The following will be a thorough step-by-step plan on how to get started building your profitable Medicare Part D plan and help patients along the way:

- Step 1: Start an insurance company. All Medicare plans must have a license from the Department of Insurance (DOI) of the...

- Step 2: Hire a Pharmacy Benefit Manager (PBM) While the health insurance company has the...

Full Answer

How are Medicare Advantage plans funded?

The funding is different for each county. Medicare is mainly funded by payroll taxes, so ultimately, all of us are funding the Medicare Advantage plans that offer a $0 monthly premium. I hope that shines some light on how Medicare Advantage plans work – and how some plans even have $0 monthly premiums.

How much profit can you make with out-of-network patients?

With 1,000 out-of-network patients paying just an extra $20 copay per visit, at two visits per year puts $40,000 in profit in your practice (minus a few expenses). You can identify poor paying plans using your billing software to compare average annual reimbursement by plan as compared to Medicare as a benchmark.

How to run a profitable business?

A profitable business is one that gets rid of deadweight. You will need to analyze which parts of your business are the least profitable and do away with them because they take up both time and money. It is better to focus on those business activities that bring in money, which justifies your decision to maintain their existence.

How to improve profitability of your company?

43 Ways To Improve Profitability of Your Company 1) Prepare a strategic plan with 1-year, 3-year, and 5-year goals 2) Determine up to five key success factors for your business 3) Implement and monitor a budget 4) Each year, abandon up to 10 percent of your business that is not aligned with your strategic plan

How profitable is Medicare Advantage?

Medicare Advantage is the common thread. Big-name health insurers raked in $8.2 billion in profit for the fourth quarter of 2019 and $35.7 billion over the course of the year.

How can I attract more people to my Medicare?

Marketing Medicare Advantage to prospective new patients as they turn 65Mailers to people turning 65.Hospital newsletters.Community events.Retargeting and pay-per-click ads.Facebook and other social media ads.

How do I succeed in Medicare Advantage?

The success of Medicare Advantage has been centered on building four foundational principles, regardless of the model chosen.Strategic contract arrangements that account for the risk profile of the population. ... Accurate coding and documentation. ... Optimal Medicare Advantage star ratings.More items...•

Who benefited the most from Medicare?

WealthyWealthy enrollees pay more into Medicare than poorer people do (in the form of general federal tax revenues and payroll taxes). However, they reap greater benefits over their lifetimes because they live longer and use more medical services.

How do I get Medicare clients?

⍟ 14 Ways to Generate Medicare Supplement LeadsBuild & Maintain a Website. ... Social Media Presence. ... Video Marketing. ... Blogging, Writing Articles. ... Email. ... Online Events: Live webinars, podcasts. ... Direct Requests / Client Referrals. ... Lead Swapping Partnerships (Asking other professionals for referrals)More items...

How much do Medicare leads cost?

As mentioned previously, new Medicare Advantage pay $25 for each direct mail lead.

What is the business with Medicare?

Medicare Business means the Company's business of providing services to groups and individuals who receive their coverage under the Company's Medicare Plan Contracts. Medicare Business has the meaning set forth in the Recitals.

Do millionaires have Medicare?

Millionaires Pay More for Medicare There's the additional 0.9% tax on income above $200,000 for individual filers and $250,000 for joint filers, and the 3.8% tax on investment income of more than $200,000/individual and $250,000/joint. Once you turn 65, you can sign up for Medicare no matter how rich you are.

What do millionaires pay for Medicare?

There are five brackets for high earners, the highest being for a single filer who earned over $500,000 in 2020. That lucky person will pay an extra $408.20 per month for Medicare Part B.

Do celebrities get Medicare?

TV ads with famous spokespeople can grab our attention, but most celebrities aren't experts in Medicare. They paint a picture of the perfect plan that's ready for you to enroll, but private entities pay those same celebrities to advertise for them.

Why Is Selling Medicare A Lucrative Business?

So if you can picture my audience, most probably are familiar with Medicare, maybe they’re even thinking about selling Medicare, maybe they sell Final Expense like you guys focused on as your primary product at one point. Maybe it was just brand new. Describe to us what makes selling Medicare a lucrative business to be involved in.

What happens if you go out and try to change Medicare?

If you go out and try to change Medicare or reduce benefits, you will have millions of seniors go to the voting register and vote the bonds out, Republican or Democrat.

Is Medicare a lifetime renewal?

I mean, the nature of Final Expense, great product, but here today, none tomorrow, right? It’s the first year drive n product, a little bit of renewal, but the Medicare products bring in a lifetime renewal.

Can you pay for leads with hundred thousand dollars?

So obviously with the hundred thousand dollars coming in, you can pay for your leads, you can take time off, maybe the stress will ease, everybody knows what commission breath is. Maybe rent’s close and you’re just a little bit short on cash for rent, you don’t have to worry about that anymore.

Is Medicare for seniors right?

You have to understand this. A senior who’s getting Medicare has paid into the system for decades. Okay? It is their right. That is how they feel about it. They have earned the right to access it at that point.

How is Medicare funded?

Medicare is mainly funded by payroll taxes, so ultimately, all of us are funding the Medicare Advantage plans that offer a $0 monthly premium.

How to create a Medicare action plan?

Create a Medicare action plan by estimating your total monthly premiums for healthcare and related expenses in retirement.

How Much Does Medicare Pay MA Plans?

The exact amount Medicare pays these private carriers gets a bit complex, but it’s based on a bidding process and a risk adjustment. The funding is different for each county.

Does Medicare Advantage have a contract with the government?

Medicare Advantage companies have a contract with the federal government.

Is Medicare Advantage a low premium?

Most Medicare Advantage plans are paid enough by the government to offer very low – sometimes even $0 premium plans – in addition to extra benefits that go above and beyond what Medicare regularly covers. For example, you might get some dental, vision, and fitness benefits.

Why don't Medicare patients choose MA plans?

The majority of Medicare recipients do not choose MA plans, either because they aren’t aware of them or because their preferred doctors may not always be part of the plans , but the numbers are growing. Based on CMS data, more than 32 percent of Medicare members in 2016 — some 19 million out of the 58 million total — enrolled in MA plans.

How much will MA revenue be in 2025?

Accordingly, we expect annual revenues for MA plans to rise from US$215 billion in fiscal year 2017 to more than $500 billion by 2025. The underlying growth of MA is good news for healthcare payors. But not all participants will benefit equally.

What is the 2015 Medicare Access and CHIP Reauthorization Act?

The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) is accelerating this shift by rewarding or penalizing Medicare providers (i.e., doctors and hospitals) through the addition of a bonus to, or subtraction of a fine from, their FFS payments based on the quality of care.

How to succeed in the MA market?

But to truly succeed, payors will need to build a coherent strategy that holistically ties these four areas with a corresponding “way to play.” For example, a clinic-based care coordinator, such as Illinois-based Riverside Healthcare, can emphasize in-person care experiences and maintain a low-cost model by automating or outsourcing operations including compliance, all while leveraging MACRA principles for its narrow network design. A regional plan with large membership, such as Florida-based managed care company Wellcare, should seek to enhance the member experience by expanding its digital footprint while developing proactive risk management and operational excellence capabilities that ensure compliant and low-cost operations.

Is there any uncertainty surrounding the repeal of the ACA?

There is great uncertainty surrounding attempts to repeal, reform, or replace the Affordable Care Act (ACA). But as we’ve noted, market participants can’t afford to sit still. Regardless of what happens, there is one very significant sector of healthcare that is positioned to succeed in this environment of uncertainty: Medicare Advantage (MA). As baby boomers age into qualification for Medicare, members are more likely to opt for plans that have benefits beyond what Medicare has traditionally offered. As a result, MA will present a significant source of growth for insurers. But to access a substantial share of this profit, plans need to urgently invest in key differentiating capabilities.

Does Medicare cover all costs?

Although Medicare reimburses providers, it doesn’t cover all costs. This is where Medicare Advantage comes into play.

Do baby boomers qualify for Medicare?

As baby boomers age into qualification for Medicare, members are more likely to opt for plans that have benefits beyond what Medicare has traditionally offered. As a result, MA will present a significant source of growth for insurers.

How to become a Medicare provider?

Become a Medicare Provider or Supplier 1 You’re a DMEPOS supplier. DMEPOS suppliers should follow the instructions on the Enroll as a DMEPOS Supplier page. 2 You’re an institutional provider. If you’re enrolling a hospital, critical care facility, skilled nursing facility, home health agency, hospice, or other similar institution, you should use the Medicare Enrollment Guide for Institutional Providers.

How to get an NPI?

If you already have an NPI, skip this step and proceed to Step 2. NPIs are issued through the National Plan & Provider Enumeration System (NPPES). You can apply for an NPI on the NPPES website.

How long does it take to change your Medicare billing?

To avoid having your Medicare billing privileges revoked, be sure to report the following changes within 30 days: a change in ownership. an adverse legal action. a change in practice location. You must report all other changes within 90 days. If you applied online, you can keep your information up to date in PECOS.

Do you need to be accredited to participate in CMS surveys?

ii If your institution has obtained accreditation from a CMS-approved accreditation organization, you will not need to participate in State Survey Agency surveys. You must inform the State Survey Agency that your institution is accredited. Accreditation is voluntary; CMS doesn’t require it for Medicare enrollment.

Can you bill Medicare for your services?

You’re a health care provider who wants to bill Medicare for your services and also have the ability to order and certify. You don’t want to bill Medicare for your services, but you do want enroll in Medicare solely to order and certify.

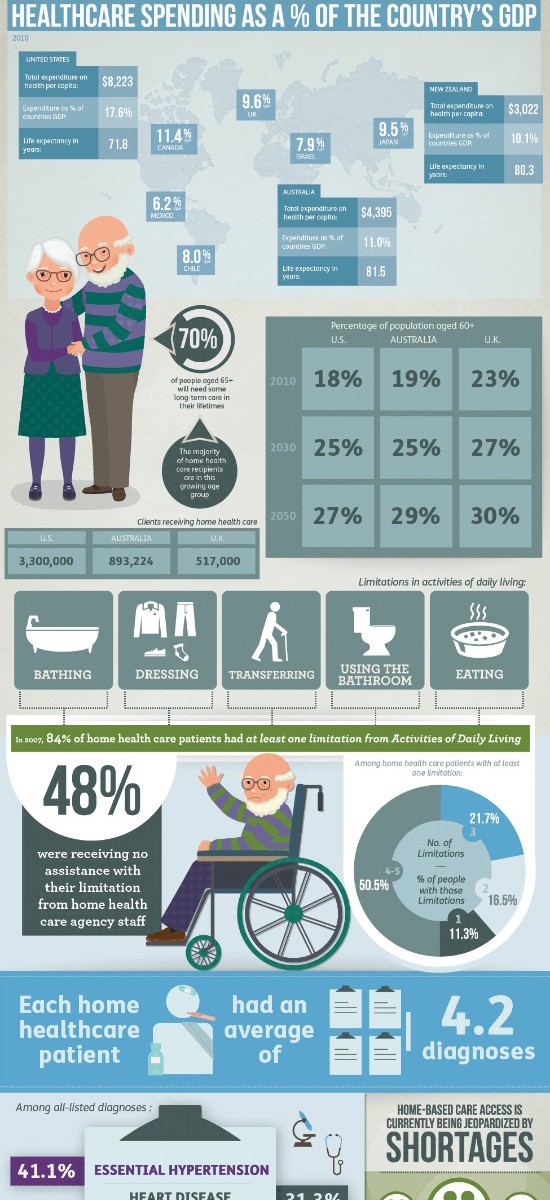

What are the factors that increase the demand for home health care?

Increases in the aging population, the move to serve more patients at home and increased insurance coverage all play a part in increasing demand.

How much is the DME market?

While competitive bidding under Medicare and other regulations have made DME sales more challenging, the U.S. DME market is expected to grow from $46.5 billion in 2015 to $60.2 billion in 2020. 1

Why is the DME market growing?

The market for durable medical equipment (DME) is growing because of the aging population and an increased desire by patients to stay in their homes. Difficulties with Medicare billing and lower payments are driving many DME suppliers to opt out, with patients paying out of pocket instead.

Does Little Drugs accept cash payments?

Little Drugs accepts cash payments from customers on some items and orders diabetic shoes only after all required documents are in. Typically, patients who need DME — such as patients with diabetes — also tend to be patients who need a range of different products and services that your pharmacy can provide.

How much can you increase profits from ECHO?

For example, I’ve found that adding ECHO to a two-provider internal medicine or family practice can increase annual profits by up to $100,000.

What to do if $20 bill doesn't show up in reconciliation?

Slip an extra $20 bill into the cash drawer. If it doesn’t show up in reconciliation, investigate that employee for embezzlement. If it does show up, give it to the employee as a bonus for causing them grief in not being able to balance the drawer.

How many products per sale for Medicare?

Multiple Products per Sale. Traditional HMEs that are 80-plus percent Medicare/Medicaid still average one product per sales transaction; they are simply processing these prescriptions for reimbursable products. In contrast, profitable retail HMEs today average two to three products per customer. After qualifying the customer and selling high, they not only provide the Medi/Medi product but also sell an upgraded version as well as related, add-on products.

What is the average profit margin for a HME?

Profits. Retail HME businesses average 45 percent gross profit margin (GPM), which translates into 55 percent cost-of-goods sold (COGS). Some of the leaner, more profitable operations average 47 to 50 percent GPM. Net profits average from 8 to 12 percent, while the more efficient HMEs (i.e. paperless) average 15 percent or higher.

What is a successful veteran HME owner?

Successful veteran HME owners and managers are very knowledgeable and capable business leaders. However, when they shift to retail, they delegate the daily operations to retail veterans who are equally competent in their own respective business model. Think big, as in multiple locations.

How to sell high?

Sell High. Start showing customers the most expensive, fully loaded product, and then work your way down to the basic reimbursable product. Car salespeople are notorious for pushing top-of-the-line, fully loaded vehicles on customers. But even with cars, consumers usually don't buy the most or least expensive models but purchase somewhere in the middle. The same holds true for home health care products.

How much of home health care sales are captured?

Capturing 80% of Sales. There is no "one-size-fits-all" for home health care product selection, and this is why most retail HME chains have failed. In retail, the front third of the store generates 80 percent of sales. An HME retailer must match demographics and local HME needs with product selection. For example, a senior community would buy patient room, bath safety, incontinence and wound care products. People in a baby boomer community and family caregivers would buy diagnostic and diabetes products, foot care products, orthopedic supports and compression hosiery.

What is the average revenue mix of a retail HME?

The average revenue mix of a profitable retail HME is from 30 to 45 percent Medicare/Medicaid, 25 to 50 percent cash and 20 to 35 percent private pay/third-party insurance. A profitable retail HME business that is also a Part B provider remains under 40 percent Medi/Medi.

What is the most efficient and profitable business model?

Think big, as in multiple locations. Hub-and-spoke business models are the most efficient and profitable in retail. Using their traditional HME as the hub, many retailers open multiple retail locations around the hub to control an entire sales or geographic territory.

What is profitable business?

A profitable business is one that gets rid of deadweight. You will need to analyze which parts of your business are the least profitable and do away with them because they take up both time and money. It is better to focus on those business activities that bring in money, which justifies your decision to maintain their existence.

Why do we need a budget?

A budget is what helps to keep your expenses in control. Your budget needs to be followed closely in order to ensure that your finances remain in order. Follow your budget strictly and only go outside of it when it is beneficial to your business generating more money or keeping more money.

What does it mean when your business grows?

As your business grows over the years, it will become more complex, which means your financial plan needs to grow with your business . This means your strategy needs to not only define how you will make money but also how you profit the majority of the money you generate.

How to be a leader in your industry?

Leaders in your industry provide you with a blueprint of how your business needs to operate. Take their strategies and turn them into your own so that you can build your business to be among the industry leaders. Once you know how to make more money, then you will put your business in the position to be successful.

When paying big money for a particular service, do you want to be sure that you are receiving the best price?

When you are paying big money for a particular service, you will want to be sure that you are receiving the best price. Let your potential vendors know you are comparing prices, and would like to determine who provides the best value for their prices. This will help you find the best vendor before being locked into a contract that you have to wait years to get out of.

Is money coming into your business yours?

They believe that just because money is coming into their business, they are actually making it. Money coming into your business is not yours until expenses have been paid. Once these expenses are paid, the remaining is the profit. Many businesses break even or are in debt after their expenses are accounted for.

Do you have to eliminate a product to make a profit?

Every product and service you have is certainly not producing a profit. When this occurs, you will need to get rid of these products and services and keep those which generate money. This will help you eliminate costs in favor of profitability. You will see your profits increase significantly once you eliminate these weak performing products and services.