How to appeal a higher Medicare Part B premium?

Jun 20, 2016 · How to Avoid Excess Medicare Part B and D Premiums. by Joanne Tackes | Jun 20, 2016 | CPA, Joanne Tackes. The vast majority (>95%) of Medicare subscribers pay the standard premium for Medicare Part B coverage and for the prescription drug coverage (Medicare Part D) plan that they choose. The other 5% of subscribers are deemed high income …

What is the standard premium for Medicare Part B?

Aug 12, 2021 · The first way to control Medicare premiums is to be aware of the ways that you can influence your income. After the age of 63 (assuming that you start Medicare at age 65), maximizing pre-tax contributions to retirement plans, IRAs, HSAs, and other tax-deferred vehicles can help to reduce your income below one of these premium thresholds.

How do I reduce my Medicare premium?

Jan 07, 2022 · “How can I avoid paying more for the premiums for Medicare Part B and the prescription drug plan?” Higher-income beneficiaries are subject to an Income-related Monthly Adjustment Amount, IRMAA for short. Since 2007, this amount has been added on top of the premium for Medicare Part B.

How much will you pay for Medicare Part B?

Mar 07, 2022 · If you have other creditable coverage, you can delay Part B and postpone paying the premium. You can sign up later without penalty, as long as you do it within eight months after your other coverage ends. If you don’t qualify to delay Part B, you’ll need to enroll during your Initial Enrollment Period to avoid paying the penalty.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

How can I reduce my Medicare Part B premiums?

Those premiums are a burden for many seniors, but here's how you can pay less for them.Sign up for Part B on time. ... Defer income to avoid a premium surcharge. ... Pay your premiums directly from your Social Security benefits. ... Get help from a Medicare Savings Program.Jan 3, 2022

Is Medicare Part B premium mandatory?

Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month.Sep 16, 2014

Is Medicare Part B ever free?

Medicare Part B isn't free, and it doesn't cover everything Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California Life, Accident, and Health Insurance Licensed Agent, and CFA.

Why is my Medicare Part B premium so high?

According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

Will Part B premium be reduced?

In 2021, the Part B premium increased by only $3 a month, but Congress directed CMS to begin paying that reduced premium back, starting in 2022.Jan 25, 2022

Can I opt out of Part B Medicare?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.Nov 24, 2021

How do I defer Medicare Part B?

If you want to defer Medicare coverage, you don't need to inform Medicare. It's simple: Just don't sign up when you become eligible. You can also sign up for Part A but not Part B during initial enrollment.

Can I cancel my Part B Medicare?

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 (PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA (1-800-772-1213) to get this form.

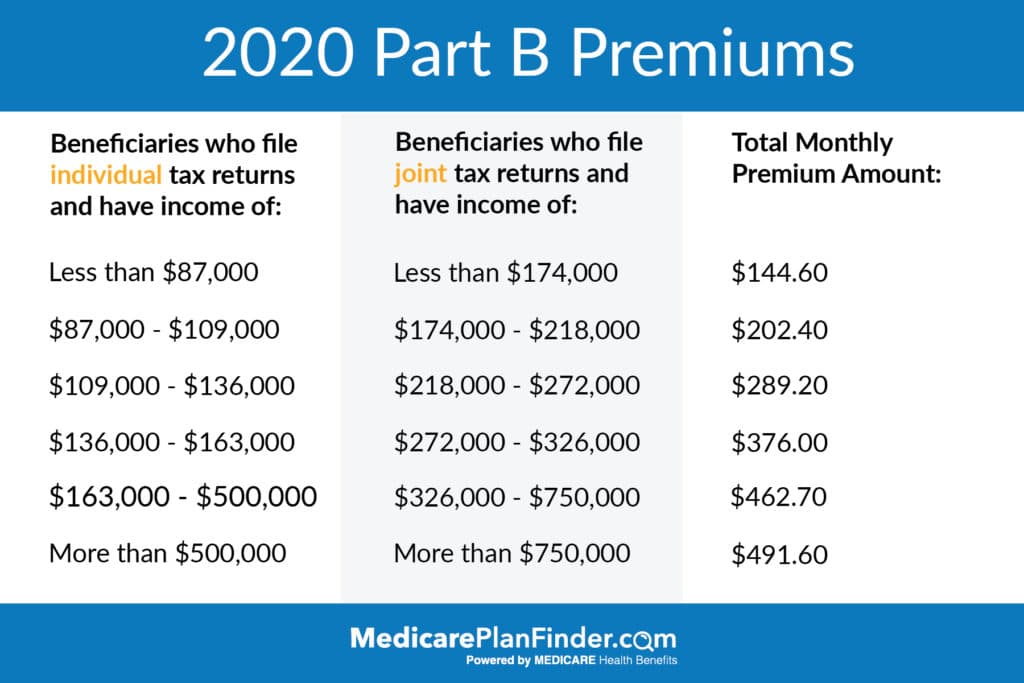

Is Medicare premium based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Is Medicare Part B going up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How long do you have to wait to sign up for Medicare?

You can sign up for Medicare three months before your 65th birthday month. You then have a seven-month-long Initial Enrollment Period. There’s a financial motive to enroll during that time. In general, if you wait and sign up for Part B later, you will pay a late enrollment penalty.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What are some examples of life changing events?

Examples of life-changing events include retirement, divorce, and the death of your spouse.

Do you pay taxes on a Roth IRA?

If you contribute money to a Roth IRA or 401K, you pay taxes on the money when you put it in. But the income you earn is tax-free. In some cases, you can convert a traditional IRA or 401K to a Roth. If you contribute to a health savings account, your contributions AND the income from them aren’t taxed as long as you use them for healthcare.

Can you deduct Medicare premiums?

Deductible medical expenses include premiums you paid for Parts B, D, and Medicare Advantage. However, there are limits to this deduction. First, you must have enough total deductions to itemize your deductions rather than taking the standard deduction.Second, you cannot deduct all your medical charges.

How much does Medicare Part B pay?

How to Avoid the Medicare Part B Late Penalty. Medicare Part B pays 80 percent of outpatient health care costs and 100 percent for many preventive services. But it pays to think carefully about when to sign up. Here’s why.

How long do you have to sign up for Part B?

You may qualify for a Special Enrollment Period when your employer coverage ends if you meet these qualifications. You’ll have eight months to sign up for Part B without penalty.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Does Medicare cover VA?

VA benefits cover care you receive in a VA facility. Medicare covers care you receive in a non-VA facility. With both VA benefits and Medicare, you’ll have options for getting the care you need. It’s usually a good idea to sign up for Medicare Part B when you become eligible.

Can you keep Cobra if you have Medicare?

Usually you can’t keep COBRA once you become eligible for Medicare. You’ll want to sign up for Medicare Part A and Part B when you turn 65, unless you have access to other creditable coverage. However, you may be able to keep parts of COBRA that cover services Medicare doesn’t, such as dental care.

Why do people get higher Medicare premiums?

The most common reason that people get assessed higher Medicare premiums is because they have recently retired. Their income two years ago was higher than it is now that they are retired. You can file a reconsideration request to appeal your Medicare IRMAA.

Can you deduct Medicare premiums on taxes?

Yes, Medicare premiums can be deducted from taxes in the right circumstances. if you have had enough medical expenses to file an itemized deduction for medical expenses on your Form 1040.

Do you have to be enrolled in Medicare Supplement or Medicare Advantage?

Whether you decide to enroll in a Medicare Supplement or a Medicare Advantage plan, you must first be enrolled in both Medicare Parts A and B. That means that you are paying for Part B every month even if you enroll in a low-premium Medicare Advantage plan.

How much is Medicare Part B 2021?

The standard premium for Medicare Part B is $148.50 per month in 2021 – but that assumes you’re not a higher earner. Those with higher income levels are subject to higher premium costs.

How long can you go without Medicare?

But for each 12-month period you go without Medicare coverage despite being eligible, you’ll be hit with a penalty that raises your Part B premium cost by 10 percent.

Is Medicare Part A free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here’s how you can pay less for them. 1. Sign up for Part B on time. Your initial window to enroll in Medicare ...

Background

Medicare Part B is commonly called “medical insurance.” For each Medicare participant, premiums are $148.50 per month for 2021, but could be higher. Part D is commonly called “prescription drug coverage.” For each participant, premiums are paid each month; the rate depends on the Part D plan chosen.

Prior Articles

Kitces (2017) points out that IRMAA tax began in 2007 and started hitting a lot more individuals in 2018 as the threshold amounts were lowered. IRMAA tax thus has become an important issue for financial planners with higher-income clients relatively recently.

Filing Form SSA-44 When the Client Retires

Clients might owe no or lower IRMAA tax in the first two years of retirement if there is a “life-changing event” and Form SSA-44 is filed with the Social Security Administration (SSA), and properly shows that MAGI from the current or previous year will be one or more IRMAA thresholds below MAGI from two years prior—when the client was employed.

First Scenario: 401 (k) Contribution as Employee and 100 Percent Tax-Deferred Retirement Accounts as Retiree

Even if the client has the most tax-disadvantaged investments (i.e., all in tax-deferred retirement accounts (TDRAs) such as traditional 401 (k)s and IRAs) to be used for spending in retirement, filing Form SSA-44 can still result in IRMAA tax savings while maintaining the same level of after-tax cash flow.4 In the present scenario, assume the client’s only wealth is in TDRAs.

Second Scenario: Roth 401 (k) Contribution as Employee and 100 Percent TDRAs Before Such Contribution

Continue to assume the same facts with two changes: salary increases to $119,738; and during the last two years as a salaried employee, the client contributes $13,000 to a Roth 401 (k) instead of a traditional 401 (k) as in the first scenario.

Third Scenario: 401 (k) Contribution as Employee, 54.5 Percent in TDRAs and 45.5 Percent in Taxable Account

Next, we will assume the client has a $3.025 million nest egg at the start of 2022—$1.65 million in an IRA and $1.375 million of stock, with a basis of $825,000, that does not pay dividends and is not in a tax-advantaged account—and withdraws $66,000 from the IRA and sells $55,000 of stock for both years.

Fourth Scenario: Roth 401 (k) Contribution as Employee, 54.5 Percent in TDRAs and 45.5 Percent in Taxable Account Before Such Contribution

Continue to assume the same facts as the last scenario with two changes: salary increases to $178,452; and during the last two years as a salaried employee, the client contributed $18,000 to a Roth 401 (k) instead of a traditional 401 (k). These last two years are the first time the client has ever contributed to a Roth retirement account.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.