Go to www.socialsecurity.gov/medicare/apply.html and select “Apply for Medicare Only.” Use the “Related Information” links if you need more information. Apply and complete the application, which normally takes 10 to 30 minutes.

Full Answer

What is Medicare Plan F and how does it work?

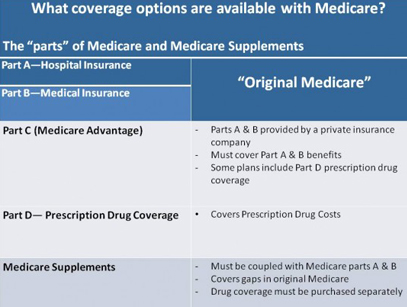

Medicare Plan F covers more expenses than any other supplement plans. It’s one of just two plans that pay for the Part B deductible. It also covers the Part B excess charge, a benefit that’s just as rare. Monthly premiums are typically higher than other plans, however.

How do I apply for Medicare Part B?

You can apply online (at Social Security) - select “Already Enrolled in Medicare” from the menu. Or, fax or mail your forms to your local Social Security office. If you live outside the U.S.: You may want to get Part B if you plan to return to the U.S. to get health care services.

What is Medicare Part B Part F?

Medicare Part B costs. Plan F is one of two Medicare Supplement plans that covers Part B excess charges (what some doctors charge above what Medicare pays for a service). Plan C is the other. Like many other Medigap policies, Plan F also covers Part B copayments and the deductible.

What are the alternatives to Medicare Plan F?

Two alternatives to regular Plan F—Plan G and high deductible Plan F—could be a better option for you. Beginning in 2020, Plans F and C, which cover the Part B deductible, are no longer available to people newly eligible to Medicare after January 1, 2020.

How do I get Medicare F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.

Can you still enroll in Medicare Part F?

Because of this, Plans C and F are no longer available to people new to Medicare on or after January 1, 2020. If you already have either of these 2 plans (or the high deductible version of Plan F) or are covered by one of these plans before January 1, 2020, you can keep your plan.

Can you get plan F in 2021?

Unfortunately, not every Medicare beneficiary can enroll in Medicare Supplement Plan F, as the plan was discontinued for many Medicare beneficiaries. You are only eligible to enroll if you received any part of Medicare before January 1, 2020. This is due to a change in Medicare known as MACRA.

What is the average cost of Medicare Part F?

How much does it cost for Medigap Plan F? The average premium for Medicare Supplement Insurance Plan F in 2022 is $172.75 per month, or $2,073 per year.

Why is plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

Is Medicare Part F still available 2022?

Previously, anyone enrolled in original Medicare could purchase Medigap Plan F. However, this plan is now being phased out. As of January 1, 2020, Medigap Plan F is only available to those who were eligible for Medicare before 2020.

What is Medicare Plan F being replaced with?

Popular Plan F Replacements Include Medicare Supplement Plan G and Plan N. There are no explicit replacements for Plan F – you'll have to choose from a number of existing Medicare Supplement plans.

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Can I switch back to plan F?

You pay for Medicare-covered costs up to the $2,490 deductible (as of 2022) before the plan begins to pay for anything. If you currently have Medicare Supplement Plan F, you can switch to high-deductible Plan F by contacting your insurance provider.

Does Medicare Plan F cover prescriptions?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.

What is the deductible for plan F in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490.

Does AARP plan F cover Medicare deductible?

In addition to the standard benefits offered under Plan A, AARP's Medicare Supplement Plan F covers: Medicare Part B excess charges. Your Medicare Part A deductible ($1,408 in 2020)

Medicare Eligibility, Applications, and Appeals

Find information about Medicare, how to apply, report fraud, and submit complaints.What help is available?Medicare is the federal health insurance...

Voluntary Termination of Medicare Part B

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 to the Social Secur...

Medicare Prescription Drug Coverage (Part D)

Part D of Medicare is an insurance coverage plan for prescription medication. Learn about the costs for Medicare drug coverage.EligibilityPrescript...

Replace Your Medicare Card

You can replace your Medicare card in one of the following ways if it was lost, stolen, or destroyed:Log into your MyMedicare.gov account and reque...

Medicare Coverage Outside the United States

Medicare coverage outside the United States is limited. Learn about coverage if you live or are traveling outside the United States.Original Medica...

Medicare Eligibility, Applications, and Appeals

Find information about Medicare, how to apply, report fraud and complaints.

Voluntary Termination of Medicare Part B

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 ( PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA ( 1-800-772-1213) to get this form.

Medicare Prescription Drug Coverage (Part D)

Part D of Medicare is an insurance coverage plan for prescription medication. Learn about the costs for Medicare drug coverage.

Replace Your Medicare Card

You can replace your Medicare card in one of the following ways if it was lost, stolen, or destroyed:

Medicare Coverage Outside the United States

Medicare coverage outside the United States is limited. Learn about coverage if you live or are traveling outside the United States.

Do you have a question?

Ask a real person any government-related question for free. They'll get you the answer or let you know where to find it.

When is Medicare newly eligible?

People who are 65 years of age or became first eligible for Medicare because of age, disability or end-stage renal sickness on or after January 1, 2020 are considered “newly eligible”. If you already had Medicare Part A and B in 2019, then you are NOT considered “newly eligible” and the MACRA rules do not apply to you.

Is Medicare Supplement Plan G the best?

For most of our clients, Medicare Supplement Plan G is usually the best short and long-term fit but there are lots of variables when it comes to choosing a plan. You can get prices and enroll in Medigap Plan F and G here. If you want to discuss your specific situation, give us a call at 800-930-7956.

What do you need to know before enrolling in a Part D plan?

The most important preparation you can do before finding a Part D plan is recording information about your medications.

When is the best time to sign up for Part D?

If you don’t have creditable drug coverage or health insurance from a current employer, the best time to sign up for Part D is during your 7-month initial enrollment period (IEP) to avoid penalties. Under your IEP, you have a 7-month window that opens 3 months before you turn 65 and closes at the end of the 3rd month following your birthday month.

How does dosage affect Part D?

Your dosage can affect your final cost or enact certain plan restrictions depending on the Part D plan. The frequency of the medication. The number of pills you take also affects the cost, so double check how often you take your medication and write it down. Once you have these recorded, you’ll be able to compare plans, apples-to-apples.

Is Medicare Part D a good program?

Although Medicare is not without its faults, one thing is clear: Medicare Part D has been a successful program. With nearly 70% of all beneficiaries enrolled in Part D, this optional add-on to Original Medicare is a popular way to lower drug costs. 1. But before diving into the deep end of Part D plans, you’ll want to perform due diligence ...