The application process is as follows:

- Learn about the types of questions you might be asked when you apply. ...

- Once you have gathered all the necessary supporting documents, you should begin the application process.

- To apply for the program, contact your state’s Medicaid office. ...

- You would be notified in 45 days if you’ve been accepted or not. ...

Full Answer

What are the four Medicare savings programs?

To apply for a Medicare Savings Program, you’ll need to contact your State Health Insurance Assistance Program (SHIP). These state-run organizations receive federal funding to help provide financial assistance through MSPs and Part D Extra Help. You can also contact a licensed insurance agent, like the ones at GoHealth.

What if I need help paying for Medicare?

May 12, 2021 · How do I apply for a Medicare Savings Program? If you have or are eligible for Part A, your income for 2020 is at or below the income limits for any of the programs above, and you have limited resources below the limits above, you should call your state Medicaid program to see if you qualify in the state you reside.

What is SSA extra help?

Jan 06, 2022 · You can apply for the Medicare Savings Program in two ways: Apply online. In the digital world, everything works online. Every organization has a website where you can apply for a subscription. Insurance companies also offer this facility to people. You can apply for the Medicare Savings Program through the website.

How does a senior apply for extra help with Medicare?

13 rows · You must reside in California. You must provide verification of income, property/resources, and other necessary information if requested. You must be entitled to receive or must be receiving Medicare Parts A and/or B. Your countable property must not exceed: $7,970 for an individual, or. $11,960 for a couple.

How do I apply for a Medicare Savings Program?

If you have or are eligible for Part A, your income for 2020 is at or below the income limits for any of the programs above, and you have limited resources below the limits above, you should call your state Medicaid program to see if you qualify in the state you reside.

What are the advantages of a Medicare Savings Program?

Medicare Savings Programs allow citizens to save money on Medicare premiums, deductibles, copayments and coinsurance. Enrollment into MSPs automatically makes a person eligible to receive the extra help with prescription drug costs with Medicare’s Extra Help benefit.

How do I apply for Medicaid?

You can apply for Medicaid and enroll any time of year. Once you are ready to apply, contact your state Medicaid agenc y for more information or submit an application through the Health Insurance Marketplace on HealthCare.gov. Once enrolled, your state can provide a list of approved health care providers you can contact for services.

What if I am not eligible for Medicaid?

If you don’t qualify for Medicaid, Benefits.gov wants you to know you still have options. Since 2002, Benefits.gov has provided millions of citizens with information on over 1,000 government benefits. Fill out our Benefit Finder questionnaire to find out what other benefits you may be eligible to receive.

What is Medicare Savings Program?

A Medicare Savings Program (MSP) can help pay deductibles, coinsurance, and other expenses that aren’t ordinarily covered by Medicare. We’re here to help you understand the different types of MSPs. Below, we explain who is eligible for these programs and how to get the assistance you need to pay for your Medicare.

What are the different types of Medicare savings programs?

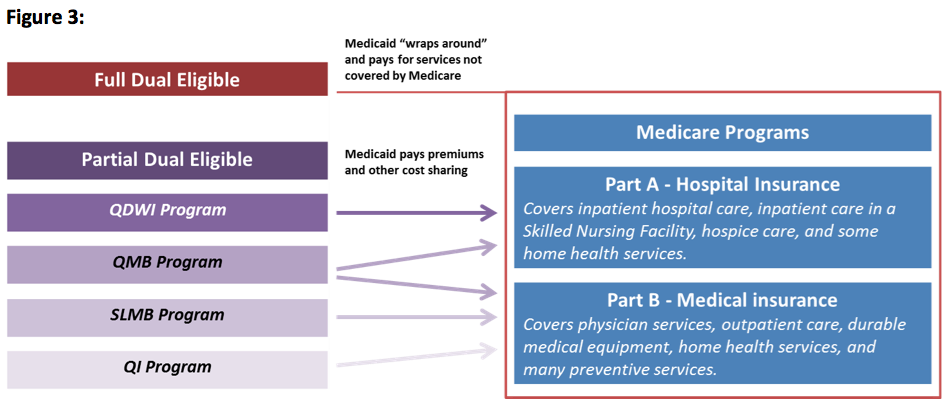

Types of Medicare Savings Programs 1 Qualified Medicare Beneficiary (QMB) Programs pay most of your out-of-pocket costs. These costs include deductibles, copays, coinsurance, and Part B premiums. A QMB will also pay the premium for Part A if you haven’t worked 40 quarters. Those who qualify for the QMB program are also automatically eligible for the Extra Help program for prescription drugs. 2 Specified Low-Income Medicare Beneficiary (SLMB) Programs pay your Part B premium. Like QMBs, those who qualify for SLMBs are automatically eligible for Extra Help. 3 Qualifying Individual (QI) Programs are also known as additional Low-Income Medicare Beneficiary (ALMB) programs. They offer the same benefit of paying the Part B premium, as does the SLMB program, but you can qualify with a higher income. Those who qualify are also automatically eligible for Extra Help. 4 Qualified Disabled and Working Individual (QDWI) Programs cover monthly Part A premiums for qualified individuals under 65 with disabilities who are currently working.

What is QI in Medicare?

Qualifying Individual (QI) Programs are also known as additional Low-Income Medicare Beneficiary (ALMB) programs. They offer the same benefit of paying the Part B premium, as does the SLMB program, but you can qualify with a higher income. Those who qualify are also automatically eligible for Extra Help.

How many types of MSPs are there?

There are four kinds of MSPs. Each type of MSP is tailored to different needs and circumstances. Qualified Medicare Beneficiary (QMB) Programs pay most of your out-of-pocket costs. These costs include deductibles, copays, coinsurance, and Part B premiums. A QMB will also pay the premium for Part A if you haven’t worked 40 quarters.

What is a QMB?

Qualified Medicare Beneficiary (QMB) Programs pay most of your out-of-pocket costs. These costs include deductibles, copays, coinsurance, and Part B premiums. A QMB will also pay the premium for Part A if you haven’t worked 40 quarters. Those who qualify for the QMB program are also automatically eligible for the Extra Help program ...

Does QMB pay for Part A?

A QMB will also pay the premium for Part A if you haven’t worked 40 quarters. Those who qualify for the QMB program are also automatically eligible for the Extra Help program for prescription drugs. Specified Low-Income Medicare Beneficiary (SLMB) Programs pay your Part B premium.

What is countable resource?

The term countable resources mean any money in bank accounts (checking or savings), stocks, and bonds. Your home, one car, a burial plot, up to $1,500 already saved for burial expenses, and personal belongings aren’t included when countable resources are considered.

How much is Medicare Part B in 2021?

Medicare Part B premium ($148.50 per month in 2021) Deductibles for both Part A ($1,484 per benefit period in 2021) and Part B ($203 annually in 2021) Coinsurance under both Part A and Part B. For example, under Part A, QMB pays the $371 per day for hospital days 61-90, and the $742 per day for the 60 hospital lifetime reserve days in 2021. ...

What is QMB in Medicare?

The Qualified Medicare Beneficiary (QMB) program helps pay for the following Medicare costs: Medicare Part A premium. Note: Some people are required to pay a premium for Medicare Part A because they do not have enough Social Security credits.

Does QDWI pay for Medicare?

QDWI pays for the Medicare Part A premium, but it doesn’t pay for Part B.

What is Medicare Savings Program?

The Medicare Savings Program (MSP) is a Medicaid-administered program that can assist people with limited income in paying for their Medicare premiums. Depending on your income, the MSP may also pay for other cost-sharing expenses.

What is the MSP program?

Medicare Savings Program (MSP) The Medicare Savings Program (MSP) is a Medicaid-administered program that can assist people with limited income in paying for their Medicare premiums. Depending on your income, the MSP may also pay for other cost-sharing expenses.