How long does it take Medicare to pay a claim?

We performed a calculation using the ‘Days Function’ in Microsoft Excel, and calculated the elapsed time between the date filed and the date posted. According to a cursory Google search, this site states that Medicare takes about 30 days to pay a claim. However, we’re thinking they’re referring to the processing of Paper Claims.

Who processes my Medicare claims?

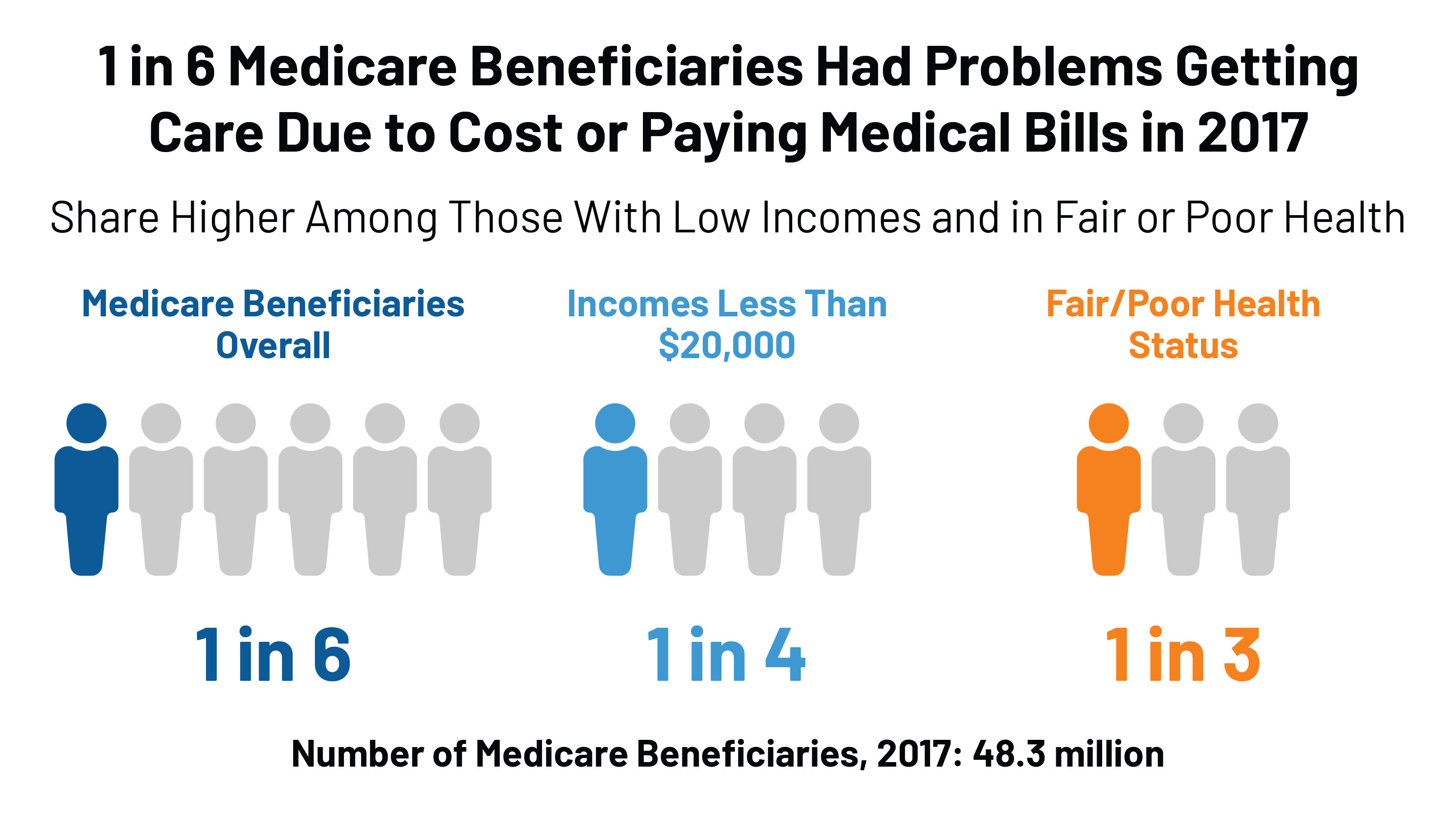

Each state has a MAC who processes their Medicare Claims. There are currently 12 (Medicare Part A&B) MACs and 4 Durable Medical Equipment MACs in the United States. These MAC’s process the Medicare claims for nearly 60% of the total Medicare beneficiary population, or 37.5 million beneficiaries.

How long does it take for Medicare to pay for medical alert?

Medical alert systems are a convenient way for seniors to have access to all the help they need whil(Continue reading) Generally speaking when it is a clean claim, Medicare will pay anywhere between 14 to 30 days after they have received the claim.

How many months does a provider have to file a claim?

How many months does a provider have to file a claim for Medicare? For the First claim, they have a year from the date of service. If the claim was denied or downcoded, there is a 3 month period where it can be re-submitted. If the office/hospital misses the 3 month deadline, they can try to resubmit with a good explanation of why it was late.

How long does it take for Medicare to pay claims?

For clean claims that are submitted electronically, they are generally paid within 14 calendar days by Medicare. The processing time for clean paper claims is a bit longer, usually around 30 days.

How are Medicare claims paid?

Your provider sends your claim to Medicare and your insurer. Medicare is primary payer and sends payment directly to the provider. The insurer is secondary payer and pays what they owe directly to the provider. Then the insurer sends you an Explanation of Benefits (EOB) saying what you owe, if anything.

How long does it typically take to receive payment with a clean claim?

A Clean Claim Report must be filed with the Office of Financial and Insurance Regulation for each claim that a health plan has not timely paid. View a Clean Claim Report here. A clean claim must be paid and corrected of all known defects within 45 days after it is received by the health plan.

What are the steps in the Medicare claims process?

However, if they are unable to or simply refuse, you will need to file your own Medicare claim.Complete a Patient's Request For Medical Payment Form. ... Obtain an itemized bill for your medical treatment. ... Add supporting documents to your claim. ... 4. Mail completed form and supporting documents to Medicare.

How often does Medicare send out EOB?

each monthYour Medicare drug plan will mail you an EOB each month you fill a prescription. This notice gives you a summary of your prescription drug claims and costs.

How do providers check Medicare claim status?

Providers can enter data via the Interactive Voice Response (IVR) telephone systems operated by the MACs. Providers can submit claim status inquiries via the Medicare Administrative Contractors' provider Internet-based portals. Some providers can enter claim status queries via direct data entry screens.

How long does it take for an online Medicare claim to process?

It can take us up to 7 days to process your claim. When you've submitted your claim, you can select: Download claim summary to view a PDF of the claim you just made. Make another claim.

What is a dirty claim?

The dirty claim definition is anything that's rejected, filed more than once, contains errors, has a preventable denial, etc.

What percentage of submitted claims are rejected?

As reported by the AARP1, estimates from US Department of Labor say that around 14% of all submitted medical claims are rejected. That's one claim in seven, which amounts to over 200 million denied claims a day.

How do providers submit claims to Medicare?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

Who pays if Medicare denies a claim?

The denial says they will not pay. If you think they should pay, you can challenge their decision not to pay. This is called “appealing a denial.” If you appeal a denial, Medicare may decide to pay some or all of the charge after all.

Can I submit claims directly to Medicare?

If you have Original Medicare and a participating provider refuses to submit a claim, you can file a complaint with 1-800-MEDICARE. Regardless of whether or not the provider is required to file claims, you can submit the healthcare claims yourself.

How long does it take for Medicare to process a claim?

It takes Medicare approximately 30 days to process each claim. Medicare pays Medicare Part A claims directly to the provider (such as inpatient hospital care). You are responsible for any deductibles, copayments, and services not covered by the plan.

How are Medicare claims processed?

If you have Medigap, your Medigap Plan may receive claims in one of 3 ways: Directly from Medicare through electronic claims processing. Directly from your provider, through the Internet, fax, or regular mail. This is allowed only if your provider accepts Medicare assignments.

What happens if a provider does not accept an assignment?

If the provider does not accept the assignment, he is required to submit a claim to Medicare, and the payment will be sent to you.

How often do you get an EOB?

The same is true for Part D: the paperwork is processed internally. You will get an EOB every month showing how much you and your plan have paid for your prescriptions.

Is Medicare a bill?

Each quarter, Medicare will send you a list of claims, known as a Medicare Summary Notice (MSN), for this period. It is NOT a BILL.

Can you file an EOB with Medicare?

This is allowed only if your provider accepts Medicare assignments. On very rare occasions, when neither Medicare nor your provider files the claim, you will need to file the claim yourself. You are supposed to get an EOB from your Medigap plan with the details of your services and the amount paid.

How does Medicare receive claims?

Your Medigap (supplemental insurance) company or retiree plan receives claims for your services 1 of 3 ways: Directly from Medicare through electronic claims processing. This is done online. Directly from your provider, if he/she accepts Medicare assignment. This is done online, by fax or through the mail.

How to file a claim with Medicare?

Follow these steps: Fill out the claim form provided by your insurance company (if required). Attach copies of the bills you are submitting for payment (if required). Attach copies of the MSN related to those bills.

How much does Medicare pay for Part B?

If the provider accepts assignment (agrees to accept Medicare’s approved amount as full reimbursement), Medicare pays the Part B claim directly to him/her for 80% of the approved amount. You are responsible for the remaining 20% (this is your coinsurance ). If the provider does not accept assignment, he/she is required to submit your claim ...

What happens if a provider does not accept assignment?

If the provider does not accept assignment, he/she is required to submit your claim to Medicare, which then pays the Part B claim directly to you. You are responsible for paying the provider the full Medicare-approved amount, plus an excess charge . Note: A provider who treats Medicare patients but does not accept assignment cannot charge more ...

Does Medicare send a bill for MSN?

For more information, see Assignment for Original Fee-for-Service Medicare . Medicare will send you a Medicare Summary Notice (MSN) form each quarter. Previously known as the Explanation of Medicare Benefits, the MSN is not a bill. You should not send money to Medicare after receiving an MSN.

How long does it take for Medicare to process a claim?

Medicare claims to providers take about 30 days to process. The provider usually gets direct payment from Medicare. What is the Medicare Reimbursement fee schedule? The fee schedule is a list of how Medicare is going to pay doctors. The list goes over Medicare’s fee maximums for doctors, ambulance, and more.

What happens if you see a doctor in your insurance network?

If you see a doctor in your plan’s network, your doctor will handle the claims process. Your doctor will only charge you for deductibles, copayments, or coinsurance. However, the situation is different if you see a doctor who is not in your plan’s network.

What to do if a pharmacist says a drug is not covered?

You may need to file a coverage determination request and seek reimbursement.

Does Medicare cover out of network doctors?

Coverage for out-of-network doctors depends on your Medicare Advantage plan. Many HMO plans do not cover non-emergency out-of-network care, while PPO plans might. If you obtain out of network care, you may have to pay for it up-front and then submit a claim to your insurance company.

Do participating doctors accept Medicare?

Most healthcare doctors are “participating providers” that accept Medicare assignment. They have agreed to accept Medicare’s rates as full payment for their services. If you see a participating doctor, they handle Medicare billing, and you don’t have to file any claim forms.

Do you have to pay for Medicare up front?

But in a few situations, you may have to pay for your care up-front and file a claim asking Medicare to reimburse you. The claims process is simple, but you will need an itemized receipt from your provider.

Do you have to ask for reimbursement from Medicare?

If you are in a Medicare Advantage plan, you will never have to ask for reimbursement from Medicare. Medicare pays Advantage companies to handle the claims. In some cases, you may need to ask the company to reimburse you. If you see a doctor in your plan’s network, your doctor will handle the claims process.

How much does Medicare pay?

Medicare pays for 80 percent of your covered expenses. If you have original Medicare you are responsible for the remaining 20 percent by paying deductibles, copayments, and coinsurance. Some people buy supplementary insurance or Medigap through private insurance to help pay for some of the 20 percent.

What is Medicare reimbursement?

The Centers for Medicare and Medicaid (CMS) sets reimbursement rates for all medical services and equipment covered under Medicare. When a provider accepts assignment, they agree to accept Medicare-established fees. Providers cannot bill you for the difference between their normal rate and Medicare set fees.

What does it mean when a provider is not a participating provider?

If the provider is not a participating provider, that means they don’t accept assignment. They may accept Medicare patients, but they have not agreed to accept the set Medicare rate for services.

What is Medicare Part D?

Medicare Part D or prescription drug coverage is provided through private insurance plans. Each plan has its own set of rules on what drugs are covered. These rules or lists are called a formulary and what you pay is based on a tier system (generic, brand, specialty medications, etc.).

What happens if you see an out of network provider?

Depending on the circumstances, if you see an out-of-network provider, you may have to file a claim to be reimbursed by the plan. Be sure to ask the plan about coverage rules when you sign up. If you were charged for a covered service, you can contact the insurance company to ask how to file a claim.

Is Medicare Advantage private or public?

Medicare Advantage or Part C works a bit differently since it is private insurance. In addition to Part A and Part B coverage, you can get extra coverage like dental, vision, prescription drugs, and more.

Do providers have to file a claim for Medicare?

They agree to accept CMS set rates for covered services. Providers will bill Medicare directly, and you don’t have to file a claim for reimbursement.

How long does it take for insurance to pay a claim?

Once the insurer agrees to pay the claim, it must make payment within five days. Insurers differ in how long they pay out claims, but most insurers complete the process within 30 days. It depends on the specific claim, though.

How long do insurance companies have to accept a claim?

They may say an insurer must handle claims in a “reasonable time.”. Here are three examples of specific time limits: California -- Insurance companies have 40 days to accept or deny a claim. If insurers need more time, they must notify you every 30 days about the claim’s status.

How long does it take to receive a loss and claim payment in Texas?

Loss and claim payment should be mailed within 10 business days after the claim is settled. Texas -- An insurer must acknowledge the claim within 15 days of receiving it. Within 15 days of receiving all the necessary paperwork, insurance companies must accept or deny the claim.

How long do you have to file a claim after a car crash?

States often require you to notify your insurer immediately or within a short period, such as five or 10 days.

How much does car insurance increase after an accident?

Insurers on average increase car insurance premiums by between 26% and 32% after an accident. That’s between $360 to $460 more money you’d spend annually for car insurance.

How long does it take for a car insurance company to settle a claim?

Most states protect consumers by demanding insurers handle the claims promptly. Some states even require a specific period, such as 30 days. During that time, the car insurer acknowledges the claim, investigates and makes a fair settlement.

How long does it take for a settlement to be issued in NC?

Payment must be issued within 30 days once a settlement is agreed upon. North Carolina – An insurance company has 30 days to acknowledge a claim. The acknowledgment can include denying the claim, making an offer of settlement, paying the claim or advising you that the investigation into the claim is ongoing.

First of all, what is a MAC?

A MAC is a Medicare Administrative Contractor. Each state has a MAC who processes their Medicare Claims. There are currently 12 (Medicare Part A&B) MACs and 4 Durable Medical Equipment MACs in the United States. These MAC’s process the Medicare claims for nearly 60% of the total Medicare beneficiary population, or 37.5 million beneficiaries.

What was the makeup of our sample?

We wanted to have a broad sample of Specialties and Locations in order to ensure the accuracy of our findings. Our specialties included; Physical Therapy, Cardiology, OB/GYN, Internal Medicine, Urgent Care, Family Practice, Orthopedics, and Podiatry. The locations we sampled utilized the following MAC’s: Palmetto, WPS, Noridian JE and JF, and FCSO.

How did we calculate the time interval

Our practice management system allows us to pull data for a fiscal date range which will tell us a host of information about all the claims filed during this fiscal period. We performed a calculation using the ‘Days Function’ in Microsoft Excel, and calculated the elapsed time between the date filed and the date posted.

What is the Medicare Payment Floor

Well, it’s not really a ‘Floor’ like the New York Stock Exchange or your local Ford dealers showroom. They don’t have representatives shouting out “Processing the 99213 for the Main Street Clinic” or “Denying the 99215 for the Mad Zepplin Physical Therapy Clinic”. It’s simply a term used to describe a specific time frame.

So, how long does it take Blue Cross Blue Shield to Process Claims?

Blue Cross is a little more complex when it comes to measuring how long it takes to pay my claim, and its harder to quantify one exact number for this analysis. Mainly because there are 36 Independently operated subsidiaries of Blue Cross that provide healthcare plans to 1 in 3 Americans, with each having its own payment process.