Call Social Security at 1-800-772-1213 to apply over the phone or to request an application; or Apply at your local Social Security office. After you apply, Social Security will review the application and send you a letter informing whether you are qualified for Low Income Subsidy.

Full Answer

Can Medicare Part D be deducted from Social Security?

recognize that they can offer that only because the government pays them a fixed amount for your care from the Medicare Part B premium taken from your Social Security. The Part B premium you are paying from your Social Security benefit is why your Medicare ...

What is Medicare Part D?

What tiers are called and what they include can differ between plans, but here’s an example:

- Tier 1: The most generic drugs with the lowest copayments

- Tier 2: Preferred brand-name drugs with medium copayments

- Tier 3: Non-preferred brand name drugs with higher copayments

- Specialty: Drugs that cost more than $670 per month, the highest copayments 4

How to get Medicare D?

Read More Attention Medicare users: more access to free at-home COVID-19 tests is on the way A new initiative to increase access to at-home COVID-19 tests will start in early spring, the government says Read More Melinda French Gates and MacKenzie Scott ...

What are Medicare Part D providers?

Part D – Prescription Drug Coverage Medicare Part D is coverage offered by private insurance companies that cover your prescription drugs. You will have a monthly premium plus co-pays for each medication depending on whether it is generic, brand name, or a specialty medication.

Is Medicare Part D subsidized?

Part D Financing Medicare subsidizes the remaining 74.5%, based on bids submitted by plans for their expected benefit payments. Higher-income Part D enrollees pay a larger share of standard Part D costs, ranging from 35% to 85%, depending on income.

Does everyone have to pay for Medicare Part D?

You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums. If you don't pay the Part D IRMAA and get disenrolled, you may also lose your retirement coverage and you may not be able to get it back.

What are two options for Medicare consumers getting Part D?

You may have the choice of two types of Medicare plans—a stand-alone Medicare Part D Prescription Drug Plan or a Medicare Advantage Prescription Drug plan. Your Part D coverage choices are generally: A stand-alone Medicare Part D Prescription Drug Plan, if you have Medicare Part A or Part B or both.

Who are Medicare Part D eligible individuals?

Those 65 or older who are entitled to or already enrolled in Medicare are eligible for Part D drug insurance. Also eligible are people who have received Social Security Disability Insurance (SSDI) benefits for more than 24 months and those who have been diagnosed with end-stage renal disease.

How much does Medicare Part D cost in 2021?

If your filing status and yearly income in 2019 was:File individual tax returnFile joint tax returnYou pay each month (in 2021)above $170,000 and less than $500,000above $340,000 and less than $750,000$71.30 + your plan premium$500,000 or above$750,000 and above$77.90 + your plan premium4 more rows

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

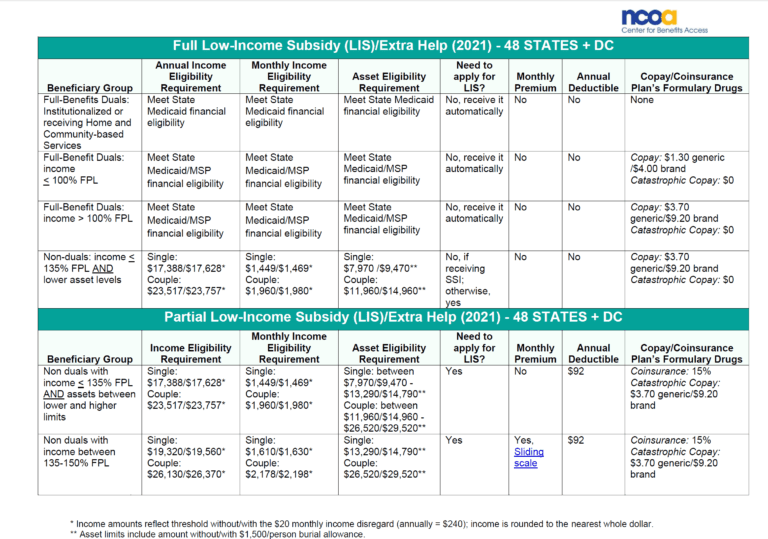

Can a consumer who qualifies for low income subsidy receive financial assistance for their part of Medicare Part D costs quizlet?

Through which means is financial assistance offered to a consumer who qualifies for Low Income Subsidy for their part of Medicare Part D costs? The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), which went into effect January 1, 2020, applies to all carriers offering Medicare supplement plans.

What happens if I don't have Medicare Part D?

If you don't sign up for a Part D plan when you are first eligible to do so, and you decide later you want to sign up, you will be required to pay a late enrollment penalty equal to 1% of the national average premium amount for every month you didn't have coverage as good as the standard Part D benefit.

When can you enroll in Medicare Part D?

The first opportunity for Medicare Part D enrollment is when you're initially eligible for Medicare – during the seven-month period beginning three months before the month you turn 65. If you enroll prior to the month you turn 65, your prescription drug coverage will begin the first of the month you turn 65.

What does Medicare Part D pay for?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan's list of covered drugs is called a “formulary,” and each plan has its own formulary.

Can Medicare Part D be added at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.