Applying in person at your local Social Security office The United States Social Security Administration is an independent agency of the U.S. federal government that administers Social Security, a social insurance program consisting of retirement, disability, and survivors' benefits. To qualify for most of these benefits, most workers pay Social …Social Security Administration

Railroad Retirement Board

The U.S. Railroad Retirement Board is an independent agency in the executive branch of the United States government created in 1935 to administer a social insurance program providing retirement benefits to the country's railroad workers.

Full Answer

How do I get Medicare if I am not receiving RRB?

If you are 65 and eligible for Medicare but not receiving RRB benefits at the time, contact your local field office to get enrolled in Medicare. • If you have a disability and are younger than 65, your eligibility for Medicare health care coverage differs from someone who is receiving Social Security benefits.

How does Medicare work with the Railroad Retirement Board (RRB)?

Generally, your Medicare costs through the RRB will be the same as those paid by people who qualify for Medicare via Social Security. Just like workers outside the railroad industry, you’ll see Medicare deductions from your paycheck during your working years.

How do I sign up for Medicare if I worked for railroad?

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772. About 2 weeks after you sign up, we’ll mail you a welcome package with your Medicare card. What can I do next? Print this page. Getting Medicare is your choice. If you want to sign up, contact Social Security.

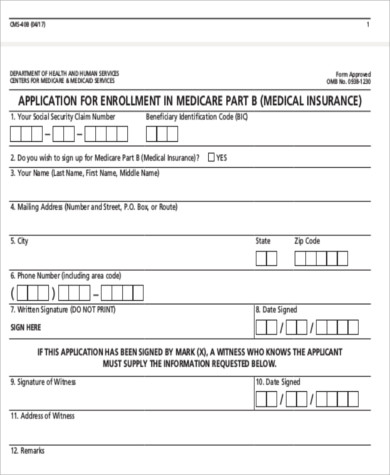

How do I apply for Medicare Part B?

You can apply online (at Social Security) - select “Already Enrolled in Medicare” from the menu. Or, fax or mail your forms to your local Social Security office. If you live outside the U.S.: You may want to get Part B if you plan to return to the U.S. to get health care services.

Who is entitled to railroad Medicare?

-- Most people age 65 or older who are citizens or permanent residents of the United States are eligible for free Medicare hospital insurance (Part A). You are eligible at age 65 if you receive or are eligible to receive railroad retirement or social security benefits.

Is there a difference between Medicare and railroad Medicare?

A: The only difference is that retired railroad beneficiaries have their Part B benefits administered by the Palmetto GBA Railroad Retirement Board Specialty Medicare Administrative Contractor (RRB SMAC) regardless of where they live. Members should be certain to advise providers of this when they receive treatment.

Who is eligible for railroad retirement benefits?

To be eligible for aged retirement benefits through RRB , a worker must have worked at least 10 years in covered service for the railroad industry, or at least 5 years after 1995.

How do I apply for railroad retirement?

Your Railroad Retirement annuity does not begin automatically – you must apply for benefits by contacting the nearest Railroad Retirement Board office. To contact your local RRB office, call (877) 772-5772 or use the RRB Zip Locator at www.rrb.gov to find the office nearest you.

Can you collect social security and railroad retirement at the same time?

Answer: Yes, you can apply for and receive both benefits, but the Tier 1 portion of your Railroad Retirement Annuity will be reduced by the amount of your Social Security benefit, so you may not receive more in total benefits.

What is Medicare railroad?

The Federal Medicare program provides hospital and medical insurance protection for railroad. retirement annuitants and their families, just as it does for social security beneficiaries.

Which is better railroad retirement or Social Security?

Employers and employees covered by the Railroad Retirement Act pay higher retirement taxes than those covered by the Social Security Act. As a result, railroad retirement benefits are higher than social security benefits, especially for “career” employees (those employees who have 30 or more years of service).

What is the average railroad retirement payment?

The average age annuity being paid by the Railroad Retirement Board (RRB) at the end of fiscal year 2017 to career rail employees was $3,415 a month, and for all retired rail employees the average was $2,730. The average age retirement benefit being paid under social security was over $1,370 a month.

What is the difference between tier 1 and Tier 2 railroad retirement benefits?

Tier 1 benefits are adjusted for the cost of living by the same percentage as Social Security benefits. Tier 2 benefits are based on the employee's service in the rail- road industry and are payable in addition to the tier 1 benefit amount.

At what age is railroad retirement no longer taxed?

This is age 60 with 30 or more years of railroad service or age 62 with less than 30 years of railroad service. beginning date. Partition payments are not subject to tax-free calculations using the EEC amount. Note - The RRB does not provide or compute the tax-free amount of railroad retirement annuities.

How long does it take to get your first railroad retirement check?

within 65 daysYou will receive your first payment, or a decision, within 65 days of the date you file your application, or become entitled to benefits, if later.

Do I have to pay taxes on my railroad retirement?

Railroad retirement annuities are not taxable by states in accordance with section 14 of the Railroad Retirement Act (45 U.S.C. § 231m). The RRB will not withhold state income taxes from railroad retirement payments. Form RRB W-4P is used by United States citizens or legal residents for U.S. tax purposes.

What Medicare Parts does RRB automatically enroll you in?

If you are receiving Railroad Retirement benefits or railroad disability annuity checks when you become eligible for Medicare, RRB should automatically enroll you in Medicare Parts A and B . You should receive your red, white, and blue Medicare card and a letter from RRB explaining that you have been enrolled in Medicare.

What to do if you are not collecting Railroad Retirement?

If you are not collecting Railroad Retirement benefits when you turn 65, you should contact your local RRB field office to enroll in Medicare. If you are under 65 and have a disability, you will have to fulfill different eligibility requirements to qualify for Medicare.

Does Medicare Part B get deducted from your check?

If you receive Railroad Retirement benefits or railroad disability annuity checks, your Medicare Part B premium should be automatically deducted from your check each month. If you do not qualify for premium-free Part A, it will also be deducted from your check.

What forms do I need to file for railroad retirement?

If you have already received a monthly railroad retirement annuity payment, you may file Forms AA-1d and G-251 for the period of disability and early Medicare coverage. Normally, you would do this if you:

How to expedite disability annuity?

To expedite filing for a disability annuity, you or a family member should call or write the nearest Railroad Retirement Board (RRB) field office to schedule an appointment. For the appointment, bring in any medical evidence in your possession and any medical records you can secure from your treating physicians.

What is the RRB in 2020?

Licensed Insurance Agent and Medicare Expert Writer. June 15, 2020. Before the Social Security Administration (SSA) was formed, the Railroad Retirement Board (RRB) developed retirement, disability, and unemployment benefits for railroad workers who were hit hard by the Great Depression. Today, the RRB offers railroad workers a similar safety net.

What is the number to call a railroad retirement board?

Call a Licensed Agent: 833-271-5571. Due to COVID-19, the Railroad Retirement Board closed offices as of March 16, 2020. We’ll keep you updated on when offices reopen. In the meantime, visit RRB.gov to learn about your online self-serve options.

How long do you have to enroll in Medicare if you have end stage renal disease?

Whether you become eligible for Medicare via age or disability, you’ll have seven months, called your Initial Enrollment Period (IEP), in which to enroll.

When do you become eligible for Medicare?

Typically, you’ll become eligible when you turn 65 or reach your 25th month of receiving disability benefits. The main difference is that the RRB classifies disability differently than the SSA does, so check with a representative ...

Does Medicare pay through the RRB?

Generally, your Medicare costs through the RRB will be the same as those paid by people who qualify for Medicare via Social Security. Just like workers outside the railroad industry, you’ll see Medicare deductions from your paycheck during your working years.

Does RRB have Medicare?

Today, the RRB offers railroad workers a similar safety net. RRB beneficiaries can tap into Medicare benefits, much like Social Security beneficiaries, with a few differences. If you are a railroad worker, learn what you can expect from Medicare in terms of eligibility, enrollment, costs, and health benefits—and how your RRB benefits differ ...

Do you pay Medicare Part D premiums through RRB?

If you add Medicare Part D, Medigap, or Medicare Advantage, you’ll pay additional premiums for these as well, but not through your RRB income checks. You’ll pay for each of these coverages separately, directly to the insurance company that provides each plan.

What is the RRB?

The RRB administers insurance and retirement benefits to all railroad workers in the country. Instead of getting retirement benefits from the U.S. Social Security Administration as other workers do, the RRB provides railroad workers and their families with retirement benefits, along with unemployment and sickness benefits, ...

Where is the railroad retirement board on my Medicare card?

Your Medicare card is similar to the new Medicare cards that all beneficiaries receive, with the exception that “Railroad Retirement Board” is printed in a red banner at the bottom of the card .

What happens if you receive a railroad retirement?

If you receive Railroad Retirement benefits or disability annuity benefits from the railroad at the time of eligibility for Medicare, you are automatically enrolled in Medicare Parts A and B by the RRB. After the RRB automatically enrolls you, you receive your Medicare card together with a letter from the RRB explaining ...

Do you have to go through the Social Security Administration if you are employed by the railroad?

However, if you have end-stage renal disease (ESRD) and qualify for Medicare, you must go through the Social Security Administration even if you are employed by the railroad.

Does Medicare cover railroad employees?

Medicare offers coverage to railroad employees just as it does for people who have Social Security. The payroll taxes of railroad employees include railroad retirement and Medicare hospital insurance taxes.