Full Answer

How do I qualify for Medicare in Iowa?

To qualify for Medicare, you must be either a United States citizen or a legal permanent resident of at least five continuous years. If you’re newly eligible, you apply for Original Medicare in Iowa the same way you would in any state: through the Social Security Administration (SSA).

What is Original Medicare in Iowa?

Original Medicare in Iowa Original Medicare is the federal health insurance program for eligible United States citizens age 65 and older or permanent residents of at least five years.

How can Iowa help pay for my Medicare expenses?

Iowa has programs that can help pay your Medicare expenses, like your premiums, deductible and coinsurance. Where can I get medical care? You may continue to go to your Medicare providers for all medical care.

Are seniors eligible for Medicaid long-term care in Iowa?

There are several different Medicaid long-term care programs for which Iowa seniors may be eligible. These programs have slightly different financial and medical (functional) eligibility requirements, as well as varying benefits.

How does Medicare determine eligibility date?

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month. If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Does Medicare need to be updated every year?

In general, once you're enrolled in Medicare, you don't need to take action to renew your coverage every year. This is true whether you are in Original Medicare, a Medicare Advantage plan, or a Medicare prescription drug plan.

Do I qualify for Medicare in Iowa?

You may be eligible for Medicare in Iowa if you're a U.S. citizen or a permanent legal resident who has lived in the U.S. for more than five years and one or more of the following applies to you: You are 65 or older. You have been on Social Security Disability Insurance (SSDI) for two years.

How many months ahead should I apply for Medicare?

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65.

Does my Medicare plan automatically renew?

Although there are a few exceptions, Medicare plans generally renew each year automatically. This is true for original Medicare as well as Medicare Advantage, Medigap, and Medicare Part D plans.

Will my Medicare A and B automatically renew?

If you have Medicare Part A (hospital insurance) and/or Part B (medical insurance) and you are up to date on your Medicare premiums, your Medicare coverage will automatically carry over from one year to the next and there is nothing you need to do to renew your plan.

What is the monthly income limit for Medicaid in Iowa?

Who is eligible for Iowa Medicaid Program?Household Size*Maximum Income Level (Per Year)1$18,0752$24,3533$30,6304$36,9084 more rows

How much can you make to qualify for Medicaid in Iowa?

Income & Asset Limits for Eligibility2022 Iowa Medicaid Long Term Care Eligibility for SeniorsType of MedicaidSingleMarried (both spouses applying)Income LimitAsset LimitInstitutional / Nursing Home Medicaid$2,523 / month*$3,000Medicaid Waivers / Home and Community Based Services*$2,523 / month$3,0001 more row•Dec 7, 2021

Does Medicare look at assets?

A Medicaid applicant is penalized if assets (money, homes, cars, artwork, etc.) were gifted, transferred, or sold for less than the fair market value. Even payments to a caregiver can be found in violation of the look-back period if done informally, meaning no written agreement has been made.

Is Medicare eligibility age changing?

Lowering the eligibility age and 2022 changes In summary, the changes have not yet come into effect but it is looking promising that the age may drop down to 60, assuming everyone can get on the same page.

What do I need to do before I turn 65?

Turning 65 Soon? Here's a Quick Retirement ChecklistPrepare for Medicare. ... Consider Additional Health Insurance. ... Review Your Social Security Benefits Plan. ... Plan Ahead for Long-Term Care Costs. ... Review Your Retirement Accounts and Investments. ... Update Your Estate Planning Documents.

Can you start Medicare in the middle of the month?

Initial Enrollment Period (IEP). You can enroll in Medicare at anytime during this seven-month period, which includes the three months before, the month of, and the three months following your 65th birthday. The date when your Medicare coverage begins depends on when you sign up.

Original Medicare in Iowa

Original Medicare is the federal health insurance program for eligible United States citizens age 65 and older or permanent residents of at least f...

Local Resources For Medicare in Iowa

Medicare Savings Programs in Iowa: Iowa beneficiaries with limited incomes can apply to get help covering their out-of-pocket Medicare costs, such...

How to Apply For Medicare in Iowa

To qualify for Medicare, you must be either a United States citizen or a legal permanent resident of at least five continuous years.If you’re newly...

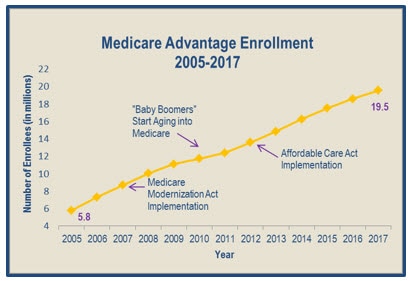

How many people will be on Medicare in Iowa in 2020?

As of September 2020, there were 638,530 residents with Medicare coverage in Iowa. T hat’s about 20 percent of the state’s population filing for Medicare benefits, versus about 19 percent of the total U.S. population.

What is the age limit for Medicare in Iowa?

Disabled Medicare beneficiaries under age 65 in Iowa also have the option to enroll in HIPIOWA, the state’s high-risk health insurance pool. HIPIOWA has a plan that provides coverage to supplement Medicare, with premiums that vary based on age.

How many counties in Iowa have Medicare Advantage plans?

Only about a quarter of Iowa’s Medicare beneficiaries are enrolled in Medicare Advantage plans. Medicare Advantage plans are available in 98 of Iowa’s 99 counties; availability in those counties ranges from three to 29 plans in 2021. 60 insurers offer Medigap plans in Iowa. Insurers aren’t required to offer Medigap plans to people under 65;

What is Medicare Rights Center?

The Medicare Rights Center is a nationwide service, with a website and call center, that provides information and assistance related to Medicare enrollment, eligibility, and benefits.

What percentage of Medicare beneficiaries are disabled?

Nationwide, 15 percent of Medicare beneficiaries are disabled and under age 65; in Iowa, 13 percent of the Medicare population is under 65 and are eligible for Medicare coverage enrollment due to a disability. On the high and low ends of the spectrum, 22 percent of Medicare beneficiaries in Alabama, Arkansas, Kentucky, and Mississippi are under 65, ...

How much is Medicare Part D in Iowa?

There are 28 stand-alone Medicare Part D plans for sale in Iowa for 2021, with premiums that range from about $7 to $105/month. More than 377,000 Iowa residents had stand-alone Medicare Part D plans as of September 2020 — about 59 percent of the state’s total Medicare population).

How many different Medigap plans are there?

Although Medigap plans are sold by private insurers, the plans are standardized under federal rules, with ten different plan designs (differentiated by letters, A through N). The benefits offered by a particular plan (Plan A, Plan F, etc.) are the same regardless of which insurer sells the plan.

How long do you have to be a resident of Iowa to qualify for medicare?

To qualify for Medicare, you must be either a United States citizen or a legal permanent resident of at least five continuous years. If you’re newly eligible, you apply for Original Medicare in Iowa the same way you would in any state: through the Social Security Administration (SSA). You can enroll by:

How many Medigap policies are there?

In most states, there are up to 10 Medigap policy options, all standardized and signified by a letter of the alphabet. All plans of the same letter offer the same benefits, regardless of where the policy is purchased. These plans may pay for costs like copayments, coinsurance, deductibles, and overseas emergency health coverage.

How long do you have to be on disability to get a railroad retirement?

You’re also automatically enrolled if you’ve received disability benefits from Social Security or certain disability benefits through the Railroad Retirement Board for 24 consecutive months; or if you have amyotrophic lateral sclerosis (ALS, or Lou Gehrig’s disease). Otherwise, you may need to manually apply.

Does Medicare cover prescriptions?

Original Medicare doesn’t include prescription drug coverage, which you can obtain separately under Medicare Part D. You also won’t be covered for benefits like routine vision and dental services, hearing aids, dentures, long-term care, and most coverage outside of the country.

Does Iowa have Medicare?

While beneficiaries may choose to receive their Medicare benefits through the government, they may wish to explore other Medicare plan options available as well. Certain types of Medicare insurance, such as prescription drug coverage, are only available through private insurance companies that contract with Medicare.

Does Medicare Advantage cover vision?

For example, Medicare Advantage Prescription Drug plans include both drug benefits and Original Medicare health benefits in one plan. Other plans may cover additional preventive services, routine vision and dental, or health and wellness programs. Costs and coverage may vary by plan and area.

What is Medicare?

Medicare is a federal health insurance program for those who are 65 years of age or have a physical or mental disability and receive Social Security or Railroad Disability insurance for a minimum of 24 months. Medicare provides coverage to more than 150 million people, and that number continues to grow.

Shop Medicare Plans

To access Medicare benefits, you must first become eligible. If you are now eligible to receive benefits, why not apply now? Give us a call now to begin organizing your retirement health care coverage. For more information about your coverage options in Iowa and across the Nation, reach out to Larry Klein of Iowa Medicare Group today!

What Medicare plans are available in Iowa?

What Iowa Medicare Plans Are Available? If you live in Iowa, you have access to Medicare Part A, Medicare Part B, Medicare Advantage and Medicare Part D via enrollment with Medicare. In addition to this, you have the option to work with private insurers to join a Medicare Supplement plan. A good portion of your premiums comes from ...

What is Medicare Part A in Iowa?

Medicare Part A: This is referred to as Original Medicare and covers the cost of your inpatient services, such as hospital stays, nursing care, hospice services and home health care. Medicare Part B: The second part of Original Medicare is Part B, which covers the cost of your routine doctor’s visits, ...

How long do you have to enroll in a health insurance plan after turning 65?

You lose this protection if you wait longer than six months after turning 65 to enroll in one of these plans.

What happens if you select Medicare Advantage?

Medicare Advantage. If you select a Medicare Advantage plan, your coverage will be administered via the private insurer you select. Some of your premiums will be offset by your Social Security benefits, and what you will pay can depend on the level of coverage you are seeking. Some people pay next to nothing for their Advantage plans.

Why is Medicare Supplement Plan important?

A Medicare Supplement plan is an excellent way to reduce your financial responsibility if you fear you will not be able to afford your copays.

Is Medicare more popular in Iowa?

Traditional Medicare plans are much more popular in Iowa than Medicare Advantage. In 2020, roughly 480,000 Iowans enrolled in Medicare Part A and B, compared with only 153,000 who selected a Medicare Advantage plan. It is advised that you consider your medical history, health risks and any diseases you are being treated for currently ...

Does Medicare Part B have a monthly premium?

Medicare Part B does have a monthly premium, but you are not required to send in a monthly payment. It will be drawn out of your pension or Social Security payment each month instead. Part B costs around $150 a month, but premiums may rise over time.

What is Medicaid in Iowa?

In Iowa, Medicaid is also called IA Health Link and is a managed care program. The Iowa Department of Human Services’ division of Iowa Medicaid Enterprise administers the Medicaid program. Medicaid (Title 19) is a wide-ranging, jointly funded state and federal health care program for low-income individuals of all ages.

How long does Iowa have a look back period?

When considering assets, one should be aware that Iowa has a Medicaid Look-Back Period of 60 months that dates back from one’s Medicaid application date. During this time frame, Medicaid checks to ensure no assets were sold or given away under fair market value.

What is the medically needy asset limit for 2021?

As of 2021, the medically needy asset limit is $10,000 per household. 2) Miller Trust – this type of trust, also called a Qualified Income Trust (QIT), is referred to a Medical Assistance Income Trust (MAIT) in Medicaid-speak in Iowa. For persons who are applying for nursing home Medicaid or a HCBS Medicaid waiver and are over the income limit, ...

What is CSRA in Medicaid?

In Medicaid terminology, this is called the Community Spouse Resource Allowance (CSRA). There is also a minimum CSRA, which is $26,076, and allows the non-applicant spouse to retain 100% of the couple’s assets, up to this figure.

What is HCBS Elderly Waiver?

1) HCBS Elderly Waiver – This Home and Community Based Services Medicaid waiver is intended to provide services to prevent and / or delay nursing home placement of seniors. Program participants have the option of directing their own care and hiring the care attendant of their choosing, including their own adult children. Other benefits include adult day care, home modifications, and personal emergency response systems.

How much income can a married couple have on medicaid?

If they choose this option, each spouse is able to have up to $2,382 / month in income and $2,000 in assets.

Can you change your Medicaid account if you have over the limit?

In simple terms, income that is over the limit is deposited into the trust and is not counted towards Medicaid’s income limit. A trustee is named who has legal control of the money in the account. The account must be irreversible, meaning once it has been established, it cannot be changed or canceled.

How long does Medicaid spend down last in Iowa?

In Iowa, coverage under the Medicaid spend-down lasts one month at a time. Enrollees have to submit additional medical expenses to receive further coverage. The Medicaid spend-down program covers long-term care in Iowa. Income limit: The income limit is $483 for both singles and couples ( as of 2018 ).

What income is required for Medicaid in Iowa?

Iowa requires that applicants have incomes below 125 percent of the cost of institutional care in order to qualify for Medicaid long-term care using a Miller Trust. Individuals with higher incomes can usually afford those services without help from Medicaid. Back to top.

How much can a spouse earn in Iowa in 2020?

In Iowa in 2020, spousal impoverishment protections can increase a community spouse’s income by $2,155 to $3,216 per month. Applicants in Iowa can use a Miller Trust to qualify for Medicaid nursing home or HCBS benefits. Iowa restricts Medicaid LTSS benefit eligibility to applicants with less than $595,000 in home equity.

What is Medicare Savings Program?

Many Medicare beneficiaries who struggle to afford the cost of Medicare coverage are eligible for help through a Medicare Savings Program (MSP). This program pays for Medicare Part B premiums, Medicare Part A and B cost-sharing, and – in some cases – Part A premiums. Qualified Medicare Beneficiary ...

How much does Medicaid ABD cover?

(Eyeglasses are covered more frequently for enrollees with medical conditions impacting the eye.) Income eligibility: The income limit is $783 a month if single and $1,175 a month if married. Asset limits: The asset limit is $2,000 if single ...

When did Medicare exempt from Medicaid?

Congress exempted Medicare premiums and cost sharing from Medicaid estate recovery starting with benefits paid after December 31, 2009. Medicaid will not try to recover what it paid for MSP benefits after that date, but may try to recover benefits it paid through that date.

Does Iowa have a wellness plan?

Most Medicaid ABD enrollees in Iowa have transitioned to the Iowa Wellness Plan, which has a $1,000 annual benefit maximum for services that aren’t preventive, diagnostic or emergency in nature. That program requires some enrollees to pay premiums and satisfy “health behaviors” to receive full dental coverage.

Who does Medicare Savings Program cover?

Individuals with limited income and resources who get Medicare Part A (hospital insurance) and/or Medicare Part B (Medical insurance)

What services are covered by Medicare Assistance?

Iowa has programs that can help pay your Medicare expenses, like your premiums, deductible and coinsurance.

Where can I get medical care?

You may continue to go to your Medicare providers for all medical care.