How To Minimize Your Medicare Surtax

- Before you sell a highly appreciated home, consider your income levels and the Medicare surtax. Most Americans will not...

- Take advantage of tax loss harvesting. I’ve been helping clients with this valuable tax-saving strategy since 2004, and...

- Look for ways to reduce your AGI. The lower your AGI (the number at the bottom of the TAX...

Full Answer

How to avoid paying higher Medicare premiums?

Aug 15, 2019 · If you’re 70 ½ or older, you can make QCDs of up to $100,000 in a single tax year to an unlimited number of 501 (c) (3) charitable organizations. Donations made to a private foundation or donor-advised fund will not qualify. The QCD will satisfy your RMD.

How does your taxable income affect your Medicare costs?

Nov 09, 2021 · How To Minimize Your Medicare Surtax Before you sell a highly appreciated home, consider your income levels and the Medicare surtax. Most Americans will not... Take advantage of tax loss harvesting. I’ve been helping clients with this valuable tax-saving strategy since 2004, and... Look for ways to ...

How can I reduce Medicare surcharges?

Apr 06, 2022 · And here are five ways to avoid the Medicare surcharge before it happens: If you’re still working, contribute to your 401 (k) or other tax-deferred account (such as a SEP IRA, if you’re self-employed). Contributions will reduce your modified adjusted gross income (MAGI), which is used to calculate the surcharge.

Is there a medicare surcharge on investment income?

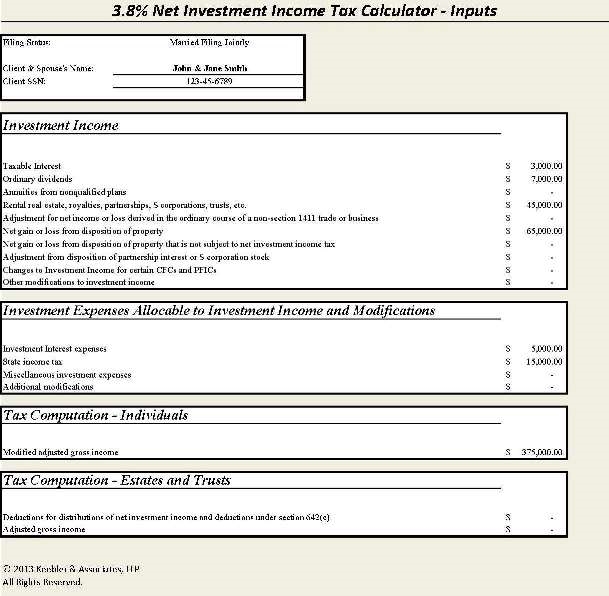

Avoiding the 3.8% Medicare Tax on Net Investment Income. The Affordable Care Act included a new 3.8% Medicare tax on net investment income which first took effect for 2013. “Net investment income” for these purposes includes most interest, dividends, rents, royalties, capital gains and passive income from a trade or business.

How can I be exempt from Medicare tax?

Wages paid for certain types of services are exempt from Social Security/Medicare taxes. Examples of exempt services include: Compensation paid to a duly ordained, commissioned, or licensed minister of a church in the exercise of his ministry.Sep 15, 2021

At what income do you stop paying Medicare tax?

FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.Jan 13, 2022

Why do I owe Medicare tax?

An individual will owe Additional Medicare Tax on wages, compensation and self-employment income (and that of the individual's spouse if married filing jointly) that exceed the applicable threshold for the individual's filing status.Jan 18, 2022

Is paying Medicare tax mandatory?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.Mar 3, 2022

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

Do I pay Medicare taxes on Social Security?

If you work for an employer, you and your employer each pay a 6.2% Social Security tax on up to $147,000 of your earnings. Each must also pay a 1.45% Medicare tax on all earnings. If you're self-employed, you pay the combined employee and employer amount.

Does everyone pay the same Medicare tax?

Does everyone on Medicare have to pay this tax? While everyone pays some taxes toward Medicare, you'll only pay the additional tax if you're at or above the income limits. If you earn less than those limits, you won't be required to pay any additional tax.

What is the Medicare tax limit for 2021?

2021 Wage Cap Rises for Social Security Payroll TaxesPayroll Taxes: Cap on Maximum EarningsType of Payroll Tax2021 Maximum Earnings2020 Maximum EarningsSocial Security$142,800$137,700MedicareNo limitNo limitSource: Social Security Administration.Oct 13, 2020

How do I avoid paying the Medicare levy surcharge?

How to avoid the Medicare Levy Surcharge. In order to avoid the surcharge, you must have the appropriate level of cover. For singles, that means a policy with an excess of $500 or less. For couples or families, it means an excess of $1,000 or less.

Why is Medicare being taken out of my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.Mar 28, 2022

Who qualifies for Medicare?

age 65 or olderGenerally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance).

What is the Medicare tax limit for 2020?

The Social Security tax rate remains at 6.2 percent. The resulting maximum Social Security tax for 2020 is $8,537.40. There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax....2020 Social Security and Medicare Tax Withholding Rates and Limits.Tax2019 Limit2020 LimitMedicare liabilityNo limitNo limit3 more rows

Best Covid-19 Travel Insurance Plans

There is a flat Medicare surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI). For single filers, the threshold is just $200,000 of AGI. This is yet another example of the marriage penalty at work in our tax code.

What Types of Income Are Subject to the Medicare Surtax?

Income sources like interest, dividends, capital gains, rental income, royalties, and even some other passive investment income will be counted.

How To Minimize Your Medicare Surtax

I hope you have such a big income paired with much growth in your investments that you can’t eliminate the Medicare surtax. But with some smart tax planning guidance, you should be able to minimize the amount of Medicare surtax you are required to pay each year.

Background

Medicare Part B is commonly called “medical insurance.” For each Medicare participant, premiums are $148.50 per month for 2021, but could be higher. Part D is commonly called “prescription drug coverage.” For each participant, premiums are paid each month; the rate depends on the Part D plan chosen.

Prior Articles

Kitces (2017) points out that IRMAA tax began in 2007 and started hitting a lot more individuals in 2018 as the threshold amounts were lowered. IRMAA tax thus has become an important issue for financial planners with higher-income clients relatively recently.

Filing Form SSA-44 When the Client Retires

Clients might owe no or lower IRMAA tax in the first two years of retirement if there is a “life-changing event” and Form SSA-44 is filed with the Social Security Administration (SSA), and properly shows that MAGI from the current or previous year will be one or more IRMAA thresholds below MAGI from two years prior—when the client was employed.

First Scenario: 401 (k) Contribution as Employee and 100 Percent Tax-Deferred Retirement Accounts as Retiree

Even if the client has the most tax-disadvantaged investments (i.e., all in tax-deferred retirement accounts (TDRAs) such as traditional 401 (k)s and IRAs) to be used for spending in retirement, filing Form SSA-44 can still result in IRMAA tax savings while maintaining the same level of after-tax cash flow.4 In the present scenario, assume the client’s only wealth is in TDRAs.

Second Scenario: Roth 401 (k) Contribution as Employee and 100 Percent TDRAs Before Such Contribution

Continue to assume the same facts with two changes: salary increases to $119,738; and during the last two years as a salaried employee, the client contributes $13,000 to a Roth 401 (k) instead of a traditional 401 (k) as in the first scenario.

Fourth Scenario: Roth 401 (k) Contribution as Employee, 54.5 Percent in TDRAs and 45.5 Percent in Taxable Account Before Such Contribution

Continue to assume the same facts as the last scenario with two changes: salary increases to $178,452; and during the last two years as a salaried employee, the client contributed $18,000 to a Roth 401 (k) instead of a traditional 401 (k). These last two years are the first time the client has ever contributed to a Roth retirement account.

Mechanics of Filing Form SSA-44

When an individual first applies for Medicare, and then in subsequent years, during November, they receive a letter from SSA, called an Annual Verification Notice, that determines if they have to pay IRMAA for the upcoming year.

Seven Ways to Avoid Medicare Traps and Costly Blunders

YONKERS, NY — If you’re about to turn 65, you’ll be part of the first wave of baby boomers signing up for Medicare. Consumer Reports Health recommends signing up as early as three months ahead of your birthday. Failing to do so could potentially cost you thousands of dollars down the road.

About Consumer Reports

Consumer Reports is a nonprofit membership organization that works side by side with consumers to create a fairer, safer, and healthier world.

What is the IRMAA based on?

Your IRMAA will be based on your income two years prior. For example, 2020 Medicare premiums will be based on income reported on 2018 tax returns, says Floyd. “If you have stopped working and your income will be lower than the amount shown on the tax return used to figure the IRMAA, you can appeal using Form SSA-44.

What is a HECM mortgage?

An HECM, or home equity conversion mortgage, is a reverse mortgage insured by the U.S. Federal Government. A HECM allows seniors to convert the equity in their home into tax-free cash flow. Medicare Part B premium 2020: Rates and deductibles rising 7% for outpatient care. Watch out: How you could endanger your own 401k.

What to do if you are subject to IRMAA?

If you’re subject to IRMAA, there are several steps you can take to avoid or reduce the extra charges added to your Part B and Part D premiums. The key, says Votava, is to maximize your cash flow without increasing taxable income.

When to convert Roth IRA to Medicare?

Floyd recommends planning ahead by doing Roth IRA conversions early — preferably by age 63 (or two years before starting Medicare if you’re staying on an employer plan after age 65) so the conversion income won’t trigger the IRMAA.

When will the GH2 brackets be adjusted for inflation?

And beginning in 2020, these brackets will be adjusted for inflation, in the same way that COLA is calculated for Social Security, says Jae Oh, the managing principal of GH2 Benefits and the author of "Maximize Your Medicare.".

Does Medicare use your MAGI?

Medicare uses your MAGI from two years earlier to determine if you’ll pay that extra charge in 2020. “I hear of so many people who are caught by surprise by the IRMAA,” says Elaine Floyd, director of retirement and life planning at Horsesmouth. “This is really an essential part of tax and retirement planning because it can add thousands ...

Can you borrow against a life insurance policy?

You might be able to borrow against the accumulated funds or cash value in your whole or permanent life insurance policy to fund living expenses and avoid an increase in your MAGI. Another option: Use a short-term, low-interest loan to reduce your taxable income, says Oh.

How long does Medicare enrollment last?

The general rule for Medicare signup is that unless you meet an exception, you get a seven-month enrollment window that starts three months before your 65th birthday month and ends three months after it. Having qualifying insurance through your employer is one of those exceptions. Here’s what to know.

How much is the surcharge for Part B?

For Part B, that surcharge is 10% for each 12-month period you could’ve had it but didn’t sign up. For Part D, the penalty is 1% of the base premium ($33.06 in 2021) multiplied by the number of full, uncovered months you didn’t have Part D or creditable coverage.

Who is Elizabeth Gavino?

“I find it is always good to just confirm,” said Elizabeth Gavino, founder of Lewin & Gavino and an independent broker and general agent for Medicare plans.

Do you have to sign up for Medicare at age 65?

Medicare may not be top of mind if you’re nearing the eligibility age of 65 and already have health insurance through your employer. However, it probably deserves some attention. While not everyone must sign up, many are required to enroll unless they want to face life-lasting late-enrollment penalties.

Can I delay Medicare if I lose my group insurance?

The general rule for workers at companies with at least 20 employees is that you can delay signing up for Medicare until you lose your group insurance (i.e., you retire). Many people with large group health insurance delay Part B but sign up for Part A because it’s free. “It doesn’t hurt you to have it,” Roberts said.

Does Medicare have a premium?

Part A has no premium as long as you have at least a 10-year work history of contributing to the program through payroll (or self-employment) taxes.

Can a 65 year old spouse get Medicare?

Some 65-year-olds with younger spouses also might want to keep their group plan. Unlike your company’s option, spouses must qualify on their own for Medicare — either by reaching age 65 or having a disability if younger than that — regardless of your own eligibility.