option for seniors. The most widely available plan is from Lasso Healthcare, and it is $0 premium. An MSA combines high-deductible health coverage with an annually funded medical savings account.

How much is Medicare Part A deductible for 2021?

The Medicare Part A deductible, as well as the coinsurance for care, fluctuates slightly every year, but here are the current costs for 2021: $1,484 deductible. Days 1-60: $0 coinsurance. Days 61-90: $371 coinsurance. Days 91+: $742 coinsurance per “lifetime reserve day,” which caps at 60 days. Beyond lifetime reserve days: You pay all costs.

What will Medicare pay for in 2021?

2021 Medicare Part A Costs. Medicare Part A helps cover bills from the hospital. So, if you are admitted and receive inpatient care, Medicare Part A is going to help with those costs. If you’ve worked at least 10 years or can draw off a spouse who has, Medicare Part A is free to have.

What does Medicare Part B cover?

Medicare Part B helps cover your medical bills. Lab tests, doctor visits, and wheelchairs are examples of some services and items that Medicare Part B would help pay for.

How much is 91+ coinsurance?

Days 91+: $742 coinsurance per “lifetime reserve day,” which caps at 60 days

Who would fund Medicare for all?

The specifics vary a bit plan to plan. In Jayapal’s bill, for instance, Medicare for All would be funded by the federal government, using money that otherwise would go to Medicare, Medicaid, and other federal programs that pay for health services.

What is the idea of Medicare for All?

Ask someone what they think about the idea of “Medicare for All” — that is, one national health insurance plan for all Americans — and you’ll likely hear one of two opinions: One , that it sounds great and could potentially fix the country’s broken healthcare system.

What is the simplest explanation for the Sanders and Jayapal bills?

As far as the current legislation on the table like the Sanders and Jayapal bills, “the simplest explanation is that these bills would move the United States from our current multi-payer healthcare system to what is known as a single-payer system,” explained Keith.

What would happen if we eliminated all private insurance and gave everyone a Medicare card?

“If we literally eliminate all private insurance and give everyone a Medicare card, it would probably be implemented by age groups ,” Weil said.

What are some misconceptions about Medicare for All?

One of the biggest misconceptions about Medicare for All is that there’s just one proposal on the table.

How many people in the US are without health insurance?

The number of Americans without health insurance also increased in 2018 to 27.5 million people, according to a report issued in September by the U.S. Census Bureau. This is the first increase in uninsured people since the ACA took effect in 2013.

What were private insurance companies allowed to do before the ACA?

Before the ACA, private insurers were allowed to turn down prospective members, charge higher premiums, or limit benefits based on your health history.

Claim

Current expenditures could likely cover the estimated costs of Medicare for All.

Reporting

On December 12 2019, the Facebook page “Fully Automated Luxury Gay Space Communism” shared the following screenshot of a retweet opining that a $738 billion expenditure for defense (and a Space Force) could be used to fund Medicare for All: