How to get insurance during a special enrollment period?

- Got married. Pick a plan by the last day of the month and your coverage can start the first day of the next month.

- Had a baby, adopted a child, or placed a child for foster care. ...

- Got divorced or legally separated and lost health insurance. ...

- Died. ...

When is your Medicare supplement special enrollment period?

Your Special Enrollment Period starts 60 days before and lasts for 63 days after your previous coverage ends. Your Medigap policy can’t begin until your previous coverage (under Medicare Advantage or PACE) is finished, since Medigap plans only work with Original Medicare. Have Medicare Advantage or Medicare SELECT & Want to Switch Back to Medigap?

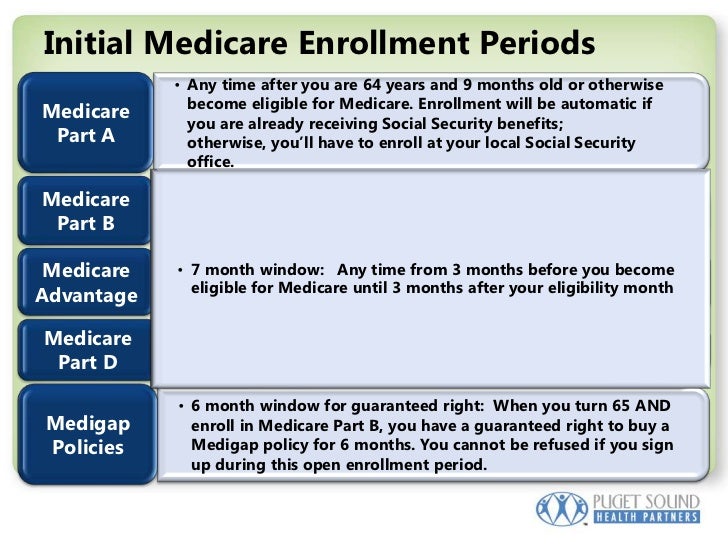

What are the types of Medicare enrollment periods?

What are the Types of Medicare Enrollment Periods

- First Enrollment Time Period (IEP)

- General Enrollment Time Frame

- Health Insurance Benefit Disenrollment Period (MADP)

- Relevant information on When to Register for Health insurance

How to time your Medicare enrollment?

You can enrol in Medicare if you live in Australia and you’re any of these:

- an Australian citizen

- a New Zealand citizen

- an Australian permanent resident

- applying for permanent residency

- a temporary resident covered by a ministerial order.

What is the special enrollment period for Medicare Part B?

What is the Medicare Part B special enrollment period (SEP)? The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse's current job. You usually have 8 months from when employment ends to enroll in Part B.

Which of the following is a qualifying life event for a Medicare Advantage Special Enrollment Period?

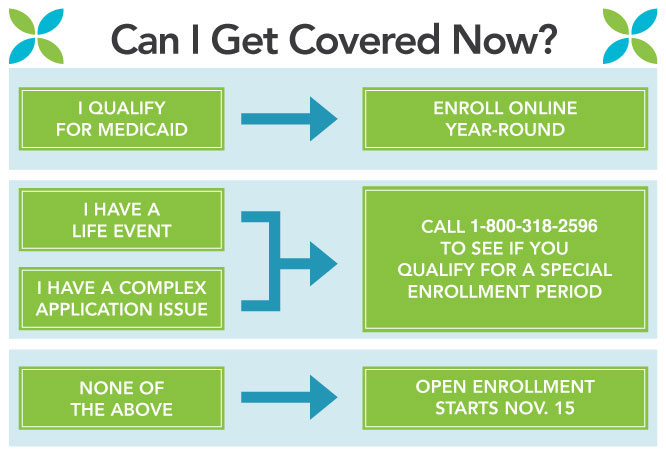

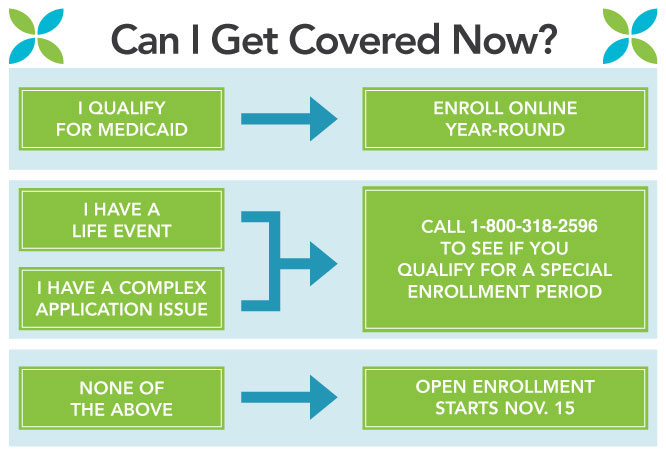

You qualify for a Special Enrollment Period if you've had certain life events, including losing health coverage, moving, getting married, having a baby, or adopting a child, or if your household income is below a certain amount.

What qualifies as a life changing event for Medicare?

A change in your situation — like getting married, having a baby, or losing health coverage — that can make you eligible for a Special Enrollment Period, allowing you to enroll in health insurance outside the yearly Open Enrollment Period.

Can you add Medicare Part B at any time?

You can sign up for Medicare Part B at any time that you have coverage through current or active employment. Or you can sign up for Medicare during the eight-month Special Enrollment Period that starts when your employer or union group coverage ends or you stop working (whichever happens first).

What can I do during OEP?

During MA OEP, you can make the following changes:Switch Medicare Advantage plans.Drop Medicare Advantage plan coverage and return to Original Medicare.Add a standalone Part D drug plan if you drop Medicare Advantage coverage.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How do I get my Medicare premium reduced?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

What does the IRS consider a qualifying event?

Qualifying life events are those situations that cause a change in your life that has an effect on your health insurance options or requirements. The IRS states that a qualifying event must have an impact on your insurance needs or change what health insurance plans that you qualify for.

When should I fill out SSA-44?

You should fill out Form SSA-44 if you experience any life-changing event that reduces your income. Life-changing events that qualify are marriage, divorce, death of a spouse, work stoppage, work reduction, loss of income-producing property, loss of pension income and employer settlement payment.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Do you have to enroll in Medicare Part B every year?

Do You Need to Renew Medicare Part B every year? As long as you pay the Medicare Part B medical insurance premiums, you'll continue to have the coverage. The premium is subtracted monthly from most people's Social Security payments. If you don't get Social Security, you'll get a bill.

Why Would I Need A Medicare Special Enrollment period?

Medicare has limited enrollment periods for Part A and Part B. Many people are automatically enrolled when they turn 65 or qualify through disabili...

When Might I Qualify For A Medicare Special Enrollment period?

Certain situations may qualify you to enroll in Part A and/or Part B using a Medicare Special Enrollment Period. Some qualifying situations may inc...

Medicare Special Enrollment Period For The Working Aged

If you (or your spouse) are still working when you turn 65 and have group coverage through an employer or union, you can generally delay Part A and...

Medicare Special Enrollment Period For International Volunteers

Individuals volunteering in a foreign country may be able to enroll in Part A and/or Part B with a Medicare Special Enrollment Period when they ret...

Medicare Special Enrollment Period For Disabled Tricare Beneficiaries

TRICARE is health insurance for retired and active-duty service members and their families. If you’re a retired service member, you must enroll in...

Medicare Special Enrollment Period If You Were Living Overseas

There are other situations where you may be able to enroll in Medicare outside of normal enrollment periods without a Special Enrollment Period. Th...

What is a special enrollment period?

A Special Enrollment Period (SEP) is an enrollment period that takes place outside of the annual Medicare enrollment periods, such as the annual Open Enrollment Period. They are granted to people who were prevented from enrolling in Medicare during the regular enrollment period for a number of specific reasons.

When is the open enrollment period for Medicare?

Learn more and use this guide to help you sign up for Medicare. Open Enrollment: The fall Medicare Open Enrollment Period has officially begun and lasts from October 15 to December 7, 2020. You may be able to enroll in ...

What happens if you don't enroll in Medicare at 65?

If you did not enroll in Medicare when you turned 65 because you were still employed and were covered by your employer’s health insurance plan, you will be granted a Special Enrollment Period.

How long does Medicare Advantage coverage last?

If you had a Medicare Advantage plan with prescription drug coverage which met Medicare’s standards of “creditable” coverage and you were to lose that coverage through no fault of your own, you may enroll in a new Medicare Advantage plan with creditable drug coverage beginning the month you received notice of your coverage change and lasting for two months after the loss of coverage (or two months after receiving the notice, whichever is later).

How long do you have to disenroll from Medicare?

If you wish to disenroll from employer or union-sponsored coverage (including a group-sponsored Medicare Advantage plan) in order to enroll in Medicare Advantage, or you wish to disenroll from Medicare Advantage in order to join an employer or union-sponsored plan, you may do so for up to two months following the end of your previous coverage.

How many stars do you need to be to enroll in Medicare Advantage?

If you are enrolled in a Medicare Advantage plan that has received a Plan Performance Rating of three stars or less for three consecutive years, 1 you may enroll in a higher rated plan throughout the year.

What is the number to call for Medicare enrollment?

If you have a particular situation that prevented you from enrolling in any type of Medicare coverage for which you were eligible, you are encouraged to call 1-800-MEDICARE and request a Special Enrollment Period.

When might I qualify for a Medicare Special Enrollment Period?

Certain situations may qualify you to enroll in Part A and/or Part B using a Medicare Special Enrollment Period. Some qualifying situations may include:

When does Medicare enroll in Part A?

Medicare has limited enrollment periods for Part A and Part B. Many people are automatically enrolled when they turn 65 or qualify through disability. Read about automatic enrollment and Medicare’s usual enrollment periods.

How long do you have to enroll in Medicare if you are still working?

When that employment – or your health coverage – ends, you can typically enroll in Part A and Part B with a Medicare Special Enrollment Period. You have eight months to enroll, beginning the month that employment or employment-based coverage ends – whichever happens first. You may not have to pay a late enrollment penalty for not enrolling when you were first eligible.

What is a SEP in Medicare?

A Medicare Special Enrollment Period (SEP) can let you sign up for Original Medicare Part A and/or Part B outside of regular enrollment periods. If you’re not eligible for an SEP, you’ll have usually to wait until the next General Enrollment Period to sign up for Part A and/or Part B. You might also have to pay a late enrollment penalty ...

What is tricare insurance?

TRICARE is health insurance for retired and active-duty service members and their families. If you’re a retired service member, you must enroll in Part B to stay eligible for TRICARE benefits. However, TRICARE beneficiaries who qualify for Medicare based on disability, Lou Gehrig’s disease (ALS) or end stage renal disease (ESRD) ...

How many times can you use Medicare Special Enrollment?

The month that the person is notified of Part A enrollment. This Medicare Special Enrollment Period can only be used one time during the TRICARE beneficiary’s lifetime.

How to contact Medicare for Part B?

For more information on Part B enrollment for U.S. citizens living abroad, contact Medicare at 1-800-MEDICARE (1-800-633-4227) . If you’re a TTY user, call 1-877-486-2048. Customer service representatives can be reached 24 hours a day, seven days a week.

How long do you have to be in your household to qualify for special enrollment?

You may qualify for a Special Enrollment Period if you or anyone in your household in the past 60 days:

What are the conditions for a special enrollment period?

Other life circumstances that may qualify you for a Special Enrollment Period: Gaining membership in a federally recognized tribe or status as an Alaska Native Claims Settlement Act (ANCSA) Corporation shareholder. Becoming newly eligible for Marketplace coverage because you became a U.S. citizen.

How to contact the Marketplace for life insurance?

If you had a life event other than a loss of coverage more than 60 days ago and missed your Special Enrollment Period, contact the Marketplace Call Center at 1-800-318-2596 (TTY: 1-855-889-4325) for more information. End highlighted text.

Can you enroll in a special enrollment period if you are moving?

Note: Moving only for medical treatment or staying somewhere for vacation doesn’t qualify you for a Special Enrollment Period.

Can you qualify for a special enrollment period if you lose Medicaid?

You may qualify for a Special Enrollment Period if you lose Medicaid or Children’s Health Insurance Program (CHIP) coverage because:

Can you drop your dependent's insurance?

Important: Voluntarily dropping coverage you have as a dependent doesn't qualify you for a Special Enrollment Period unless you also had a decrease in household income or a change in your previous coverage that made you eligible for savings on a Marketplace plan.

Does the 2021 Marketplace plan count towards deductible?

Note: If you change plans or add a new household member, any out-of-pocket costs you already paid on your current 2021 Marketplace plan probably won’t count towards your new deductible, even if you stay with the same insurance company. Call your insurance company before changing plans or adding a new household member to find out if you’ll need to start over to meet your new plan’s deductible.

What is the Medicare Part B Special Enrollment Period (SEP)?

The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse’s current job. You usually have 8 months from when employment ends to enroll in Part B. Coverage that isn’t through a current job – such as COBRA benefits, retiree or individual-market coverage – won’t help you qualify for this SEP, but the SEP lasts for 8 months, so you may still qualify if your employment ended recently.

How many forms do you need to submit to get SEP?

Beneficiaries must submit two forms to get approval for the SEP.

How do I use the Part B SEP?

To use this SEP you should call the Social Security Administration at 1-800-772-1213 and request two forms: the Part B enrollment request form (CMS 40B) and the request for employment information form (CMS L564). You’ll complete the Medicare enrollment application and give the request for employment information form to the employer to fill out. You want to request additional copies of form L564 from Social Security if you’ve been covered through more than one job-based plan since you qualified for Medicare.

What is a Part B SEP?

The Part B SEP allows beneficiaries to delay enrollment if they have health coverage through their own or a spouse’s current employer. SEP eligibility depends on three factors. Beneficiaries must submit two forms to get approval for the SEP. Coverage an employer helps you buy on your own won’t qualify you for this SEP.

What to do if your Social Security enrollment is denied?

If your enrollment request is denied, you’ll have the chance to appeal.

When do you have to take Part B?

You have to take Part B once your or your spouse’s employment ends. Medicare becomes your primary insurer once you stop working, even if you’re still covered by the employer-based plan or COBRA. If you don’t enroll in Part B, your insurer will “claw back” the amount it paid for your care when it finds out.

Can disabled people get SEP?

People 65 and older only qualify for this SEP if they have coverage through their own or their spouse’s job, but disabled individuals can also qualify because they’re covered by a non-spouse family member’s plan.

When does the enrollment period start for a group health plan?

Your initial enrollment period starts three months before the month you attain age 65 and ends three months after the month you turn 65. If your group health plan coverage is based on severance or retirement pay and the job your coverage is based on ended in the last eight months.

How old do you have to be to get Medicare?

If you are age 65 or older, you or your spouse are still working and you are covered under a group health plan based on that current employment, you may not need to apply for Medicare medical insurance (Part B) at age 65. You may qualify for a "Special Enrollment Period" (SEP) that will let you sign up for Part B: 1 During any month you remain covered under the group health plan and your, or your spouse's, current employment continues; or 2 In the eight-month period that begins with the month after your group health plan coverage or the current employment it is based on ends, whichever comes first.#N#Exception: If your group health plan coverage or the employment it is based on ends during your initial enrollment period for Medicare Part B, you do not qualify for a SEP. Your initial enrollment period starts three months before the month you attain age 65 and ends three months after the month you turn 65. 3 If your group health plan coverage is based on severance or retirement pay and the job your coverage is based on ended in the last eight months.

What is a SEP in health insurance?

You may qualify for a "Special Enrollment Period" (SEP) that will let you sign up for Part B: During any month you remain covered under the group health plan and your, or your spouse's, current employment continues; or.

Do people on Social Security have a special enrollment period?

People who receive Social Security disability benefits and are covered under a group health plan from either their own or a family member's current employment also have a special enrollment period and premium rights similar to those for workers age 65 or older.

How long do you have to submit documents to enroll in Marketplace?

After you pick a plan, you have 30 days to send the documents. Find your life event on the list below to see what kinds of documents you can submit:

What to include if denied Medicaid?

Examples include: a denial letter from your state agency, a letter from the Marketplace, or a screenshot of your eligibility results. See the full list.

Changes in Household

Changes in Residence

- Household moves that qualify you for a Special Enrollment Period: 1. Moving to a new home in a new ZIP code or county 2. Moving to the U.S. from a foreign country or United States territory 3. If you're a student, moving to or from the place you attend school 4. If you're a seasonal worker, moving to or from the place you both live and work 5. Moving to or from a shelter or other transit…

Loss of Health Insurance

- You may qualify for a Special Enrollment Period if you or anyone in your household lost qualifying health coverage in the past 60 days (or more than 60 days ago but since January 1, 2020) OR expects to lose coverage in the next 60 days. Coverage losses that may qualify you for a Special Enrollment Period:

An Employer Offer to Help with The Cost of Coverage

- You may qualify for a Special Enrollment Period if you or anyone in your household newly gained access to an individual coverage HRA or a Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) in the past 60 days OR expects to in the next 60 days. Note:Your employer may refer to an individual coverage HRA by a different name, like the acronym “ICHRA.…

More Qualifying Changes

- Other life circumstances that may qualify you for a Special Enrollment Period: 1. Gaining membership in a federally recognized tribe or status as an Alaska Native Claims Settlement Act (ANCSA) Corporation shareholder 2. Becoming newly eligible for Marketplace coverage because you became a U.S. citizen 3. Leaving incarceration 4. Starting or ending service as an AmeriCorp…