Submit any MSP information to the intermediary using condition and occurrence codes on the claim. As a Part B provider (i.e. physicians and suppliers), you should: Obtain billing information at the time the service is rendered.

Full Answer

How much will you pay for Medicare Part B?

The standard Part B premium in 2021 is $148.50 per month, though you could potentially pay more, depending on your income. Your Medicare Part B premium largely depends on the income reported on your tax return from two years prior.

Does everyone pay the same for Medicare Part B?

Most beneficiaries pay the same amount for Medicare Part B. However, those in a higher-income bracket do pay more as well as those in a lower income bracket may get assistance with paying their Part B premium. No, eligibility for Part B is not based on income. How much is taken out of your Social Security check for Medicare?

How do I pay for Medicare Part B?

What else do I need to know about paying my Medicare premium online through my bank?

- You tell the bank your Medicare information to set up this service—make sure your payment is set up correctly so your bill is paid on time.

- Remember: You're responsible for making sure the bank pays the right premium amount at the right time.

- Your statement will show a payment made to "CMS Medicare."

Do I have to pay for Medicare Part B?

You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How do I bill Medicare Part B?

Talk to someone about your premium bill For specific Medicare billing questions: Call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. For questions about your Part A or Part B coverage: Call Social Security at 1-800-772-1213. TTY: 1-800-325-0778.

How do I bill for Medicare services?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

What must a provider do to receive payment from Medicare?

You are responsible for the entire cost of your care. The provider must give you a private contract describing their charges and confirming that you understand you are responsible for the full cost of your care and that Medicare will not reimburse you. Opt-out providers do not bill Medicare for services you receive.

What is the KX modifier for Medicare?

The KX modifier, described in subsection D., is added to claim lines to indicate that the clinician attests that services at and above the therapy caps are medically necessary and justification is documented in the medical record.

Should I use GT or 95 modifier?

A GT modifier is an older coding modifier that serves a similar purpose as the 95 modifier. CMS recommends 95, different companies have varying standards for which codes to be billed. It is a good idea to check with the plans before billing.

What is a 95 modifier used for?

Per the AMA, modifier 95 means: “synchronous telemedicine service rendered via a real-time interactive audio and video telecommunications system.” Modifier 95 is only for codes that are listed in Appendix P of the CPT manual.

Can you bill Medicare on paper?

The Administrative Simplification Compliance Act (ASCA) requires that as of October 16, 2003, all initial Medicare claims be submitted electronically, except in limited situations. Medicare is prohibited from payment of claims submitted on a paper claim form that do not meet the limited exception criteria. web page.

Can I submit a claim directly to Medicare?

If you have Original Medicare and a participating provider refuses to submit a claim, you can file a complaint with 1-800-MEDICARE. Regardless of whether or not the provider is required to file claims, you can submit the healthcare claims yourself.

Can a Medicare provider refuse to bill Medicare?

In summary, a provider, whether participating or nonparticipating in Medicare, is required to bill Medicare for all covered services provided. If the provider has reason to believe that a covered service may be excluded because it may be found not to be reasonable and necessary the patient should be provided an ABN.

What is the KF modifier used for?

Although not associated with a specific , the KF modifier is required for claim submission of this HCPCS code as well. This information will be added to the applicable -related Policy Articles in an upcoming revision....Publication History.Publication DateDescription08/29/19Originally PublishedFeb 19, 2020

What is modifier 97 used for?

Modifier 97- Rehabilitative Services: When a service or procedure that may be either habilitative or rehabilitative in nature is provided for rehabilitative purposes, the physician or other qualified healthcare professional may add modifier 97- to the service or procedure code to indicate that the service or procedure ...

What is the Ku modifier used for?

The KU modifier is used to receive the unadjusted fee schedule amount and is being implemented for a variety of wheelchair accessories and seat back cushions used with complex rehabilitative manual wheelchairs and certain manual chairs.

How to become a Medicare provider?

Become a Medicare Provider or Supplier 1 You’re a DMEPOS supplier. DMEPOS suppliers should follow the instructions on the Enroll as a DMEPOS Supplier page. 2 You’re an institutional provider. If you’re enrolling a hospital, critical care facility, skilled nursing facility, home health agency, hospice, or other similar institution, you should use the Medicare Enrollment Guide for Institutional Providers.

How long does it take to change your Medicare billing?

To avoid having your Medicare billing privileges revoked, be sure to report the following changes within 30 days: a change in ownership. an adverse legal action. a change in practice location. You must report all other changes within 90 days. If you applied online, you can keep your information up to date in PECOS.

How to get an NPI?

If you already have an NPI, skip this step and proceed to Step 2. NPIs are issued through the National Plan & Provider Enumeration System (NPPES). You can apply for an NPI on the NPPES website.

Do you need to be accredited to participate in CMS surveys?

ii If your institution has obtained accreditation from a CMS-approved accreditation organization, you will not need to participate in State Survey Agency surveys. You must inform the State Survey Agency that your institution is accredited. Accreditation is voluntary; CMS doesn’t require it for Medicare enrollment.

Can you bill Medicare for your services?

You’re a health care provider who wants to bill Medicare for your services and also have the ability to order and certify. You don’t want to bill Medicare for your services, but you do want enroll in Medicare solely to order and certify.

Why would Medicare allow additional Part B payments?

Specifically, the proposed rule would allow additional Part B payment when a Medicare Part A claim is denied because the beneficiary should have been treated as an outpatient, rather than being admitted to the hospital as an inpatient. The proposed rule, Medicare Program; Part B Inpatient Billing in Hospitals, proposes that if ...

How long after the date of service can a hospital bill?

Also under current policy, the hospital may only bill for the limited list of Part B inpatient ancillary services and those services must be billed no later than 12 months after the date of service.

What is the reasonable and necessary standard for Medicare?

The “reasonable and necessary” standard is a prerequisite for Medicare coverage in the Social Security Act. The statutory timely filing deadline, under which claims must be filed within 12 months of the date of service, would continue to apply to the Part B inpatient claims. Also on March 13, CMS Acting Administrator Marilyn Tavenner issued an ...

Does Medicare pay for inpatient services?

Under longstanding Medicare policy, Medicare only pays for a limited number of ancillary medical and other health services as inpatient services under Part B when a Part A claim submitted by a hospital for payment of an inpatient admission is denied as not reasonable and necessary. Hospitals have expressed concern about Medicare’s policy, arguing that all Part B hospital services provided should be billable to Medicare because they would have been reasonable and necessary if the beneficiary had been treated as an outpatient and not as an inpatient.

Does the hospital rule cover self audits?

The Ruling does not cover hospital self-audits or situations where Part A payment cannot be made because the beneficiary has exhausted or is not entitled to Part A benefits. The Ruling only addresses Part A claims denied because the inpatient admission was not reasonable and necessary.

Should Medicare bill Part B?

Hospitals have expressed concern about Medicare’s policy, arguing that all Part B hospital services provided should be billable to Medicare because they would have been reasonable and necessary if the beneficiary had been treated as an outpatient and not as an inpatient. Last year, in response to hospitals’ concerns, ...

When do hospitals report Medicare beneficiaries?

If the beneficiary is a dependent under his/her spouse's group health insurance and the spouse retired prior to the beneficiary's Medicare Part A entitlement date, hospitals report the beneficiary's Medicare entitlement date as his/her retirement date.

What is secondary payer?

Medicare is the Secondary Payer when Beneficiaries are: 1 Treated for a work-related injury or illness. Medicare may pay conditionally for services received for a work-related illness or injury in cases where payment from the state workers’ compensation (WC) insurance is not expected within 120 days. This conditional payment is subject to recovery by Medicare after a WC settlement has been reached. If WC denies a claim or a portion of a claim, the claim can be filed with Medicare for consideration of payment. 2 Treated for an illness or injury caused by an accident, and liability and/or no-fault insurance will cover the medical expenses as the primary payer. 3 Covered under their own employer’s or a spouse’s employer’s group health plan (GHP). 4 Disabled with coverage under a large group health plan (LGHP). 5 Afflicted with permanent kidney failure (End-Stage Renal Disease) and are within the 30-month coordination period. See ESRD link in the Related Links section below for more information. Note: For more information on when Medicare is the Secondary Payer, click the Medicare Secondary Payer link in the Related Links section below.

Does Medicare pay for black lung?

Federal Black Lung Benefits - Medicare does not pay for services covered under the Federal Black Lung Program. However, if a Medicare-eligible patient has an illness or injury not related to black lung, the patient may submit a claim to Medicare. For further information, contact the Federal Black Lung Program at 1-800-638-7072.

Does Medicare pay for the same services as the VA?

Veteran’s Administration (VA) Benefits - Medicare does not pay for the same services covered by VA benefits.

Is Medicare a primary or secondary payer?

Providers must determine if Medicare is the primary or secondary payer; therefore, the beneficiary must be queried about other possible coverage that may be primary to Medicare. Failure to maintain a system of identifying other payers is viewed as a violation of the provider agreement with Medicare.

Who pays for Part B?

On the other hand, in a Part B claim, who pays depends on who has accepted the assignment of the claim. If the provider accepts the assignment of the claim, Medicare pays the provider 80% of the cost of the procedure, and the remaining 20% of the cost is passed on to the patient.

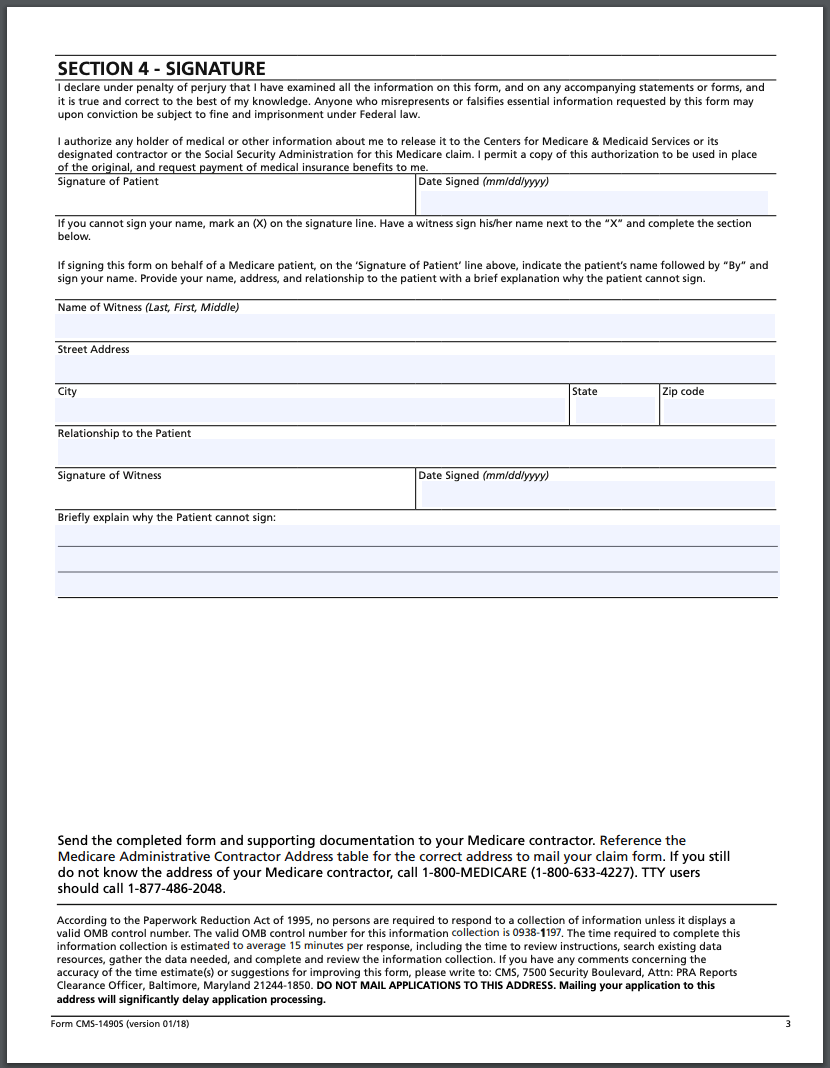

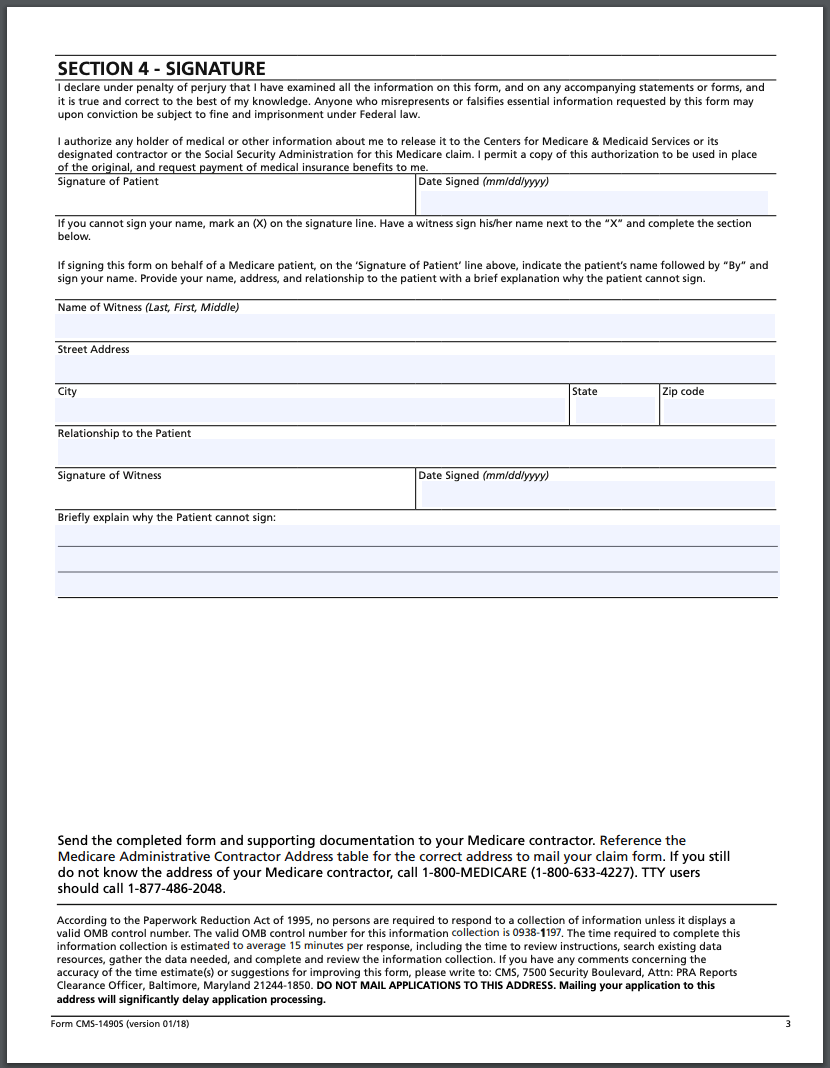

What form do you need to bill Medicare?

If a biller has to use manual forms to bill Medicare, a few complications can arise. For instance, billing for Part A requires a UB-04 form (which is also known as a CMS-1450). Part B, on the other hand, requires a CMS-1500. For the most part, however, billers will enter the proper information into a software program and then use ...

What is 3.06 Medicare?

3.06: Medicare, Medicaid and Billing. Like billing to a private third-party payer, billers must send claims to Medicare and Medicaid. These claims are very similar to the claims you’d send to a private third-party payer, with a few notable exceptions.

What is a medical biller?

In general, the medical biller creates claims like they would for Part A or B of Medicare or for a private, third-party payer. The claim must contain the proper information about the place of service, the NPI, the procedures performed and the diagnoses listed. The claim must also, of course, list the price of the procedures.

How long does it take for Medicare to process a claim?

The MAC evaluates (or adjudicates) each claim sent to Medicare, and processes the claim. This process usually takes around 30 days .

Is it harder to bill for medicaid or Medicare?

Billing for Medicaid. Creating claims for Medicaid can be even more difficult than creating claims for Medicare. Because Medicaid varies state-by-state, so do its regulations and billing requirements. As such, the claim forms and formats the biller must use will change by state. It’s up to the biller to check with their state’s Medicaid program ...

Can you bill Medicare for a patient with Part C?

Because Part C is actually a private insurance plan paid for, in part, by the federal government, billers are not allowed to bill Medicare for services delivered to a patient who has Part C coverage. Only those providers who are licensed to bill for Part D may bill Medicare for vaccines or prescription drugs provided under Part D.