The application process is as follows:

- Learn about the types of questions you might be asked when you apply. ...

- Once you have gathered all the necessary supporting documents, you should begin the application process.

- To apply for the program, contact your state’s Medicaid office. ...

- You would be notified in 45 days if you’ve been accepted or not. ...

Full Answer

What are the four Medicare savings programs?

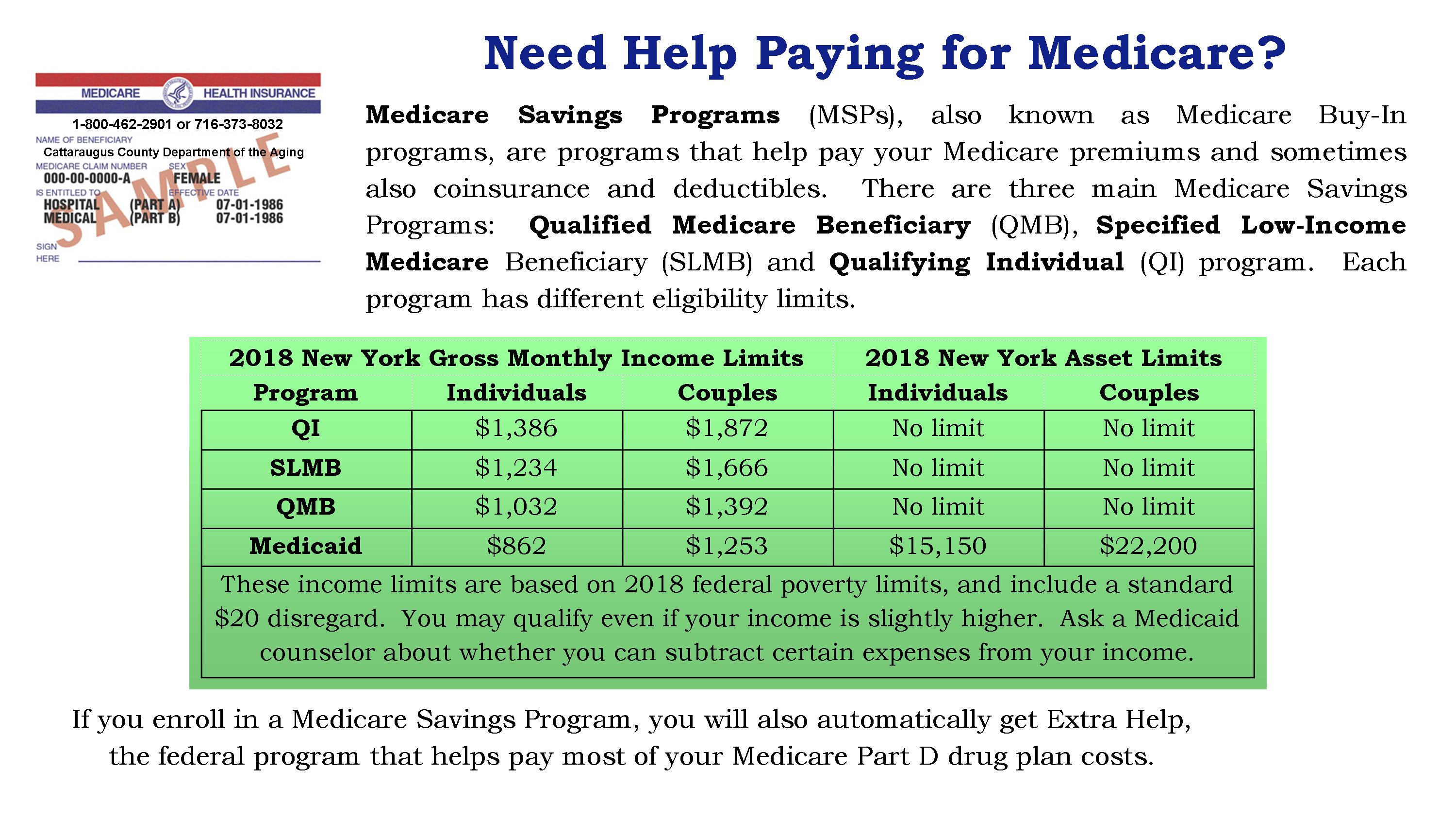

- Most MSPs pay Medicare Part B premiums and some help with additional Part A and B costs

- MSPs don’t cover costs from Medicare Part C plans (Medicare Advantage)

- Medicare beneficiaries who qualify for an MSP also receive Medicare Extra Help to help pay for prescription drugs

What if I need help paying for Medicare?

- Qualified Medicare Beneficiary Program (QMB). Helps to pay premiums for Part A and Part B, as well as copays, deductibles, and coinsurance. ...

- Specified Low Income Medicare Beneficiary Program (SLMB). Helps to pay premiums for Part B. ...

- Qualified Individual Program (QI). ...

- Qualified Disabled and Working Individuals Program (QDWI). ...

What is SSA extra help?

Extra Help is a low-income subsidy that helps pay for Part D premiums, deductibles, and copays. There are four categories of people who qualify for the Extra Help program. The categories are defined by the Medicare recipient's income in relation to the Federal Poverty Level (FPL).

How does a senior apply for extra help with Medicare?

These programs can help you pay your Medicare costs:

- Medicaid. Medicaid is federal program overseen by each state that helps people with limited incomes pay their healthcare costs.

- Medicare savings programs (MSPs). MSPs help people with limited incomes pay some of the out-of-pocket costs of Medicare.

- Program of All-inclusive Care for the Elderly (PACE). ...

- Extra Help. ...

How much money can you have in the bank if your on Medicare?

4. How to Qualify. To find out if you qualify for one of Medi-Cal's programs, look at your countable asset levels. As of July 1, 2022, you may have up to $130,000 in assets as an individual, up to $195,000 in assets as a couple, and an additional $65,000 for each family member.

What is the Medicare payback program?

The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C (Medicare Advantage) plans. If you enroll in a Medicare Advantage plan with this benefit, the plan carrier will pay some or all of your Part B monthly premium.

How much money can you make before it affects your Medicare?

an individual monthly income of $4,379 or less. an individual resources limit of $4,000. a married couple monthly income of $5,892 or less. a married couple resources limit of $6,000.

What does QMB mean in Medicare?

Qualified Medicare BeneficiarySPOTLIGHT & RELEASES. The Qualified Medicare Beneficiary (QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

What is the income limit for extra help in 2021?

To qualify for Extra Help, your annual income must be limited to $20,385 for an individual or $27,465 for a married couple living together.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

How much does Social Security take out for Medicare each month?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

Is QMB the same as Medicare?

The Qualified Medicare Beneficiary (QMB) Program is one of the four Medicare Savings Programs that allows you to get help from your state to pay your Medicare premiums. This Program helps pay for Part A premiums, Part B premiums, and deductibles, coinsurance, and copayments.

What does QMB without Medicare dollars mean?

This means that if you have QMB, Medicare providers should not bill you for any Medicare-covered services you receive.

Can you have Medicare and Medicaid?

Medicare-Medicaid Plans Medicare is working with some states and health plans to offer demonstration plans for certain people who have both Medicare and Medicaid and make it easier for them to get the services they need. They're called Medicare-Medicaid Plans.

How to apply for MSP?

Before applying for an MSP, you should call your local Medicaid office for application steps, submission information (online, mail, appointment, or through community health centers and other organizations), and other state-specific guidelines. Call your State Health Insurance Assistance Program (SHIP) to find out if you are eligible for an MSP in your state.

How long does it take to get a copy of my medicaid application?

If you are at a Medicaid office, ask that they make a copy for you. You should be sent a Notice of Action within 45 days of filing an application. This notice will inform you of your application status.

What is the Medicare Rights Center?

If you live in New York, the Medicare Rights Center can help you enroll in various Medicare cost-savings programs. Please answer a few questions to see if we can connect you with a trained benefits enrollment counselor.

How long does it take for a Part B to be paid back?

If you receive an approval : And are found eligible for SLMB or QI, the state will pay your Part B premium starting the month indicated on your Notice of Action. However, it may take several months for the Part B premium ($148.50 in 2021) to be added back to your monthly Social Security check.

What is the monthly income for Medicare?

If your monthly income is below $1630 (or below $2198 if married) you may qualify for several Medicare cost-savings benefit programs. The following information will help us determine which programs you might be eligible for.

How long does it take to get a notice of action from Medicaid?

If you do not receive a Notice of Action within 45 days, contact the Medicaid office where you applied.

What to do if you are denied an MSP?

If you receive a denial and are told you do not qualify for an MSP, you have the right to request a fair hearing to challenge the decision.

What is the income limit for Medicare Savings Program?

These income limits help you determine whether you are eligible for a certain program or not.

What is the difference between Medicare Savings Program and Medicaid?

Health insurance is an important facility that every person needs to have in life. The government provides many health insurance benefits through its organization to every kind of person.

What is Medicare?

Medicare is a health insurance program launched by the federal government of the United States to facilitate its citizens in medical benefits. This health insurance program is specifically designed for people older than 65 and young people with disabilities.

How does Medicare work?

The Medicare program was created under the Social Security Act 1965 to benefit old people and physically disabled people. The government was motivated to provide the best medical services to progress as a medically fit country. Medicare has continued with many modifications in policies based on the demands of people.

What does medical insurance cover?

When an insured person buys medical insurance, they are given all the medical benefits written in the plan.

Who Qualifies for a Medicare Savings Program?

To qualify for an MSP, you first need to be eligible for Part A. For those who don’t qualify for full Medicaid benefits, your monthly income must also be below the limits in the following chart.

What is QI in Medicare?

Qualifying Individual (QI) Programs are also known as additional Low-Income Medicare Beneficiary (ALMB) programs. They offer the same benefit of paying the Part B premium, as does the SLMB program, but you can qualify with a higher income. Those who qualify are also automatically eligible for Extra Help.

Can you get financial assistance if you are on a fixed income?

If you’re also on a fixed income, you could qualify for financial assistance with the high cost of health care. A Medicare Savings Program (MSP) can help pay deductibles, coinsurance, and other expenses that aren’t ordinarily covered by Medicare. We’re here to help you understand the different types of MSPs.

Does Medicare savers have a penalty?

Also, those that qualify for a Medicare Savings Program may not be subject to a Part D or Part B penalty. Although, this depends on your level of extra help and the state you reside in. Call the number above today to get rate quotes for your area.

What is the MSP program?

Medicare Savings Program (MSP) The Medicare Savings Program (MSP) is a Medicaid-administered program that can assist people with limited income in paying for their Medicare premiums. Depending on your income, the MSP may also pay for other cost-sharing expenses.

What is a QMB on Social Security?

If qualified, you will no longer have this premium amount deducted from your Social Security benefit. Qualified Medicare Beneficiary ( QMB): Pays for Medicare Part A premium for people who do not have enough work history to get premium free Part A. QMB also pays the Part B premium, deductibles and coinsurances.

What Is the Income Limit for the Medicare Savings Program?

These limits get adjusted each year. For 2021, the Medicare Savings Program income and resource limit s are:

How Much Money Can You Have in the Bank on Medicare?

Money in bank accounts is considered a resource when determining whether you’re eligible for a Medicare Savings Plan. This amount changes depending on which Medicare Savings Program you qualify for. Just like with income limits, your state may accept your application if your resources are higher than the limits allowed. To see if you are eligible, contact your local SHIP.

How old do you have to be to qualify for Medicare?

There are four types of Medicare Savings Programs. Three of them are available only if you have Medicare and are at least 65 years old: The Qualified Medicare Beneficiary (QMB) Program helps pay for Medicare Part A premiums and Medicare Part B premiums, deductibles, coinsurance, and copays.

What is the Medicare Extra Help program?

However, Medicare recipients who qualify for an MSP are also automatically eligible for Medicare Extra Help, which helps pay for a Medicare Part D prescription drug plan. Extra Help eliminates your premiums and deductibles. It also reduces your copays for generic and brand-name medications.

What is SLMB in Medicare?

The Specified Low-Income Medicare Beneficiary (SLMB) Program helps pay for Medicare Part B premiums only. You must already have Medicare Part A to qualify. You can take part in the SLMB program and other Medicaid programs at the same time. Some states may refer to this as the SLIMB program.

What is Medicare Part A?

Original Medicare is comprised of Medicare Part A (hospital insurance) and Medicare Part B (outpatient insurance). MSPs are run at the state level by each individual state’s Medicaid program. That means you need to contact your state’s Medicaid office to apply for an MSP. Even if you already take part in a Medicare Savings Program, ...

How long does Medicare Part B pay out?

The premium payments normally come out of your Social Security check. Service for these two MSPs may be retroactive for up to three months.

What is the fourth MSP?

The fourth MSP is available to workers who have a disability and are under age 65: The Qualified Disabled and Working Individuals (QDWI) Program helps workers who have a disability to pay Medicare Part A premiums. It’s only available to those who lost Part A coverage because they returned to work.

What is medicaid?

Medicaid is a federal assistance program that provides health insurance for low-income and vulnerable Americans. The program is partially funded by the states and each state can set its own eligibility requirements. Qualifying for Medicaid benefits depends largely on your income, but also on your age, disability status, pregnancy, household size, and your household role.

What is Medicare Savings Program?

If you have limited income and resources, a Medicare Savings Program (MSP) could help you save money on Medicare costs like premiums, deductibles and coinsurance. 1

Can you get QI if you qualify for medicaid?

QI applications are granted on a first-come, first-served basis, and you must apply each year. You can’t get QI benefits if you qualify for Medicaid.

How to contact Medicare Cost Sharing?

To learn more about Medicare Cost Sharing or to request an application call the Department of Human Services ( DHS) at 1-800-843-6154 (TTY: 1-800-447-6404). The call is free.

How Do I Know If I Qualify?

You must have Medicare Hospital Insurance (Part A). If you’re not sure whether you have it, look on your Medicare card or call Social Security, at 1-800-772-1213 (TTY:1-800-325-0778) to find out. The call is free.

Does Illinois pay Medicare?

The State of Illinois may pay some or all of the following Medicare expenses depending on your income: