When you apply for MassHealth benefits, you must provide details about your employer, how long you have been employed and how much you earn. You'll also need to provide proof of your income. Your W-2s, or tax returns from the previous year, and pay stubs are acceptable documentation.

Full Answer

What is MassHealth standard and how does it work?

MassHealth Standard is the most complete coverage offered by MassHealth. It pays for a wide range of health care benefits, including long-term-care services.

What is one care with MassHealth and Medicare?

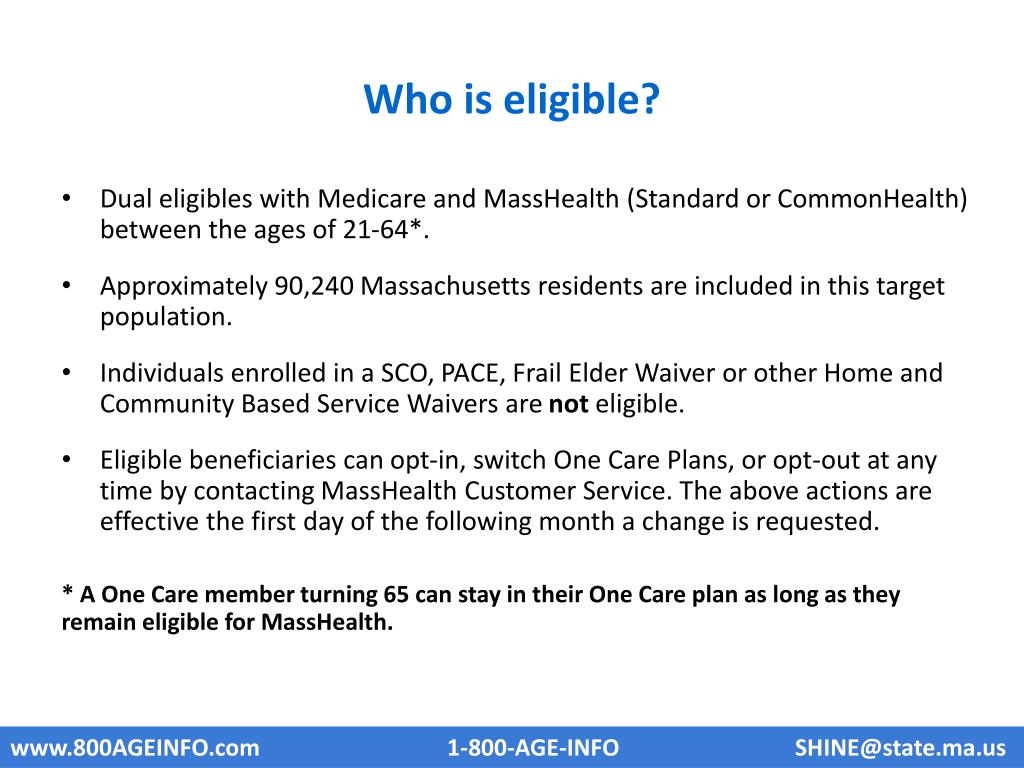

MassHealth and Medicare have joined together with health plans in Massachusetts to offer One Care: MassHealth plus Medicare. One Care is a way to get your MassHealth and Medicare benefits together. One Care offers services that you can't get when your MassHealth and Medicare benefits are separate.

What is the difference between MassHealth and Medicare?

Medicare is primarily based on your age and whether or not you have a disability. So it’s mostly for those 65 and older, or younger people with disabilities. MassHealth funds many programs for people who need care. It covers costs of long-term care, either in a nursing home or at home.

What are the requirements to get MassHealth benefits?

You must be a resident of Massachusetts to get MassHealth or other health care benefits that are funded by the Commonwealth. You live in Massachusetts and either intend to reside in Massachusetts, with or without a fixed address, or have entered Massachusetts with a job commitment or seeking employment

Can you be on MassHealth and Medicare?

One Care is a way to get your MassHealth and Medicare benefits together. One Care offers services that you can't get when your MassHealth and Medicare benefits are separate. With One Care, you have one plan, one card, and one person to coordinate your care.

Who qualifies for MassHealth standard?

MassHealth Standard serving families, children under 19, independent foster care adolescents who age out of DSS care or custody until the age of 21, pregnant women, disabled individuals and certain women with breast or cervical cancer.

What is the income limit to qualify for MassHealth?

2022 MassHealth Income Standards and Federal Poverty GuidelinesFamily SizeMassHealth Income Standards100% Federal Poverty Level1$522$1,1332$650$1,5263$775$1,9204$891$2,3136 more rows

How do I get MassHealth as a secondary insurance?

How to enrollOnline + The fastest way to enroll in a health plan is online.By phone + Call the MassHealth Customer Service Center. We can help. (800) 841-2900. ... By mail + Fill out a MassHealth Health Plan Enrollment Form. English. ... By fax + You can fax your MassHealth Health Plan Enrollment Form to (617) 988-8903.

What is MassHealth standard?

MassHealth Standard is the most complete coverage offered by MassHealth. It pays for a wide range of health care benefits, including long-term-care services.

Is MassHealth standard Medicaid?

Medicaid, or MassHealth. So I'll start by saying that MassHealth and Medicaid are the same thing. In Massachusetts, we call our Medicaid program MassHealth, because we wanted our own name for it. Some other states also have their own names, while others just call it Medicaid.

What is the income limit for MassHealth Standard 2021?

The CommonHealth deductible income standard for nonworking adults is $542 per mo. for one person & $670 for a couple The upper income level for PACE and home & community based waiver programs is $2382 per month eff. Jan 1, 2021.

What does MassHealth standard cover?

MassHealth pays for many important health-care services including doctor visits, hospital stays, rehabilitation and therapeutic services, and behavioral health and substance use disorder services.

Does MassHealth look at your bank account?

MassHealth does not look at your savings– you can have a large bank account or trust or things like that. But once you turn 65, they look at your assets. For MassHealth Standard you can only have up to $2,000 in savings, although there are certain types of assets that are not counted towards this limit.

What is the difference between MassHealth standard and CommonHealth?

MassHealth CommonHealth is a MassHealth program available to individuals with disabilities who are not eligible for MassHealth Standard. Unlike MassHealth Standard, MassHealth CommonHealth participants are not subject to income or asset limitations.

Can I have MassHealth and another insurance?

MassHealth members can have both MassHealth and private health insurance at the same time. If you have both types of insurance, the private health insurance is considered a liable third party or “TPL”. This means the private health insurance is billed as the primary insurer and MassHealth is the secondary coverage.

How do I know if I have MassHealth standard?

If you have questions about your health assistance benefits such as MassHealth, call 1-800-841-2900. Visit the MassHealth website for general information about MassHealth and how to apply for MassHealth and other health assistance programs.

What is MassHealth standard?

MassHealth Standard. MassHealth Standard is the most complete coverage offered by MassHealth. It pays for a wide range of health care benefits, including long-term-care services. Covered services. For MassHealth Standard, covered services include the ones listed below. There may be some limits.

What is Medicare Part A and B?

Payment of Medicare cost sharing: Medicare Part A and B premiums and nonpharmacy Medicare copayments and deductibles. * If you're eligible for both Medicare and MassHealth, Medicare provides most of your prescription drug coverage through a Medicare prescription drug plan.

How many hours can you work in Massachusetts?

A resident of Massachusetts, and. A disabled adult who works 40 hours or more a month, or. Currently working and have worked at least 240 hours in the 6 months immediately before the month of the application, MassHealth decides if you are disabled according to the standards set by federal and state law.

What is the amount of the premium based on?

The amount of the premium is based on. Your monthly income, as it compares to the FPL, and. Your household size, and. If you have other health insurance. If you must pay a premium, we will tell you the amount and send you a bill every month. Certain adults may have to pay copayments for some medical services.

Does MassHealth pay for long term care?

MassHealth Limited doesn't pay for long-term-care services. MassHealth Limited coverage is for emergency medical services only. Covered services. MassHealth Limited covers only care for medical emergencies (conditions that could cause serious harm if not treated). Examples of covered services are listed below.

Does MassHealth cover immigration?

MassHealth will give you the most complete coverage that you can get. Your eligibility depends on things like income, citizenship or immigration status, age, and special circumstances. You must be a Massachusetts resident to get any of these services.

Notices & Alerts

One Care is a way to get your MassHealth and Medicare benefits together. One Care offers services that you can't get when your MassHealth and Medicare benefits are separate. With One Care, you have one plan, one card, and one person to coordinate your care. It's a better, simpler way to get care for your individual needs and goals.

One Care Implementation Council December Town Hall Meeting, Dec. 14, 2021, 10:00am-12:00pm Nov. 10, 2021, 12:00 pm

One Care is a way to get your MassHealth and Medicare benefits together. One Care offers services that you can't get when your MassHealth and Medicare benefits are separate. With One Care, you have one plan, one card, and one person to coordinate your care. It's a better, simpler way to get care for your individual needs and goals.

How to contact MassHealth?

MassHealth Customer Service Center. Phone. Main Call MassHealth Customer Service Center, Main at (800) 841-2900. Self-service available 24 hrs/day in English and Spanish.

Can you get a refund from MassHealth?

Show the written MassHealth notice to your health care provider right away. If the health care provider determines that MassHealth will pay for the services you already paid for, the provider could refund what you paid.

MassHealth Plans and Enrollment Guide

Learn about Accountable Care Organization plans and other plans, and find resources like our Enrollment Guide to help you choose.

Primary Care Clinician (PCC) Plan for MassHealth Members

The Primary Care Clinician Plan is a managed health care plan for MassHealth members.

What does Medicare Part A pay for?

Medicare Part A pays for inpatient hospital care, skilled nursing facility care, and hospice care. Medicare Part B pays for outpatient surgery , doctor visits, and many other medical services not covered by Part A. Through this option, you are eligible to use any doctor or hospital that.

What is Medicare Advantage?

Medicare Advantage: is an alternative to Original Medicare and Medicare Part D benefits which provides you with complete coverage for your Medicare benefits as well as additional benefits beyond Original Medicare, including routine vision care, routine dental coverage, etc.

Is health insurance expensive in Massachusetts?

However, health insurance does not have to be expensive. Knowing how to plan for health insurance, where to get it and the considerations to make can help you reduce your expenses.

Do you need health insurance in Massachusetts?

Everyone Needs Health Insurance Any age is the right one to research and buy a health insurance policy in Massachusetts. If you are pregnant, then you need to have a health insurance policy in place to pay for maternity care and delivery. Of course, you should make sure a policy is in place for after an infant is born to pay for examinations ...

When will Medicare limits change?

These new limits make more people eligible for these programs. *These amounts may change as of March 1, 2020. **These amounts may change as of January 1, 2021. To see if you qualify for a Medicare Savings Plan, see the Medicare Savings Program application.

What is Medicare Savings Program?

A Medicare Savings Program can help pay some out-of-pocket costs, including: Your monthly Medicare Part B premium. Prescription drug costs through the Part D Extra Help program, which you automatically qualify for with a Medicare Savings Program.