If you suspect a fraud has occurred, you should report it, providing as many details as you can, in any of the following ways:

- Call Medicare’s help line at 800-633-4227.

- Call the Office of Inspector General directly at 800‑HHS‑TIPS (800‑447‑8477, or TTY 800‑377‑4950).

- File an online report with the Office of Inspector General.

How to spot and report Medicare fraud?

Contact: Provider fraud or abuse in Original Medicare (including a fraudulent claim, or a claim from a provider you didn’t get care from) 1-800-MEDICARE (1-800-633-4227) or. The U.S. Department of Health and Human Services – Office of the Inspector General.

How do I identify Medicare fraud?

If you suspect a fraud has occurred, you should report it, providing as many details as you can, in any of the following ways: Call Medicare’s help line at 800-633-4227. Call the Office of Inspector General directly at 800‑HHS‑TIPS (800‑447‑8477, or …

How to report suspected Medicare fraud?

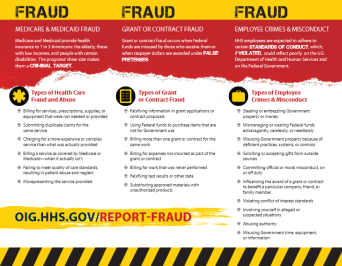

Medicare fraud and abuse examples Overview of fraud and abuse laws Government agencies and partnerships dedicated to preventing, detecting, and fighting fraud and abuse Resources for reporting suspected fraud and abuse Help Fight Fraud by Reporting It The Office of Inspector General (OIG) Hotline accepts tips and complaints

Where to report Medicare fraud?

Aug 06, 2014 · To report suspected Medicare fraud, call toll free 1-800-HHS-TIPS (1-800-447-8477). Medicare fraud happens when Medicare is billed for services or supplies you never got. Medicare fraud costs Medicare a lot of money each year. …

How do I report potential Medicare fraud?

To report suspected Medicare fraud, call toll free 1-800-HHS-TIPS (1-800-447-8477). Medicare fraud happens when Medicare is billed for services or supplies you never got. Medicare fraud costs Medicare a lot of money each year. See: Examples of possible Medicare fraud.

How do I report Medicare fraud in Australia?

Report suspected fraud by health providers against health programs....You can report suspected fraud or corruption by:completing our reporting suspect fraud form.completing our health provider fraud tip-off form.calling our fraud hotline – 1800 829 403.writing to us.Aug 18, 2021

What are red flags for Medicare fraud?

Some red flags to watch out for include providers that: Offer services “for free” in exchange for your Medicare card number or offer “free” consultations for Medicare patients. Pressure you into buying higher-priced services. Charge Medicare for services or equipment you have not received or aren't entitled to.

What can a scammer do with my Medicare number?

If you get a call from people promising you things if you give them your Medicare Number — don't do it. This is a common Medicare scam. Refuse any offer of money or gifts for free medical care. A common ploy of identity thieves is to say they can send you your free gift right away — they just need your Medicare Number.Sep 15, 2021

How do I report someone for false claiming benefits?

You can report suspected housing benefit fraud in three ways:Phone: Contact the National Benefit Fraud Hotline on 0800 854 4400. Your call is free and confidential you do not have to give your name or address. ... Online at: Report benefit fraud on GOV.UK website.Post: NBFH, PO Box 224, Preston PR1 1GP.

Can you anonymously report someone to Centrelink?

How you report fraud. If you suspect someone may be committing fraud against Centrelink, Medicare or Child Support, you can report it anonymously.Dec 23, 2021

What are the 26 Red flag Rules?

In addition, we considered Red Flags from the following five categories (and the 26 numbered examples under them) from Supplement A to Appendix A of the FTC's Red Flags Rule, as they fit our situation: 1) alerts, notifications or warnings from a credit reporting agency; 2) suspicious documents; 3) suspicious personal ...

How do I stop Medicare fraud?

There are several things you can do to help prevent Medicare fraud.Protect your Medicare number. Treat your Medicare card and number the same way you would a credit card number. ... Protect your medical information. ... Learn more about Medicare's coverage rules. ... Do not accept services you do not need. ... Be skeptical.

What is account take over fraud?

Account takeover fraud is a form of identity theft. It works through a series of small steps: A fraudster gains access to victims' accounts. Then, makes non-monetary changes to account details such as: Modifies personally identifiable information (PII)

Can someone steal my identity with my Medicare number?

Medical identity theft happens when someone steals or uses your personal information (like your name, Social Security Number, or Medicare Number) to submit fraudulent claims to Medicare and other health insurers without your permission. Medicare is working to find and prevent fraud and abuse.

Does Medicare ever call your house?

Hard Facts About Medicare Medicare will never call or come to your home uninvited to sell products or services. SSA representatives may call Medicare beneficiaries if they need more information to process applications for Social Security benefits or enrollment in certain Medicare Plans, but, again, this is rare.May 24, 2021

Does Medicare ever call your home?

Medicare will never call you! Medicare may need information from you or may need to reach you; but, they'll NEVER call. You'll get a letter that will notify you of the necessary information that Medicare needs. Long story short, if the calls you're receiving claim to be from Medicare, it's a spam call.

What does "knowingly submitting" mean?

Knowingly submitting, or causing to be submitted, false claims or making misrepresentations of fact to obtain a To learn about real-life cases of Federal health care payment for which no entitlement Medicare fraud and abuse and would otherwise existthe consequences for culprits,

What is the role of third party payers in healthcare?

The U.S. health care system relies heavily on third-party payers to pay the majority of medical bills on behalf of patients . When the Federal Government covers items or services rendered to Medicare and Medicaid beneficiaries, the Federal fraud and abuse laws apply. Many similar State fraud and abuse laws apply to your provision of care under state-financed programs and to private-pay patients.

What is the OIG?

The OIG protects the integrity of HHS’ programs and the health and welfare of program beneficiaries. The OIG operates through a nationwide network of audits, investigations, inspections, evaluations, and other related functions. The Inspector General is authorized to, among other things, exclude individuals and entities who engage in fraud or abuse from participation in all Federal health care programs, and to impose CMPs for certain violations.

What is heat in Medicare?

The DOJ, OIG, and HHS established HEAT to build and strengthen existing programs combatting Medicare fraud while investing new resources and technology to prevent and detect fraud and abuse . HEAT expanded the DOJ-HHS Medicare Fraud Strike Force, which targets emerging or migrating fraud schemes, including fraud by criminals masquerading as health care providers or suppliers.

What is the Stark Law?

Section 1395nn, often called the Stark Law, prohibits a physician from referring patients to receive “designated health services” payable by Medicare or Medicaid to an entity with which the physician or a member of the physician’s immediate family has a financial relationship , unless an exception applies.

Is CPT copyrighted?

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. All Rights Reserved. Applicable FARS/HHSAR apply. CPT is a registered trademark of the American Medical Association. Applicable FARS/HHSAR Restrictions Apply to Government Use. Fee schedules, relative value units, conversion factors and/or related components are not assigned by the AMA, are not part of CPT, and the AMA is not recommending their use. The AMA does not directly or indirectly practice medicine or dispense medical services. The AMA assumes no liability of data contained or not contained herein.

What is the OIG exclusion statute?

Section 1320a-7, requires the OIG to exclude individuals and entities convicted of any of the following offenses from participation in all Federal health care programs:

What is the False Claims Act?

The False Claims Act also provides civil remedy to fight fraud. A successful qui tam action may entitle whistleblowers to a percentage of recovered funds as well as the protection of the Federal and/or government. You must report your personal Medicare fraud. Allegations need to be specific and not generalized.

Who can report Medicare fraud?

Patients should inform when something is wrong but medical professionals are in the best position to have knowledge of and report Medicare Fraud. Doctors, Specialists, Administrators, Nurses, Pharmacist or any medical employee can report. Working in the healthcare system provides them an insider’s knowledge of the right ...

Is Medicare a federal program?

Medicare, Medicaid and Tricare are Federally funded health programs. Public programs fall under the protection of the Federal False Claims Act (FCA). Knowingly making false claims to these public programs for medical treatments, services or drugs is illegal. The FCA has a qui tam section allowing individuals to report wrongdoing.

What is Medicare FCA?

Medicare FCA Claims for Larger Rewards. Another option for individuals is submitting a claim using the False Claims Act. The FCA provides rewards and protection for people who report fraud against any Federal Government program. Civil health care programs are covered under the FCA.

What is the role of third party payers in healthcare?

The U.S. health care system relies heavily on third-party payers to pay the majority of medical bills on behalf of patients . When the Federal Government covers items or services rendered to Medicare and Medicaid beneficiaries, the Federal fraud and abuse laws apply. Many similar State fraud and abuse laws apply to your provision of care under State-financed programs and to private-pay patients.

What is the OIG?

The OIG protects the integrity of HHS’ programs and the health and welfare of program beneficiaries. The OIG operates through a nationwide network of audits, investigations, inspections, evaluations, and other related functions. The Inspector General is authorized to, among other things, exclude individuals and entities who engage in fraud or abuse from participation in all Federal health care programs, and to impose CMPs for certain violations.

What is heat in Medicare?

The DOJ, OIG, and HHS established HEAT to build and strengthen existing programs combatting Medicare fraud while investing new resources and technology to prevent and detect fraud and abuse . HEAT expanded the DOJ-HHS Medicare Fraud Strike Force, which targets emerging or migrating fraud schemes, including fraud by criminals masquerading as health care providers or suppliers.

What is the Stark Law?

Section 1395nn, often called the Stark Law, prohibits a physician from referring patients to receive “designated health services” payable by Medicare or Medicaid to an entity with which the physician or a member of the physician’s immediate family has a financial relationship , unless an exception applies.

Is CPT copyrighted?

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. All Rights Reserved. Applicable FARS/HHSAR apply. CPT is a registered trademark of the American Medical Association. Applicable FARS/HHSAR Restrictions Apply to Government Use. Fee schedules, relative value units, conversion factors and/or related components are not assigned by the AMA, are not part of CPT, and the AMA is not recommending their use. The AMA does not directly or indirectly practice medicine or dispense medical services. The AMA assumes no liability of data contained or not contained herein.

What is the OIG exclusion statute?

Section 1320a-7, requires the OIG to exclude individuals and entities convicted of any of the following offenses from participation in all Federal health care programs:

Is there a measure of fraud in health care?

Although no precise measure of health care fraud exists, those who exploit Federal health care programs can cost taxpayers billions of dollars while putting beneficiaries’ health and welfare at risk. The impact of these losses and risks magnifies as Medicare continues to serve a growing number of beneficiaries.

What is Medicare fraud?

In the Medicare context, fraud scheme include billing Medicare for services that were not delivered, or increasing the payment amount on claims forms. Health care providers who intentionally bill false charges to Medicare cost taxpayers billions of dollars a year and put the health of Medicare beneficiaries at risk.

Can a clerical error be corrected?

Simple clerical errors can be corrected, and typically don't rise to the level of intent required to prove either abuse or fraud. If the error is noted, your health care provider can correct it with Medicare and issue a new claim with the updated amount.

What to do if you suspect fraud or abuse?

If you suspect fraud or abuse, study the entries on your claim forms and compare them to earlier records. When you visit your doctor or order medical supplies, record the dates yourself along with the services or supplies you will receive.

What are some examples of Medicare fraud?

Examples of medicare abuse or fraud include suppliers billing Medicare for equipment you never ordered or received, or healthcare providers billing Medicare for services you were never provided. Fraud ranges from broad-based operations by nationwide institutions to individual health care providers working on a small scale.

What is abuse in healthcare?

Abuse includes acts such as over-charging for services, or unbundling services, which happens when a health care provider charges separately for individual components of one service rather than the single charge for the service as a whole. Bending the rules constitutes abuse, whereas intentional deception may be fraud.

What are the penalties for false claims?

Civil penalties for such a violation include fines from $5,000 to $10,000 per false claim . He also could face criminal penalties. Another type of fraud involves health care providers receiving money in exchange for making referrals to another health care providers.

What is the number to report Medicare fraud?

You can call the national fraud hotline at 1-800-MEDICARE to report fraud to the OIG.

What does Medicare check?

If you have Original Medicare, check your MSN. This notice shows the health care services, supplies, or equipment you got, what you were charged, and how much Medicare paid. If you’re in a Medicare health plan, check the statements you get from your plan.

What is identity theft?

Identity theft is a serious crime that happens when someone uses your personal information without your consent to commit fraud or other crimes. Personal information includes things like your name and your Social Security, Medicare, or credit card numbers.