- Reasons for appeal. A person can appeal an IRMAA for several reasons. ...

- Documents. The appeal requires documentation. To begin an appeal, a person will need to contact the SSA at 800-772-1213.

- Decision. If the SSA approve the appeal, they will adjust the person’s monthly Medicare premiums. If they deny the appeal, they will explain why, generally in a hearing.

How to appeal a denial of Medicaid?

Part 6 of 6: Bringing a Medicare Prescription Drug Appeal

- Talk to your doctor. Appealing the denial from your Medicare prescription drug plan is similar to appealing an “original Medicare” decision.

- Ask for a coverage determination. You or your doctor needs to contact your prescription drug plan. ...

- Receive a determination. ...

- Request Redetermination. ...

- Request Reconsideration by an Independent Review Entity (IRE). ...

How to file for Medicare Appeals?

You can file an appeal if you disagree with a coverage or payment decision made by one of these:

- Medicare

- Your Medicare health plan

- Your Medicare drug plan

How to appeal a higher Medicare Part B monthly premium?

- Getting married, divorced, or losing a spouse

- Loss or sale or income-producing property

- You or your spouse retired and/or income significantly decreased

- Loss of pension income

How can I appeal a denial of Medicare coverage?

- The ALJ level is the best chance to obtain Medicare coverage.

- The QIC should provide a written copy of its decision with information about how to request an ALJ hearing.

- You must request the hearing within 60 days of notice from the QIC that it has denied Medicare coverage for your care.

- Unfortunately, ALJ hearings and decisions are not expedited. ...

How long do I have to appeal Irmaa?

You have 60 days to ask for an appeal, beginning with the date you receive the letter notifying you that you owe Part D-IRMAA. SSA will assume you receive your notice 5 days after the date of the letter, unless you show that you did not get it within the 5-day period.

How do I stop Irmaa surcharges?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).

Can I appeal Medicare premiums?

Yes. If we determine you must pay more for your Medicare Part B or Medicare prescription drug coverage because of your income, and you disagree, you have the right to request an appeal, also known as a reconsideration.

How do I appeal Medicare surcharge?

How to Appeal. If you're subject to the surcharge, you should have received a notice from Social Security known as an initial determination. To request a review, complete Form SSA-44, and provide supporting documents.

How do I appeal Irmaa online?

Appealing an IRMAA decisionComplete a request to SSA for reconsideration. ... If your reconsideration is successful, your premium amounts will be corrected. ... If your OMHA level appeal is successful, your premium amount will be corrected. ... If your Council appeal is successful, your Part B premium amount will be corrected.

Is Irmaa adjustment retroactive?

If a change to your IRMAA determination occurs, corrections will be retroactive. If you request an appeal, you must: Ask for an appeal within 60 days. The 60 days start the day after you get your letter.

Can I appeal Irmaa?

As a beneficiary, you have the right to appeal if you believe that an Income Related Monthly Adjustment Amount (IRMAA) is incorrect for one of the qualifying reasons. First, you must request a reconsideration of the initial determination from the Social Security Administration.

How often is Irmaa reviewed?

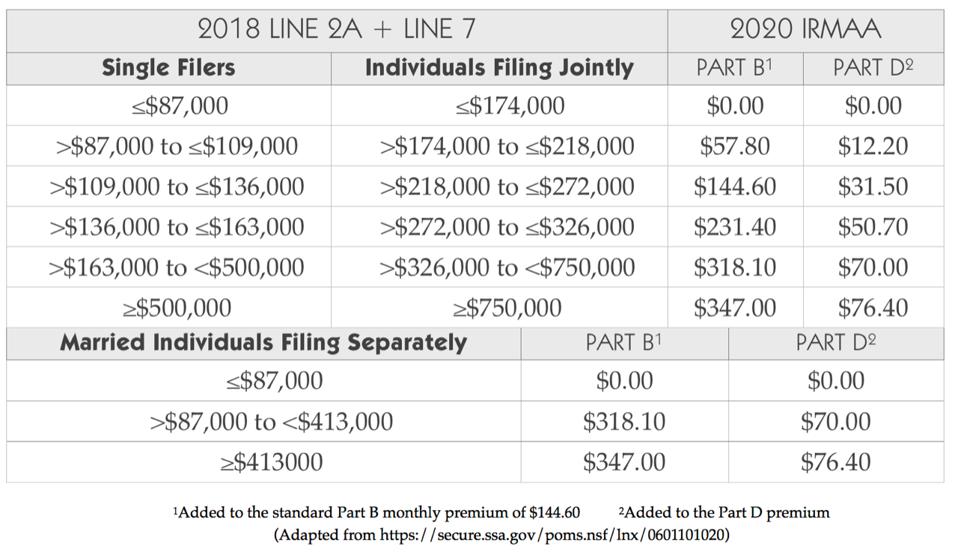

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually.

What are the five steps in the Medicare appeals process?

The Social Security Act (the Act) establishes five levels to the Medicare appeals process: redetermination, reconsideration, Administrative Law Judge hearing, Medicare Appeals Council review, and judicial review in U.S. District Court. At the first level of the appeal process, the MAC processes the redetermination.

Does Social Security income count towards Irmaa?

Some examples of what counts as income towards IRMAA are: Wages, Social Security benefits, Pension/Rental income, Interest, Dividends, distributions from any tax-deferred investment like a Traditional 401(k) or IRA and, again, Capital Gains.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

What are the Irmaa brackets for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $276,000 but less than or equal to $330,000$386.10More than $330,000 but less than $750,000$475.20More than $750,000$504.90Married filing separately12 more rows•Dec 6, 2021