You will start the medical billing process for Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

How much of a medical bill does Medicare usually cover?

Medicare Supplement insurance plans typically pay up to 365 days of hospital costs when your Part A benefits are used up. (Under Medicare Supplement Plan N, you might have to pay a copayment up to $20 for some office visits, and up to $50 for emergency room visits if they don’t result in hospital admission.)

How much can you make to qualify for Medicare?

What Are the Medicare Income Limits in 2021?

- There are no income limits to receive Medicare benefits.

- You may pay more for your premiums based on your level of income.

- If you have limited income, you might qualify for assistance in paying Medicare premiums.

What are the requirements for Medicare billing?

- The regular physician is unavailable to provide the service.

- The beneficiary has arranged or seeks to receive the services from the regular physician.

- The locum tenens is NOT an employee of the regular physician.

- The regular physician pays the locum tenens physician on a per diem or fee-for-service basis.

How do I become a Medicare Biller?

What Is an Insurance Biller?

- Get Trained. Formal training in insurance billing is available at vocational schools and community colleges in the form of diploma, certificate and associate's degree programs.

- Obtain Certification. Licensure is not required for insurance billers; however, obtaining professional certification is highly recommended.

- Acquire Work Experience. ...

What must a provider do to receive payment from Medicare?

You are responsible for the entire cost of your care. The provider must give you a private contract describing their charges and confirming that you understand you are responsible for the full cost of your care and that Medicare will not reimburse you. Opt-out providers do not bill Medicare for services you receive.

Can I bill a Medicare patient?

Balance billing is prohibited for Medicare-covered services in the Medicare Advantage program, except in the case of private fee-for-service plans. In traditional Medicare, the maximum that non-participating providers may charge for a Medicare-covered service is 115 percent of the discounted fee-schedule amount.

What is a Medicare fee-for-service Provider?

What is fee-for-service? Fee-for-service is a system of health care payment in which a provider is paid separately for each particular service rendered. Original Medicare is an example of fee-for-service coverage, and there are Medicare Advantage plans that also operate on a fee-for-service basis.

Does Medicare still use fee-for-service?

Since Medicare was created in 1965, the program has changed with the times in the ways physicians and APRNs get paid. Today, Medicare pays 1) under fee-for-service, also known as Original Medicare; or 2) through Medicare Advantage plans.

Can I bill Medicare for non covered services?

Under Medicare rules, it may be possible for a physician to bill the patient for services that Medicare does not cover. If a patient requests a service that Medicare does not consider medically reasonable and necessary, the payer's website should be checked for coverage information on the service.

Does Medicare use CPT codes?

Medicare uses a system of CPT and HCPCS codes to reimburse health care providers for their services.

Who process Medicare fee-for-service claims?

Every year, Medicare Administrative Contractors (MACs) process an estimated 1.2 billion fee-for-service claims on behalf of the Centers for Medicare & Medicaid Services (CMS) for more than 33.9 million Medicare beneficiaries who receive health care benefits through the Original Medicare program.

How is fee-for-service billed?

Fee for service (FFS) is the most traditional payment model of healthcare. In this model, the healthcare providers and physicians are reimbursed based on the number of services they provide or their procedures. Payments in an FFS model are not bundled.

What are some examples of fee-for-service?

A method in which doctors and other health care providers are paid for each service performed. Examples of services include tests and office visits.

What is the difference between fee-for-service and Medicare Advantage?

While fee-for-service Medicare covers 83 percent of costs in Part A hospital services and Part B provider services, Medicare Advantage covers 89 percent of these costs along with supplemental benefits ranging from Part D prescription drug coverage to out-of-pocket healthcare spending caps.

Is Medicare Part C fee-for-service?

A Medicare Private Fee-for-Service plan is a type of Medicare Advantage plan (Part C) administered by a private insurance company. The plan determines how much you must pay when you get care. Doctors decide whether to accept patients with PFFS plans.

How do I find my Medicare fee schedule?

To start your search, go to the Medicare Physician Fee Schedule Look-up Tool. To read more about the MPFS search tool, go to the MLN® booklet, How to Use The Searchable Medicare Physician Fee Schedule Booklet (PDF) .

What form do you need to bill Medicare?

If a biller has to use manual forms to bill Medicare, a few complications can arise. For instance, billing for Part A requires a UB-04 form (which is also known as a CMS-1450). Part B, on the other hand, requires a CMS-1500. For the most part, however, billers will enter the proper information into a software program and then use ...

What is a medical biller?

In general, the medical biller creates claims like they would for Part A or B of Medicare or for a private, third-party payer. The claim must contain the proper information about the place of service, the NPI, the procedures performed and the diagnoses listed. The claim must also, of course, list the price of the procedures.

What is 3.06 Medicare?

3.06: Medicare, Medicaid and Billing. Like billing to a private third-party payer, billers must send claims to Medicare and Medicaid. These claims are very similar to the claims you’d send to a private third-party payer, with a few notable exceptions.

How long does it take for Medicare to process a claim?

The MAC evaluates (or adjudicates) each claim sent to Medicare, and processes the claim. This process usually takes around 30 days .

Is it harder to bill for medicaid or Medicare?

Billing for Medicaid. Creating claims for Medicaid can be even more difficult than creating claims for Medicare. Because Medicaid varies state-by-state, so do its regulations and billing requirements. As such, the claim forms and formats the biller must use will change by state. It’s up to the biller to check with their state’s Medicaid program ...

Can you bill Medicare for a patient with Part C?

Because Part C is actually a private insurance plan paid for, in part, by the federal government, billers are not allowed to bill Medicare for services delivered to a patient who has Part C coverage. Only those providers who are licensed to bill for Part D may bill Medicare for vaccines or prescription drugs provided under Part D.

Do you have to go through a clearinghouse for Medicare and Medicaid?

Since these two government programs are high-volume payers, billers send claims directly to Medicare and Medicaid. That means billers do not need to go through a clearinghouse for these claims, and it also means that the onus for “clean” claims is on the biller.

How long does it take to change your Medicare billing?

To avoid having your Medicare billing privileges revoked, be sure to report the following changes within 30 days: a change in ownership. an adverse legal action. a change in practice location. You must report all other changes within 90 days. If you applied online, you can keep your information up to date in PECOS.

How to become a Medicare provider?

Become a Medicare Provider or Supplier 1 You’re a DMEPOS supplier. DMEPOS suppliers should follow the instructions on the Enroll as a DMEPOS Supplier page. 2 You’re an institutional provider. If you’re enrolling a hospital, critical care facility, skilled nursing facility, home health agency, hospice, or other similar institution, you should use the Medicare Enrollment Guide for Institutional Providers.

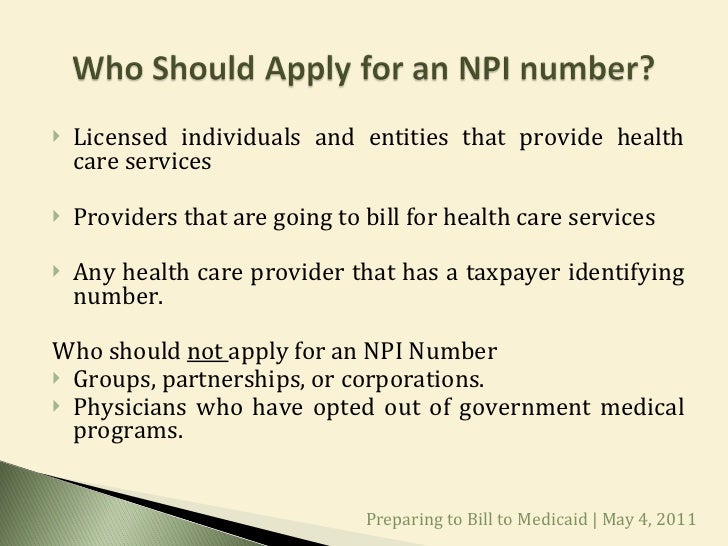

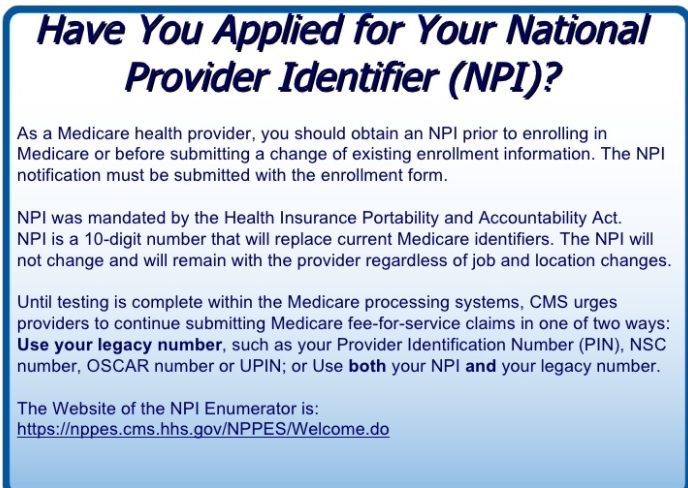

How to get an NPI?

If you already have an NPI, skip this step and proceed to Step 2. NPIs are issued through the National Plan & Provider Enumeration System (NPPES). You can apply for an NPI on the NPPES website.

Do you need to be accredited to participate in CMS surveys?

ii If your institution has obtained accreditation from a CMS-approved accreditation organization, you will not need to participate in State Survey Agency surveys. You must inform the State Survey Agency that your institution is accredited. Accreditation is voluntary; CMS doesn’t require it for Medicare enrollment.

Can you bill Medicare for your services?

You’re a health care provider who wants to bill Medicare for your services and also have the ability to order and certify. You don’t want to bill Medicare for your services, but you do want enroll in Medicare solely to order and certify.

How long does it take for Medicare to pay?

Medicare claims must be filed no later than 12 months (or 1 full calendar year) after the date when the services were provided. If a claim isn't filed within this time limit, Medicare can't pay its share. For example, if you see your doctor on March 22, 2019, your doctor must file the Medicare claim for that visit no later than March 22, 2020.

What to call if you don't file a Medicare claim?

If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227) . TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got. If it's close to the end of the time limit and your doctor or supplier still hasn't filed the claim, you should file the claim.

How to file a medical claim?

Follow the instructions for the type of claim you're filing (listed above under "How do I file a claim?"). Generally, you’ll need to submit these items: 1 The completed claim form (Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB]) 2 The itemized bill from your doctor, supplier, or other health care provider 3 A letter explaining in detail your reason for submitting the claim, like your provider or supplier isn’t able to file the claim, your provider or supplier refuses to file the claim, and/or your provider or supplier isn’t enrolled in Medicare 4 Any supporting documents related to your claim

What is an itemized bill?

The itemized bill from your doctor, supplier, or other health care provider. A letter explaining in detail your reason for submitting the claim, like your provider or supplier isn’t able to file the claim, your provider or supplier refuses to file the claim, and/or your provider or supplier isn’t enrolled in Medicare.

What happens after you pay a deductible?

After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). , the law requires doctors and suppliers to file Medicare. claim. A request for payment that you submit to Medicare or other health insurance when you get items and services that you think are covered.

When do you have to file Medicare claim for 2020?

For example, if you see your doctor on March 22, 2019, your doctor must file the Medicare claim for that visit no later than March 22, 2020. Check the "Medicare Summary Notice" (MSN) you get in the mail every 3 months, or log into your secure Medicare account to make sure claims are being filed in a timely way.

Does Medicare Advantage cover hospice?

Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Most Medicare Advantage Plans offer prescription drug coverage. , these plans don’t have to file claims because Medicare pays these private insurance companies a set amount each month.

What is a medical social service?

Medical social services. Part-time or intermittent home health aide services (personal hands-on care) Injectible osteoporosis drugs for women. Usually, a home health care agency coordinates the services your doctor orders for you. Medicare doesn't pay for: 24-hour-a-day care at home. Meals delivered to your home.

Who is covered by Part A and Part B?

All people with Part A and/or Part B who meet all of these conditions are covered: You must be under the care of a doctor , and you must be getting services under a plan of care created and reviewed regularly by a doctor.

What is an ABN for home health?

The home health agency should give you a notice called the Advance Beneficiary Notice" (ABN) before giving you services and supplies that Medicare doesn't cover. Note. If you get services from a home health agency in Florida, Illinois, Massachusetts, Michigan, or Texas, you may be affected by a Medicare demonstration program. ...

Does Medicare cover home health services?

Your Medicare home health services benefits aren't changing and your access to home health services shouldn’t be delayed by the pre-claim review process.

Do you have to be homebound to get home health insurance?

You must be homebound, and a doctor must certify that you're homebound. You're not eligible for the home health benefit if you need more than part-time or "intermittent" skilled nursing care. You may leave home for medical treatment or short, infrequent absences for non-medical reasons, like attending religious services.

Can you get home health care if you attend daycare?

You can still get home health care if you attend adult day care. Home health services may also include medical supplies for use at home, durable medical equipment, or injectable osteoporosis drugs.

How long can a hospice patient be on Medicare?

After certification, the patient may elect the hospice benefit for: Two 90-day periods followed by an unlimited number of subsequent 60-day periods.

How much is coinsurance for hospice?

The coinsurance amount is 5% of the cost of the drug or biological to the hospice, determined by the drug copayment schedule set by the hospice. The coinsurance for each prescription may not be more than $5.00. The patient does not owe any coinsurance when they got it during general inpatient care or respite care.

What is hospice care?

Hospice is a comprehensive, holistic program of care and support for terminally ill patients and their families. Hospice care changes the focus to comfort care (palliative care) for pain relief and symptom management instead of care to cure the patient’s illness. Patients with Medicare Part A can get hospice care benefits if they meet ...

What is hospice coinsurance?

Drugs and Biologicals Coinsurance: Hospices provide drugs and biologicals to lessen and manage pain and symptoms of a patient’s terminal illness and related conditions. For each hospice-related palliative drug and biological prescription:

Can hospice patients be homemaker?

The care consists mainly of nursing care on a continuous basis at home. Patients can also get hospice aide, homemaker services, or both on a continuous basis. Hospice patients can get continuous home care only during brief periods of crisis and only as needed to maintain the patient at home.

Does Medicare pay for hospice?

The Medicare hospice benefit includes these items and services to reduce pain or disease severity and manage the terminal illness and related conditions: Medicare may pay for other reasonable and necessary hospice services in the patient’s POC. The hospice program must offer and arrange these services.