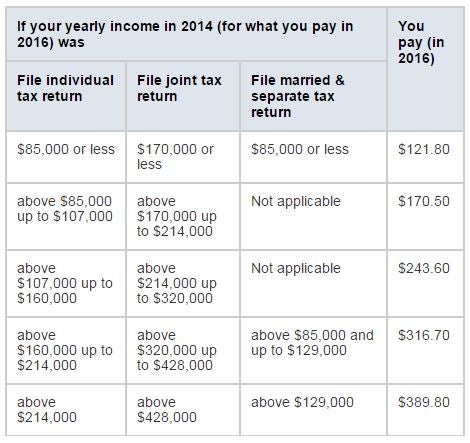

Defer income to avoid a premium surcharge The standard premium for Medicare Part B is $170.10 per month in 2022 – but that assumes you’re not a higher earner. Those with higher income levels are subject to higher premium costs.

Full Answer

How to avoid paying higher Medicare premiums?

10 ways to avoid paying higher Medicare premiums. 1 Start early. Once you start taking required minimum distributions (RMDs), in most cases starting at age 70½, you have no control over that income, ... 2 Maximize contributions to HSAs. 3 Take money from your Roth IRA. 4 Consider an HECM. 5 Life insurance withdrawals? More items

How much does Medicare cost per month?

Medicare costs at a glance. If you buy Part A, you'll pay up to $437 each month in 2019 ($458 in 2020). If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $437 ($458 in 2020). If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $240 ($252 in 2020).

Are You being surprised at the cost of Medicare premiums?

Many people who are new to Medicare are surprised at the monthly cost of Part B Medicare premiums. Medicare premiums sometimes come as a shock to new Medicare beneficiaries. Maybe you noticed that the federal government has been deducting taxes out of your paychecks for years.

How can I reduce Medicare surcharges?

Votava recommends working with your advisers “to see what elements of your retirement plan can be adjusted to limit unnecessary Medicare surcharges.” Additionally, she says, you can plan for those surcharges to limit sticker shock. Your IRMAA will be based on your income two years prior.

How can I avoid paying Medicare premiums?

Those premiums are a burden for many seniors, but here's how you can pay less for them.Sign up for Part B on time. ... Defer income to avoid a premium surcharge. ... Pay your premiums directly from your Social Security benefits. ... Get help from a Medicare Savings Program.

How can I avoid paying $144 for Medicare?

If you are having trouble paying premiums for Medicare, consider these ways to reduce your Medicare premiums.File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction.More items...•

What part of Medicare does not require a monthly premium?

Part APart A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Can I get Medicare Part B for free?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

Is Medicare really free?

Medicare is a federal insurance program for people aged 65 years and over and those with certain health conditions. The program aims to help older adults fund healthcare costs, but it is not completely free. Each part of Medicare has different costs, which can include coinsurances, deductibles, and monthly premiums.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Does everyone have to pay for Medicare?

A: Most Medicare-eligible people do not have to pay premiums for Medicare Part A. If you are 65 and you or your spouse has paid Medicare taxes for at least 10 years, you don't pay a premium for Part A.

Why is my first Medicare bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

Why do I have to pay for Medicare Part B?

You must keep paying your Part B premium to keep your supplement insurance. Helps lower your share of costs for Part A and Part B services in Original Medicare. Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

When to convert Roth IRA to Medicare?

Floyd recommends planning ahead by doing Roth IRA conversions early — preferably by age 63 (or two years before starting Medicare if you’re staying on an employer plan after age 65) so the conversion income won’t trigger the IRMAA.

What to do if you are subject to IRMAA?

If you’re subject to IRMAA, there are several steps you can take to avoid or reduce the extra charges added to your Part B and Part D premiums. The key, says Votava, is to maximize your cash flow without increasing taxable income.

When will the GH2 brackets be adjusted for inflation?

And beginning in 2020, these brackets will be adjusted for inflation, in the same way that COLA is calculated for Social Security, says Jae Oh, the managing principal of GH2 Benefits and the author of "Maximize Your Medicare.".

Does Medicare use your MAGI?

Medicare uses your MAGI from two years earlier to determine if you’ll pay that extra charge in 2020. “I hear of so many people who are caught by surprise by the IRMAA,” says Elaine Floyd, director of retirement and life planning at Horsesmouth. “This is really an essential part of tax and retirement planning because it can add thousands ...

Why do people get higher Medicare premiums?

The most common reason that people get assessed higher Medicare premiums is because they have recently retired. Their income two years ago was higher than it is now that they are retired. You can file a reconsideration request to appeal your Medicare IRMAA.

Do you have to be enrolled in Medicare Supplement or Medicare Advantage?

Whether you decide to enroll in a Medicare Supplement or a Medicare Advantage plan, you must first be enrolled in both Medicare Parts A and B. That means that you are paying for Part B every month even if you enroll in a low-premium Medicare Advantage plan.

Can you deduct Medicare premiums on taxes?

Yes, Medicare premiums can be deducted from taxes in the right circumstances. if you have had enough medical expenses to file an itemized deduction for medical expenses on your Form 1040.

Does Medicare Advantage have a zero premium?

In some states though, particularly in Florida, there are some Medicare Advantage plans that not only have a zero-premium, but also offer you a Part B premium reduction. The way this works is that the Advantage plan pays for a portion of your Part B premiums.

Do Medicare premiums go toward Part B?

Many people who are new to Medicare are surprised at the monthly cost of Part B Medicare premiums. Medicare premiums sometimes come as a shock to new Medicare beneficiaries. Maybe you noticed that the federal government has been deducting taxes out of your paychecks for years. And yes, these deductions go toward funding your future Part A Medicare ...

How much do Medicare beneficiaries pay in out-of-pocket costs?

According to the Kaiser Family Foundation, the average Medicare beneficiary spent $5,460 in total out-of-pocket costs in 2016.

Seven ways to minimize out-of-pocket costs

You cannot avoid all out-of-pocket costs, but you can do your best to minimize them. Most importantly, you can plan and anticipate them so you can avoid surprise medical bills. Here’s what you can do:

1. Sign up on time

Enroll in Medicare on time to avoid late penalties, especially because you could get stuck paying some of those penalties for as long as you have Medicare coverage. It is important to not miss these deadlines.

2. Pick the right Medicare doctors

Choose doctors – whenever possible – who not only accept Medicare for payment but who also “accept assignment.” This means they signed a contract to charge no more than Medicare-approved rates for their services.

3. Ask about your hospital orders

Not all hospital stays are billed the same – even when you stay overnight. Ask your doctor about your orders, inpatient or observation, when you stay in the hospital.

4. Watch for billing errors

Check your Medicare bills for accuracy. Paying for services that were never provided or for other billing errors is wasteful. Do not hesitate to reach out to your doctor’s billing office if you have questions or concerns.

5. Consider Medicare supplement plans

Consider a Medicare supplement plan – also known as Medigap – to save on expenses not covered by Original Medicare. Depending on the plan you choose, they can help to cover your Part A deductible, Part A/B coinsurance, and even healthcare you receive in a foreign country.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.