- Find work in an insurance consulting firm. Before you specialize in Medicare consulting, you'll want to gain experience working in a consulting firm.

- Enroll in informational courses about Medicare. To become a Medicare consultant, you'll need to be aware of any changes made.

- Build an emphasis in Medicare consulting. After you've gained experience as a Medicare specialist, return to insurance consulting.

- Advertise yourself as a Medicare consultant. Once you've worked with a substantial amount of Medicare-related clients, begin advertising yourself as a Medicare consultant.

- Open your own private practice. Once you've gained a considerable amount of experience, you could choose to open up your own consulting practice.

Full Answer

What degree do I need to become a Medicare consultant?

Medicare consultants are experts in this type of government insurance, and they can help you expedite your claims and provide the support you need to make the most of your Medicare benefits. A bachelor’s degree or a specialized college degree may not be required for Medicare consulting. A Medicare consultant, on the other hand, employs knowledge of medical billing …

How do I Specialize in Medicare consulting?

Jan 31, 2022 · Career Steps Step 1: Gain Work Experience Although the specific requirements to work as a Medicare specialist differ depending on the... Step 2: Consider Earning a Bachelor's Degree Some employers prefer to hire Medicare specialists who have bachelor's... Step 3: Advance Your Career

How do I become a medical billing consultant?

Feb 10, 2021 · The first thing you’ll need to do is obtain a health insurance license in the state you currently live in (known as your resident state health insurance producer license). Aside from this being a requirement, you will get the fundamental training needed to understand how health insurance plans, including Medicare, work.

How do I become a Medicare agent?

1. Becoming a licensed Medicare Agent – Complete a pre-licensing course. Courses tend to be similar in price and content. Depending on your own specific learning/studying style, you can choose to take the course in a traditional classroom, online or via self-study.

Is selling Medicare lucrative?

Is Selling Medicare Lucrative? In short, yes. The average Medicare Advantage policy pays around $287 a year in commission if the purchase replaces an existing plan. However, you can get approximately double that — $573— if you write up a new Medicare Advantage plan for someone who hasn't had one before.Feb 22, 2022

What is a Medicare expert?

Medicare advisors are insurance agents, Medicare brokers and Medicare underwriters. They work for private companies that are under contract with Medicare to sell certain Medicare plans — Medicare Advantage plans and Medicare Part D prescription drug plans.

Why do Medicare advisors call?

If someone calls claiming to be from Medicare, asking for your Social Security number or bank information to get your new card or new benefits, that's a scam. Don't give personal information to a caller claiming to be from Medicare. You can't trust caller id.Mar 15, 2019

Is United Medicare Advisors legitimate?

Yes, United Medicare Advisors is a reputable company offering legitimate services and insurance products. Its licensed agents can provide free, reliable advice as you navigate the confusing world of Medicare supplement insurance so that you can choose the best plans for your needs and budget.

What is Medicare consultant?

Medicare consultants focus on medical billing and other aspects of Medicare. Many of those involved in the health care field may look at changing careers and becoming a Medicare consultant. A Medicare consultant is a professional who focuses on aspects of Medicare medical billing, eligibility issues, or other aspects of dealing with ...

What is Medicare set aside certification?

A Medicare Set-Aside Consultant-Certified (MSCC) exam is one certification choice that includes information on Medicare as a second payer, and is usually a useful addition to a resume for someone who wants to become a Medicare consultant. The Medicare program helps cover the cost of prescription drugs for elderly individuals.

What is Medicare for seniors?

Medicare is a federally administered program that provides health insurance for people over the age of 65. The Medicare program helps cover the cost of prescription drugs for elderly individuals. A Medicare consultant may help patients understand eligibility requirements.

Why is Medicare the most popular government program?

Medicare is one of the most popular government programs in the country because it provides for basic medical needs. More than 60 million Americans receive health insurance through Medicare. But not all Medicare programs are alike. Some offer different services than others. The Medicare insurance agent works with people on ...

What is Medicare insurance agent?

You have a few options. A Medicare insurance agent helps people consider and evaluate different Medicare plans. They guide people toward choosing the one that is best for them. A Medicare insurance agent needs to be familiar with the ins-and-outs of every Medicare plan.

How does Medicare work?

The Medicare insurance agent works with people on the services they need in Medicare. You can become an insurance agent and promote the health of thousands of people. You just need to know how to get started. Here is a quick guide on how to become a Medicare insurance agent.

Is it a good idea to become a Medicare agent?

Becoming a Medicare insurance agent is a smart idea . It is a lucrative career path that offers plenty of opportunities for upward mobility. You can learn the basics of how to become a Medicare insurance agent in very little time.

What does a Medicare agent do?

They need to respect the brands of insurance companies, building off of them to sell products to clients. As an insurance agent, you can be independent. You can work with different insurance companies, enrolling people in plans with any of them.

What do independent agents need?

You will need a strong work ethic and independent streak to succeed as an Independent Agent. You will need an eye for marketing because you will be building your own brand within Medicare insurance.

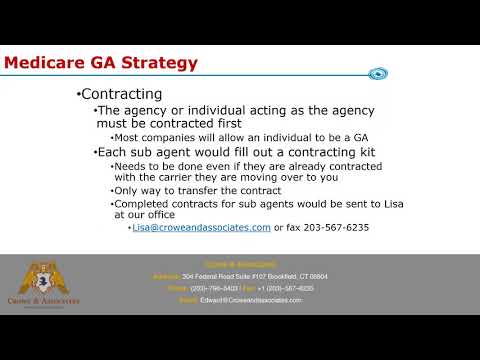

What is captive agent?

A captive agent can sign up with one insurance company in particular or an FMO. When you sign a contract with an FMO, you can sell Medicare Advantage, prescription drug plans, and supplements as long as they are appointed with those lines of authority. An FMO helps you get appointed with insurance carriers.

What is the job description of a Medicare agent?

When you become a Medicare insurance agent, there are two main groups you are marketing to. Those are turning 65 and becoming eligible for Medicare health benefits. Those who are disabled, under 65, and are eligible for Medicare. Selling Medicare health insurance can be rewarding in many ways, ...

What is an FMO?

Choosing an FMO. FMO is an acronym that stands for the field marketing organization. These are companies that distribute health insurance plans to agents and agencies on behalf of various carriers. An FMO can help you quickly get contracted and appointed to sell with multiple insurance companies.

What is E&O insurance?

E&O insurance is insurance intended to protect you in the event you give a client incorrect or misleading information and they decide to take legal action against you. As well as getting covered through an FMO, these policies can also be purchased through many property and casualty insurance agencies.