With Original Medicare, you pay a Medicare Part A deductible for each benefit period. A benefit period begins when you enter the hospital and ends when you are out for 60 days in a row. One benefit period may include more than one hospitalization.

How much does Medicare pay if you already met your deductible?

Medicare Part A deductibles work as follows, during a hospital stay: - Beneficiary pays deductible of $1,100 during days 1-60 of hospital stay. - Beneficiary then pays $275 per day for days 61-90 of hospital stay. - Beneficiary then pays $550 per day for days 91-150 of hospital stay.

Do you have to pay monthly for Medicare Part A?

Every 3 months. Part A (Hospital Insurance) Every month. Part D income-related monthly adjustment amount (Part D IRMAA) Part D IRMAA. An extra amount you pay in addition to your Part D plan premium, if your income is above a certain amount. Every month.

What are Medicare Part A deductibles and how do they work?

If you refer back to your broken arm example. Say your treatment cost you $80. If you broke your arm before you reached your Part B deductible amount of $198, you’d have to pay the full $80 for your care or whichever amount you had left to hit your $198 cap. If you already met your deductible, you’d only have to pay for 20% of the $80.

When do you pay your health insurance deductible?

May 04, 2022 · A health insurance deductible is usually charged once for the plan year. Starting January 1 or whenever your plan year begins, you pay your health care costs up to the deductible amount. After that, your health plan kicks in to help pay the …

Is Part A deductible annual?

Does Medicare Part A require monthly payments?

Is there a Medicare deductible every year?

How are Medicare deductibles paid?

What is Medicare Part A deductible for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What is Medicare Part A deductible for 2022?

The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,556 in 2022, an increase of $72 from $1,484 in 2021.Nov 12, 2021

How does the Part A deductible work?

What month does Medicare deductible start?

What is benefit period for Medicare Part A?

Who pays Medicare deductible?

How does Medicare Part B reimbursement work?

Does Medicare Part A cover emergency room visits?

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is the coinsurance amount for Medicare?

The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example. Say your treatment cost you $80.

What is Medicare Supplement?

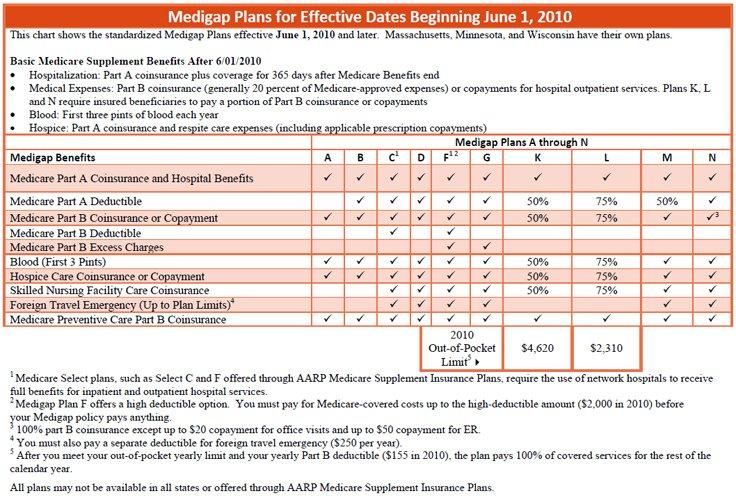

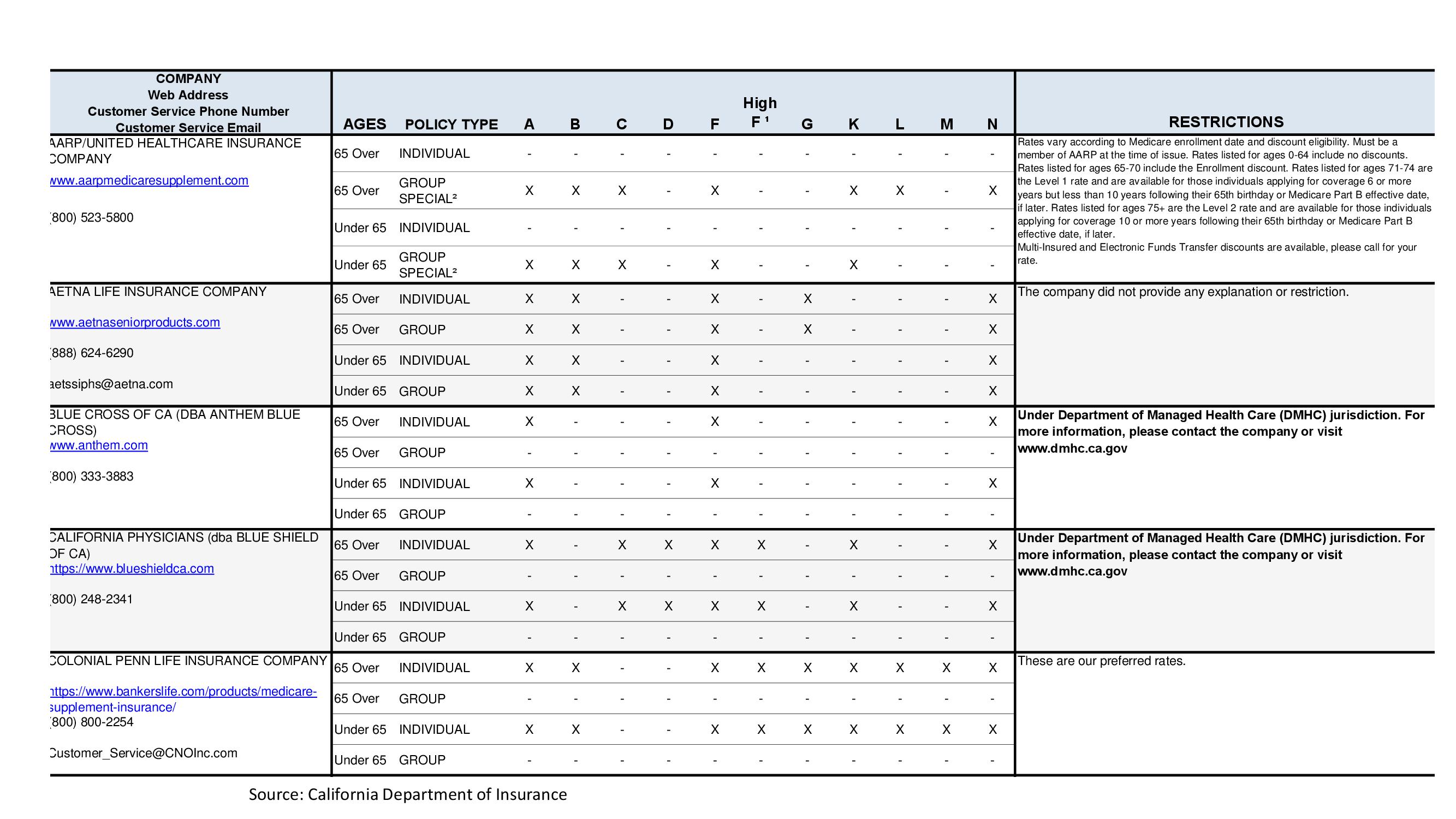

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

Does Medicare have a deductible?

Medicare Part A, Benefit Periods and Deductibles. Published by: Medicare Made Clear. You may be familiar with insurance deductibles. Many homeowners and car insurance policies charge a deductible whenever you file a claim. A health insurance deductible is usually charged once for the plan year.

How long does Medicare Part A last?

A benefit period begins when you enter the hospital and ends when you are out for 60 days in a row. One benefit period may include more than one hospitalization.

When does Medicare kick in?

Starting January 1 or whenever your plan year begins, you pay your health care costs up to the deductible amount. After that, your health plan kicks in to help pay the cost of your care for the rest of the plan year. The cycle starts over at the beginning of each new plan year. Medicare Part A deductibles are different.

How long does Medicare cover?

Medicare Part A covers an unlimited number of benefit periods, and it helps pay for up to 90 days of care for each one. After 90 days, it’s possible to tap into lifetime reserve days.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How long is Roger in the hospital?

He was out of the hospital less than 60 days before he went back. Roger is in the hospital for a total of 8 days, all within a single benefit period.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

How much will Medicare premiums be in 2021?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also: Have. Medicare Part B (Medical Insurance)

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. from Social Security or the Railroad Retirement Board.

What does Part B cover?

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

What is Part B insurance?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Pay monthly premiums for both Part A and Part B. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

What does Medicare cover?

What you pay for Medicare depends on the type of enrollment you have: Parts A, B, C, and/or D. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. It doesn't generally charge a premium. Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium ...

How much will Medicare cost in 2021?

In 2021, it costs $259 or $471 each month, depending on how long you paid Medicare taxes. 2 . That doesn’t mean you aren’t charged a deductible. For each benefit period, you pay the first $1,484 in 2021. A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days.

Is Medicare free for 2020?

Updated December 29, 2020. You paid into Medicare all of your working career. You would think Medicare would be free once you enroll—but that’s only partially true. If you’re confused about what you’ll pay for Medicare, we have you covered.

What is Medicare Part A 2021?

Medicare Part A Costs in 2021. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. 1 For most people, this is the closest thing to free they’ll get from Medicare, as Medicare Part A (generally) doesn't charge a premium. 2 . Tip: If you don't qualify for Part A, you can buy Part A coverage.

What is the premium for Part B?

Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium of $148.50 in 2021. A small percentage of people will pay more than that amount if reporting income greater than $88,000 as single filers or more than $176,000 as joint filers. 3

How much is Part A coinsurance in 2021?

If you re-enter the hospital the day after your benefit period ends, you’re responsible for the first $1,484 of charges again. 3 . Part A also charges coinsurance if your hospital stay lasts more than 60 days. In 2021, for days 61 to 90 of your hospital stay, you pay $371 per day; days 91 through the balance of your lifetime reserve days, ...

AARP Poll Reveals Strong Family Caregiver Tax Credit Support 1 Comments

Most older voters want to get their care at home for as long as possible

What to Watch on TV and Streaming This Week 27 Comments

Sandra Oh’s great new series on Netflix and a juicy documentary on Showtime

Museum Commemorates Baseball Great Roberto Clemente 2 Comments

Exhibit pays homage to Hall of Famer's legendary career and humanitarian efforts

Roberto Clemente: A Life in Baseball and Beyond 0 Comments

The famed outfielder was passionate about his family, helping others, and his Puerto Rican heritage

State-by-State Guide to Face Mask Requirements 122 Comments

Following federal guidance, many states dropping mask orders for fully vaccinated people

AARP In Your State

Visit the AARP state page for information about events, news and resources near you.

What percentage of Medicare deductible is paid?

After your Part B deductible is met, you typically pay 20 percent of the Medicare-approved amount for most doctor services. This 20 percent is known as your Medicare Part B coinsurance (mentioned in the section above).

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is a copay in Medicare?

A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met. A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin ...

How much is Medicare Part A 2021?

The Medicare Part A deductible in 2021 is $1,484 per benefit period. You must meet this deductible before Medicare pays for any Part A services in each benefit period. Medicare Part A benefit periods are based on how long you've been discharged from the hospital.

How much is Medicare Part B deductible for 2021?

The Medicare Part B deductible in 2021 is $203 per year. You must meet this deductible before Medicare pays for any Part B services. Unlike the Part A deductible, Part B only requires you to pay one deductible per year, no matter how often you see the doctor. After your Part B deductible is met, you typically pay 20 percent ...

Does Medicare cover out of pocket costs?

There is one way that many Medicare enrollees get help covering their Medicare out-of-pocket costs. Medigap insurance plans are a form of private health insurance that help supplement your Original Medicare coverage. You pay a premium to a private insurance company for enrollment in a Medigap plan, and the Medigap insurance helps pay ...

What is Medicare approved amount?

The Medicare-approved amount is the maximum amount that a doctor or other health care provider can be paid by Medicare. Some screenings and other preventive services covered by Part B do not require any Medicare copays or coinsurance.

What is Medicare Part A?

The Medicare program is split into several sections, or parts. These include: Medicare Part A. Medicare Part A covers hospitalization and inpatient care, including hospice and skilled nursing care. This also includes medications you receive while you’re in the hospital.

When do you enroll in Medicare Part A?

You’re automatically enrolled in original Medicare — which is made up of parts A and B — starting on the first day of the month you turn 65 years old.

What is Medicare for people over 65?

Medicare is a government healthcare program that cover s healthcare costs for people ages 65 and over or those with certain disabilities. The Medicare program is split into several sections, or parts. These include:

How old do you have to be to get Medicare?

You’re 65 years old and you or your spouse had Medicare-covered health benefits from a government job. You’re under age 65 and have received Social Security or RRB disability benefits for 24 months. You have end stage renal disease.

How much is the Part A premium for 2021?

If you or your spouse worked for 30 to 39 quarters, the standard monthly Part A premium cost is $259 in 2021. If you or your spouse for worked fewer than 30 quarters, the standard monthly Part A premium cost is $471 in 2021.

How much does hospice cost in 2021?

Medicare Part A covers the full cost of hospice care, but there are specific coinsurance costs for skilled nursing care services. In 2021, these costs are: $0 coinsurance for days 1 through 20 for each benefit period. $185.50 daily coinsurance for days 21 through 100 for each benefit period. all costs for days 101 and beyond in each benefit period.

How much is coinsurance for 2021?

In 2021, these costs are: $0 coinsurance for days 1 through 20 for each benefit period. $185.50 daily coinsurance for days 21 through 100 for each benefit period. all costs for days 101 and beyond in each benefit period.