MSP Billing. When Medicare is the secondary payer, submit the claim first to the primary insurer. The primary insurer must process the claim in accordance with the coverage provisions of its contract. If, after processing the claim, the primary insurer does not pay in full for the services, submit a claim via paper or electronically, to Medicare for consideration of secondary benefits.

Full Answer

Does Medicare automatically Bill secondary insurance?

Medicare usually covers most of your healthcare costs, but if you have other insurance coverage, it can act as a secondary payer for some of the costs.

What is the best secondary insurance with Medicare?

- Vision: Your medical plan will not cover you for vision care. ...

- Dental: A dental plan can cover you for preventive care such as routine teeth cleanings and some X-rays. ...

- Disability: Short- and long-term disability plans are a type of secondary insurance coverage. ...

How do you determine if Medicare is primary or secondary?

For example:

- Tricare will pay for services you receive from a Veteran’s Administration (VA) hospital.

- Medicare will pay for services you receive from a non-VA hospital.

- Medicare will be the primary payer for Medicare-covered services and Tricare will pay the coinsurance amount.

- Tricare is the primary payer for services not covered by Medicare.

What does Medicare pay as the secondary payer?

The Medicare secondary payment is $100. When Medicare is the secondary payer, the combined payment made by the primary payer and Medicare on behalf of the beneficiary is $3,000. The beneficiary has no liability for Medicare-covered services since the primary payment satisfied the $520 deductible.

How do I bill Medicare secondary claims?

Medicare Secondary Payer (MSP) claims can be submitted electronically to Novitas Solutions via your billing service/clearinghouse, directly through a Secure File Transfer Protocol (SFTP) connection, or via Novitasphere portal's batch claim submission.

What is Medicare Secondary Payer Rule?

Generally the Medicare Secondary Payer rules prohibit employers with 20 or more employees from in any way incentivizing an active employee age 65 or older to elect Medicare instead of the group health plan, which includes offering a financial incentive.

Does Medicare submit claims to secondary insurance?

Provider Central If a Medicare member has secondary insurance coverage through one of our plans (such as the Federal Employee Program, Medex, a group policy, or coverage through a vendor), Medicare generally forwards claims to us for processing.

Is Medicare billed as primary or secondary?

Medicare is primary and your providers must submit claims to Medicare first. Your retiree coverage through your employer will pay secondary. Often your retiree coverage will provide prescription drug benefits, so you may not need to purchase Part D.

How do you fill out CMS 1500 when Medicare is secondary?

0:239:21Medicare Secondary Payer (MSP) CMS-1500 Submission - YouTubeYouTubeStart of suggested clipEnd of suggested clipHere when the insured. And the patient are the same the biller enters the word. Same if medicare isMoreHere when the insured. And the patient are the same the biller enters the word. Same if medicare is primary this item is left blank.

When would a biller most likely submit a claim to secondary insurance?

If a claim has a remaining balance after the primary insurance has paid, you will want to submit the claim to the secondary insurance, if one applies. This article assumes that the primary insurance did not cross over the claim to the secondary insurance on your behalf.

When submitting a secondary claim what fields will the secondary insurance be in?

Secondary insurance of the patient is chosen as primary insurance for this secondary claim; primary insurance in the primary claim is chosen as secondary insurance in the secondary claim. Payment received from primary payer should be put in 'Amount Paid (Copay)(29)' field in Step-2 of Secondary claim wizard.

How does Medicare crossover claims work?

1. What is meant by the crossover payment? When Medicaid providers submit claims to Medicare for Medicare/Medicaid beneficiaries, Medicare will pay the claim, apply a deductible/coinsurance or co-pay amount and then automatically forward the claim to Medicaid.

What information do you send to an insurance company when billing a secondary claim?

Secondary Claim Adjustments When sending claims on to the secondary payers, those secondary payers want to see the total billed amount of the claim, the amount the primary insurance paid on the claim, and the reasons why the billed amount was not paid in full by the primary payer.

How do you determine which insurance is primary and which is secondary?

The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" to pay. The insurance that pays first is called the primary payer. The primary payer pays up to the limits of its coverage. The insurance that pays second is called the secondary payer.

Is Medicare Secondary Payer questionnaire required?

CMS electronic tools help identify and verify MSP situations. Get more information in Medicare Secondary Payer Manual, Chapter 3, Section 20 or contact your MAC. Providers must keep completed MSP questionnaire copies and other MSP information for 10 years after the service date.

Is Medicare Part D always primary?

Usually Medicare Part D coverage pays first. For example: Are you retired and have prescription drug coverage through your or your spouse's former employer's or union's retiree Group Health Plan and Medicare Part D coverage? If so, your Medicare Part D coverage is primary and the Group Health Plan is secondary.

When Medicare is the secondary payer, what is the primary payer?

When Medicare is the secondary payer, submit the claim first to the primary insurer. The primary insurer must process the claim in accordance with the coverage provisions of its contract. If, after processing the claim, the primary insurer does not pay in full for the services, submit a claim via paper or electronically, ...

Who is responsible for obtaining primary insurance information from the beneficiary and billing Medicare appropriately?

It is the provider' s responsibility to obtain primary insurance information from the beneficiary and bill Medicare appropriately.

When sending an MSP claim electronically, should the primary explanation of benefits be sent separately?

When sending an MSP claim electronically, the primary explanation of benefits should not be sent separately.

What is MSP in Medicare?

The MSP provisions apply to situations when Medicare is not the beneficiary’s primary health insurance coverage. Physicians, non-physician practitioners and suppliers are responsible for gathering MSP data to determine whether Medicare is the primary payer by asking Medicare beneficiaries questions concerning their MSP status.

How much is Medicare fee schedule?

The Medicare fee schedule amount is $185, and no Medicare benefits are payable. The patient can be billed for the remaining $110, and $185 would go toward the Part B deductible. A patient has a $185 deductible, which he or she has paid $50 toward. He or she incurred $100 in charges, which the primary payer paid in full.

Do you have to ship a claim off to the primary payer?

Similar to any other scenario involving primary and secondary payers, you’ll need to ship the claim off to the primary payer first. Only once you’ve received an Explanation of Benefits (EOB) from the primary insurance can you attempt to bill Medicare.

Does Medicare cover the cost of a service?

That said, according to CMS, if the primary payer does not provide prompt payment (and you can provide evidence of this), Medicare will temporarily cover the cost of any service the primary insurance would typically reimburse.

Does Medicare credit deductibles?

In other words, Medicare will credit any amount paid by the primary insurance up to the amount allowed by the Medicare fee schedule toward the deductible. Here are a couple of examples: Say a patient’s deductible is $185, which he or she has not yet met.

Can Medicare and other insurances work together?

And for Medicare patients with other health insurance providers, few things are better than when Medicare and their private payers work together cooperatively. However, Medicare has a lot of unique rules, which means providers should tread carefully when their patients have Medicare and a second insurance. To that end, here’s a rundown of all the things PTs, OTs, and SLPs need to know about Medicare as a secondary payer:

Is Medicare a secondary insurance?

This first part is often where things go awry: Medicare functions differently depending on the other types of insurance benefits the patient receive s (i.e., Medicare always functions as the secondary in some instances).

Do Medicare patients have to pay deductibles?

As CMS explains in the Medicare Secondary Payer Manual, patients will likely still have to make payments toward their deductibles, which “are credited to those deductibles even if the expenses are reimbursed by a [group health plan].”.

What is Medicare Secondary Payer?

The Medicare Secondary Payer (MSP) provisions protect the Medicare Trust Fund from making payments when another entity has the responsibility of paying first. Any entity providing items and services to Medicare patients must determine if Medicare is the primary payer. This booklet gives an overview of the MSP provisions and explains your responsibilities in detail.

Who pays first for Medicare?

Primary payers must pay a claim first. Medicare pays first for patients who don’t have other primary insurance or coverage. In certain situations, Medicare pays first when the patient has other insurance coverage.

What is MSP in Medicare?

MSP provisions prevent Medicare paying items and services when patients have other primary health insurance coverage. In these cases, the MSP Program contributes:

Why does Medicare make a conditional payment?

Medicare may make pending case conditional payments to avoid imposing a financial hardship on you and the patient while awaiting a contested case decision.

What is a COB in health insurance?

Coordination of Benefits (COB) allows plans to determine their payment responsibilities. The BCRC collects, manages, and uploads information to the Common Working File (CWF) about patients’ other health insurance coverage. Providers, physicians, and other suppliers must collect accurate MSP patient information to ensure that claims are filed properly.

What happens if you don't file a claim with the primary payer?

File proper and timely claims with the primary payer. Not filing proper and timely claims with the primary payer may result in claim denial. Policies vary depending on the payer; check with the payer to learn its specific policies.

Does Medicare pay first when there is no fault?

no-fault pays first when there’s Ongoing Responsibility for Medicals (ORM) reported. Medicare doesn’t make a payment.

How to access MSP payment information?

Press F6 to access the "MSP Payment Information" screen for primary payer 2 (if there is one).

What is UB-04 in Medicare?

When a beneficiary is entitled to benefits under the Federal Black Lung (BL) Program, and services provided are related to BL, a paper (UB-04) claim must be submitted with MSP coding and the denial notice from the Federal BL Program. If applicable, also provide the workers' compensation insurer denial notice. If the services provided are not related to BL and does not include a BL related diagnosis code, the claim can be submitted via 5010 or FISS DDE showing Medicare as the primary payer.

How to submit MSP claims?

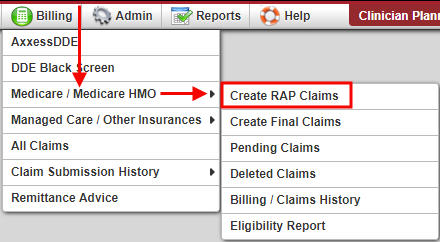

MSP claims are submitted using the ANSI ASC X12N 837 format, or by entering the claim directly into the Fiscal Intermediary Standard System (FISS) via Direct Data Entry (DDE). If you need access to FISS in order to enter claims/adjustments via FISS DDE, contact the CGS EDI department at 1.877.299.4500 (select Option 2).

Can MSP claims be corrected?

Return to Provider (RTP): MSP claims may be corrected out of the RTP file (status/location T B9997). However, providers must ensure that claim adjustment segment (CAS) information is reported on the "MSP Payment Information" screen (MAP1719), accessed from Claim Page 03 by pressing F11.

Which line does Medicare enter information on?

If Medicare is the secondary or tertiary payer, the provider identifies the primary payer on line A and enters Medicare information on line B or C as appropriate. Please see IOM Publication 100-05, Chapter 5 , section 30.5 for specific tertiary guidelines.

What is Medicare 31266?

31266 – An electronic Medicare secondary payer claim is submitted, and the value code amount is blank or zero and one following CAR C’s are present (see external narrative). Please correct if you can otherwise submit a new claim.

Why is it important for providers to code the CAS segments of their claims accurately?

It is important for providers to code the CAS segments of their claims accurately so that Medicare will make the correct MSP payments.

Why are conditional payments referred to as conditional payments?

These payments are referred to as conditional payments because the money must be repaid to Medicare when a settlement, judgment, award, or other payment is secured. If the primary payer applied full or partial payment to deductible and coinsurance, it must be billed as a conditional payment.

Can Medicare pay for MSP?

The intermediary's records indicate that the medical services and supplies provided to this beneficiary are covered by another primary payer insurance therefore, payment cannot be made under Medicare to the extent that services are covered by the primary insurance. Please bill the appropriate insurance plan and submit a MSP bill to Medicare upon receipt of the primary payment and/or denial.

Can you use CPT in Medicare?

You, your employees and agents are authorized to use CPT only as contained in the following authorized materials of Centers for Medicare and Medicaid Services (CMS) internally within your organization within the United States for the sole use by yourself, employees and agents. Use is limited to use in Medicare, Medicaid or other programs administered by CMS. You agree to take all necessary steps to insure that your employees and agents abide by the terms of this agreement.

Can Medicare beneficiaries get reimbursed for black lung?

If you are aware that a Medicare beneficiary may be entitled to have the services reimbursed by the Department of Labor (DOL) under the Federal Black Lung Program, bill DOL for only Black Lung related claims and submit a no-payment bill to your intermediary. See the CMS IOM Publication 100-05, Chapter 5 , section 30.4 for more information.