Full Answer

Can I delay Medicare Part B without paying a penalty?

Mar 07, 2022 · If you don’t qualify to delay Part B, you’ll need to enroll during your Initial Enrollment Period to avoid paying the penalty. You may refuse Part B without penalty if you have creditable coverage, but you have to do it before your coverage start date. Follow the directions on the back of your Medicare card if you want to refuse Part B.

What is the penalty for not taking Medicare Part B?

Oct 01, 2020 · How to Avoid the Medicare Part B Penalty. If playback doesn't begin shortly, try restarting your device. Videos you watch may be added to the TV's watch history and influence TV recommendations. To avoid this, cancel and sign in to YouTube on your computer. An error occurred while retrieving sharing information.

How do you opt out of Medicare Part B?

Part B late enrollment penalty. If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B. And, the penalty increases the longer you go without Part B coverage.

How to avoid Medicare Part B excess charges?

Dec 01, 2020 · Enroll in Part B as soon as you are eligible and you will avoid Medicare’s Part B enrollment penalty. This penalty can be substantial because it is permanent and you will continue to pay it the remainder of your life. The exception to the penalty is if you are covered by group health plan because you or your spouse are still working.

How do I avoid Medicare Part B penalty?

If you don't qualify to delay Part B, you'll need to enroll during your Initial Enrollment Period to avoid paying the penalty. You may refuse Part B without penalty if you have creditable coverage, but you have to do it before your coverage start date.

Is there a cap on Medicare Part B penalty?

Is There a Cap on the Medicare Part B Penalty? As of now, there is no cap on the Part B late enrollment penalty. However, if passed, the Medicare Part B Fairness Act or H.R. 1788 would cap the penalty amount at 15% of the current premium, regardless of how many 12-month periods the beneficiary goes without coverage.

Is Part B mandatory on Medicare?

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed later, you don't have to enroll in Part B, particularly if you're still working when you reach age 65.

Can I decline Medicare Part B?

Declining Part B Coverage You can decline Medicare Part B coverage if you can't get another program to pay for it and you don't want to pay for it yourself. The important thing to know about declining Part B coverage is that if you decline it and then decide that you want it later, you may have to pay a higher premium.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

How do I appeal a Medicare Part B premium?

First, you must request a reconsideration of the initial determination from the Social Security Administration. A request for reconsideration can be done orally by calling the SSA 1-800 number (800.772. 1213) as well as by writing to SSA.

How do I opt out of Medicare?

To opt out, you will need to:Be of an eligible type or specialty.Submit an opt-out affidavit to Medicare.Enter into a private contract with each of your Medicare patients.Dec 1, 2021

What parts of Medicare are mandatory?

There are four parts to Medicare: A, B, C, and D. Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse.

Can I opt out of Medicare Part B at any time?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.Nov 24, 2021

Why was I automatically enrolled in Medicare Part B?

You automatically get Part A and Part B after you get disability benefits from Social Security or certain disability benefits from the RRB for 24 months. If you're automatically enrolled, you'll get your Medicare card in the mail 3 months before your 65th birthday or your 25th month of disability.

What happens if you don't sign up for Medicare Part B?

Medicare Part B Late Enrollment Penalty. If you’re new to Medicare and don’t sign up for Part B when you’re first eligible, you may end up having to pay the Part B late enrollment penalty. The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying ...

How long does Medicare Part B last?

Your IEP begins three months before your birth month and ends three months after your birth month.

What is the late enrollment penalty?

The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying it every month for as long as you have Part B.

When does Part B start?

General Enrollment runs from January 1st to March 31st each year. If you enroll at this time, your coverage will not start until July 1st. Meaning you may be without insurance if you have ...

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What happens if you don't get Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

When does Part B start?

You waited to sign up for Part B until March 2019 during the General Enrollment Period. Your coverage starts July 1, 2019. Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B.

How long do you have to dispute a Part D drug claim?

If you are charged a penalty for Part D, you can dispute it. You will be notified by letter that you are going to be charged a penalty. Along with that letter, you will receive a reconsideration request form. You have 60 days from the date of the letter to provide proof to support your case. Proof of creditable prescription drug coverage should be sufficient.

Can you appeal a Part B penalty?

The only way you can dispute it is you received bad advice from a government agent on delaying your enrollment. If this is the case, you need to put a case together with information regarding the time and date of the conversation, the name of the person, and what you did as a result of the information.

Is TRICARE a creditable plan?

You may already be part of a prescription drug plan that will waive the penalty. If you are enrolled in a drug plan from your current or former employer, TRICARE, the Indian Health Service, the Veterans Administration, or even individual health coverage, it is considered creditable. Make sure you tell your Medicare plan about this coverage.

Part B late enrollment penalty

Some people are automatically enrolled in Medicare Part B, while others have to sign up. In most cases, if you don’t sign up for Part B when you’re first eligible, you’ll have to pay a late enrollment penalty for as long as you have Part B.

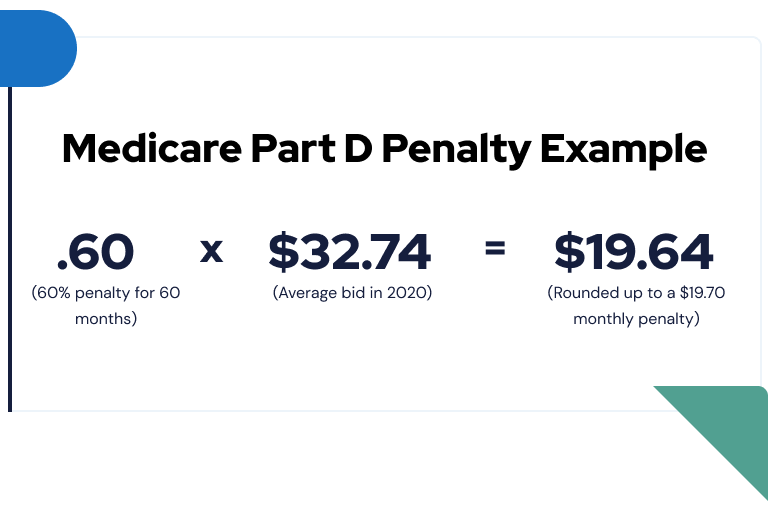

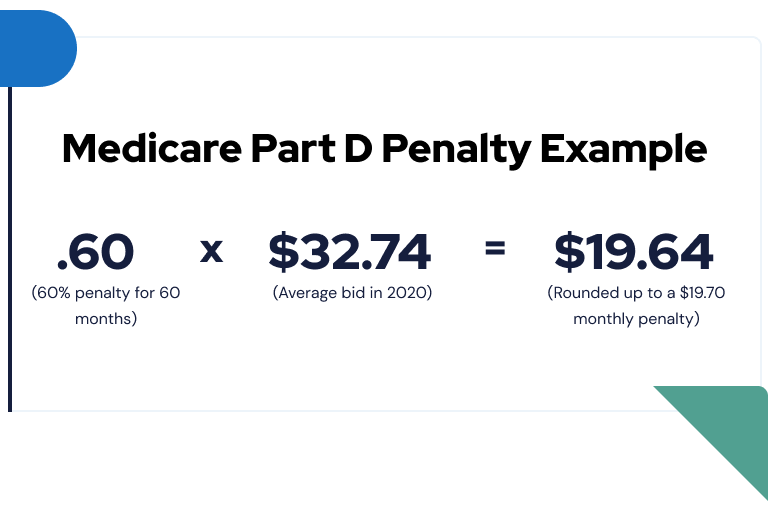

Part D penalty

The government requires everyone on Medicare to have creditable prescription drug coverage (Part D coverage that’s at least as good as Medicare’s standard).

The easiest way to avoid this penalty?

You can simply sign up for a Part D plan or find a private plan that offers prescription drug coverage when you sign up for Medicare. To learn more, visit medicare.gov or talk to a Medicare expert you trust.

Need help paying for coverage?

If you’re delaying enrollment in Part B and/or Part D because you can’t afford it, check to see if you qualify for help.

What happens if you don't sign up for Medicare Part A?

If not, you might be subject to the Medicare Part A late enrollment penalty. Unfortunately, this penalty may increase your monthly premium by up to 10%. In most cases, you might have to pay this increased premium for double the number of years you could have had Part A but did not sign up. Let’s give an example.

What happens if you wait too long to enroll in Medicare?

If you wait too long, you might have to pay the Medicare Part B late enrollment penalty. Unlike Part A, you’ll typically have to pay a Part B penalty for as long as you have Part B. Your penalty has the potential to increase up to 10% for every year you were eligible but did not sign up. Let’s give another example.

How long does open enrollment for Medicare last?

Your Open Enrollment Period lasts seven months: three months before, through the month of, and three months after your 65th birthday. You may be wondering: what if I don’t enroll in Medicare during this time period? ...

When do you get Medicare Part A?

Thankfully, most people don’t have to worry about enrolling in Medicare Part A. It’s common that you will automatically qualify for Medicare Part A when you turn 65. If this happens for you, you’ll typically receive Part A premium-free.

How many parts are there in Medicare?

As you’re doing your research, you’ll learn that there are four parts to Medicare: Medicare Part A, Part B (Original Medicare), Part C (Medicare Advantage), and Part D (Medicare Prescription Drug Coverage). There are different penalties for enrolling late into most of the different parts of Medicare. Let’s dive into the specific penalties ...

Does Medicare cover prescription drugs?

In most cases, Medicare considers prescription drug coverage from programs such as Medicare Part C (Medicare Advantage), a current or former employer, TRICARE, Indian Health Service, Department of Veterans Affairs, or any other Medicare health plan that offers prescription drug coverage as credible prescription drug coverage.

How long does Medicare Supplement last?

Your enrollment period for a Medicare Supplement plan starts once you enroll in Part B and lasts for six months. While you won’t have to pay a late enrollment penalty if you miss your Medicare Supplement open enrollment period, you’ll have to undergo medical underwriting when applying for your Medicare Supplement plans.