How do you get exempt from Social Security? To request an exemption from Social Security taxes, get Form 4029—Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits from the Internal Revenue Service (IRS). Then, file the form with the Social Security Administration (address is on the form).

What jobs are exempt from Social Security?

- The employee was performing regular and substantial services for remuneration for the state or political subdivision employer before April 1, 1986,

- The employee was a bona fide employee of that employer on March 31, 1986,

- The employment relationship was not entered into for purpose of avoiding the Medicare tax, and

Who is exempt from paying Social Security taxes?

- Social Security Tax / Medicare Tax and Self-Employment

- Foreign Student Liability for Social Security and Medicare Taxes

- Employees of Foreign Governments or International Organizations

- Foreign Agricultural Workers Exemption from Withholding of U.S. ...

- Form 941, Employer's Quarterly Federal Tax Return, and Instructions

Who is exempt from paying Medicare tax?

Who is exempt from paying Medicare tax? The following classes of nonimmigrants and nonresident aliens are exempt from U.S. Social Security and Medicare taxes: A-visas. Employees of foreign governments, their families, and their servants are exempt on salaries paid to them in their official capacities as foreign government employees.

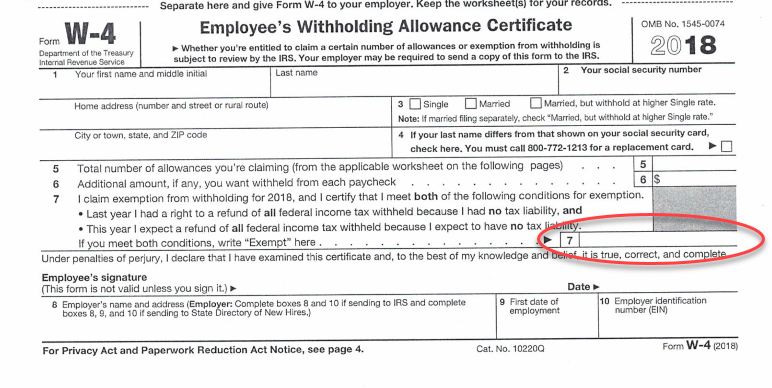

What deductions are FICA exempt?

What Pretax Deductions Lower FICA?

- Deductions Exempt From FICA. Qualified benefits offered under a cafeteria or Section 125 plan are exempt from FICA. ...

- Pretax Versus After-Tax Deductions. ...

- Benefits That Do not Lower FICA Earnings. ...

- Wages Excluded From FICA. ...

- FICA Wages on a W-2. ...

Who is exempt from Social Security and Medicare withholding?

The Code grants an exemption from Social Security and Medicare taxes to nonimmigrant scholars, teachers, researchers, and trainees (including medical interns), physicians, au pairs, summer camp workers, and other non-students temporarily present in the United States in J-1, Q-1 or Q-2 status.

How do I avoid Social Security and Medicare tax?

If your group meets these requirements and opposes accepting Social Security benefits, you can apply for an exemption. To do that, you'll use IRS Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits.

Can you opt out of Social Security and Medicare deductions?

The problem is that you can't opt out of Medicare Part A and continue to receive Social Security retirement benefits. In fact, if you are already receiving Social Security retirement benefits, you'll have to pay back all the benefits you've received so far in order to opt out of Medicare Part A coverage.

Can you be exempt from Social Security tax?

As a member of certain religious groups, you may qualify for an exemption from the Social Security tax. You must waive your rights to all benefits under the Social Security Act, including hospital insurance benefits. You may be either an employee or self-employed.

What happens if you opt out of Social Security?

If you become disabled and have opted out, you won't receive any Supplemental Security Income at all, since that also comes out of the Social Security pool. Don't opt out without having a good long-term disability policy in place.

Does everyone have to pay Medicare tax?

Who pays the Medicare tax? Generally, all employees who work in the U.S. must pay the Medicare tax, regardless of the citizenship or residency status of the employee or employer.

Can I decline Medicare coverage?

Declining Medicare completely is possible, but you will have to withdraw from your Social Security benefits and pay back any Social Security payments you have already received.

How do I opt out of Medicare Part B?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.

How do I opt out of Medicare Part A?

If you want to disenroll from Medicare Part A, you can fill out CMS form 1763 and mail it to your local Social Security Administration Office. Remember, disenrolling from Part A would require you to pay back all the money you may have received from Social Security, as well as any Medicare benefits paid.

Who is exempt from paying taxes?

Heads of households earning less than $18,800 (if under 65) and less than $20,500 (if 65 or older) are also exempt. If you're over the age of 65, single and have a gross income of $14,250 or less, you don't have to pay taxes.

What group is exempt from Social Security?

Foreign students and educational professionals in the U.S. on a temporary basis don't have to pay Social Security taxes. Nonresidents working in the U.S. for a foreign government are exempt from paying Social Security taxes on their salaries. Their families and domestic workers can also qualify for the exemption.

Do retirees pay Social Security and Medicare taxes?

Earned Income Any income you earn from regular employment and self-employment sources is subject to Social Security, Medicare, and income taxes. If you receive Social Security benefits and continue to work and earn income, you will have to pay Social Security and Medicare taxes on that earned income.

What is exempt from Social Security?

Also exempt are public-sector employees who participate in a state government pension plan that provides benefits in replacement of Social Security. For instance, Massachusetts state and municipal workers have such a plan; they contribute to it through payroll withholding.

What is Social Security 2021?

Social Security is a U. S. federal program that provides recipients with benefits, including retirement and disability income, Medicare and Medicaid, and death and survivorship. Social Security taxes are collected and used to disburse these benefits.

Can religious groups get exemption from Social Security?

Certain religious groups qualify for Social Security tax exemption if they are recognized as being officially opposed to Social Security benefits. Non-resident aliens may qualify for exemption based on the type of visa they have been issued.

Do foreigners pay Social Security?

Foreigners who work for their governments in the U.S. or for international organizations, such as the World Bank, do not pay Social Security taxes either (United States citizens who work for a foreign government or global organizations located in the U.S. do, however).

Do students get Social Security if they work for a foreign government?

Current students who acquire a job at their university are eligible for Social Security tax exemption on the income earned from those positions. Individuals who work for a foreign government may be exempt from Social Security taxes while working in an official capacity on official business.

Will the rest of us pay Social Security?

The Rest of Us Will Just Have to Deal with It. There are no other ways to remain a U.S. Citizen and not pay Social Security and Medicare taxes unless you’re willing to move out of the country. But the real question is whether Social Security will actually run out of benefits by the time today’s young people retire.

Do you have to pay Social Security if you have another job?

If you have another job, you’ll still have to pay Social Security and Medicare taxes on those earnings and you’ll be eligible for benefits based on those earnings. Again, this exemption is very limited in terms of who qualifies and in its scope.

How long do you have to pay Social Security taxes?

Social Security benefits are given to workers who have paid Social Security taxes for at least 40 "quarters of coverage," or 10 years. 9 Benefits are paid monthly to retirees, disabled individuals, surviving spouses, and others.

What is Social Security enrollment?

Enrollment is connected to the Social Security numbers of workers and taxpayers within the U.S. All Social Security benefits were created as part of a social safety net designed to reduce poverty and provide care for the elderly and disabled.

What is the Social Security tax rate for 2021?

But high-income individuals are exempt from paying the tax on earnings over $142,899 for 2021. 7 8 This reduces their overall Social Security tax liability .

How much of Social Security do elderly people get?

Among elderly beneficiaries, 50% of married couples and 70% of unmarried recipients receive 50% or more of their retirement income from Social Security. 1 . Most American taxpayers do not qualify for an exemption, though they do exist for a small number of people.

Can religious groups be exempt from Social Security?

Members of certain religious groups may be exempt from Social Security taxes. To become exempt, they must waive their rights to benefits, including hospital insurance benefits. They must also be a member of a religious sect that provides food, shelter, and medical care for its members, and is conscientiously opposed to receiving private death ...

Do religious orders pay taxes?

Members of religious orders who have taken a vow of poverty are exempt from paying self-employment taxes on work performed for the order and don't need to request a separate exemption. However, if the order elects to be covered under Social Security, then taxes would apply.

1129.1 How can the Social Security self-employment tax exemption be claimed?

To claim the exemption, you must file IRS Form 4029 ( Application for Exemption From Social Security Taxes and Waiver of Benefits) with the IRS. The application for exemption must be filed on or before the due date for the tax return for the first taxable year in which you have self-employment income or are a member of an approved organization.

1129.2 How long does the exemption remain in effect?

Once granted, the exemption remains in effect until you or the religious group of which you are a member ceases to meet the requirements stated in � 1128.