All Medicare bills are due on the 25th of the month. In most cases, your premium is due the same month that you get the bill. Example of our billing timeline. For your payment to be on time, we must get your payment by the due date on your bill.

How much Medicare tax do I pay?

Mar 28, 2022 · The employer would pay an additional $60 each month on their behalf, totaling $120 contributed to Medicare. Those who are self-employed pay a Medicare tax as a part of the self-employment tax. Rather than being deducted from a paycheck, the money is paid through quarterly estimated tax payments.

Do you have to pay Medicare tax After retirement?

Jan 04, 2022 · American workers have taxes for Social Security and Medicare withheld from their paychecks. Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2022 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

Why do I have Medicare tax on my paycheck?

There is no wage limit for Medicare tax, which is currently 1.45% and applied to all covered wages paid. Keep in mind, if you make more than $200,000, your income is subject to an additional 0.9% Medicare tax (employers do not have to pay this additional tax ).

Does the amount of Medicare tax change?

Jul 14, 2021 · You’ll need to pay the Medicare tax on all income you earn throughout the year. If your income is above $200,000 ($250,000 for married couples filing together), your Medicare tax rate will rise to 2.35%. Breaking Down the Additional Medicare Tax

Is Medicare deducted from every paycheck?

How much is Medicare tax per year?

How is Medicare tax paid?

Why is Medicare on my paycheck?

How much Medicare tax do I pay in 2020?

Can I opt out of Medicare tax?

Do I get Medicare tax back?

How does the 3.8 Medicare tax work?

How do you calculate Medicare tax 2021?

How is Medicare calculated?

What type of tax is Medicare?

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and peopl...

What is the tax rate for Social Security and Medicare?

The FICA tax includes the Social Security tax rate at 6.2% and the Medicare tax at 1.45% for a total of 7.65% deducted from your paycheck.

What does it mean if you see a Medicare deduction on your paycheck?

This is a standard deduction, and it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax prov...

What happens if your employer did not withhold Social Security and Medicare taxes?

Employers that do not adhere to tax laws by withholding FICA taxes for Social Security and Medicare could be subject to criminal and civil sanction...

What is a Medicare benefit tax statement?

This evidence of coverage statement confirms that you have enrolled in Medicare Part A and have health insurance that meets the Affordable Care Act...

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What are the taxes that are withheld from paychecks?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax.

What is the surtax rate for 2021?

The additional tax (0.9% in 2021) is the sole responsibility of the employee and is not split between the employee and employer. If you make more than $200,000 per year in 2021, the 0.9 percent surtax only applies to the amount you make that is over $200,000.

How many parts are there in self employed tax?

The self-employed tax consists of two parts:

When was the Affordable Care Act passed?

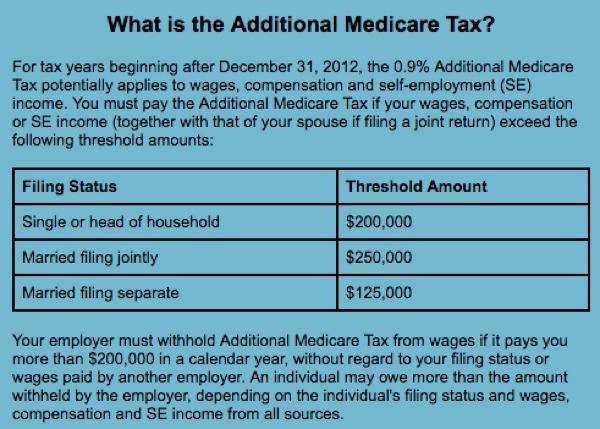

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

When was Medicare tax added?

The Additional Medicare Tax (AMT) was added by the Affordable Care Act (ACA) in November 2013. The ACA increased the Medicare tax by an additional 0.9% for taxpayers whose incomes are over a certain threshold based on their filing status. Those affected pay a total Medicare tax of 3.8%.

How much is Medicare Hospital Insurance tax?

Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax. Social Security has an annual wage limit, so you pay the tax only on income ...

What is the Medicare tax rate for 2020?

Updated December 07, 2020. The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn. But there are two other Medicare taxes ...

What is Medicare contribution tax?

A Medicare contribution tax of 3.8% now additionally applies to "unearned income"—that which is received from investments, such as interest or dividends, rather than from wages or salaries paid in compensation for labor or self-employment income. This tax is called the Net Investment Income Tax (NIIT). 7 .

How much is Social Security taxed in 2021?

Social Security has an annual wage limit, so you pay the tax only on income above a certain amount: $137,700 annually as of 2020 and $142,800 in 2021. 5 . Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, ...

When did Medicare start?

The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965 . 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

Is Medicare a part of self employment?

Medicare as Part of the Self-Employment Tax. You'll take something of a double hit on the Medicare tax if you're self-employed. You must pay both halves of the tax because you're the employee and the employer.

How much is Medicare tax?

There is no wage limit for Medicare tax, which is currently 1.45% and applied to all covered wages paid. Keep in mind, if you make more than $200,000, your income is subject to an additional 0.9% Medicare tax (employers do not have to pay this additional tax ).

Why does my employer withhold Medicare tax?

What is the Medicare tax? Your employer automatically withholds the Medicare tax from your paycheck in order to help cover the costs of the country’s Medicare program. The tax comprises one part of the Federal Insurance Contributions Act (FICA).

How to get a refund for Medicare and Social Security?

To claim a refund of Social Security and Medicare taxes, you will need to complete and submit IRS Form 843. When you apply for a refund from the IRS, include either: A letter from your employer stating how much you were reimbursed. A cover letter attesting that your employer has refused or failed to reimburse you.

Which classes of nonimmigrants are exempt from Social Security and Medicare?

Social Security and Medicare taxes: A-visas. Employees of foreign governments, their families, and their servants are exempt on salaries paid to them in their official capacities as foreign government employees.

What is the Social Security tax limit for 2021?

In 2021, this limit is $142,800, up from the 2020 limit of $137,700. As a result, in 2021 you’ll pay no more than $8,853.60 ($142,800 x 6.2%) in Social Security taxes.

Is transportation expense pretax?

Also, qualified retirement contributions, transportation expenses and educational assistance may be pretax deductions. Most of these benefits are exempt from Medicare tax, except for adoption assistance, retirement contributions, and life insurance premiums on coverage that exceeds $50,000.

Do you pay Social Security if you have no earned income?

If you have no earned income, you do not pay Social Security or Medicare taxes.

What is the Medicare tax rate?

The Medicare tax rate is 1.45%. But the Federal Insurance Contributions Act tax combines two rates. FICA taxes include both the Social Security Administration tax rate of 6.2% and the Medicare tax rate.

What percentage of income goes to Medicare?

The percentage of income that goes to your Medicare tax is 1.45%. Your employer will then match the rate you pay. But if you’re self-employed, you’ll pay the full 2.9%.

What is the Medicare surtax?

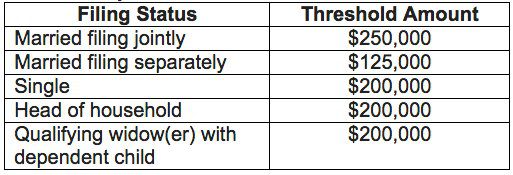

The Affordable Care Act enforces high wage earners to pay an extra Medicare payroll tax, or Medicare surtax, of 0.9% on earned income. All U.S. employees have to pay the Medicare tax.No matter the citizenship or residency status, each individual must pay this tax. Single filers with an income of at least $200,000 will need to pay the additional Medicare tax.

How much income do you need to file Medicare?

Single filers with an income of at least $200,000 will need to pay the additional Medicare tax. Married individuals who file separately will pay an extra tax if income is $125,000 or more. But if married and filing jointly, you’ll be subject to a fee when combined income is $250,000 or more.

What is the tax rate for self employment?

The self-employment tax rate is slightly higher, at 15.3%. Both the Social Security tax rate of 12.4% and the 2.9% Medicare tax rate contribute to this figure.

How to calculate Social Security and Medicare tax?

You can calculate your Social Security and Medicare tax by taking your gross income and multiplying it by 7.65%. This is the amount of your company’s Social Security and Medicare tax matching contribution.

How much is the maximum Social Security tax?

The maximum Social Security tax amount for both employees and employers is $8,239.80. For self-employed people, the maximum Social Security tax is $16,479.60. Anyone who earns wages over $200,000 will need to pay an extra 0.9% Medicare tax. Employers aren’t responsible for this additional fee.

How many deposit schedules are there for Social Security?

In general, you must deposit federal income tax withheld, and both the employer and employee social security and Medicare taxes. There are two deposit schedules, monthly and semi-weekly. Before the beginning of each calendar year, you must determine which of the two deposit schedules you are required to use. To determine your payment schedule, ...

When do you need to deposit a 940?

The tax must be deposited by the end of the month following the end of the quarter. You must use electronic funds transfer ( EFTPS) to make all federal tax deposits.

Does the employer pay a FUTA tax?

Only the employer pays FUTA tax; it is not withheld from the employee's wages. Report your FUTA taxes by filing Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return.

What percentage of your income is taxable for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

Is Medicare payroll tax deductible?

If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax.

When is Medicare tax withheld?

Beginning January 1, 2013, employers are responsible for withholding the 0.9% Additional Medicare Tax on an employee's wages and compensation that exceeds a threshold amount based on the employee's filing status. You are required to begin withholding Additional Medicare Tax in the pay period in which it pays wages and compensation in excess of the threshold amount to an employee. There is no employer match for the Additional Medicare Tax.

What is the wage base limit for Social Security?

See requirements for depositing. The social security wage base limit is $137,700 for 2020 and $142,800 for 2021. The employee tax rate for social security is 6.2% for both years.

Do you have to deposit withholdings?

You must deposit your withholdings. The requirements for depositing, as explained in Publication 15, vary based on your business and the amount you withhold.

Do you pay federal unemployment tax?

You pay FUTA tax only from your own funds. Employees do not pay this tax or have it withheld from their pay.